Thursday, June 25, 2020

Why stock pickers are failing to outperform the S&P 500 index

تم إعداد هذا المنشور من قبل سنشري للاستشارات

The S&P 500 index’s performance has had a rollercoaster 2020, as fears of a global recession and the coronavirus pandemic wreaked havoc with share prices.

Despite an armed conflict flare-up between the US and Iran at the start of the year, the S&P 500 stood at a healthy 3,257 on 2 January.

While the blue-chip index grew steadily to reach a high of 3,380 on 14 February, by mid-March the S&P 500 had plunged to 2,237 as fears over the health, social and economic impact of the pandemic began to take hold.

As of 23 June, the S&P 500 trades back at the 3,131 level thanks to the US government and Federal Reserve’s efforts to shore up the economy, which lifted the index’s performance.

However, according to data from S&P Dow Jones Indices, US large-cap stock-picking funds have failed to show the same momentum.

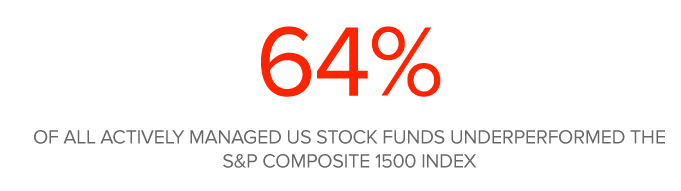

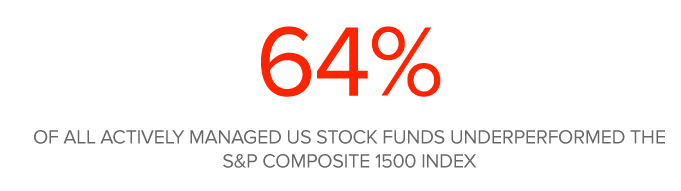

Of all actively managed US stock funds, 64% underperformed the S&P Composite 1500 index, which tracks large mid and small-cap stocks, in the first four months of 2020.

Among actively managed large-cap US stock funds, 59% underperformed the S&P 500 index in the same period of time, calling into question whether the idea that active tends to outperform in volatile markets is still valid.

An unbalanced S&P 500

Conventional wisdom dictates “while index funds may have the advantage in rising markets, it’s in volatile downturns that active management can prove its worth”, according to Berlinda Liu, director at S&P Dow Jones Indices.

However, despite a prime environment for active managers, most have continued to underperform passive indexes.

“Active managers got a pitch down the middle, and they’re swinging and missing more often than they would like,” Todd Rosenbluth, senior director of ETF and mutual fund research at CFRA, said, according to ETF Trends.

Part of the problem lies in the outperformance of tech stocks like Amazon [AMZN] and Facebook [FB] during the pandemic.

“The largest companies, like Microsoft [MSFT] and Apple [AAPL] and Facebook, that have won, if they continue to win, it's hard to beat them when you're trying to be different than the benchmark,” Rosenbluth added.

Of course, it has meant rosy returns for those investors betting on big tech.

Rebecca O'Keeffe, head of investment at Interactive Investor, told Opto: “US Mega-caps have soared in recent months, with technology stocks at the forefront of the recovery. These companies are driving the major indices forward, leaving their smaller-cap rivals in their wake. This performance disparity explains why those active managers whose mandate is large-cap or have chosen to overweight big US tech companies have outperformed the wider S&P index.”

Large-cap stocks prove resilient

“A major problem for investors in US equities is that many active funds fail to beat the S&P 500, so taking a passive approach is favoured,” Gavin Haynes, investment consultant and co-founder of Fairview Investing, tells Opto.

“However, there have been a number of large-cap active funds that have proven very resilient during the recent pandemic and are generating positive returns year to date. The key has been following managers with a focus on growth businesses that have been able to thrive despite economic turbulence.”

According to Haynes, the winners have had a high weighting in technology, which is an area that has benefited from the increasing move to digitisation, as well as healthcare and consumer staples.

However, at the other end of the spectrum, US fund managers taking a value approach have been punished. Cyclical areas of the market such as energy and financials have experienced a prolonged period of underperformance.

Equity strategists at Goldman Sachs agree, calling energy stocks the “biggest laggard” of 2020 to date and that it will avoid the sector in the weeks ahead.

In contrast, the firm’s equity strategist David Kostin believes that tech stocks will continue to outperform. “The IT sector has returned 7% year to date. It has been supported by its quality attributes, including strong balance sheets and high-profit margins,” Kostin said, according to Money Control.

“Major risks to the sector include its popularity, which could cause underperformance in the event of a sharp investor derisking as well as the possibilities of government regulation and tax reform.”

Forecasts of volatility put focus back on growth

According to Bloomberg data, the average year-end forecast for the S&P 500 is 2,933, suggesting that the recent rally could be somewhat short-lived.

Haynes expects that continued low growth and low-interest rates would see “the strong … get stronger and US funds focusing on US large-cap global leaders will be well-positioned to continue outperforming”.

If the growth underpinning large-cap stocks persists and a market correction occurs in the second half of 2020, active investors might still have time to hit a few runs.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.