Thursday, May 28, 2020

Will sales momentum charge Nio’s share price?

By Century Financial in 'Brainy Bull'

Electric vehicle maker Nio’s [NIO] share price has been on an overall downward trend since floating on the Nasdaq in September 2018. The stock had hit an all-time high of $10.16 on 5 March 2019, but hasn’t traded anywhere near that mark since — on 26 May it’s share price closed at $3.82.

This year’s market volatility has taken hold of Nio too. Its share price is down 4.9% YTD through 26 May close and has a 200-day moving average of $3.20.

However, a recent positive trading update ahead of its first-quarter earnings announcement on Thursday (28 May) could see investors racing to get their hands on the stock.

Surging sales in April boost forecast

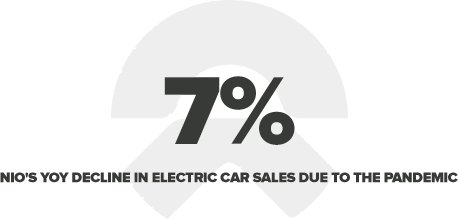

The global auto industry clocked a 7% year-over-year decline in electric car sales due to the pandemic in the first quarter, according to a study by PwC.

Despite this, Nio, also known as the Tesla [TSLA] of China, had a surprisingly upbeat trading update for the month of April.

The company said it delivered a massive 3,155 vehicles during the month — a 108.70% year-over-year increase. It’s share price climbed 10% to $3.62 on 6 May.

The robust 105.80% month-over-month increase in sales was due to “recovering production and delivery capabilities”, CEO William Bin Li said. And follows on from a previous 116.8% month-over-month increase in March.

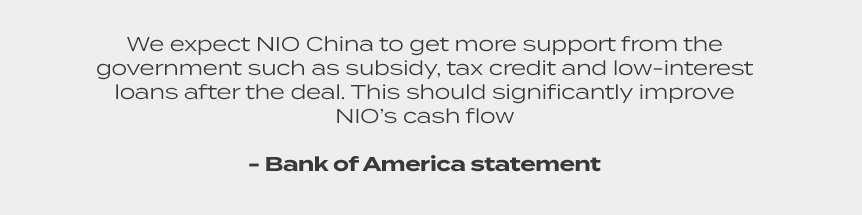

The news prompted Bank of America analyst Ming-Hsun Lee to upgrade his rating on the stock from neutral to buy, revising his share price target from $3.40 to of $5, according to Barron’s.

The analyst expects the company to benefit from China’s recently announced electric vehicle purchase-subsidy programme, which has been extended to 2022.

“We expect NIO China to get more support from the government such as subsidy, tax credit and low-interest loans after the deal. This should significantly improve NIO’s cash flow,” Bank of America states, according to Seeking Alpha.

While the sales update is only for one month, it makes for a strong showing ahead of Nio’s earnings announcement.

Debt questions

However, the company had reported a loss of RMB2.5m for the third quarter of 2019, prompting it to warn shareholders that it did not have enough working capital and liquidity to continue its operations.

By the end of 2019, Nio had less than $152m in cash while its total debt was in excess of $1.15bn, Bill Maurer writes in Seeking Alpha.

In an effort to help curb its losses and boost capital, Nio entered a collaboration framework agreement with the municipal government of Hefei, Anhui Province, on 25 February to gather funding support.

By 29 April the company had secured RMB7bn in new financing from a group of investors led by the Anhui Provincial Emerging Industry Investment among others in exchange for a 24.1% stake.

The deal would see the parties form a new company called NIO (Anhui) Holding, which Nio would have a controlling 75.9% stake in. While it’s still not clear how the company will manage its cash burn, the long-term deal will help it to expand its operations.

Looking to Nio first-quarter earnings, the company is expected to see a boost in sales from the launch of its ES8 SUV, which is its second most expensive vehicle. It plans to launch its EC6 SUV later this year.

Maurer believes this will help Nio to gain a bit of traction before Tesla launches its Model Y in China in 2021, which he says will provide “stiff competition”. Maurer remains bearish on the stock, citing its financial woes as a deterrent.

As it stands, the company has a positive earnings outlook from analysts with Zacks Equity Research expecting earnings to rise 8.33% from the same quarter a year ago to -$0.33. However, out of 12 analysts polled by MarketWatch, the stock has a consensus hold rating.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.