Tuesday, October 04, 2022

What is stagflation and why it matters?

تم إعداد هذا المنشور من قبل سنشري للاستشارات

.jpg)

In June this year, the World Bank warned that the global economy could be heading to a severe downturn, the likes which were not seen since the 1970s. Weak growth, rising prices and high unemployment are a toxic blend that will test the resolve of countries already struggling to rebound from the COVID-19 pandemic. Plus, the ongoing conflict between Russia and Ukraine, continued supply chain disruption, and ongoing waves of COVID-19 cases can unsettle global stock market investments to create a downward spiral.

The World Bank called these forces “stagflation”, and if world economies don’t adhere to this warning, it could induce years of struggles for these countries.

Here’s what you need to know about stagflation and the risk it presents to the global economy:

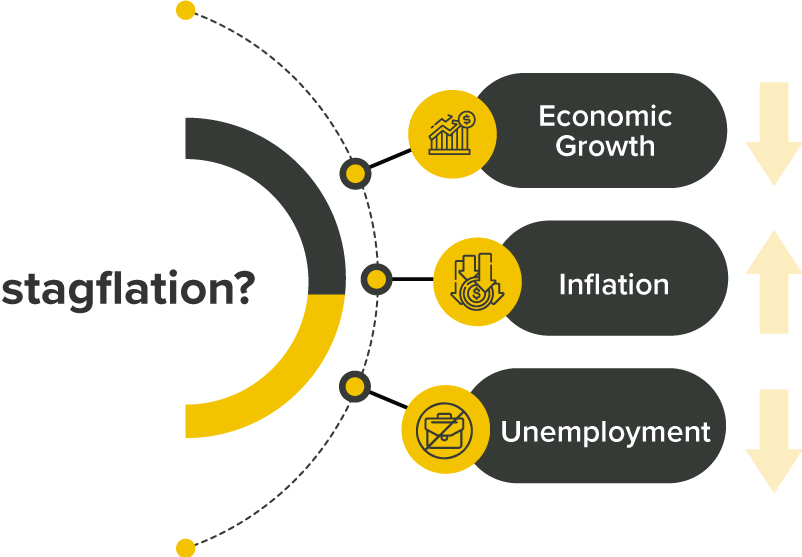

So, what is stagflation?

Stagflation is an economic event where economic growth is slow while the rate of inflation is high. In such a scenario, the lack of economic growth will eventually lead to higher unemployment.

Why is stagflation bad?

Generally, when the economy is booming, and prices are low for consumers to buy goods and services, people are generally happy. However, if the opposite is happening and with it, you could lose your job, then things are getting worse.

When stagflation occurs, households and businesses worry that the current inflationary pressures will continue to soar in the long term. The result is that they change their economic behavior, ensuring inflation will continue to rise.

The simple truth is that stagflation is not an easy fix. This is a fear for governments, as any policy to lower inflation may increase unemployment and vice-versa. It’s a job usually left to central bankers, like the Federal Reserve, to ensure a stable economy and keep a check on inflation. Generally, the Fed aims to keep inflation around 2%. But, when inflation exceeds that level, there is a likelihood to see interest rate hikes by the Fed. This makes it difficult for households and businesses to borrow money and discourages them from spending money while reducing price increases.

Causes of Stagflation

Most economists cannot agree with the reasons for stagflation, but many are of the consensus that there are two leading causes:

According to the theory based on supply shock, stagflation occurs when an economy suddenly faces an increase or decrease in the supply of a commodity or service. Here, an economy sees a surge in prices, resulting in higher production costs and less profitability.

Why are we talking about stagflation now?

If you have seen recent economic data, you would have noticed that the US and other countries are experiencing higher inflation rates. This has generally occurred due to disruptions in supply chains and shifting consumer demands. Take China, where the recent surges of COVID-19 cases have forced factories and ports to shut down for weeks and, at times, months. Additionally, the Russia-Ukraine conflict has further escalated fears of a stagflation. Russia’s oil and natural gas exports have been disrupted, which has led to global energy-price inflation, while its blockade on Ukraine’s grain exports is driving up food commodity prices globally.

So, what happens if stagflation persists?

If stagflation continues for years in the developed world, it would be safe to say that something has gone terribly wrong. A way of dealing with stagflation is eliminating inflation, which will increase unemployment leading to a recessionary market, which in most cases can be resolved within a year. However, the real long-term risk will fall on emerging economies like BRIC nations (Brazil, Russia, India and China), where their economies rely on importing countries to sustain growth. They are also dependent on foreign investment, but businesses are likely to take their investments out of these countries when markets are volatile, leading to a credit crisis.

Tips to Remember

What to do if the government starts a recession to stop stagflation

Is it possible to avoid stagflation?

Unlikely, as financial regulators are forced to balance two competing interests: inflation and unemployment. For most economists, the only known remedy for stagflation is a recession. It would involve raising rates, sacrificing economic growth and accepting higher unemployment. The rationale is relatively simple – the market will recover faster from unemployment compared to persistently high consumer prices. The other way of avoiding stagflation is deregulating industries like oil, wheat, steel, etc., but its positive effects can take months to surface.

لا تقدم شركة سنشري للإستشارات والتحليل المالي ش.ذ.م.م (الشركة) محتوى هذه المدونة، بما في ذلك أي أبحاث أو تحليلات أو آراء أو توقعات أو أي معلومات أخرى (يُشار إليها مجتمعةً باسم "المعلومات")، إلا لأغراض التسويق والتثقيف وإتاحة المعلومات العامة. ولا يُفسَّر ذلك على أنه نصيحة استثمارية أو توصية أو دعوة لشراء أو بيع أي أدوات مالية.

كما يجوز نشر هذه المعلومات عبر قنوات مختلفة، بما في ذلك موقع الشركة الإلكتروني، ومنصات الغير، والنشرات الإخبارية، والمواد التسويقية، ورسائل البريد الإلكتروني، ووسائل التواصل الاجتماعي، وتطبيقات المراسلة، والندوات الإلكترونية، وغيرها من وسائل التواصل. وبينما تسعى الشركة لضمان دقة المحتوى، فإنها لا تضمن اكتماله أو موثوقيته أو تحديثه في الوقت المناسب. وعليه، فأي قرارات تُتخذ بناءً على هذه المعلومات تكون على مسؤوليتك الشخصية. ولا تتحمل الشركة أي مسؤولية عن أي خسارة أو ضرر ناتج عن استخدامها.

ينطوي تداول المنتجات المالية على مخاطر كبيرة، بما لا يتناسب مع جميع المستثمرين. فيُرجى التأكد من وعيك التام بالمخاطر، وطلب الاستشارة المهنية المتخصصة إذا لزم الأمر.

يُرجى الاطلاع على بيان كشف المخاطر الشامل المتوفر على موقعنا الإلكتروني.

__1418016979.jpg)