Monday, October 19, 2020

CMC US Renewable Energy Share Basket v/s Oil & Gas Share Basket

تم إعداد هذا المنشور من قبل سنشري للاستشارات

*This performance is only observed with historical backtests and not traded by the company.

Risks & Assumptions

- The strategy is based on the historical performance of 2 share baskets – CMC US Renewable Energy & CMC US Oil & Gas. The performance is based on the current composition of the individual shares that are part of the basket.

- The baskets & their components are subject to periodic review by their index providers. For any addition or removal of existing components, the performance of both these share baskets is likely to deviate from their previous trend.

- The strategy takes into account the current market dynamics of fossil fuels & renewable sources of energy as well as their historical trend. Going ahead, any significant changes to market dynamics will likely affect the strategy performance.

- Data for performance analysis has been taken from 05/01/2015 – 13/10/2020. For stocks in Renewable Energy Basket– Maxeon & TPI Composite, data taken from their respective listing dates.

Strategy Trade

The strategy involves going long on US Renewable Energy Share Basket & simultaneously going short on US Oil & Gas Share Basket.

Strategy Rationale

The strategy is essentially a play between cleaner/greener sources of energy i.e. renewable sources and traditional non-renewable sources of energy. The former majorly consists of sources like wind, solar, electricity & water. Non-renewable sources include high carbon fossil fuels like crude oil, coal & natural gas.

As seen from below statistics, renewable company shares have outperformed their non-renewable peers over the last 5-year period. Recent US election polls predicting Blue Wave Sweep under Joe Biden has given a further impetus to renewable energy shares.

US Oil & Gas shares on the other hand continue to suffer from legacy issues of sharp reaction to any drastic price movement in crude oil prices. WTI dipping below 0 level this year & the sharp rally thereafter in oil prices has clearly highlighted volatile nature of fossil fuel markets along with its long-lasting impact on non-renewable oil & gas companies fiscal health.

At macro level, other factors that are supportive for further long term growth in renewable energy shares is the fact that world is increasingly looking to turn towards more environmental friendly sources. Renewable energy is entering a new phase altogether with technology driving changes in this sector. As a result, there has been increased use of such sources in everything ranging from automobiles to home appliances & even power generation.

ESG (Environmental, Social, and Governance) theme is further likely to provide a major tailwind for further growth in renewable sources of energy. An outright win by Joe Biden & his party would likely propel further growth in this sector. Biden's massive infrastructure package bets big on using more clean, green & renewable sources of energy.

International Energy Agency’s latest World Energy Outlook report for 2020 now estimates world having 43 % more solar output by 2040 than it had expected in 2018. This is primarily on back of their new analysis which sees solar energy 25 % - 30 % cheaper than previous estimates.

