Thursday, March 19, 2020

How to back the stocks tackling coronavirus?

By Century Financial in 'Brainy Bull'

A recent market crisis has been driven by the COVID-19 outbreak, resulting in a number of large moves in stocks related to the news. The impact has ranged from the speculative surges in companies making protective masks like Lakeland Industries [LAKE] and Alpha Pro Tech [APT] to large-cap biotech companies searching for treatment and vaccines like Gilead Sciences [GILD], Regeneron Pharmaceuticals [REGN] and Moderna [MRNA].

Meanwhile, the shutdown in global travel has resulted in major weakness in airlines, hotels, theme parks, and other venue stocks, while the idea that telecommuting will be in more demand can benefit newer tech companies like Zoom [ZOOM] and Slack [WORK].

Deeper into the health space, companies like Gardner Denver [GDI] and Regal Beloit [RBC], which make pumps for ventilators, are seeing a surge in demand. Allied Motion [AMOT] is another industrial firm with 14% of sales tied to the medical markets, including respiratory ventilators.

Aptar [ATR] is a $6.6bn packaging leader with strong ties to pharma that is the lead maker of pumps and metered dose inhaler valves for asthma. Another strong performer since the crisis has been TelaDoc [TDOC] the leader in telehealth, which I previously made the case for here.

While the moves in the protective mask names are more of a fad, there is a case to be made looking at respiratory illness from a broader perspective as a trader, as these kinds of outbreaks are likely to continue to occur. Meanwhile, there are rising concerns around smoking and poor air quality due to climate change.

The large-cap respiratory stocks to watch

A number of med-tech names involved in the respiratory care market make for quality investments on this theme. The respiratory care devices market is projected to reach $31.8bn by 2024 from $20.6bn in 2019, at a CAGR of 9.1%. This includes the therapeutic (ventilator, mask, PAP device, inhaler, nebuliser), monitoring (pulse oximeter, capnograph), diagnostic, and consumables segment.

ResMed [RMD] is one of the bigger names of interest. It has a market cap of $23bn and focuses on respiratory disorders. Although it is well known for its focus on sleep apnea, the company also has exposure to other respiratory illnesses and has built out a leading software ecosystem connecting over 12 million patients. A great med-tech competitor to ResMed in the sleep apnea market is Inspire Medical Systems [INSP].

Masimo [MASI] is another high-quality med-tech growth name with some exposure to respiratory markets via its patient monitoring systems that tie into intravenous therapy (IV) pumps and ventilators. Masimo has a market cap near $9bn and trades at 40 times earnings and 9.6 times sales with revenues expected to rise around 10% in 2020 and 2021. It is an innovative company expanding its product portfolio and increasing its total available market with a focus on hospital automation and opioid safety.

Hill-Rom [HRC] has a $6.5bn market cap and makes medical equipment used in hospitals including a respiratory care unit that has the following treatments Vest system, VitalCough system, MetaNeb System, Monarch and Life2000 system to assist patients in the mobilisation of retained blockages.

Shares in Hill-Rom trade at 15.55 times earnings, 2.23 times sales and 29 times free cash flow (FCF), with revenue growth of just 1.1% forecasted for 2020 but expected to accelerate starting in Q4 through 2021. Last August, Hill-Rom acquired Breathe Tech, a maker of wearable ventilators, for $130m.

