Thursday, January 29, 2026

Gold Trading Strategies Explained: How to Trade Gold Like A Pro

تم إعداد هذا المنشور من قبل سنشري للاستشارات

Why Trade Gold?

This glittery element that predates Earth has been an unavoidable part of commerce since the epoch of civilizations as we know it. Gold has adorned not just necks and treasuries but is also an active part of individual and institutional portfolios. So, to answer the question, trading in gold is not merely about maintaining a balanced portfolio; it is about stepping into the extensive and exciting global financial markets.

Some market participants may view gold as an outdated asset, while the reality is anything but. With financially engineered products that allow both long- and short-term participation and many a gold trading strategy, today’s traders leverage this bullion to unlock the market’s true potential.

Let’s start by looking at some golden strategies.

What are Gold Trading Strategies?

In the market’s vocabulary, investing has long-term intent, and trading has a short-term motive. By that logic, gold trading strategies are used to capitalize on the short-term momentum of gold prices. These strategies help you plan and manage your risk, capital, and portfolio.

Thanks to digitized forms of this asset, your gold trading strategy won’t be about taking your gold to the nearest bank or jeweler. From ETFs to CFDs, gold trading has been made easy and instantaneously available at your fingertips through platforms like the Century Trader App.

| Aspect | Trading in Digitized Gold | Investing in Physical Gold |

|---|---|---|

| Objective | To earn from short-term price changes | Long-term value storage |

| Execution | CFDs, ETFs, F&O | Bars, coins, jewellery |

| Liquidity | Easy and instant entry/exit | Harder to find counterparty |

| Costs | Spreads, overnight charges | Storage, insurance |

| Hidden Charges | Fund management costs | Making charges, purity concerns |

| Flexibility | Trades can be long or short | Usually limited to long exposure |

Long-Term vs Short-Term Gold Trading

Market participants can choose how they trade. If someone enters with the intent to stay with the same asset for decades, they are more than welcome to do so. Traders also take positions they'll exit in minutes, even seconds.

Trading in gold is the same. You can choose it if you're in it for the long haul or just looking to make quick profits. But the intent and strategy behind these positions are vastly different and satisfy various needs of your portfolio. The best gold trading strategy empowers you to meet your portfolio's needs aptly.

Long-Term

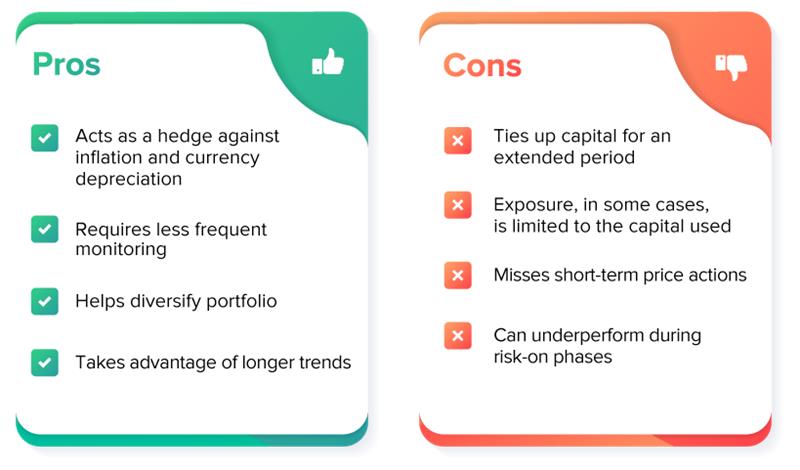

Long-term participation in gold focuses on macro trends such as inflation cycles, central bank policies, and currency shifts. Since gold is countercyclical, it is a good hedge for your investment portfolio.

With long-term investment in gold, the focus is not on price action or the everyday volatility of this asset. These positions can be held for months or even years, depending on the outlook.

Short-Term

Short-term participation focuses on precision and making the most of price movements that occur within seconds to weeks. Traders thrive on volatility and use technical indicators and patterns to recognize potential opportunities.

Benchmark prices are set through AM/PM fixing, and traders base their strategies on those prices and the indicators they point to. It is riskier and needs more patience and preparation.

Types of Gold Trading Strategies

A good gold trading strategy can be beneficial in multiple ways. Gold is known around the world as a safe haven. It is the preferred instrument when the market is losing confidence in stocks. Demand in gold is also a good measure to gauge inflation, geopolitical and macroeconomic tensions, and many other factors influencing the global markets.

Hence, to build a solid portfolio that stands the test of volatile markets, having a sound gold trading strategy becomes crucial. Let’s look at some of the popular ones.

