The definition of a bear market is one that has fallen in value by more than 20% for over a two-month period, during a period of widespread market pessimism. This fall is often due to investor fears about a country's economic outlook. A bear market can offer opportunities for traders to find a good entry position, and multiple short-selling opportunities. Modern traders can trade a bear market by using popular derivative tools.

The financial markets naturally grow and contract due to changes in supply and demand. This constant change is caused by fundamental economic factors influencing the natural buy and sell cycle of an economy. This gives rise to bull and bear markets. A full-on bear market should not be confused with shorter-term corrections of a bull market. It's almost impossible to predict when a bear market will occur, or how long it will last for. It is equally as difficult predicting the end of a bear market and this makes trading these markets especially tricky.

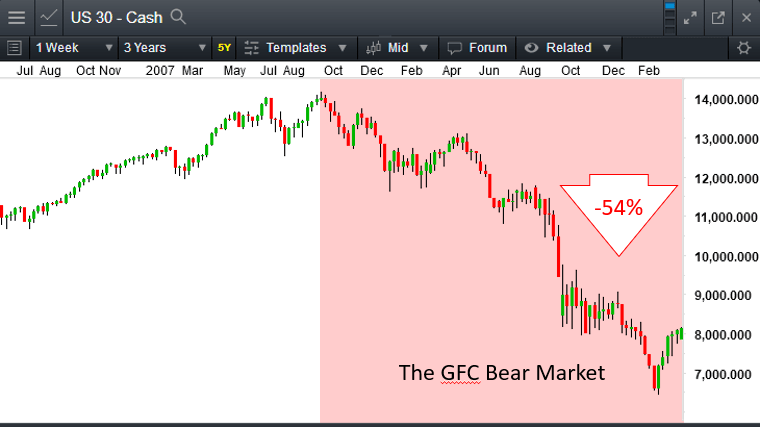

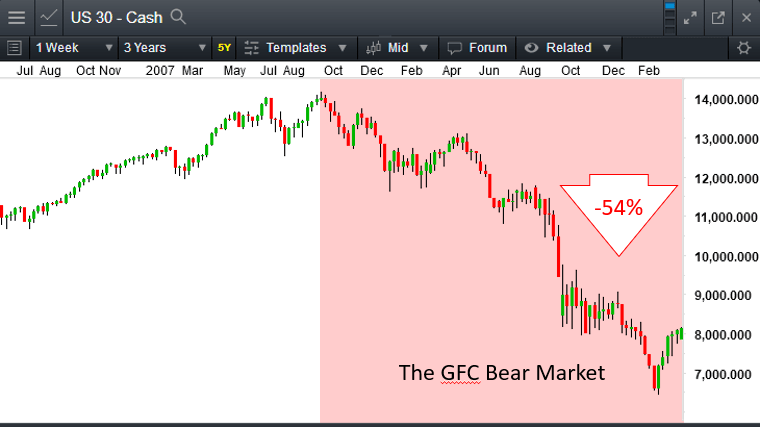

The most recent bear market was during the global financial crisis, when the Dow Jones Industrial Average fell 54% from October 2007 to March 2009. This bear market crash offered astute traders numerous opportunities to short sell the global index markets and individual securities

