Friday, September 30, 2022

Is it time to rethink bonds as a safe haven?

By Century Financial in 'Blog'

.jpg)

For investors, inflation could be a considerable risk to their investments. That is why it is imperative that investors invest their hard-earned money in financial instruments that outpace inflation so its value is not reduced. Fortunately, investors have many ways to hedge their investments against inflation like gold, real estate and ever-safe bonds.

However, recently, there have been concerns about how safe it is to invest in bonds.

How Does Hedging Against Inflation Work

Well, if you are to take steps to protect your investments from the effects of inflation, there are two ways to go about it.

The trustworthy bonds have always been considered a safe haven financial instrument due to their low risk/low return nature. In fact, most financial planners would have recommended to their clients who are preparing to retire or have already retired to divest from stock investments to safe and secure treasury bonds so their wealth isn’t diminished. However, in today’s market, they may need to reconsider their investment strategy.

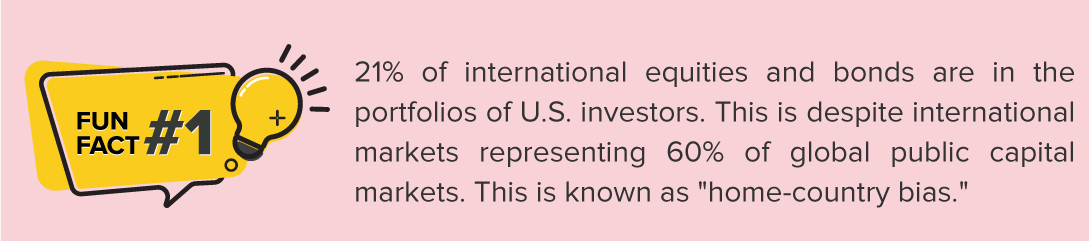

There seems to be a bond anomaly noticed by financial advisors and investment managers that they may not be as safe as they were once thought of, and in the short term, you could even lose a lot of your money. Let’s take a closer look at the graph below of the performance of bonds as per Bloomberg’s U.S. Aggregate Bond Total Return Index.

.jpg)

Here is what we learnt

So, while bonds have historically been a vital financial instrument to have in your portfolio in today’s inflationary environment, it is more likely to negatively impact your portfolio.

So why do we consider bonds safe?

For the longest time, government debt securities were seen as stable investments. The UK’s Gilts or the US’ T-bills have acted as a safe haven for investors. A huge reason for this was the government’s credit status and its high quality of income. Another reason investors sought bonds lay in the fact that trade government bonds provided a fixed rate of return until maturity while ensuring the principal is repaid to the investor. For investors, this seems like a great safe haven, as they were not losing any of the initial capital invested. Some have even gone as far as to call it risk-free.

However, the truth is that bonds are still impacted by inflation, interest rate hikes and currency changes. After all, whenever any instrument is traded on the financial market, there is always a risk. So it is imperative that you protect your positions with sound risk-management strategies.

So why relook at bonds as a safe haven?

As highlighted by Bloomberg’s U.S. Aggregate Bond Total Return Index, core bonds have performed the worst in the last 50 years. Often when assessing fixed instruments in a diversified portfolio, we overlook the impact of inflation.

The average inflation rate since 1976 during down quarters for bonds and stocks was at 6.1%. But when bonds gave investors a chance to protect their investment through diversification, the inflation rate was substantially lower at 3.3%, proving that if inflation remains high, then the diversification benefit of bonds is minimal (at best).

So, where should I park my money to hedge against inflation?

These are some of the investments investors use to hedge against inflation.

Gold: The precious yellow metal is seen, especially among gold investors, as the most efficient instrument to hedge against inflation. However, it hasn’t always been. While it is true it keeps up with inflation, there are periods when its price is not in sync with inflation.

Real Estate: When you buy real property, you own a house and aren’t affected by external factors like paying rent. Firstly, it has intrinsic value and provides consistent income through dividends. Secondly, there is always demand for homes, and as inflation rises, so do property values.

Commodities: The logic is simple; when money loses purchasing power, the price of goods rises. So when you invest in commodities or businesses involved in commodities, you are hedging against inflation as their value increases when inflation rises.

Today, many financial planners, analysts and economists feel equities are a better way to hedge, especially in the long term. When inflation is high, corporate earnings grow faster as people are likely to spend, leading to economic growth. Even with market fluctuations, the stock market has annually appreciated 10% on averagely. So maybe it is time for a rethink on bonds.

The content in this blog, including any research, analysis, opinions, forecasts, or other information (collectively, "Information"), is provided by Century Financial Consultancy LLC (CFC) for marketing, educational, and general informational purposes only. It should not be construed as investment advice, a recommendation, or a solicitation to buy or sell any financial instruments.

This Information may also be published across various channels, including CFC’s website, third-party platforms, newsletters, marketing materials, emails, social media, messaging apps, webinars, and other communications. While CFC strives for accuracy, we do not guarantee the completeness, reliability, or timeliness of any content. Any decisions made based on this Information are at your own risk. CFC accepts no liability for any loss or damage arising from its use.

Trading financial products involves significant risk and may not be suitable for all investors. Please ensure you fully understand the risks and seek independent professional advice if necessary.

Please refer to the full risk disclosure mentioned on our website.

.png)

.png)

.png)

.png)