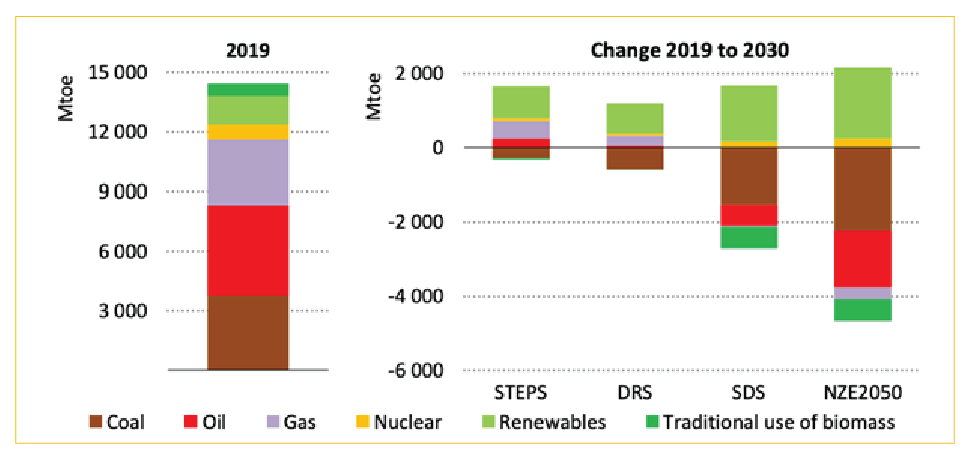

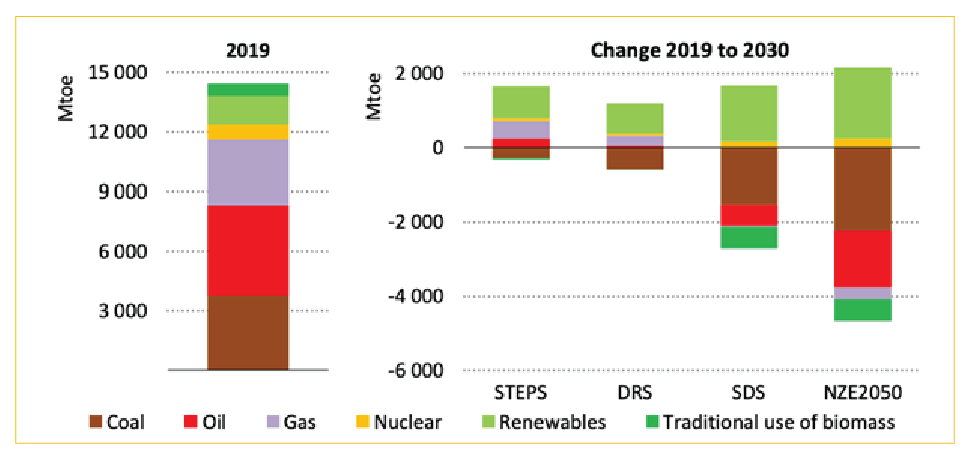

IEA’s World Economic Output report has detailed 4 scenarios for net zero emission over longer period. Under all 4 scenarios, demand for renewable sources of energy is likely to grow. This is presented in the below chart taken from International Energy Agency World Economic Outlook Report 2020.

Renewable Sources (Legend: Light Green) is likely to account for the majority of demand growth in all 4 cases. Fossil fuels on the other hand are likely to see gradual reduction in their overall demand over the coming years.

The importance of clean energy can be seen from billions of dollars of investment done by big 6 super oil majors - BP, Shell, Chevron, Total, Eni and Exxon. BP for example is planning to invest more in renewable sources of energy with the company already having a 2200 MW of wind capacity in US. Shell in 2018 bought a 44 % stake in US Solar power plant firm Silicon Ranch for $ 200 million. Total, French oil major, bought a 74% stake in the French electricity retailer Direct Energie for $1.7bn in 2018.

Strategy Statistics

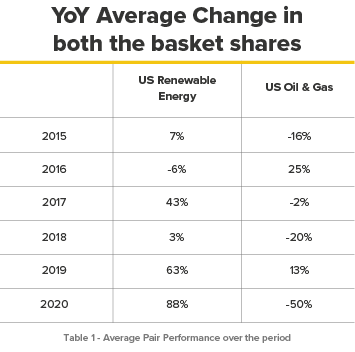

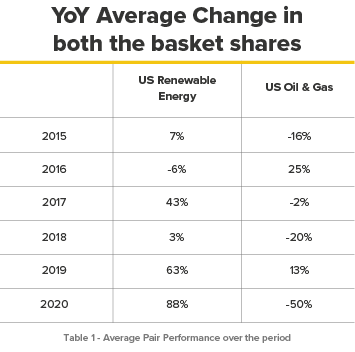

1) Over the last 5 year period, the average performance of US Renewable shares has been 32 % as against average performance of -8 % for US Oil & Gas shares.

2) On the total returns side, if we take the average returns of total sum of the entire respective basket stocks, for US Renewable it is 191%. For US Oil & Gas it is -49%.

