.jpg)

For the Layman

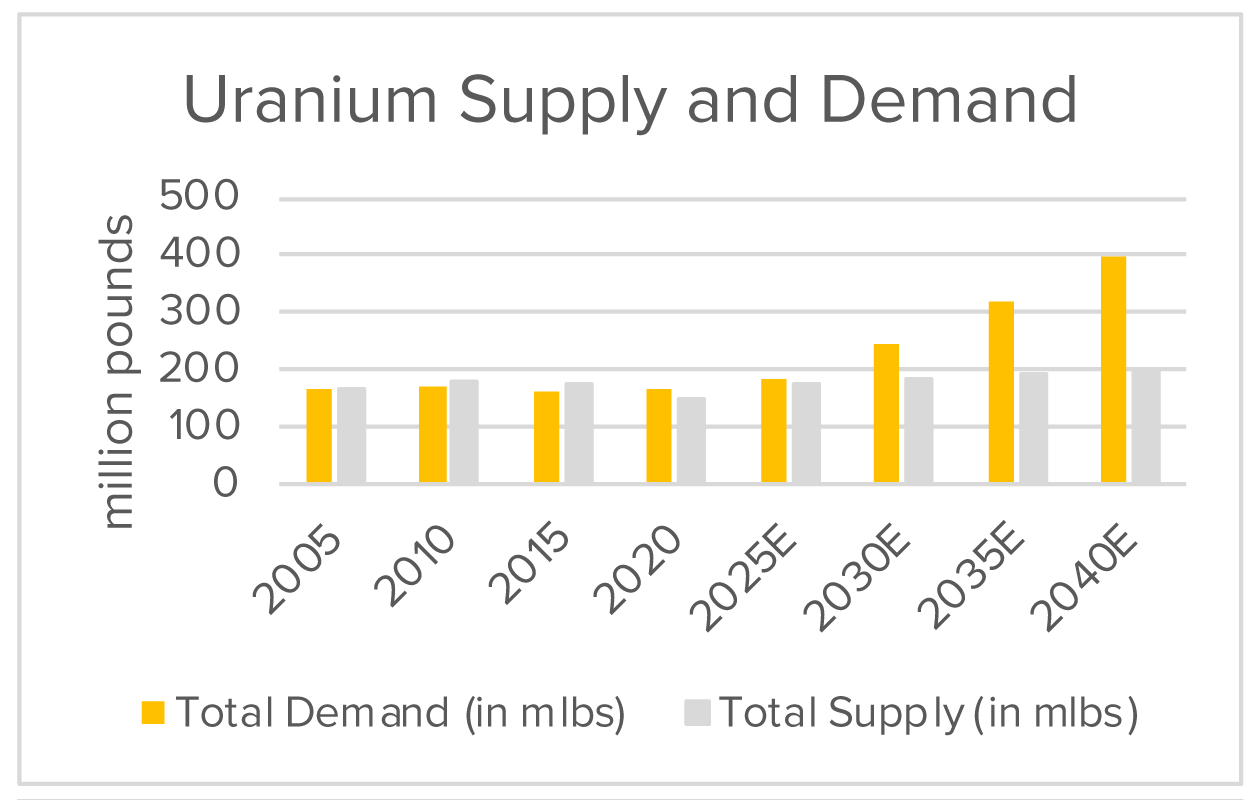

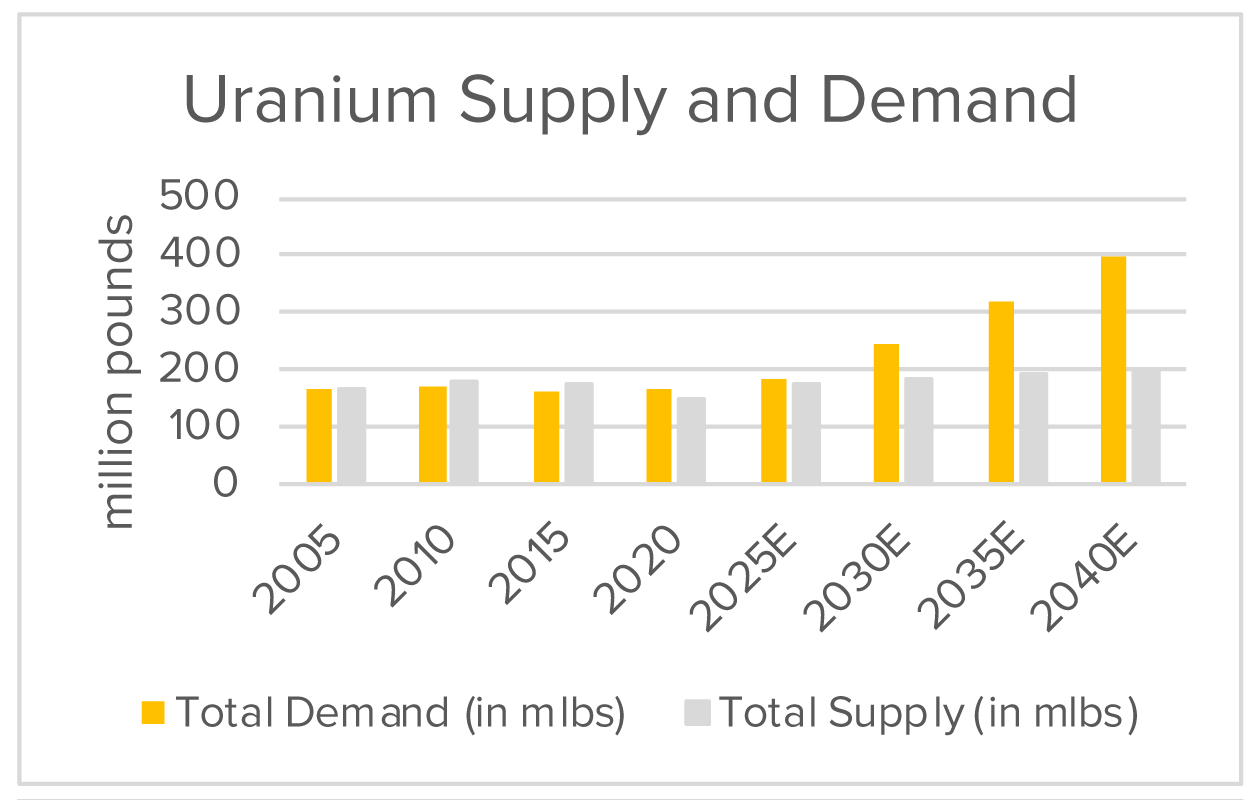

- As of 2025, the uranium market is in 3.3% deficit, and is expected to increase to a 49%+ deficit by 2040, supporting a bullish stance on uranium prices.

- As contracts of uranium miners closely track those of spot uranium, a long position on Cameco Corporation (CCJ), the world's largest-listed vertically integrated uranium producer, would be a direct play. As a diversified option, the Sprott Uranium Miners ETF (URNM) can be an alternative.

- Another method to capitalise on the uranium supercycle is via the Sprott Physical Uranium Trust ETF (U.UN) . This ETF invests and holds substantially all of its assets in uranium in the form of U3O8.

Uranium is a radioactive element that must be refined prior to being manufactured into fuel pellets or rods. Note that the uranium grade 308 is required for energy generation, and all the numbers mentioned in this report are of uranium 308.

The Products

.png)

.png)

Uranium pellets are stacked together to sealed metal tubes called fuel rods.

Inside the reactor vessel, the fuel rods are immersed in water, where the chemical reaction produces steam that drives the turbine and generates electricity.

Supply and Demand Dynamics

Looking at the demand and supply dynamics as of 2025, the demand for uranium was 182 million pounds (mlbs), while supply was 176 mlbs, implying a deficit of about 3%. Looking ahead, by 2040, the deficit is expected to increase to as high as 50% as the demand soars to a little under 400 mlbs.

On the supply side, it typically takes about 10-15 years from initial discovery and exploration; however, if feasible, then the mines can run for 20-40 years. Hence, this bottleneck in discovery and exploration limits the supply, even though the globally identified recoverable uranium resources amount to 17.5 Kmlbs.

Demand can be attributed primarily to 2 factors: rising electricity demand and increased pressure for clean energy.

.jpg)

In 2025, the Uranium market is projected (as the actual numbers are yet to be released) to be in a deficit of about 3.3%, as demand and supply stand at 182 mlbs and 176 mlbs, respectively. Looking ahead, the deficit is expected to rise to a staggering 49%+.

Amid the rapid expansion of data centres and hyperscalers, electrification, and industrial growth, electricity demand is expected to increase significantly. This leads to a natural question – Why Nuclear Energy?

