The moving average convergence divergence (MACD) is a simple yet effective trading indicator that is used to identify new trends and decipher if they’re bullish or bearish.

The MACD indicator is a trend-following momentum indicator/oscillator, developed by Gerald Appel in the late-1970s. It is used to determine the strength and momentum of a trend and is calculated on price data, which is plotted as a time series. The MACD can provide a visual snapshot to help analyse trends, allowing traders to scan charts rapidly. That makes it an invaluable tool for technical analysis, especially with the myriad of financial instruments available to traders today, in particular the forex market, as well as indices, commodities and shares.

MACD indicator

The idea behind the MACD is simple:

- The degree/magnitude of separation between a shorter and longer-term moving average (MA) denotes the strength of a trend. It also indicates the momentum of that trend.

- The underlying logic is that a shorter-term MA reflects current price action, whereas a longer-term MA reflects earlier price action, in addition to the current price action.

- If there is a good separation between these two MAs, it means that the current price action is moving away from earlier price action. This indicates that the market is trending either up or down.

A time series is simply a set of data plotted over time. An example of a time series would be temperature data. The classification of price points as either high, low, or average, and are plotted daily. Financial instruments traded in the market are plotted as price data that is continuously recorded. Prices may be plotted for a certain number of transactions (ticks). They may also be plotted in time periods, of usually one second and upwards. They are plotted on a chart as the open-high-low-close for that period; either as an open-high-low-close (OHLC bar), or as a candlestick chart.

The astute trader can gather a wide breadth of information by studying the MACD, using it to establish a market’s prevailing trendlines and momentum.

MACD vs moving averages

A moving average is an average of time series data calculated over a certain number of time periods. As we progress through time, the latest period factors into the calculation, and the earliest period from the previous calculation drops off.

- A faster MA is defined as one that is calculated over a smaller number of periods.

- A slower MA is one calculated over a larger number of periods.

- Calculated MAs are subsequently plotted on the charts and are usually overlaid on top of the price action.

MAs come in multiple variations, but some may be more relevant than others in understanding the MACD. There are three moving averages:

- A simple moving average (SMA) is an average of data plotted over a certain number of periods.

- A weighted moving average (WMA) is a moving average with greater emphasis (or weight) being placed on certain (or few) periods.

- The exponential moving average (EMA) is where more recent periods have a higher weight in the calculation, compared to earlier periods. This is done using a weighting multiplier calculated as 2/(time period + 1). Therefore, for a nine-period time series, it is 2/(9 + 1) which is 0.2 or 20%.

Given that the logic behind the MACD is to compare recent versus earlier price action, an EMA is more applicable and used in the MACD calculation as a result.

How to trade with MACD indicator

The prices of all these financial instruments aren’t moving in a straight line, but rather in a jagged ‘up and down’ fashion with a series of sharp peaks and troughs. These fluctuations and oscillations are filtered out by low pass filters. A low-pass filter will pass signal with a frequency that is lower than a selected cutoff frequency and attenuate signals with frequencies higher than this cutoff frequency. MAs present a smoother profile, which allows for ease of analysis and identifying trends.

The MACD formula seeks to harness the benefits of two low-pass filters: a fast EMA and a slow EMA. The standard or "box" setting for the fast EMA is 12 periods, for example, an EMA calculated over 12 periods. The standard or "box" setting for the slow EMA is 26 periods, for example, an EMA calculated over 26 periods.

How to read MACD histogram

The MACD indicator consists of signal lines and a histogram. The histogram displays the difference between the MACD line (more commonly referred to simply as MACD) and the signal line plotted as a bar chart over time. The MACD histograms oscillate above and below a "zero line", where the MACD and the signal line intersect. The shape of the histogram is important, for example, a rising histogram profile indicates an uptrend. The shape of the histogram with respect to the zero line also has a bearing on the trend, as a strong downtrend is indicated by a falling profile below the zero line.

Daily MACD crossover

The MACD can be used in several ways by traders. At a very basic level, it is used to generate buy and/or sell signals using crossovers. When the MACD crosses the signal line from under it and goes over, a buy signal is generated. Such a crossover is often known as the "golden cross". Conversely, when the MACD crosses the signal line from above and goes under it, this generates a sell signal, and is often known as the "death cross". These are also referred to as an MACD bearish crossover or a MACD bullish crossover, depending on which way the price heads.

MACD divergence

The MACD indicator, despite being one of the first indicators to be developed, is still widely used in today’s modern markets due to its effectiveness. One of the core reasons it has remained at the forefront of technical traders’ analysis portfolios is its ability to predict potential market direction in conjunction with price action.