3) Taking a Y-o-Y comparison between both respective basket shares, the difference is clearly visible as seen below

US Renewable Energy Basket Shares |

||||||||||||||||||

| Year | Emphase | Maxeon | First Solar | SunPower | TPI Composites | Ormat Tech | Plug Power | Renewable Energy Group | Hannon Armstrong | NextEra | MKS Instruments | Sunrun | IDA Corp | Hawaiian Electric | Northwestern | Avista | BWX Techno | Portfolio Level Average |

| 2015 | -75% | 58% | 23% | 33% | -30% | -3% | 33% | -12% | 1% | 34% | 5% | -13% | -3% | 2% | 50% | |||

| 2016 | -71% | -52% | -78% | 21% | 47% | -43% | 5% | 0% | -14% | 65% | -53% | 18% | 14% | 5% | 13% | 25% | ||

| 2017 | 130% | 101% | 23% | 33% | 21% | 95% | 19% | 26% | 67% | 58% | 6% | 14% | 10% | 5% | 30% | 54% | ||

| 2018 | 82% | -40% | -45% | 18% | -19% | -49% | 116% | -21% | -1% | -34% | 84% | 4% | 3% | 2% | -18% | -37% | ||

| 2019 | 431% | 31% | 54% | -27% | 44% | 138% | 4% | 63% | 25% | 66% | 26% | 19% | 31% | 24% | 12% | 60% | ||

| 2020 | 236% | 8% | 45% | 225% | 90% | -1% | 428% | 109% | 45% | 26% | 6% | 361% | -17% | -25% | -27% | -27% | -9% | |

| Sum | 760% | 8% | 144% | 202% | 134% | 125% | 539% | 250% | 146% | 91% | 162% | 457% | 42% | 20% | 6% | 12% | 142% | 191% |

| Average | 127% | 8% | 24% | 34% | 27% | 21% | 90% | 42% | 24% | 15% | 27% | 76% | 7% | 3% | 1% | 2% | 24% | |

| Individual Stock Returns (From 5/1/2015 - 13/10/2020) | 668% | 8% | 98% | 4% | 164% | 170% | 468% | 510% | 216% | 93% | 227% | 645% | 32% | 2% | -10% | -2% | 169% | |

| Table 2 - US Renewable Basket Shares Performance over last 5 years | ||||||||||||||||||

US Oil & Gas Share Basket Shares |

||||||||||||||||||

| Concor Phillips | Kinder Morgan | EOG Resources | Chevron | Pioneer | Exxon Mobil | Phillips 66 | Baker Huges | Valero | Schlumberger | Portfolio Level Average | ||||||||

| 2015 | -32% | -65% | -23% | -20% | -16% | -16% | 13% | -18% | 40% | -19% | ||||||||

| 2016 | 7% | 36% | 45% | 32% | 45% | 17% | 8% | 38% | -2% | 21% | ||||||||

| 2017 | 8% | -16% | 4% | 6% | -7% | -8% | 17% | -30% | 31% | -21% | ||||||||

| 2018 | 13% | -18% | -20% | -15% | -24% | -20% | -15% | -33% | -19% | -48% | ||||||||

| 2019 | 3% | 34% | -8% | 9% | 13% | 0% | 26% | 22% | 24% | 8% | ||||||||

| 2020 | -47% | -40% | -54% | -40% | -42% | -52% | -54% | -50% | -56% | -61% | ||||||||

| Sum | -48% | -70% | -56% | -27% | -32% | -79% | -6% | -72% | 17% | -119% | -49% | |||||||

| Average | -8% | -12% | -9% | -4% | -5% | -13% | -1% | -12% | 3% | -20% | ||||||||

| Individual Stock Returns (From 5/1/2015 - 13/10/2020) | -49% | -71% | -58% | -35% | 41% | -63% | -29% | -67% | 216% | -82% | ||||||||

| Table 3 - US Oil & Gas Basket Shares Performance over last 5 years | ||||||||||||||||||

Strategy Performance

For a hypothetical position of client investing $ 100,000 each side - Buying US CMC Renewable Energy Share Basket and Selling CMC US Oil & Gas Share Basket, below are the performance statistics over last 1 year period. Since the both these indices data are available only from last year, a longer past 5 year performance of individual shares of the baskets can be seen from Table 2 & Table 3 as given above.

