Tuesday, December 15, 2020

Can Stitch Fix’s share price keep gaining?

By Century Financial in 'Brainy Bull'

Stitch Fix’s [SFIX] share price is on fire right now. Since 4 December, the stock has gained 68.90% thanks to stellar quarterly earnings results and an upbeat outlook for the coming fiscal year (as of 11 December’s close).

Like most other stocks, Stitch Fix’s share price plummeted in March as the coronavirus rocked global markets. The online company, which uses algorithms to deliver personalised styling advice, or “fixes”, saw the effects last quarter as the pandemic caused supply chain problems. Yet, it has also benefited from the pandemic-triggered shift to online shopping, as traditional brick-and-mortar clothing retailers have been forced to close. Investors have taken note, with Stitch Fix’s share price gaining over 385.92% since 12 March (as of 11 December’s close).

The big question is whether there are any gains left in the current rally, or if investors should wait to see if Stitch Fix’s share price dips before jumping in.

Stitch Fix’s share price soars on earnings beat

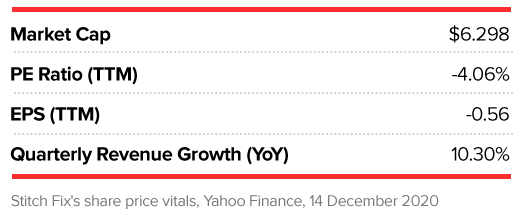

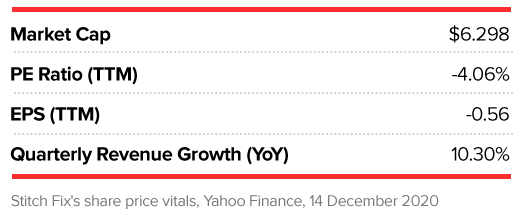

Stitch Fix sewed up impressive earnings of $0.09 per share, on revenue of $490.4m, easily beating Wall Street forecasts of a $0.20 loss per share on $481.2m revenue. In the same quarter last year, Stitch Fix delivered $445m in revenue and recorded a loss. Active clients — those who bought an item from its website in the last 52 weeks — came in at 3.8 million, up 10.2% from the same period last year.

During the earnings call, CEO Katrina Lake said that the results had delivered “several multi-year highs, including our highest sequential client addition on record”. However, it wasn’t all good news, with net revenue per active client coming in at $467, a 4% year on year decrease.

These strong results represent an impressive turn around from last quarter’s disappointing $0.44 loss per share. In that quarter, sales fell 9% partially due to backlogged orders, with Stitch Fix’s share price tanking 14% in after-hours trading.

“While the apparel industry is currently contracting, we expect to take share and drive higher new client sign-ups as the relevance of our model of personalized discovery and convenience grows,” said Stitch Fix in a bullish letter to shareholders.

Backing up that statement is Stitch Fix now expecting to deliver 20% to 25% revenue growth in the fiscal year 2021. For next quarter, Stitch Fix is guiding for between $506m and $515m in revenue, which would represent a 12% to 14% growth compared to the same period last year.

Following the results, Stitch Fix’s share price surged 30% in after-hours trading.

Stitch Fix welcomes Amazon exec as CFO

To continue expanding its business, Stitch Fix has tapped Amazon veteran Dan Jedda to take over as CFO. Jedda has spent the last 15 years in finance positions at Amazon, including as divisional CFO for its digital video, music and advertising businesses.

“Dan will play a critical role in helping us expand our personalization platform to deliver the most relevant, resonant and delightful shopping experiences to consumers everywhere,” said Lake on the appointment.

Jedda is the latest member of Amazon’s finance team to take a CFO role elsewhere. The ability to attract top talent like Jedda may also be a sign of the strength of Stitch Fix’s business.

Where next for Stitch Fix’s share price?

The pace of Stitch Fix’s share price surge could mean that the stock is due a correction. On Thursday, Goldman Sachs MD Heath Terry downgraded his recommendation on Stitch Fix from Buy to Neutral, although he maintained his $58 price target.

Despite the downgrade, Terry is still optimistic on the company itself, arguing that “opportunity for StitchFix is significant as the apparel category recovers and the [market] share shifts to e-commerce”. However, the expansion investments Stitch Fix has been making are likely to hurt profitability in the near-term.

Among the analysts tracking the stock on Yahoo Finance, Stitch Fix’s share price has an average $46.11 price target. Hitting this would represent a steep 30.25% downside on the current share price as of 11 December’s close. The most bullish price target on the stock is $65, which would see an 8.22% upside.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.