The way to do this is by using the concepts of divergence and convergence. The MACD is said to be convergent with price action if both prices and the MACD are moving in the same direction. In other words, if prices are making higher highs (in an uptrend) and the MACD makes corresponding higher highs, then we have convergence. Convergence of the MACD with price action confirms the strength, direction, and momentum of a trend. If the MACD moves in the opposite direction, making lower highs as price is making higher highs, then we have negative divergence. Divergence with price action indicates the potential weakening or possible reversal of a trend.

Calculating MACD

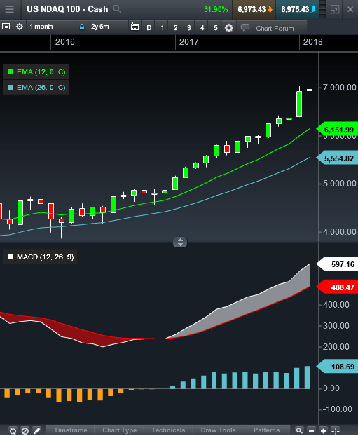

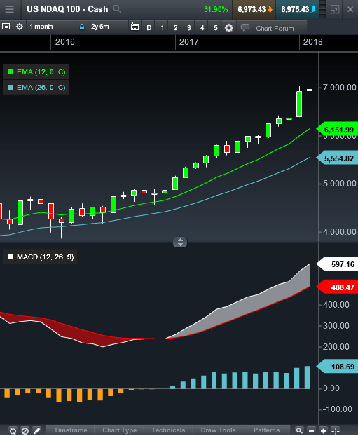

The mathematics behind MACD is relatively simple and powerful when used effectively. The MACD is calculated by subtracting the slow EMA from the fast EMA. In the example below, the fast EMA (12) has a value of 6,151.99 and the slow EMA (26) has a value of 5554.52. The resultant MACD value is 597.16.

MACD signal lines

The MACD signal line is the second component of the MACD indicator. It is an EMA of the MACD over a certain number of periods. The standard or "box" setting for this is nine, in other words, an EMA of the MACD calculated over nine periods. It is used to generate buy and sell signals as the MACD line crosses.

As the MACD and MACD signal line are derived from two EMAs, their value will be dependent on the underlying security. As such, it is not possible to compare these values for a group of currencies or across markets such as between the US SPX 500 and an exchange-traded fund.

MACD setup

The platform allows traders to customize technical indicators and tools, add drawing tools to price charts and graphs, and identify chart patterns in order to improve your trading strategy. In addition, the platform is also available via mobile trading apps, for both Android and iOS systems, so you can practice your MACD trading strategy on-the-go.

Benefits of MACD

The MACD is a relatively simple indicator, easy to comprehend, appeals to intuitive logic and therefore resonates well with most traders. It can be a powerful tool if used effectively, especially for assessing the strength and momentum of trends, and consequently to predict their continuance and potential reversal.

Limitations of MACD

One of the most significant limitations of the MACD is the occurrence of false positives. A reversal is signaled, but never takes place. The opposite can also take place, where a reversal occurs without being signaled. A way to attempt to overcome any of these false signals would be to implement a MACD signal line filter.

Another drawback is that moving averages slightly lag behind real-time prices. This is because it’s an average of the historical prices, so any drastic changes in price would not be seen straight away. Therefore, although the MACD is widely used by traders, it might not be the best technical tool to use in isolation when dealing with volatile price movements. Instead, be sure to use in combination with other technical indicators.

Source: CMC Markets UK

Disclaimer: Century Financial Consultancy LLC (“CFC”) is Limited Liability Company incorporated under the Laws of UAE and is duly licensed and regulated by the Emirates Securities and Commodities Authority of UAE (SCA). This document is a marketing material and is for informational purposes only and must not be construed to be an advice to invest or otherwise in any investment or financial product. CFC does not guarantee as to adequacy, accuracy, completeness or reliability of any information or data contained herein and under no circumstances whatsoever none of such information or data be construed as an advice or trading strategy or recommendation to deal (Buy/Sell) in any investment or financial product. CFC is not responsible or liable for any result, gain or loss, based on this information, in whole or in part.

PLEASE READ THE FOLLOWING TERMS AND CONDITIONS OF ACCESS FOR THE PUBLICATION BEFORE THE USE THEREOF.

