Tuesday, May 05, 2020

Can a giant leap of faith in Virgin Galactic’s share price pay off?

By Century Financial in 'Brainy Bull'

Ever since Virgin Galactic listed on the New York Stock Exchange in 2017, its share price has taken off.

Shares in the space tourism venture have climbed more than 200% in value since its debut listing on 28 October 2019 to a record high of $37.35 on 19 February this year. But as the markets started to collapse in response to the coronavirus pandemic, did Virgin Galactic’s share price?

Since reaching that all-time-high, the share price has been in free fall, tumbling 52% to $17.92 as of 1 May’s close, with $3.5bn wiped off its market capitalisation.

With the spaceflight company set to announce its first-quarter earnings for 2020 on Tuesday 5 May, what should SPCE share price investors and traders be looking out for?

Virgin Atlantic causes trouble

For early-stage businesses like Virgin Galactic, which has barely made any revenue apart from the deposits for pre-booked flights into space and offering its engineering services, earnings announcements are tough.

Indeed, at its last quarterly announcement the company reported a larger than anticipated net loss of $73m, which was considerably more than the $46.9m expected by analysts surveyed by FactSet, according to CNBC. The business only generated $529,000 in sales last quarter.

While Virgin Galactic ended 2019 with $480m cash on the balance sheet, there are concerns over whether that will be enough of a capital buffer to survive until next year when it is expected to start generating revenues.

News that CEO Richard Branson was struggling with sister company Virgin Atlantic, sent shares in Virgin Galactic down more than 11% on 21 April, after it raised concerns over whether that would put further pressure on the early-stage space business.

The pandemic-enforced travel restrictions have left most of Virgin Atlantic’s fleet grounded, starving the company of its cash flow and prompting Branson to seek a government bailout or buyer. It doesn’t bode well for a struggling Virgin Galactic.

“If Branson doesn't have the cash he needs to salvage his 36-year investment in his flagship company, Virgin Atlantic, he probably also doesn't have a lot of resources to spare for Virgin Galactic,” Rich Smith writes in The Motley Fool. “If Virgin Galactic is going to survive this recession, it's probably going to have to do so on its own.”

A risky mission?

There are many factors standing in the way of Branson’s space transport company’s success. Indeed, Morgan Stanley analyst Adam Jonas is “waiting for the fundamentals to catch up”, according to Bloomberg. He decided to take a step back from the stock in February, downgrading his rating to neutral.

“Management’s mission to be a sustainable and highly successful/profitable commercial space-line will require a confluence of events to come together over many years and in a potentially (if not likely) a non-linear manner,” Jonas wrote in a note.

Analysts covering the space travel and tourism specialist expect earnings to decline by $0.15 per share for the quarter according to Investor Place, with revenue of just $700,000.

For the full year, Zacks Equity Research has a consensus revenue target of $1.82m, with analysts expecting earnings to decline by $0.60 per share. These estimates represent an increase of 44.95% and 244.05%, respectively, from 2019.

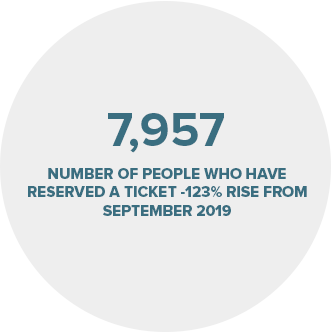

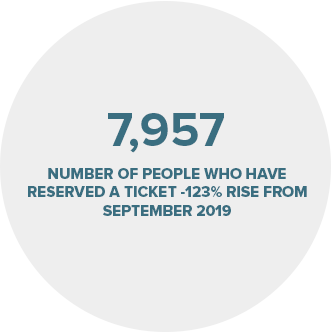

However, despite the market downturn, the company currently has a market cap of $3.5bn, suggesting investors are pegging it as a long-term investment. The increasing demand in-flight reservations is a good gauge of interest. As of 23 February, 7,957 people had reserved a ticket, that’s a 123% rise from the 3,557 at the end of September 2019.

Furthermore, its shareholder returns have consistently beat both the broader market and the aerospace industry over the last 90 days, data compiled by Simply Wall Street shows. While the wider US market has declined 9.3% over the past 90 days, Virgin Galactic has returned 2.7% to shareholders.

That’s a strong showing for a share price that supports minuscule earnings. Three analysts polled by MarketWatch give Virgin Galactic’s share price an average overweight rating, with an average price target of $29.67, representing a 65.6% uptick from current levels.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.