Century DATCOs

Share Baskets Trading

Century DATCOs

Share Baskets Trading

General Description

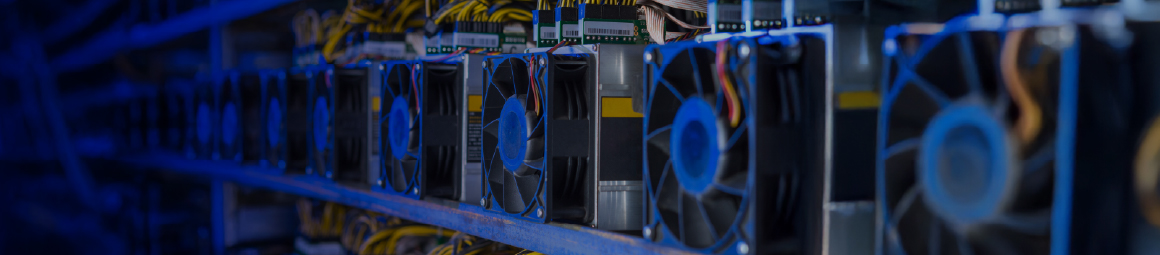

The cryptocurrency landscape has garnered substantial investor interest and institutional adoption this year due to a confluence of macroeconomic and regulatory tailwinds. There is a notable shift in how cryptocurrencies are perceived, as they have evolved from being viewed as a speculative asset class to a legitimate financial instrument with indispensable real-world utility. Banks, asset management companies, and fintech firms have enhanced the integration of blockchain technology to fuel efficiency and innovation in their product offerings and services. Moreover, Trump's pro-crypto stance, as evidenced by deregulation policies, increased domestic mining, and increased adoption of digital assets, is a noteworthy catalyst for the industry. Crypto treasury stocks offer a compelling blend of exposure to digital assets, such as Bitcoin, while also providing the traditional equity market structure. The core operating business of several prominent crypto treasury companies involves blockchain infrastructure, crypto mining, and fintech innovation, thereby offering better intrinsic value beyond speculative holdings

Trading hours

| Day | Trading hours |

| Mon | 17:30-00:00 |

| Tue | 17:30-00:00 |

| Wed | 17:30-00:00 |

| Thur | 17:30-00:00 |

| Fri | 17:30-00:00 |

▼

Trading hours shown in UAE local time, please check under product overview for more details

Index Constituent Weightings

| Component | Initial Weighting |

| Apple Inc | 15.0% |

| Microsoft Corp | 15.0% |

| 15.0% | |

| Amazon.com Inc | 12.4% |

| Alphabet Inc | 11.4% |

| Meta Platforms | 9.4% |

| Tesla Inc | 5.0% |

| Broadcom Inc | 6.8% |

| Costco Wholesale Corp | 5.0% |

| Netflix Inc | 5.0% |