Much of the world was preparing to celebrate New Year’s Eve 2019, when a Chinese government website warned of the existence of “pneumonia of unknown cause” that was bringing death and mayhem to the city of Wuhan. Nobody must have imagined then that 100 days later, this virus termed Covid-19 would have infected nearly 1.5 million people and claimed over 85000 lives, confined more than 50% of world population to their homes, halted international travel and extinguished economic activity.

The virus has not only created havoc in the daily life but also led to turmoil in all the financial markets. When the news of the virus first broke out, it didn’t seem to have any impact on the stock markets with Wallstreet indices creating new highs. However, as the virus spread outside China particularly in Iran Italy and South Korea, financial stock markets across the world started to feel the pain.

Impact on Stock Markets

As the virus spread across the Eurozone and the US, equity indices witnessed a free fall with SPX 500 sliding over 30% from the highs. Among the worst hit were Eurozone indices with Spain (IBEX), France (CAC40), and Germany (DAX 30) with all losing almost 39% at one point in time from the 2020 highs. Likewise, India’s Nifty index, UK’s FTSE and Australia ASX 200 all witnessed losses in excess of 35% from their respective highs this year.

With oil income contributing to over 70% of the public revenues, major GCC bourses also suffered massive losses. Saudi Arabia’s Tadawul index lost 30% from this year’s high at one point. ADX and DFM also lost in excess of 35% from the highs this year impacted by drop in tourism as well as oil prices.

Stocks related to the travel and tourism sector and the leisure industry particularly the airlines, cruise, casino and hotel stocks were hit the hardest. To name a few United airlines stock lost 73% this year, Carnival Corp has shed a whopping 78% while Wynn resorts has lost nearly 60% YTD.

The sectors which have outperformed during this volatile environment are primarily Pharma and Consumer staples. Select pharma stocks that are working on finding a cure to COVID-19 or supply masks and gloves and other instruments which aid in fighting COVID-19 have seen their share price soar this year. Novavax which already boasts success in vaccine development for the MERS and SARS strains and is developing a vaccine for this respiratory disease has seen its stock price surged a massive +300% this year while Moderna Inc, the first company to ship coronavirus vaccine for human testing to the NIAID has rallied almost 65% YTD.

Tealdoc Inc, the worldwide leader in virtual care which allow healthcare professionals to provide medical consultations via videoconferencing has recorded a YTD gain of over 65%. Clorox, the company which sells disinfectant wipes and other household cleaning products saw its stocks climb 17% YTD. Besides, stocks which aid Work from home like zoom video and slack technology also witnessed a robust rally. Zoom video communications which provides a remote conferencing service that combines video conferencing, online meetings, chat, and mobile collaboration saw its stock price climb by 80% YTD.

Impact on Commodities

Among the commodities, crude oil suffered the most impacted by the double whammy effect of increased oil supply as well as lower oil demand. Oil prices tumbled by more than 70% at one point in time as Saudi Arabia and Russia entered into a price war at a time when global oil demand is expected to drop by at least 25 %.

Current oil price slump has created a massive contango in the oil markets with current spread between Brent cash prices & Brent September contract at record $ 10 - $ 11 range, level seen during last Global financial crisis.

With the halt in economic activity, industrial metals, like platinum, copper, iron, also witnessed losses and are trading 23%, 19% and 13% lower respectively on YTD basis. Palladium, highly used in the automobile industry, is also trading 24% lower from the highs this year. The metal which breached the level of $2850 this year dipped to as low as $1484 at one point as the pandemic dented the automobile demand.

