Tuesday, July 29, 2025

How will Trump’s 2025 Tariffs affect countries like US, UAE, China and India?

By Century Financial in 'Blog'

.jpg)

Introduction

Ever since the announcement of Liberation Day in early April, where President Trump announced reciprocal tariffs for almost all their trading partners, the world has been longing to see a day of certainty. Markets tumble, economies feel the tremors, and the people live in grave uncertainty owing to the tariffs. Trump has delayed the tariff twice now, once a 90-day delay giving countries chances to negotiate with trade deal until July 9th, and further a little more than a fortnight as the final deadline being August 1. Post the second delay, tariffs seem as real as they can be, with letters containing fresh tariff threats being sent to countries. The impact of tariffs over countries has not been easy and the future looks turbulent too with major economies like China, India and the UAE taking the massive brunt.

Table of Contents

US Economy and Domestic Shifts

The world didn’t take the tariff announcement really well. A bloodbath around the global markets is enough proof. On April 2nd, Trump announced the retaliation tariffs. Following day on April 3rd, US Index S&P500 fell about 4.83%. Dow Jones Industrial Average dropped nearly 1700 points, Nasdaq Composite fell almost 6%, making their worst-single day performances since 2020. The sell-off wiped out trillions of dollars in market value and sent shockwaves through global financial systems.

The agenda of tariffs is essentially to give local manufacturing a boost by making foreign products costlier than they used to be. However, the weird thing about tariffs is that the brunt of extra cost is borne by the companies who call for the imported products, and these companies usually transfer these extra costs to their consumers, eventually leaving lesser money in the pockets of the average consumer. For example, electronic companies in America who need copper for their manufacturing, a 50% tariff on copper would make their manufacturing more expensive and eventually for the consumers too.

While official CPI inflation came in line with expectations at 2.7% year-on-year as of June 2025, economists warn that the full impact of tariffs is still unfolding. The Federal Reserve warned that tariffs could complicate monetary policy, especially in a high-rate environment. According to a report by Reuters, Fed Chair Jerome Powell said that the looming tariffs are expected to drive “a meaningful increase in inflation”. He added, “Everyone I know is forecasting a meaningful increase in inflation in coming months from tariffs. Ultimately, the cost of tariff must be paid, and some of it will fall on the consumer.”

UAE’s positioning amid global tensions

UAE, just like the rest of the world are facing uncertain times, however, a bittersweet reaction to the tariffs strategically places UAE in a better position than other countries. Trump has placed a 10% baseline tariff on UAE and Saudi Arabia and a steeper 20% on Jordan. These measures are expected to raise export costs for GCC-based businesses, potentially affecting their competitiveness in U.S. markets. However, not all outlooks are grim. Vijay Valecha, Chief Investment Officer with Century Financial, remains cautiously optimistic, noting that “given the relatively low volume of bilateral trade with US and GCC, the broader impact remains limited. The GCC contributes to 16% of America’s aluminium imports and a reduced foreign demand can be redirected for internal development.

Source:Statista; Office of the U.S. Trade Representative

However, the biggest sword looms over the Oil demand and Investment concerns. As one of Middle East’s leading oil exporters, the UAE’s fortunes are closely tied to global energy demand. When trade tensions rise and the world economy starts to cool down, factories slow, transport declines, and energy use dips. That ripple can hit the UAE hard, lower oil demand means lower prices, and directly impacts export earnings.

India’s trade alignment and response

All these years of Modi strengthening India’s bilateral ties have proved to be worthwhile. According to Moody’s ratings, India could benefit from lower tariffs as compared to counter parts like Vietnam and Cambodia. This will help India attract more foreign investment and strengthen its position as a manufacturing hub.

On July 24, India signed a landmark Comprehensive Economic and Trade Agreement (CETA) with the United Kingdom, eliminating tariffs on 99% Indian exports. This deal is expected to boost key sectors such as textile, leather, apparel, and marine products, further solidifying India’s position as a global manufacturing hub.

As far as the US is concerned, it slapped India too with a 26% tariff sending shockwaves across the seven seas. The Indian government is using the 90-day hiatus to establish a mini trade deal with the US. As per the latest updates, the talks are at a critical stage, with India seeking more access for its labour-intensive exports, and the US pushing for concessions genetically modified agricultural products, medical devices, and data localization rules. Additionally, it noted that while India stands to gain from supply chain shifts driven by tariffs, the transition in global sourcing patterns is expected to be slow and incremental.