Trend Trading Strategy

Trends are gold mines for short-term traders. Here, the intent is to go with the market’s flow to find opportunities. They watch the markets closely to determine whether the trend is bullish or bearish and identify potential support levels, then enter trades to make quick gains.

Core Idea:

Capturing clear price momentum arising from strong trends

Tools Used:

Moving averages

MACD Trading

Trendlines

Breakout Strategy

The market has three phases: bearish, bullish, and range-bound (consolidation). But when the tide is about to turn, it gives specific signals. This change, or the beginning of gold’s transition into another phase, is called a breakout, and such situations can provide several opportunities, both short- and long-term.

Core Idea:

Trade volatility expansion for strong directional move

Tools Used:

Bollinger Bands

Volume Indicators Trading

Donchian Channels

Range Trading Strategy

When gold prices are range-bound, they oscillate between two levels. While this consolidation phase looks lackluster, traders buy when the price is near support and sell near resistance, thereby profiting from relatively low volatility.

Core Idea:

Gaining from shorter movements in calmer trading sessions

Tools Used:

RSI

Stochastic Oscillator Trading

Support/Resistance Trendlines

News & Fundamental Trading

When influential news breaks, such as a Fed policy announcement or geopolitical tensions, gold prices react strongly. Fundamental traders keep a close watch on macroeconomic factors and, based on their analysis, catch big moves.

Core Idea:

Leverage news and macroeconomic factors for short to mid-term trades

Tools Used:

Economic Calendars

Market News Update Trading

Following Geopolitical Happenings

Scalping & Day Trading

Momentum trades that capture minor basis-point differences may not seem like much, but with leverage, instruments can amplify your exposure, and entering multiple short trades in a day can yield substantial profits. Scalping is all about this.

Core Idea:

Use short timeframes and quick reactions for short-term gains

Tools Used:

Tick Charts

VWAP Trading

Momentum Indicators

Best Indicators for Gold Trading

Gold might seem eccentric when compared to stocks. Being a safe-haven with counter-cyclical trends, deciphering exactly where the gold price was headed could be confusing. To make sense of these idiosyncratic trends, traders depend on numerous indicators and patterns. These tools not only help them get a head start on trends but also provide the foundation for a good trade—entry, exit, and stop-loss estimates.

Together, news, patterns, and indicators form a narrative that traders can easily follow. The following are some tools to trade gold more efficiently.

Moving averages smooth out the spiked volatility of the markets and are an integral part of the financial market trading basics. By removing noise, moving averages reveal the underlying trend. For example, when gold's 50-day moving average crosses above the 200-day, it often signals the beginning of a bullish phase.

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are popular momentum indicators that help spot overbought or oversold conditions and reversals. When RSI dips below 30 while MACD turns upward, it suggests a potential rebound.

Bollinger Bands measure volatility and identify when gold is trading too far from its mean. When the price approaches the lower band and volatility begins to decrease, it can serve as a constructive signal for a potential upside reversal.

Fibonacci levels are great for spotting potential areas where prices might turn around based on past price movements. Traders tend to keep an eye on retracement levels like 38.2% and 61.8% to get a sense of where gold could bounce back or hit a pause.

Traders often mix different indicators to get a clearer signal and avoid getting fooled by false alarms. Some popular combos are:

| Market Situation | Effective Indicator Combinations |

|---|---|

| Strong Uptrend | 20- & 50-day Moving Averages + MACD |

| Range-Bound Market | RSI + Bollinger Bands |

| High Volatility | Bollinger Bands + Fibonacci Retracements |

| Trend Reversal Zone | MACD + RSI Divergence |

| News-Driven Whipsaws | Moving Averages + ATR (Volatility Filter) |

Gold Trading Strategy in Different Market Condition

Every asset in the markets responds in special ways to trends, changes, and news. While trading gold, you can build your strategy by first understanding which market phase the market is in. This will give you an idea about how gold will react.

Types of Market Conditions

Markets go beyond bullish and bearish sentiments. Let's get a more nuanced perspective on all of the market's phases.

Bull markets happen when investor confidence is running high. When broader markets rally, gold’s allure fades. This is a risk-on environment, and riskier assets, such as equities, perform better.

Bear markets make gold shine brighter. Fear dominates the market, and everyone is scrambling to find safer assets. And what is safer than a safe-haven like gold?

Stagflation or inflationary environments cause the value of money to fall. Among other assets, participants favor gold because it tends to hold its value better than fiat currencies.

Rising interest rates bring investor attention back to yield-bearing instruments. Gold prices tend to fall, offering short trade opportunities during falling and range-bound phases.

Geopolitical or Liquidity Crises cause a fall in risk appetite. Participants lose trust in the market and turn to defensive assets. Currencies and precious metals become coveted instruments in this phase.