| Open(31st May,2019) | Close(13th October,2020) | Total Returns | P & L in case off $ 100K invested each side ( Long US Renewable Energy & Short US Oil & Gas ) | Net P & L | |

| CMC US Renewable Energy | $ 3,462 | $ 8,732 | 142% | $ 141,792 | $ 185,464 |

| CMC US Oil & Gas | $ 8,738 | $ 4,922 | -44% | $ 43,672 | |

| Table 4 - Pair P & L for $ 100K investment each side *Figures for P & L exclusive of holding costs & transaction charges as well as any other costs |

|||||

*Past performance is not indicative of and does not guarantee future results. Trading in markets may involve loss of capital.

Risks & Assumptions

Data Source: Bloomberg & International Energy Agency World Economic Outlook Report 2020

Chart Source: International Energy Agency World Economic Outlook Report 2020

Arun Leslie John

Chief Market Analyst

Disclaimer: Century Financial Consultancy LLC (“CFC”) is Limited Liability Company incorporated under the Laws of UAE and is duly licensed and regulated by the Emirates Securities and Commodities Authority of UAE (SCA).This document is a marketing material and is for informational purposes only and must not be construed to be an advice to invest or otherwise in any investment or financial product. CFC does not guarantee as to adequacy, accuracy, completeness or reliability of any information or data contained herein and under no circumstances whatsoever none of such information or data be construed as an advice or trading strategy or recommendation to deal (Buy/Sell) in any investment or financial product. CFC is not responsible or liable for any result, gain or loss, based on this information, in whole or in part. Please carefully read disclaimer mentioned below/next page/next frame.

PLEASE READ THE FOLLOWING TERMS AND CONDITIONS OF ACCESS FOR THE PUBLICATION BEFORE THE USE THEREOF.

By use of the publication and continuing to access the publication, you accept these terms and conditions and undertake to be bound by the acceptance. CFC reserves the right to amend, remove, or add to the publication and Disclaimer at any time without any prior notice to you. Such modifications may be effective immediately or otherwise. Accordingly, please continue to review this Disclaimer whenever accessing, or using the publication. Your access of, and use of the publication, after modifications to the Disclaimer will constitute your acceptance of the terms and conditions of use of the publication, as modified. If, at any time, you do not wish to accept the content of this Disclaimer, you may not access, or use the publication. Any terms and conditions proposed by you which are in addition to or which conflict with this Disclaimer are expressly rejected by CFC and shall be of no force or effect.

No information as given herein by CFC in this publication should be construed as an offer, recommendation or solicitation to purchase or dispose of any securities/financial instruments/products or to enter in any transaction or adopt any hedging, trading or investment strategy. The data/information contained in the publication is not designed to initiate or conclude any transaction. Neither this publication nor anything contained herein shall form the basis of any contract or commitment whatsoever. Distribution of this publication does not oblige CFC to enter into any transaction. The information in this document is not intended, by itself, to constitute independent, impartial or objective research or a recommendation from CFC and should not be treated as such.

The content of this publication should not be considered legal, regulatory, credit, tax or accounting advice. Anyone proposing to rely on or use the information contained in the publication should independently verify and check the accuracy, completeness, reliability and suitability of the information and should obtain independent and specific advice from appropriate professionals or experts regarding information contained in this publication. CFC cannot be held responsible for the impact of any transactional costs or any taxes as may be applicable on transactions.

Information contained herein is based on various sources, including but not limited to public information, annual reports and statistical data that CFC considers reliable. However, CFC makes no representation or warranty as to the accuracy or completeness of any report or statistical data made in or in connection with this publication and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the information contained in this publication. References to any financial instrument or investment product does not imply that an actual trading market exists for such instrument or product. In publishing this document CFC is not acting in the capacity of a fiduciary or financial advisor.

