The end of cash may seem like a fantasy, but look at how money has changed since debit and credit card was introduced. We all are well on our way to becoming cashless economy with mobile and digital payments being embraced at an unprecedented rate.

Be it economies ranging from Western and Nordic regions to developing areas like India and Asia-Pacific, all are seeing a fundamental shift to a cashless economy.

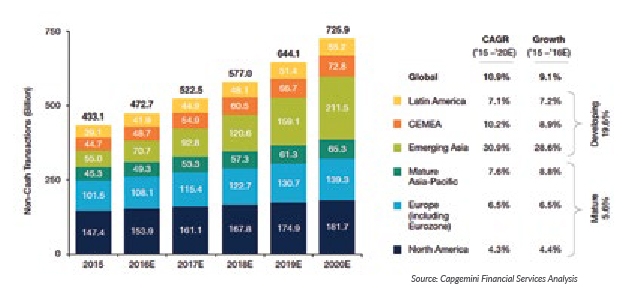

Number of non-cash transactions worldwide by region from 2010 to 2014 (in billions)

Source: Capgemini Financial Services Analysis, 2016; Bank for International Settlements Red Book, 2014 figures released December 2015.

It’s the convenience of new technologies that have facilitated non-cash transactions. Today there are numerous ways to make payments digitally including:

Personally, we individuals increasingly route money across the globe with bank transfers enacted from our tablet devices, we use our apple pay for payment at stores, shopping malls, coffee shops etc., and we travel abroad without even thinking about buying foreign currency before we go.With the advance in these technologies, Cash is no longer The King.

To list a few statistics:

Popularly termed as “The War on Cash”- there is a universal push by lawmakers across the globe to eliminate the use of physical money.There are three major role players out here:

Governments and central banks have moved swiftly in dozens of countries to start reducing physical cash transactions. Consider these statistics:

- More than 95% of transactions are digital in Sweden.

- Singapore eliminated its highest $10000 note in 2014.

- Last year, India pulled back more than 85% of existing currency from circulation in order to demonetize the economy and to expand mobile banking.

- In Europe, the ECB has stopped producing €500 notes and will stop the distribution entirely by 2018.

- Vietnam announced a bold initiative to become a 90% cashless retail economy by 2020.

- South Korea also aims to eliminate paper money entirely by 2020.

Moreover, the shift to a cashless economy has been driven by consumers and innovators who are determined to disrupt their competitors’ business. Uber can be cited as the best example that started the cashless trend in the industry.

The Uber Effect

Uber has been the pioneer of the cashless economy as it transformed business models and travel sector in general. Doing away with the hassle of carrying cash to pay for a ride was obviously a key innovation, but creating an all-in-one transaction by embedding a payment mechanism into a mobile-only experience was a genius move. Uber customers don’t need to worry about payments, they just happen. Now, Uber can expand that mobile experience to food (UberEATS), hotels, entertainment, travel and anything else their customer desire. Uber has virtually transformed the archaic taxi business model overnight. What could similar mobile-first solutions do for airlines, hotels and ground transportation?

Gone are the days when people stood in queues to purchase a ticket. With digitalisation, you can purchase an air ticket or a movie ticket with just a few clicks from your mobile phone. Customer expectations are rising, thanks to apps like Apple pay, and companies like Uber. They are now expecting more of mobile/digital payments leave alone credit card payments. Beyond revenues, the goal of digitalisation should be a seamless experience in which the end-to-end service offered is prompt with no hindrances. The world is drifting swiftly towards mobile commerce far away from a cash-driven market. And if companies want to continue to add to their profits, they will have to quickly embrace this trend. Companies in the travel sector and other industries can capture a much bigger piece of the market if they now invest in digital/mobile solutions.

.png)

.png)

.png)

.png)