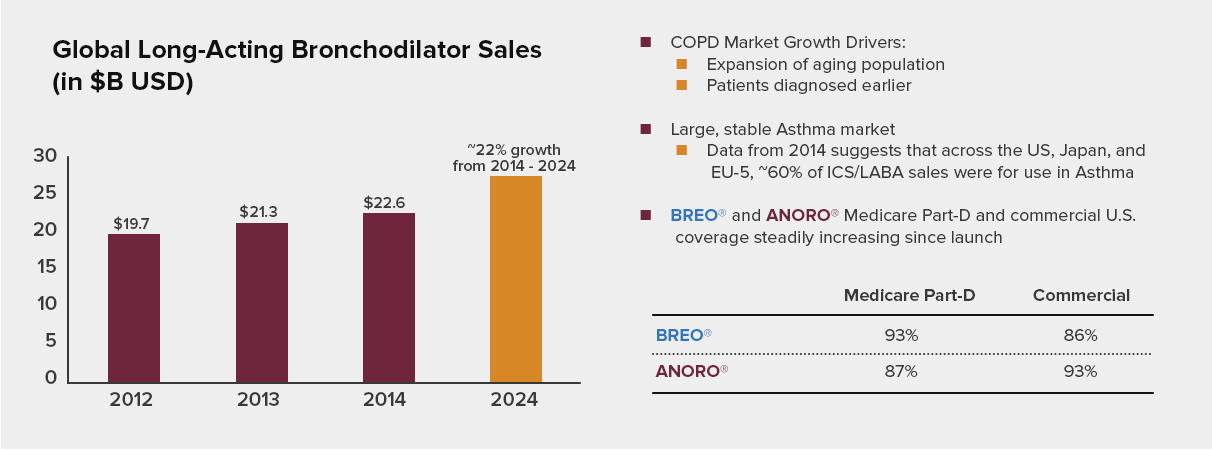

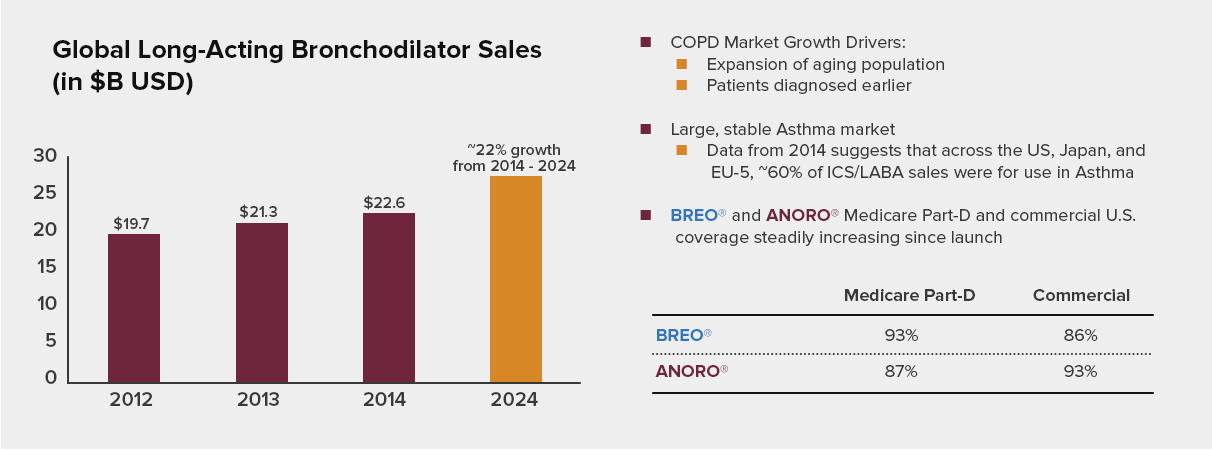

Innoviva [INVA] with a $1.36bn market cap trades at 11.55 times earnings and 5.2 times sales with revenues seen rising 10% year-on-year in Q1. It has multiple commercial respiratory products for chronic obstructive pulmonary disease (COPD) and asthma markets.

Is a large-cap medical technology name that has some exposure to many of these markets but is also so large it may not be as much of a needle-drive, and not the kind of pure play I am looking for on this theme. The same can be said for one of my longtime favorites in med-tech Teleflex [TFX], which has respiratory care products but overall is diversified. Philips [PHG] is also a big player in respiratory care for its healthcare segment.

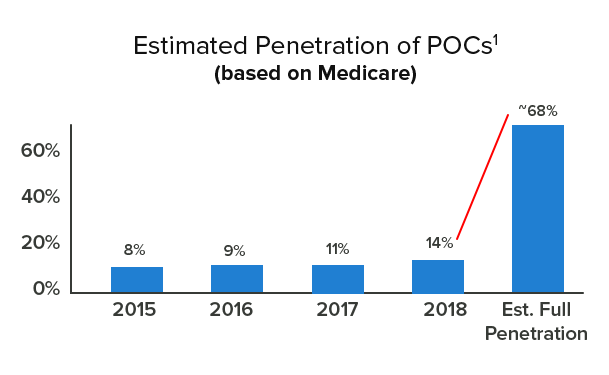

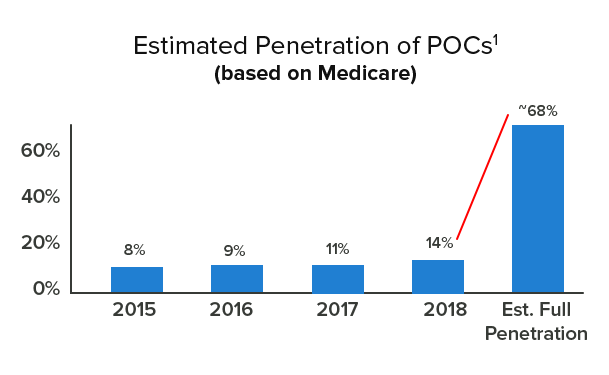

Is a $1bn company that is fairly well-known as a maker of portable oxygen concentrators for patients with chronic respiratory conditions. Its light-weight portable systems improve quality of life for patients. Inogen shares have corrected sharply in the past two years, but now trades at 39 times earnings and 2.77 times sales. Revenue growth is set to reaccelerate in 2020 and 2021 to 6.6% and 10% respectively. Revenue growth and margins both look to have troughed as its direct-to-consumer business stabilises.

The medium-cap respiratory stocks to watch

Electromed [ELMD] and Beyond Air [XAIR] are two micro-cap med-tech names I discovered while researching and both look quite interesting as longer-term investments. Electromed has an $89.6m market cap. Its revenues grew 9% in 2019 and are expected to rise 12.5% in 2020 and 12% in 2021.