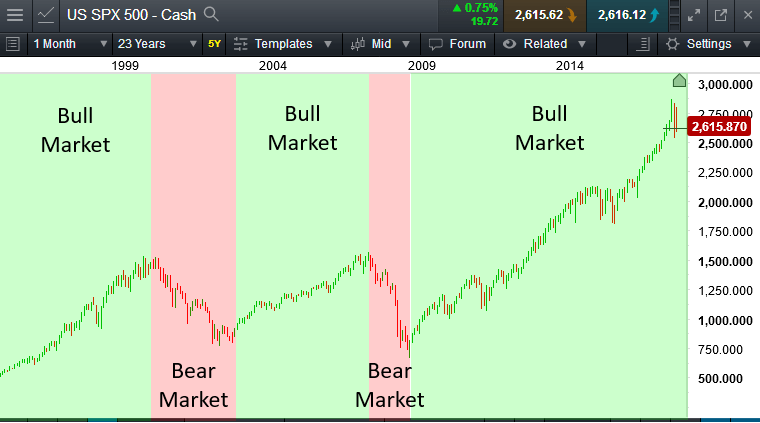

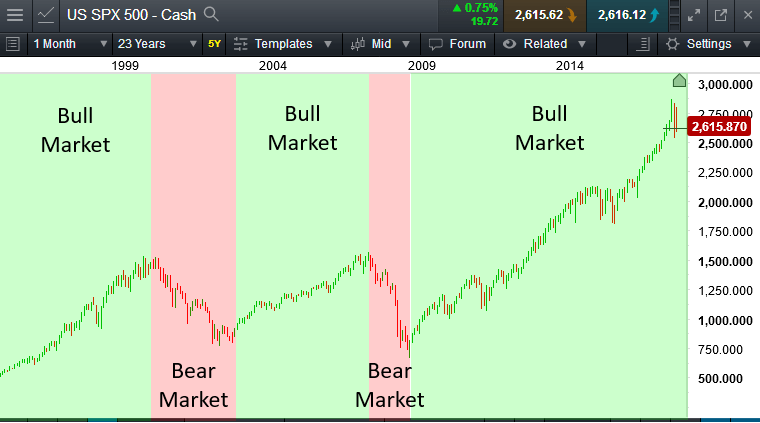

Note: The bear market caused by the global financial crisis. For illustrative purposes only.

How to trade a bear market?

Traders increase their probabilities of trading market trends by having a stringent trading strategy and capital management plan. This applies equally when trading both bull and bear markets. There are some important aspects worth considering when attempting to trade a bear market.

A bear market can move rapidly so it's wise to choose trades cautiously and manage risk appropriately. During bear markets, it is possible for investors and traders to be successful by seeking out and buying good value stock portfolio propositions during a falling market. These stocks may still pay healthy dividends or can be sold later if they recover their value.

Traders need a range of investment strategies to maximize their profits and minimize their losses. This includes various forms of hedging, and short selling. Short selling is where traders profit by selling borrowed stocks and buying them back for less at a later time.

The typical bear market short trade would be based on an underlying trade idea. This incorporates the target asset and the price a short trade should be initiated at. Shorting a market index such as the S&P 500 is a popular choice with traders as this index represents a basket of underlying stocks. Their popularity is founded in their accessibility for most traders as well as their technical and highly tradeable trends. Some traders prefer to target the underlying stocks themselves. Exchange-traded funds (ETFs) are marketable securities that track a basket of securities, a stock market index, bonds, or a commodity. ETF trading usually has more liquidity and lower fees than mutual funds, making them a popular choice for traders wanting to short a bear market. Inverse ETFs provide a useful tool to either speculate for profit or to protect a stock portfolio.

The next important decision is which type of trading vehicle should be used: contracts for difference (CFD), futures or options. A CFD is a popular form of derivative trading that allows a trader to speculate on an asset by going short during a bear market. It is an agreement between the trader and the CFD provider to pay each other the difference between the opening and closing prices of a financial instrument. CFDs allow traders to gain exposure to an asset without having to own the underlying asset. CFDs are often leveraged, which allows traders to hold larger positions than the actual value of the amount they invest to open the trade.

Trading options is another useful tool in a trader's investment strategy. Put options give the owner the option to sell a stock at a specific price on, or before, a certain date. They can be used to hedge against, and speculate on, falling prices. Call options provide the opportunity to buy at a certain point in anticipation of an asset rising, meaning buyers can acquire the stock for a lower price and then sell it for a profit. The strike price is usually used to identify the contract price at which a derivative can be bought or sold. Note the key difference between CFDs and options. CFDs are agreements to close out a contract at the difference between an instrument's opening and closing price, while options are the right to purchase an asset at a set price.

Risks of trading in a bear market

All traders need to set up an effective risk management strategy in order to minimize risk if the markets go against them. This is less of a problem in a bull market when there are likely to be opportunities to recoup former losses by buying a security as it is revalued higher. But trading in a bear market can be more difficult. To keep your head when everyone in the financial market is stampeding towards the exits requires the ability to be decisive and act quickly. And this must be backed up by a solid understanding of the technical resources that are available to help manage your trading account.

The standard trade management tools apply in a bear market. In particular, that means ensuring appropriate trade execution orders have been used. A stop entry order is simply an order to buy or sell a security when its price moves past a particular point. A limit entry order can help to diversify a trader's game plan by making it possible to short into rallies in a bear market. These orders bring some predictability to a trading strategy by making sure trades are executed at a predefined price. Some traders prefer to take more active control of their account and not to be automatically taken out of their position.

Stop-losses are a useful tool to close an open trade that is going against you at a predefined price level to limit the loss of capital. However, markets can move fast and this is often the case when they turn bearish. Bear markets don't head down continuously – price may pull back from time to time. That means traders may risk being stopped out when the market was simply consolidating, rather than making a fundamental shift. Traders are not always guaranteed to get closed out at the price they set their stop-loss orders at. This is known as slippage. The faster the market moves the greater this slippage can be. To circumvent this, you might choose to trade an option with a strike price where a stop-loss would have been located. This could allow you more time to evaluate whether or not you are truly in a losing position.