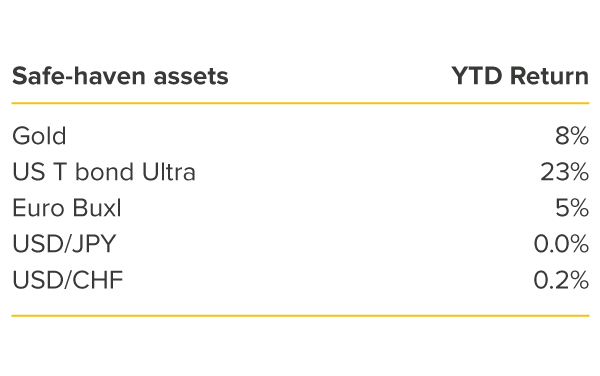

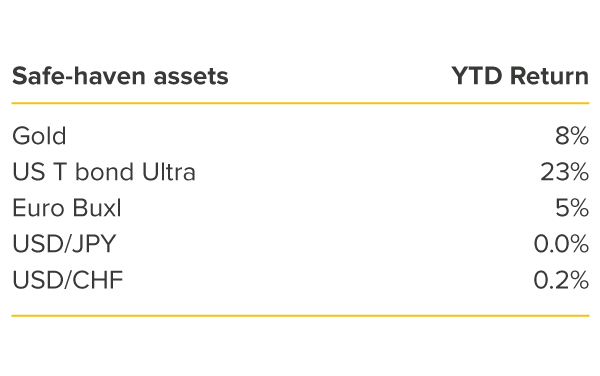

Impact on Safe-haven Assets and Currencies

The star performer among the commodities was gold which recorded a high of $1703 as fear of recession gripped the investors. The safe-haven metal which is often sought in times of crisis is trading 8% higher for the year. Apart from the oil contango another major shock to the market, was the spread between the gold spot and futures contract. At one point in time, the futures contract was trading $90 above the spot contract on concerns whether there will be enough gold available in New York to deliver against futures contracts traded on the Comex in the city.

Besides, as recession fears rose, so did the demand for Treasury bonds. US Treasury Ultra bond witnessed a robust YTD rally of 23% while Euro BUXL rallied by 5% YTD. In the currency market, US Dollar was the king as the need to hold cash and the massive liquidity crunch saw the Dollar Index climb to almost $103 mark before settling around $100 level. For the year, the Dollar index which tracks the Greenback against a basket of other currencies is trading almost 4% high this year.

Measures announced by Governments & central Banks to counter the impact of global slowdown

Massive stimulus measures from the governments and monetary support from the Central banks came to the rescue of the reeling markets. With G20 economies announcing plans of injecting more than $5 trillion into the global economy over and above the unprecedented fiscal stimulus and monetary measures from major Central Banks, equity markets have recovered part of their losses. Major indices have rallied by over 15% from their lows despite all the doom and gloom related to the economic fallout of Covid-19 outbreak. Hopes that the cases have peaked in the Eurozone and are nearing their peak in the US also supported the rally. However, this is expected to be short lived as investors realize that any turnaround in infection rates isn’t going to be a one-way street. Besides Bear markets are often characterized by sharp rallies. If a cure is found soon, the rally will continue. However, in the absence of a cure, there is a high probability that the rally will fail especially when corporates earnings will be slammed, and the guidance will be uncertain. The moot question is whether the recovery in the markets will be a V-shaped or W-shaped. Given the experience of 2008, and the long time required for normalization as well as customer reengagement; it seems that the recovery in financial markets will be W shaped.

Data Source: Bloomberg

Arun Leslie John

Chief Market Analyst

Disclaimer: Century Financial Consultancy LLC (“CFC”) is Limited Liability Company incorporated under the Laws of UAE and is duly licensed and regulated by the Emirates Securities and Commodities Authority of UAE (SCA).This document is a marketing material and is for informational purposes only and must not be construed to be an advice to invest or otherwise in any investment or financial product. CFC does not guarantee as to adequacy, accuracy, completeness or reliability of any information or data contained herein and under no circumstances whatsoever none of such information or data be construed as an advice or trading strategy or recommendation to deal (Buy/Sell) in any investment or financial product. CFC is not responsible or liable for any result, gain or loss, based on this information, in whole or in part. Please carefully read disclaimer mentioned below/next page/next frame.

PLEASE READ THE FOLLOWING TERMS AND CONDITIONS OF ACCESS FOR THE PUBLICATION BEFORE THE USE THEREOF.

By use of the publication and continuing to access the publication, you accept these terms and conditions and undertake to be bound by the acceptance. CFC reserves the right to amend, remove, or add to the publication and Disclaimer at any time without any prior notice to you. Such modifications may be effective immediately or otherwise. Accordingly, please continue to review this Disclaimer whenever accessing, or using the publication. Your access of, and use of the publication, after modifications to the Disclaimer will constitute your acceptance of the terms and conditions of use of the publication, as modified. If, at any time, you do not wish to accept the content of this Disclaimer, you may not access, or use the publication. Any terms and conditions proposed by you which are in addition to or which conflict with this Disclaimer are expressly rejected by CFC and shall be of no force or effect.

No information as given herein by CFC in this publication should be construed as an offer, recommendation or solicitation to purchase or dispose of any securities/financial instruments/products or to enter in any transaction or adopt any hedging, trading or investment strategy. The data/information contained in the publication is not designed to initiate or conclude any transaction. Neither this publication nor anything contained herein shall form the basis of any contract or commitment whatsoever. Distribution of this publication does not oblige CFC to enter into any transaction. The information in this document is not intended, by itself, to constitute independent, impartial or objective research or a recommendation from CFC and should not be treated as such.