Why It Is Important

Understanding market phases helps you calibrate your approach for maximum effectiveness. Tracking macroeconomic news, geopolitical happenings, the gold-copper ratio, and market trends enables you to recognize which market phase you are currently in.

Once the phases and trends are confirmed, you can finalize your gold trading strategy, assign capital, measure desired exposure, determine entries and exits, and take a position to capitalize on gold trading trends.

How to Trade Gold CFDs with Century Financial

Leverage trading is the most popular short-term gold trading strategy. Trading with CFDs lets you take bigger positions and amplify your gains.

You can trade in gold CFDs with Century Financial by:

Opening an account through our quick fill form

Choosing from the array of platforms that include the Century Trader App, MT5, CQG, and TWS

Analyzing the markets through technical tools and research insights

Defining the entries, exits, and stop-limits through thorough risk management

Taking a long or short position by buying or selling gold according to your analysis

How to Build a Good Gold Trading Strategy

A sound gold trading strategy takes into account everything from the current trend to the trading platform being used. Building the right strategy would look something like this:

Defining the trading goals

Studying market drivers

Choosing the right platform

Applying the right analysis

Implementing risk controls

Monitoring trends (and margins with leverage)

It is best to avoid sentimental and trend-based trading, as it can skew your bias. Discipline is the most effective way to trade in any market, including the gold market.

Conclusion

Gold's best attribute is not its shine but its resilience. This commodity is your hedge against inflation, a portfolio diversifier and equalizer, a safe haven, and, above all, a dependable store of value. The best gold trading strategy delves into the technicals and fundamentals, allowing you to adapt to the ever-changing market dynamics.

Whether it is the short-term patterns or trends that span years, gold trading can help you fill the cracks in your portfolio. Equip yourself with the best gold trading strategy and the right platform for trading in gold with Century Financial's education hub and trading platforms!

FAQs

Q1. What is the most profitable strategy for gold trading?

A: The best gold trading strategy is to continually recognize and recalibrate your approach in response to market conditions and data. Combining multiple indicators and strategies can help reduce risk and capture price momentum.

Q2: Can beginners trade gold CFDs successfully?

A: Yes, provided they start with small positions, use demo accounts, and learn how leverage works. Building confidence and discipline is as necessary as a great strategy.

Q3: Which technical indicators work best for trading gold?

A: There is no one indicator best suited for gold trading. Using a combination of indicators and patterns can yield desirable results.

Q4. What factors move gold prices the most?

A: Interest rate changes, the strength of the US dollar, inflation expectations, macroeconomic trends, geopolitical risks, and trade cycles are some factors that most significantly impact the gold trading price.

Q5. Is gold better for long-term holding or short-term trading?

A: Gold can work for both; the period of investment in gold (and other assets) depends on the participant's intent. For example, strong trends can offer opportunities for traders, while an investor can opt for gold to diversify and balance their portfolio.

Related Reads

لا تقدم شركة سنشري للإستشارات والتحليل المالي ش.ذ.م.م (الشركة) محتوى هذه المدونة، بما في ذلك أي أبحاث أو تحليلات أو آراء أو توقعات أو أي معلومات أخرى (يُشار إليها مجتمعةً باسم "المعلومات")، إلا لأغراض التسويق والتثقيف وإتاحة المعلومات العامة. ولا يُفسَّر ذلك على أنه نصيحة استثمارية أو توصية أو دعوة لشراء أو بيع أي أدوات مالية.

كما يجوز نشر هذه المعلومات عبر قنوات مختلفة، بما في ذلك موقع الشركة الإلكتروني، ومنصات الغير، والنشرات الإخبارية، والمواد التسويقية، ورسائل البريد الإلكتروني، ووسائل التواصل الاجتماعي، وتطبيقات المراسلة، والندوات الإلكترونية، وغيرها من وسائل التواصل. وبينما تسعى الشركة لضمان دقة المحتوى، فإنها لا تضمن اكتماله أو موثوقيته أو تحديثه في الوقت المناسب. وعليه، فأي قرارات تُتخذ بناءً على هذه المعلومات تكون على مسؤوليتك الشخصية. ولا تتحمل الشركة أي مسؤولية عن أي خسارة أو ضرر ناتج عن استخدامها.

ينطوي تداول المنتجات المالية على مخاطر كبيرة، بما لا يتناسب مع جميع المستثمرين. فيُرجى التأكد من وعيك التام بالمخاطر، وطلب الاستشارة المهنية المتخصصة إذا لزم الأمر.

يُرجى الاطلاع على بيان كشف المخاطر الشامل المتوفر على موقعنا الإلكتروني.