The answer is that nuclear energy is denser than fossil fuels. This means a much smaller amount of fuel is required to generate the same amount of electricity, leading to operational cost advantages and less waste by volume. Capacity factor, a measure of efficiency, is the ratio of the power produced by a source over the total power it could have produced if running at full strength over a given period. Nuclear has the highest capacity factor of any power source at 90%, followed by coal and combined-cycle gas (60%), wind (35%), and solar (25%). Furthermore, nuclear energy is often favoured from a sustainable, clean energy standpoint.

How can the Uranium Supercycle be Played?

Uranium Miners

Currently, like other commodities, uranium does not trade in the open market, and buyers and sellers negotiate contracts privately. However, over the long term, the perceived spot price and the price set by miners tend to be similar; in fact, the price set by miners is often at a premium, as shown.

This means that the miners would be direct beneficiaries when the price of uranium increases. A stock to watch out for in this space is Cameco Corporation (CCJ).

CCJ is the world's largest-listed vertically integrated uranium producer and is well positioned to take advantage of a favourable outlook for the nuclear energy industry.

Uranium ETF

Another method to capitalise on the uranium supercycle is via the Sprott Physical Uranium Trust ETF (U.UN). This ETF invests and holds substantially all of its assets in uranium in the form of U3O8.

From a technical standpoint, it has broken out above the trendline resistance on the monthly timeframe, supporting a bullish stance.

Others

Though CCJ and U.UN would be direct beneficiaries of a rally in the uranium prices, it must be noted that there would be other companies that would gain from the momentum in the uranium space. Other beneficiaries include: Oklo Inc. (OKLO), NuScale Power Corporation (SMR), and Constellation Energy Corporation (CEG).

Disclaimer:Century Financial Consultancy LLC (CFC) is duly licensed and regulated by the Securities and Commodities Authority of UAE (SCA) under license numbers 20200000028 and 301044 to practice the activities of Trading broker in the international markets, Trading broker of the OTC derivatives and currencies in the spot market, Introduction, Financial Consultation and Financial Analysis, and Promotion. CFC is a Limited Liability Company incorporated under the laws of UAE and registered with the Department of Economic Development of Dubai (registration number 768189). CFC has its registered oce at 601, Level 6, Building no. 4, Emaar Square, Downtown, Dubai, UAE, PO Box 65777.

PLEASE READ THE FOLLOWING TERMS AND CONDITIONS OF ACCESS FOR THE PUBLICATION BEFORE THE USE THEREOF.

Please carefully read and agree to the terms and conditions before using the publication. By accessing and continuing to use the publication, you acknowledge and accept the terms and conditions outlined in this Disclaimer (“Disclaimer”). CFC holds the right to modify or update the Publication and the Disclaimer at any time without any prior notice. Your access and usage of the Publication post the modifications or updates to the Disclaimer will constitute your agreement to abide by the revised terms and conditions. If you do not agree with the contents of this Disclaimer please refrain from using the Publication. Any terms and conditions you propose that may contradict this Disclaimer are liable to be rejected by CFC and shall be considered null and void.

This Publication is a marketing material. It has not been prepared in accordance with legal requirements intended to promote the independence of investment research and, therefore, is a straightforward marketing communication. This Publication's opinions, news, research, analysis, prices, and other information comprise a general market commentary and do not represent the opinion or advice of CFC or any form of personalized or investment advice. Accordingly, CFC is not liable for any loss or damage, including but not limited to any loss of profit, that may arise directly or indirectly from using or relying on this Publication.

The information in this Publication cannot disclose everything about the nature and risks of the abovementioned data/information. Therefore, this is not an exhaustive list of the risks involved. Please refer to our website for the complete Risk Disclosure Statement.

Charts, graphs, tables, calculations of profit and loss, leverage, scenario analysis, other numbers and calculations and related data or information provided in this Publication are intended for illustrative purposes only. The information contained in this Publication is prepared as of a particular date and time and will not reflect subsequent changes in the market or any other factors relevant to their determination. All statements as to future matters are not guaranteed to be accurate. CFC disclaims any obligation to amend or revise any forward-looking statements to reflect new information, events, or circumstances after the date of this Publication or to reflect the occurrence of unanticipated events. The Publication may contain forward-looking statements and projections based on current market conditions and an assessment of future trends. Actual results may dier materially from those projected. CFC does not guarantee the accuracy or reliability of any such statements.

No information given in this Publication should be construed as an endorsement of any particular security, company, or industry, offer, recommendation, or solicitation to purchase or dispose of any securities/financial instruments/products or to enter into any transaction or adopt any hedging, trading or investment strategy. The data/information contained in the Publication is not designed to initiate or conclude any transaction. Neither this Publication nor anything contained herein shall form the basis of any contract or commitment whatsoever. Distribution of this Publication does not oblige CFC to enter into any transaction.

