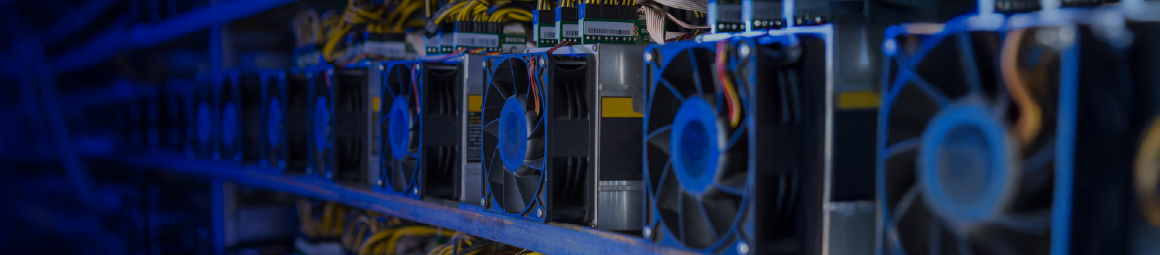

Crypto Miners

Share baskets trading

Oil & Gas

Share baskets trading

General Description

Bitcoin is the worlds first decentralized cryptocurrency, grounded in free-market principles and capped at a supply of 21 million coins. As long as it retains the core attributes of money—scarcity, portability, and divisibility—demand is expected to endure. Theres a well-known market adage: If you expect gold prices to rise, buy the miners instead. The same logic applies to Bitcoin. Over the past two years, Bitcoin and listed Bitcoin mining stocks have maintained a correlation of ~68%. Bitcoin miners act as high-beta proxies to Bitcoin itself, often outperforming the underlying asset due to operational leverage. As block rewards decrease after halving, efficient and scalable miners are likely to consolidate their market share and margins. This makes well-capitalized miners an asymmetric bet on Bitcoins upside. In essence, while Bitcoin represents digital scarcity, miners are the infrastructure that underpins the security and decentralization critical to Bitcoins long-term viability. This basket targets miners who are not only technically competitive but also financially positioned to benefit from broader crypto adoption. Over the past 5 years, the basket generated an annualized return of 62.9% compared to the Nasdaq 100s 18.2% returns.

Trading hours

| Day | Trading hours |

| Mon | 17:30-00:00 |

| Tue | 17:30-00:00 |

| Wed | 17:30-00:00 |

| Thur | 17:30-00:00 |

| Fri | 17:30-00:00 |

▼

Trading hours shown in UAE local time, please check under product overview for more details

Index constituent weightings

| Component | Initial Weighting |

| Alibaba Group Holding Ltd | 15.0% |

| Tencent Holdings Ltd | 15.0% |

| Meituan | 7.05% |

| Xiaomi Corp | 15.00% |

| BYD Co Ltd | 14.01% |

| JD.com Inc | 6.78% |

| NetEase Inc | 7.00% |

| Baidu Inc | 6.68% |

| Geely Automobile Holdings Ltd | 6.63% |

| Semiconductor Manufacturing International Corp | 6.84% |

▼

Review under Share Basket Disruption Event and Share Basket Rebalancing.