By use of the publication and continuing to access the publication, you accept these terms and conditions and undertake to be bound by the acceptance. CFC reserves the right to amend, remove, or add to the publication and Disclaimer at any time without any prior notice to you. Such modifications shall be effective immediately. Accordingly, please continue to review this Disclaimer whenever accessing, or using the publication. Your access of, and use of the publication, after modifications to the Disclaimer will constitute your acceptance of the terms and conditions of use of the publication, as modified. If, at any time, you do not wish to accept the content of this Disclaimer, you may not access, or use the publication. Any terms and conditions proposed by you which are in addition to or which conflict with this Disclaimer are expressly rejected by CFC and shall be of no force or effect.

No information as given herein by CFC in this publication should be construed as an offer, recommendation or solicitation to purchase or dispose of any securities/financial instruments/products or to enter in any transaction or adopt any hedging, trading or investment strategy. Neither this publication nor anything contained herein shall form the basis of any contract or commitment whatsoever. Distribution of this publication does not oblige CFC to enter into any transaction.

The content of this publication should not be considered legal, regulatory, credit, tax or accounting advice. Anyone proposing to rely on or use the information contained in the publication should independently verify and check the accuracy, completeness, reliability and suitability of the information and should obtain independent and specific advice from appropriate professionals or experts regarding information contained in this publication. CFC cannot be held responsible for the impact of any transactional costs or any taxes as may be applicable on transactions.

Information contained herein is based on various sources, including but not limited to public information, annual reports and statistical data that CFC considers reliable. However, CFC makes no representation or warranty as to the accuracy or completeness of any report or statistical data made in or in connection with this publication and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the information contained in this publication. The articles does not take into account the investment objectives, financial situations and specific needs of recipients. The recipient of this publication must make its own independent decisions regarding whether this communication and any securities or financial instruments mentioned herein, is appropriate in the light of its existing portfolio holdings and/or investment needs.

This document is a marketing material and has been prepared by individual(s), marketing and/or research personnel of CFC. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is purely a marketing communication. In this publication, any opinions, news, research, analysis, prices, or other information constitute is a general market commentary, and do not constitute the opinion or advice of CFC or any form of personal or investment advice. CFC neither endorses nor guarantees offerings of third party, nor is CFC responsible for the content, veracity or opinions of third-party speakers, presenters, participants or providers. CFC will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Charts, graphs and related data or information provided in this publication are intended to serve for illustrative purposes only. The information contained in this publication is prepared as of a particular date and time and will not reflect subsequent changes in the market or changes in any other factors relevant to their determination. All statements as to future matters are not guaranteed to be accurate. CFC expressly disclaims any obligation to update or revise any forward-looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events.

Staff members/employees of CFC may provide/present oral or written market commentary or analysis to you that reflect opinions that are contrary to the opinions expressed in this research and may contain insights and reports that are inconsistent with the views expressed in this publication. Neither CFC nor any of its affiliates, group companies, directors, employees, agents or representatives assume any liability nor shall they be made liable for any damages whether direct, indirect, special or consequential including loss of revenue or profits that may arise from or in connection with the use of the information provided in this publication.

Information or data provided by means in this publication may have many inherent limitations, like module errors or lack accuracy in its historical data. Data included in the publication may rely on models that do not reflect or take into account all potentially significant factors such as market risk, liquidity risk, credit risk etc.

The use of our information, products and services should be on your own due diligence and you agree that CFC is not liable for any failure to achieve desired return on investment that is in any manner related to availing of services or products of CFC and use of our information, products and services. You acknowledge and agree that past investment performance is not indicative of the future performance results of any investment and that the information contained herein is not to be used as an indication for the future performance of any investment activity.

This publication is being furnished to you solely for your information and neither it nor any part of it may be used, forwarded, disclosed, distributed or delivered to anyone else. You may not copy, reproduce, display, modify or create derivative works from any data or information contained in this publication.

Services offered by CFC include products that are traded on margin and can result in losses that exceed deposits. Before deciding to trade on margin products, you should consider your investment objectives, risk tolerance and your level of experience on these products. Trading with leverage carries significant risk of losses and as such margin products are not suitable for every investor and you should ensure that you understand the risks involved and should seek independent advice from professionals or experts if necessary.

هل أنت مستعد للاستثمار؟

استكشف تجربة تداول جديدة مع

تطبيق سنشري تريدر

يمكن أن تتجاوز الخسائر قيمة إيداعاتك

هل أنت مستعد للاستثمار؟

استكشف تجربة تداول جديدة مع

تطبيق سنشري تريدر

يمكن أن تتجاوز الخسائر قيمة ودائعك