Shares trade at just 23.3 times earnings, 2.72 times sales and 47.2 times FCF. Electromed makes innovative airway clearance devices, and its SmartVest High Frequency Chest Wall Oscillation system helps patients clear mucus from the lungs.

The company improves quality of life and reduces risk of infection for patients with compromised pulmonary function due to chronic diseases and conditions such as bronchiectasis and other diseases under the COPD1 umbrella as well as cystic fibrosis and neuromuscular disorders.

Beyond Air is a $93.3m medical device company that delivers nitric oxide delivery systems for respiratory diseases and could be picked up as a coronavirus play. The company is currently applying its therapeutic expertise to develop treatments for pulmonary hypertension in various settings, in addition to treatments for lower respiratory tract infections that are not effectively addressed with current standards of care.

On its latest earnings call, it made some interesting mentions. “While the company has never attempted to treat the specific coronavirus that is causing the current global alarm. We currently have confidence that our LungFit BRO system is effective in treating certain types of coronavirusbased on data already generated,” it said.

“We look forward to the opportunity to test our system on the difficult-to-treat coronavirus strains. And hopefully, we will get a chance to test it on the coronavirus from China.” Beyond Air generated $7.7m in revenues in 2019 with $13.9m expected in 2020 and $57m in 2021.

The company sees market potential for its products across three indications at $4.3bn. LungFit PH for pulmonary hypertension is set for a Q4 2020 US launch, for bronchiolitis in 2022, and for severe lung infections in 2024.

The small-cap respiratory stocks to watch

Viemed Healthcare [VMD:CN] is an intriguing small-cap name in Canada that has grown revenues 49.7% in 2017, 39% in 2018 and is set to grow near 40% in 2019. Its title of its January 2020 investor relations presentation is “leading the healthcare industry in-home respiratory care”.

The company is the largest independent specialised provider of non-invasive ventilation (NIV) in the US home respiratory market. It has a service offering that includes 24/7 in-home respiratory care including specialised respiratory therapists and medical devices.

Viemed Healthcare is focused on the large and growing COPD market and sees favorable trends in the increasing need for effective homecare solutions to reduce hospital re-admissions. It also recently listed on the NASDAQ under the ticker VMD.

Itamar Medical [ITMR] is a small-cap valued at $160m and based in Israel that makes non-invasive devices. Revenues grew 16.8% in 2018 and are estimated to have risen 29% in 2019 and 31% in 2020, with shares trading at just 5.75 times sales – attractive for that impressive growth.

Shares are fairly thinly traded, and its focus is mainly in the sleep apnea market. Its WatchPAT system is a faster and more comfortable way for diagnosis and monitoring.

Fisher and Paykel [FPH:NZ], which has seen shares rise sharply since 2019, is a $14.8bn medical device company with revenues expected to grow 4% in 2019 and 2020 following double-digit growth in 2017 and 2018. Its focus is also on the sleep apnea market.

Getinge [GIND:SS] is a $47bn Swedish maker of healthcare equipment. It has a broad portfolio within cardiac, pulmonary and vascular therapies, intensive care products, as well as products and solutions for surgical workflows and hospital infrastructure.

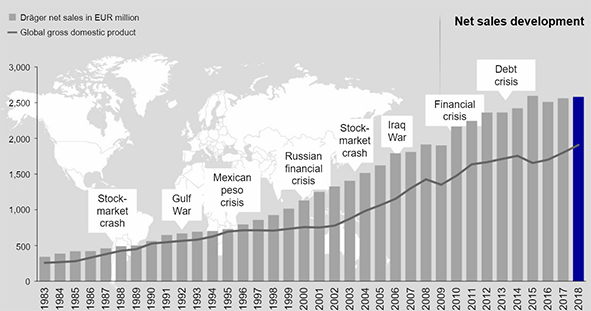

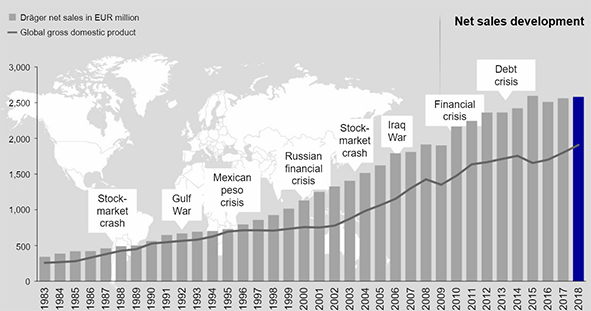

Dragerwerk [DRWS:GR] is an intriguing German company that grew sales by 3.8% in 2017 and 5.6% in 2018. It has a portfolio of products which makes breathing and protection equipment, gas detection and analysis systems, and non-invasive patient monitoring technologies. Medical accounts for 65% of sales while safety is 35%. It serves the hospitals, fire services, oil and gas, chemical, mining and other markets.

By Joe Kunkle, who is the founder of Options Hawk, a service that provides news, analysis and option movement research. Alongside this, he runs his personal trading account and is head research analyst at investment firm Relativity Capital.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.