What is the difference between bear and bull markets?

Essentially, bull and bear markets are either going significantly up or down in value and market capitalization. A popular theory on the naming convention traces the terms back to how each animal attacks. Bulls drive up with their horns. Bears rake down with their claws.

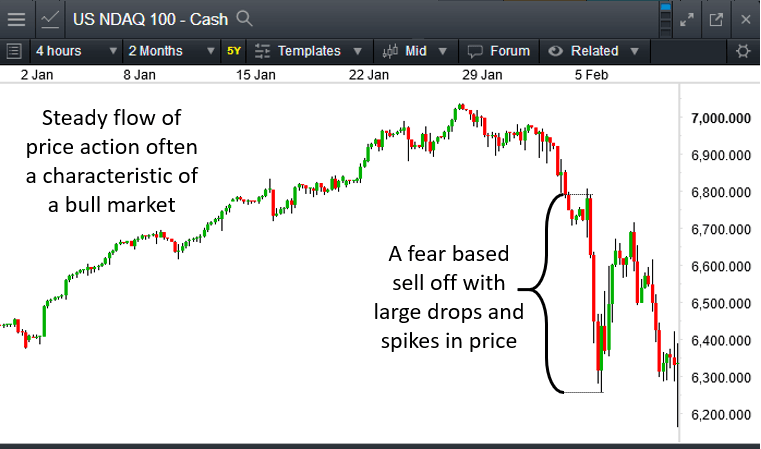

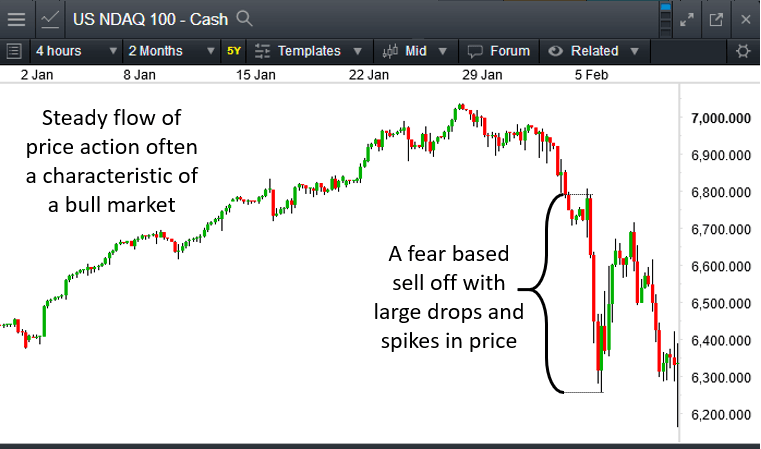

Note: Price behaves differently during bull and bear markets. For illustrative purposes only.

In a bull market, share prices rise steadily off the back of investor confidence. This confidence increases demand and keeps supply low. A characteristic of a bull market is that price action is usually steady without major whips and stalls. It can continue in this fashion for many years; however, markets cannot remain bullish forever. The balance between demand and supply will naturally change leading to price corrections. They are not always severe enough to be classified a bear market. A great example if this would be the 12 months that the S&P 500 index stalled during 2015/16. Price action dropped 14.5%, which is not enough to fulfil the definition of a bear market. As such, this period was just a price correction in a bull market.

One of the major characteristics of a bear market is that it is usually influenced by widespread investor fear over the future outlook for an economy. This fear leads to panic selling which causes large drops and spikes in price movements. These periods are often fraught with scare mongering in the press as market proponents predict financial Armageddon. As such, bear markets tend to feed themselves and become, to an extent, self-perpetuating.

Since 1990, there have been two bear markets that were both two years in duration. Although price movements were more volatile and severe than the preceding bull markets, they did come to an end. This in turn gave rise to the next bull market that would then run on further and longer than the last.

Note: Since 1990, bull markets have lasted for longer periods than bear markets. For illustrative purposes only.

Source: CMC Markets UK

Disclaimer: Century Financial Consultancy LLC (“CFC”) is Limited Liability Company incorporated under the Laws of UAE and is duly licensed and regulated by the Emirates Securities and Commodities Authority of UAE (SCA). This document is a marketing material and is for informational purposes only and must not be construed to be an advice to invest or otherwise in any investment or financial product. CFC does not guarantee as to adequacy, accuracy, completeness or reliability of any information or data contained herein and under no circumstances whatsoever none of such information or data be construed as an advice or trading strategy or recommendation to deal (Buy/Sell) in any investment or financial product. CFC is not responsible or liable for any result, gain or loss, based on this information, in whole or in part.

PLEASE READ THE FOLLOWING TERMS AND CONDITIONS OF ACCESS FOR THE PUBLICATION BEFORE THE USE THEREOF.