The report does not take into account the investment objectives, financial situations and specific needs of recipients. The recipient of this publication must make its own independent decisions regarding whether this communication and any securities or financial instruments mentioned herein, is appropriate in the light of its investment objectives, investment experience, financial situation, existing portfolio holdings and/or investment needs. Recipients will need to decide on their own as to whether or not the contents of this document are suitable for them.

This document is a marketing material and has been prepared by individual(s), marketing and/or research personnel of CFC. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is purely a marketing communication. In this publication, any opinions, news, research, analysis, prices, or other information constitute is a general market commentary, and do not constitute the opinion or advice of CFC or any form of personal or investment advice. CFC neither endorses nor guarantees offerings of third party, nor is CFC responsible for the content, veracity or opinions of third-party speakers, presenters, participants or providers. CFC will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Charts, graphs and related data or information provided in this publication are intended to serve for illustrative purposes only. The information contained in this publication is prepared as of a particular date and time and will not reflect subsequent changes in the market or changes in any other factors relevant to their determination. All statements as to future matters are not guaranteed to be accurate. CFC expressly disclaims any obligation to update or revise any forward-looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events.

The information in this communication cannot disclose everything about the nature and risks of the abovementioned data / information. This is not an exhaustive list of the risks involved, nor should it be regarded as offering advice on the suitability of these investments for the recipient.

All views expressed in all reports, analysis and documents are subject to change without notice. CFC may have issued other reports, analysis or other documents expressing different views from the contents hereof. Staff members/employees of CFC may provide/present oral or written market commentary or analysis to you that reflect opinions that are contrary to the opinions expressed in this research and may contain insights and reports that are inconsistent with the views expressed in this publication. Neither CFC nor any of its affiliates, group companies, directors, employees, agents or representatives assume any liability nor shall they be made liable for any damages whether direct, indirect, special or consequential including loss of revenue or profits that may arise from or in connection with the use of the information provided in this publication.

Information or data provided by means in this publication may have many inherent limitations, like module errors or lack accuracy in its historical data. Data included in the publication may rely on models that do not reflect or take into account all potentially significant factors such as market risk, liquidity risk, credit risk etc.

CFC and its affiliates reserve the right to act upon or use the contents hereof at any time, including before its publication herein. The use of our information, products and services should be on your own due diligence and you agree that CFC is not liable for any failure to achieve desired return on investment that is in any manner related to availing of services or products of CFC and use of our information, products and services. You acknowledge and agree that past investment performance is not indicative of the future performance results of any investment and that the information contained herein is not to be used as an indication for the future performance of any investment activity. Any prices provided in this document are indicative only and do not represent firm quotes as to either price or size. The value of any investment or income may go down as well as up. All investments involve an element of risk, including capital loss.

This publication is being furnished to you solely for your information and neither it nor any part of it may be used, forwarded, disclosed, distributed or delivered to anyone else. You may not copy, reproduce, display, modify or create derivative works from any data or information contained in this publication. This document may not be published, circulated, reproduced, or distributed in whole or part to any other person (whether within or in a jurisdiction outside UAE) without the prior written consent of CFC.

Declaration of the Financial Analyst

The analyst(s) who prepared this report certifies that the opinions contained herein accurately and exclusively reflect his or her views. The Analyst further undertakes that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein. The analyst(s) who wrote this report does not hold securities in the Company mentioned in the report. The analyst(s) receives a fixed compensation from CFC. No part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this report. The business solicitation or marketing departments of CFC are separate and independent from the reporting line of the analyst(s). The analyst(s) confirms that he or she and his / her associates do not serve as directors or officers of the Company, and the Company or other third parties have not provided or agreed to provide any compensation or other benefits to the analyst(s) in connection with this report. An “associate” is defined as the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child, of the analyst.

Services offered by CFC include products that are traded on margin and can result in losses that exceed deposits. Before deciding to trade on margin products, you should consider your investment objectives, risk tolerance and your level of experience on these products. Trading with leverage carries significant risk of losses and as such margin products are not suitable for every investor and you should ensure that you understand the risks involved and should seek independent advice from professionals or experts if necessary.