Impact on China

“The only deal that matters is China, that’s the deal. Because these are the two largest economies and there are so many issues with China. Technology, Economic War, AI, Taiwan, TikTok, all of this stuff.” Said Kevin O’Leary, Shark Tank Investor on Fox News.

Export heavy provinces like Guangdong and Zhejiang are witnessing slowdowns in factory outputs and layoffs. Small and mid-sized manufacturers are particularly vulnerable as they lack the capital to diversify quickly.

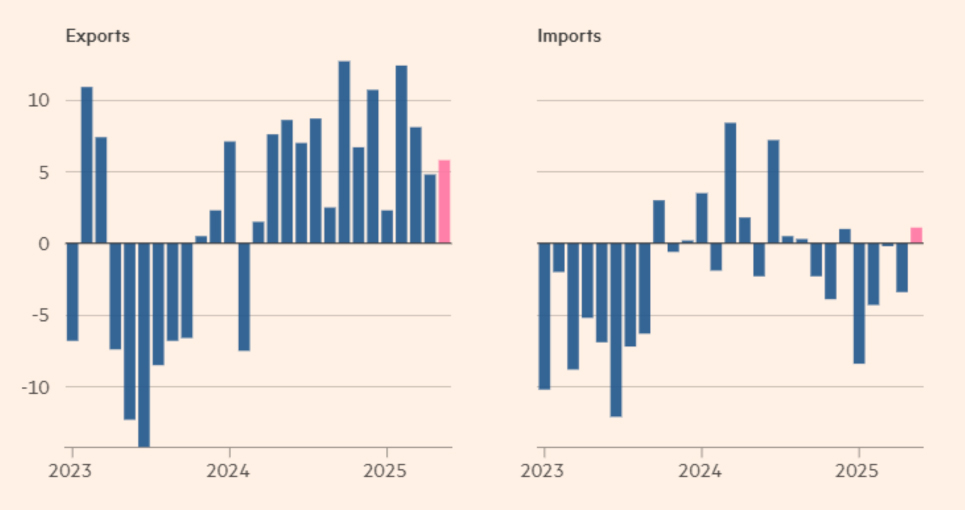

China has been on the receiving end on the maximum number of retaliations along with US Markets, top tech and retail stocks dipping red, majorly due to US’ heavy reliance on Chinese imports. In fact, amidst the growing uncertainty regarding sweeping tariffs on August 1, Chinese ports saw a major uptick in its import and exports. Chinese exports rose 5.8% YoY in dollar terms in June beating expectations of 5% from a Reuters poll.

Source:China’s General Admission of Customs; Financial Times

Even with all this speculation, China refuses to turn down without a fight. Chinese businesses and investors are bracing for the Yuan to hold steady in the short term, with a likely depreciation ahead as US trade tensions persist. Recent signals and policy actions from monetary authorities indicate that this expectation way be well-founded.

Beijing even has imposed selective tariffs on key U.S. agricultural goods, like soybeans, but is focusing on strengthening trade ties with Asia, Middle East, and Latin America.

Conclusion:

Gavin Bade on Wall Street Journal said, “Trump sees tariffs as more than just a trade and economic tool, they’re his cudgel for political control and influence and political domination over other nations no matter what the irritant is. He really views this as a blunt force to exert American control over entire regions and economies. We will see in months and years to come if he has overplayed his hand with that tool because tariffs of course a double-edged sword”, said the WSJ Trade and Economic Policy Reporter. As the final tariff deadline of August 1 approaches, nations are faced with a tough choice: negotiate, retaliate, or realign. Whether this tariff era leads to a more balanced trade ecosystem or deepens divisions will depend on the decisions made in these crucial few weeks.

This marketing and educational content has been created by Century Financial Consultancy LLC (“Century”) for general information only. It does not constitute investment, legal, tax, or other professional advice, nor does it constitute a recommendation, offer, or solicitation to buy or sell any financial instrument. The material does not take into account your investment objectives, financial situation, or particular needs.

The opinions expressed by the hosts, speakers, or guests are their own and may change without notice. Information is based on sources we consider to be reliable; however, Century does not guarantee its accuracy, completeness, or timeliness and accepts no liability for any loss arising from reliance on this content.

Trading and investing involve significant risk, and losses may exceed initial deposits. Past performance is not indicative of future results. CFDs and other leveraged products are complex instruments that may not be suitable for all investors. Please ensure you understand how these products work, the associated risks, and seek independent professional advice if necessary.

Century is licensed and regulated by the UAE Capital Market Authority (CMA) under License Nos. 20200000028 and 301044.

Please refer to the full risk disclosure mentioned on our website.

.png)

.png)

.png)

.png)