By use of the publication and continuing to access the publication, you accept these terms and conditions and undertake to be bound by the acceptance. CFC reserves the right to amend, remove, or add to the publication and Disclaimer at any time without any prior notice to you. Such modifications shall be effective immediately. Accordingly, please continue to review this Disclaimer whenever accessing, or using the publication. Your access of, and use of the publication, after modifications to the Disclaimer will constitute your acceptance of the terms and conditions of use of the publication, as modified. If, at any time, you do not wish to accept the content of this Disclaimer, you may not access, or use the publication. Any terms and conditions proposed by you which are in addition to or which conflict with this Disclaimer are expressly rejected by CFC and shall be of no force or effect.

No information as given herein by CFC in this publication should be construed as an offer, recommendation or solicitation to purchase or dispose of any securities/financial instruments/products or to enter in any transaction or adopt any hedging, trading or investment strategy. Neither this publication nor anything contained herein shall form the basis of any contract or commitment whatsoever. Distribution of this publication does not oblige CFC to enter into any transaction.

The content of this publication should not be considered legal, regulatory, credit, tax or accounting advice. Anyone proposing to rely on or use the information contained in the publication should independently verify and check the accuracy, completeness, reliability and suitability of the information and should obtain independent and specific advice from appropriate professionals or experts regarding information contained in this publication. CFC cannot be held responsible for the impact of any transactional costs or any taxes as may be applicable on transactions.

Information contained herein is based on various sources, including but not limited to public information, annual reports and statistical data that CFC considers reliable. However, CFC makes no representation or warranty as to the accuracy or completeness of any report or statistical data made in or in connection with this publication and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the information contained in this publication. The articles does not take into account the investment objectives, financial situations and specific needs of recipients. The recipient of this publication must make its own independent decisions regarding whether this communication and any securities or financial instruments mentioned herein, is appropriate in the light of its existing portfolio holdings and/or investment needs.

This document is a marketing material and has been prepared by individual(s), marketing and/or research personnel of CFC. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is purely a marketing communication. In this publication, any opinions, news, research, analysis, prices, or other information constitute is a general market commentary, and do not constitute the opinion or advice of CFC or any form of personal or investment advice. CFC neither endorses nor guarantees offerings of third party, nor is CFC responsible for the content, veracity or opinions of third-party speakers, presenters, participants or providers. CFC will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Charts, graphs and related data or information provided in this publication are intended to serve for illustrative purposes only. The information contained in this publication is prepared as of a particular date and time and will not reflect subsequent changes in the market or changes in any other factors relevant to their determination. All statements as to future matters are not guaranteed to be accurate. CFC expressly disclaims any obligation to update or revise any forward-looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events.

Staff members/employees of CFC may provide/present oral or written market commentary or analysis to you that reflect opinions that are contrary to the opinions expressed in this research and may contain insights and reports that are inconsistent with the views expressed in this publication. Neither CFC nor any of its affiliates, group companies, directors, employees, agents or representatives assume any liability nor shall they be made liable for any damages whether direct, indirect, special or consequential including loss of revenue or profits that may arise from or in connection with the use of the information provided in this publication.

Information or data provided by means in this publication may have many inherent limitations, like module errors or lack accuracy in its historical data. Data included in the publication may rely on models that do not reflect or take into account all potentially significant factors such as market risk, liquidity risk, credit risk etc.

The use of our information, products and services should be on your own due diligence and you agree that CFC is not liable for any failure to achieve desired return on investment that is in any manner related to availing of services or products of CFC and use of our information, products and services. You acknowledge and agree that past investment performance is not indicative of the future performance results of any investment and that the information contained herein is not to be used as an indication for the future performance of any investment activity.

This publication is being furnished to you solely for your information and neither it nor any part of it may be used, forwarded, disclosed, distributed or delivered to anyone else. You may not copy, reproduce, display, modify or create derivative works from any data or information contained in this publication.

Services offered by CFC include products that are traded on margin and can result in losses that exceed deposits. Before deciding to trade on margin products, you should consider your investment objectives, risk tolerance and your level of experience on these products. Trading with leverage carries significant risk of losses and as such margin products are not suitable for every investor and you should ensure that you understand the risks involved and should seek independent advice from professionals or experts if necessary.

هل أنت مستعد للاستثمار؟

استكشف تجربة تداول جديدة مع

تطبيق سنشري تريدر

يمكن أن تتجاوز الخسائر قيمة إيداعاتك

هل أنت مستعد للاستثمار؟

استكشف تجربة تداول جديدة مع

تطبيق سنشري تريدر

يمكن أن تتجاوز الخسائر قيمة ودائعك