The content of this publication should not be considered legal, regulatory, credit, tax or accounting advice. Anyone proposing to rely on or use the information contained in the publication should independently verify and check the accuracy, completeness, reliability and suitability of the information and should obtain independent and specific advice from appropriate professionals or experts regarding information contained in this publication. CFC cannot be held responsible for the impact of any transactional costs or any taxes as may be applicable on transactions.

Information contained herein is based on various sources, including but not limited to public information, annual reports and statistical data that CFC considers reliable. However, CFC makes no representation or warranty as to the accuracy or completeness of any report or statistical data made in or in connection with this publication and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the information contained in this publication. References to any financial instrument or investment product does not imply that an actual trading market exists for such instrument or product. In publishing this document CFC is not acting in the capacity of a fiduciary or financial advisor.

The report does not take into account the investment objectives, financial situations and specific needs of recipients. The recipient of this publication must make its own independent decisions regarding whether this communication and any securities or financial instruments mentioned herein, is appropriate in the light of its investment objectives, investment experience, financial situation, existing portfolio holdings and/or investment needs. Recipients will need to decide on their own as to whether or not the contents of this document are suitable for them.

This document is a marketing material and has been prepared by individual(s), marketing and/or research personnel of CFC. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is purely a marketing communication. In this publication, any opinions, news, research, analysis, prices, or other information constitute is a general market commentary, and do not constitute the opinion or advice of CFC or any form of personal or investment advice. CFC neither endorses nor guarantees offerings of third party, nor is CFC responsible for the content, veracity or opinions of third-party speakers, presenters, participants or providers. CFC will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Charts, graphs and related data or information provided in this publication are intended to serve for illustrative purposes only. The information contained in this publication is prepared as of a particular date and time and will not reflect subsequent changes in the market or changes in any other factors relevant to their determination. All statements as to future matters are not guaranteed to be accurate. CFC expressly disclaims any obligation to update or revise any forward-looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events.

The information in this communication cannot disclose everything about the nature and risks of the abovementioned data / information. This is not an exhaustive list of the risks involved, nor should it be regarded as offering advice on the suitability of these investments for the recipient.

All views expressed in all reports, analysis and documents are subject to change without notice. CFC may have issued other reports, analysis or other documents expressing different views from the contents hereof. Staff members/employees of CFC may provide/present oral or written market commentary or analysis to you that reflect opinions that are contrary to the opinions expressed in this research and may contain insights and reports that are inconsistent with the views expressed in this publication. Neither CFC nor any of its affiliates, group companies, directors, employees, agents or representatives assume any liability nor shall they be made liable for any damages whether direct, indirect, special or consequential including loss of revenue or profits that may arise from or in connection with the use of the information provided in this publication.

Information or data provided by means in this publication may have many inherent limitations, like module errors or lack accuracy in its historical data. Data included in the publication may rely on models that do not reflect or take into account all potentially significant factors such as market risk, liquidity risk, credit risk etc.

CFC and its affiliates reserve the right to act upon or use the contents hereof at any time, including before its publication herein. The use of our information, products and services should be on your own due diligence and you agree that CFC is not liable for any failure to achieve desired return on investment that is in any manner related to availing of services or products of CFC and use of our information, products and services. You acknowledge and agree that past investment performance is not indicative of the future performance results of any investment and that the information contained herein is not to be used as an indication for the future performance of any investment activity. Any prices provided in this document are indicative only and do not represent firm quotes as to either price or size. The value of any investment or income may go down as well as up. All investments involve an element of risk, including capital loss.

This publication is being furnished to you solely for your information and neither it nor any part of it may be used, forwarded, disclosed, distributed or delivered to anyone else. You may not copy, reproduce, display, modify or create derivative works from any data or information contained in this publication. This document may not be published, circulated, reproduced, or distributed in whole or part to any other person (whether within or in a jurisdiction outside UAE) without the prior written consent of CFC.

Declaration of the Financial Analyst

The analyst(s) who prepared this report certifies that the opinions contained herein accurately and exclusively reflect his or her views. The Analyst further undertakes that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein. The analyst(s) who wrote this report does not hold securities in the Company mentioned in the report. The analyst(s) receives a fixed compensation from CFC. No part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this report. The business solicitation or marketing departments of CFC are separate and independent from the reporting line of the analyst(s). The analyst(s) confirms that he or she and his / her associates do not serve as directors or officers of the Company, and the Company or other third parties have not provided or agreed to provide any compensation or other benefits to the analyst(s) in connection with this report. An “associate” is defined as the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child, of the analyst.

Services offered by CFC include products that are traded on margin and can result in losses that exceed deposits. Before deciding to trade on margin products, you should consider your investment objectives, risk tolerance and your level of experience on these products. Trading with leverage carries significant risk of losses and as such margin products are not suitable for every investor and you should ensure that you understand the risks involved and should seek independent advice from professionals or experts if necessary.