The Publication should not be considered legal, regulatory, credit, tax, or accounting advice. Anyone proposing to rely on or use the information contained in the Publication should independently verify and check its accuracy, completeness, reliability, and suitability and obtain independent professional advice. The Publication does not take into account the investment objectives, financial situations, and specific needs of recipients. The recipient of this Publication must make independent decisions regarding whether this communication and any securities or financial instruments mentioned herein are appropriate in the light of their investment objectives, investment experience, financial situation, existing portfolio holdings and/or investment needs. Recipients will need to decide on their own as to whether or not the contents of this Publication are suitable for them.

Information contained in this Publication is based on various sources, including but not limited to public information, annual reports, and statistical data that CFC believes to be reliable. However, CFC makes no representation or warranty as to the accuracy or completeness of any report or statistical data made in or in connection with this Publication and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the information contained in this Publication. In addition, the names used to describe various financial products or instruments in this Publication may vary from the ones used on dierent trading platforms.

All views expressed in all reports, analysis and documents are subject to change without notice. CFC may have issued other reports, analysis, or other documents expressing dierent views from this Publication. In addition, sta members/employees of CFC may provide/present oral or written market commentary or analysis to you that reflect opinions contrary to the opinions expressed in this research and may contain insights and reports inconsistent with the views expressed in this Publication. Neither CFC nor any of its aliates, group companies, directors, employees, agents, or representatives assume any liability, nor shall they be made liable for any damages, whether direct, indirect, special, or consequential, including loss of revenue or profits that may arise from or in connection with the use of the information provided in this Publication. Information or data provided by means in this Publication may have many inherent limitations, like module errors or lack of accuracy in its historical data. In addition, data included in the Publication may rely on models that do not reflect or consider all potentially significant factors such as market risk, liquidity risk, interest risk, credit risk etc.

Information or data provided by means in this Publication may have many inherent limitations, like module errors or lack of accuracy in its historical data. In addition, data included in the Publication may rely on models that do not reflect or consider all potentially significant factors such as market risk, liquidity risk, interest risk, credit risk etc.

CFC and its aliates reserve the right to act upon or use the contents hereof at any time. The use of our information, products and services should be on your own due diligence and you agree that CFC is not liable for any failure to achieve the desired return on investment that is in any manner related to availing of services or products of CFC and use of our information, products and services. You acknowledge and agree that past investment performance is not indicative of the future performance results of any investment and that the information contained in this Publication is not to be used as an indication for the future performance of any investment activity. Any prices provided in this Publication are indicative only and do not represent firm quotes as to either price or size.

This Publication is being furnished to you solely for your information and neither it nor any part of it may be used, forwarded, disclosed, distributed or delivered to anyone else. You may not copy, reproduce, display, modify or create derivative works from any data or information contained in this Publication. This document may not be published, circulated, reproduced, or distributed in whole or part to any other person (whether within or in a jurisdiction outside UAE) without the prior written consent of CFC.

Declaration of the Financial Analyst: The Analyst(s) who prepared this report certifies that the opinions contained herein exclusively reflect his or her views. The Analyst further undertakes that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein. The Analyst(s) who wrote this report does not hold securities in the Company mentioned in the report (“Company”). The Analyst(s) confirms that he or she and his / her Associates do not serve as directors or ocers of the Company, and the Company or other third parties have not provided or agreed to provide any compensation or other benefits to the Analyst(s) in connection with this report. An “Associate” is defined as the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child of the Analyst. The Analyst(s) receives a fixed compensation from CFC. No part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this report. The business solicitation or marketing departments of CFC are separate and independent from the reporting line of the Analyst(s).

Trading in financial products carries risk. Trading in leveraged Over-The-Counter (OTC) Derivative products including Contracts for Di erence (CFDs) and spot foreign exchange contracts involves a significant risk of loss which can exceed deposits and may not be suitable for all investors. OTC Derivative products / CFDs are complex financial instruments that do not confer any claim or right to the underlying financial instrument. Transactions in these instruments are very risky, and you should trade only with the capital you can a ord to lose. Before deciding to trade on these products, you should consider your investment objectives, risk tolerance, and your level of experience. Accordingly, you should ensure that you understand the risks involved and seek independent advice from professionals, if necessary.