Wednesday, October 28, 2020

Can Q3 earnings lift Boeing’s share price?

By Century Financial in 'Brainy Bull'

Although Boeing’s [BA] share price has improved somewhat since March, it’s still struggling to get off the ground. Despite reaching an intraday high of $234.20 on 8 June, Boeing’s share price is still in the red so far in 2020. As the aviation giant prepares to announce its third-quarter earnings results on 28 October, what should investors expect?

Boeing’s share price started 2020 with a strong performance. The stock had climbed 6.6% to close at $347.45 on 12 February. However, the coronavirus pandemic sent the market, and Boeing’s share price, spiralling downwards the following month.

The stock fell to an intraday low of $94.28 on 20 March before closing slightly higher at $95.01. Not only did this mark a year-to-date loss of 70.6%, but it was also the stock’s lowest value in five years.

Since then, Boeing’s share price has struggled to reach a value above its 2020 opening price of $328.55. As of 26 October’s close, Boeing’s share price was down 52.3% for the year to date at $160.83.

How has Boeing been performing?

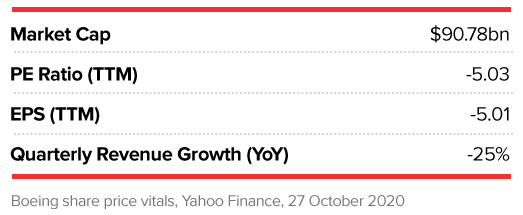

When Boeing released its second-quarter earnings on 29 July, it reported a loss of $4.79 per share, which was below the Zacks consensus estimate of a loss of $2.93. This was in stark contrast to the previous year’s reported earnings of $2.92 per share.

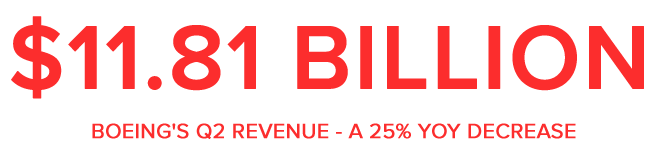

For the quarter ended June 2020, Boeing posted revenue of $11.81bn, which missed the Zacks consensus estimate by 6.35% and was 25% lower than 2019’s second-quarter revenue of $15.75bn.

Over the past four quarters, Boeing has only beaten consensus earnings and revenue estimates once. David Calhoun, CEO of Boeing, cited the company’s diversified business as being critical to adding stability to its financials.

Looking ahead, it’s worth noting that Boeing reported dismal deliveries for the third quarter - a meagre 65 units compared to 170 in the third quarter of 2019, according to Zacks. The research publication noted that deliveries were down 54.8% and 108.1%, respectively, for commercial and defence shipments. Such numbers do not bode well for Boeing’s share price.

As for its upcoming earnings call, Boeing is expected to report a loss of $2.46 per share, a 269.7% year-over-year decrease. Revenues are also expected to decline 27.7% to $14.45bn.

For the full year, analysts are expecting a loss of $10.44 per share and revenue of $58.13bn, according to Zacks. These would mark respective losses of 200.86% and 24% from last year. Boeing’s share price is unlikely to recover, then, immediately following its Q3 earnings announcement.

What the analysts think of Boeing’s share price

When Boeing released its annual market outlook at the start of October, the company signalled a long, slow recovery for the aviation sector. It cut its 10-year forecast from $3.1trn to $2.9trn for 18,350 jets at list prices, according to the Financial Times.

Darren Hulst, Boeing’s vice president of commercial marketing, told the publication that he expected it to take five years or longer to recover.

Kristine Liwag, an analyst at Morgan Stanley, said the updated outlook “may still be optimistic,” according to The Fly.

"[The] forecast could be overstated by as much as 45% over the period,” Liwag said. As a result, she has kept an Underweight rating on Boeing, with a price target of $181.

The consensus according to Zacks is to sell the stock. Meanwhile, the consensus among 27 analysts polled by CNN Money is to hold, a rating given by 13 analysts, while 10 rated it a Buy, one Outperform and three saying to sell the stock.

Among 22 analysts offering 12-month share price forecasts on CNN Money, the median target of $178 would imply a 10.7% increase on Boeing’s share price at 26 October’s close.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.