Monday, September 22, 2025

Mastering Option Trading Strategies for Smarter Investments

By Century Financial in 'Blog'

.jpg)

Introduction

Options are among the most versatile instruments in financial markets. It enables traders to hedge risks, generate income, and capture price movements with defined risk.

However, success in option trading depends largely on the right option trading strategies. Whether you are a beginner looking for option trading tips or an experienced trader exploring advanced stock option trading strategies, a solid foundation of good strategies will give you clarity and help you define your approach to trading.

What is Option Trading?

Option trading involves contracts that give the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific time frame. Traders use options for hedging or for beneficially positioning themselves, depending on their market outlook.

Call Options:

Right to buy an asset at a set price.

Put Options:

Right to sell an asset at a set price.

With Options, traders can design strategies tailored for bullish, bearish, or neutral market conditions. They are highly flexible instruments that allow traders to manage risk, generate income, and even leverage small amounts of capital for larger market exposure. Unlike stocks, their value is influenced not just by price movements but also by time decay and volatility.

Successful option trading requires a clear understanding of market trends, strike prices, and expiration dates. Many traders also use option trading strategies like spreads, straddles, and covered calls to optimize returns while limiting risk.

Why Use Option Trading Strategies?

Unlike simply buying and selling stocks, option trading requires structured planning. With proper strategies, you can:

Reduce risk exposure.

Hedge against market volatility.

_---.png)

Generate consistent income (through option selling).

Maximize returns in specific market conditions.

Best Option Trading Strategies Explained

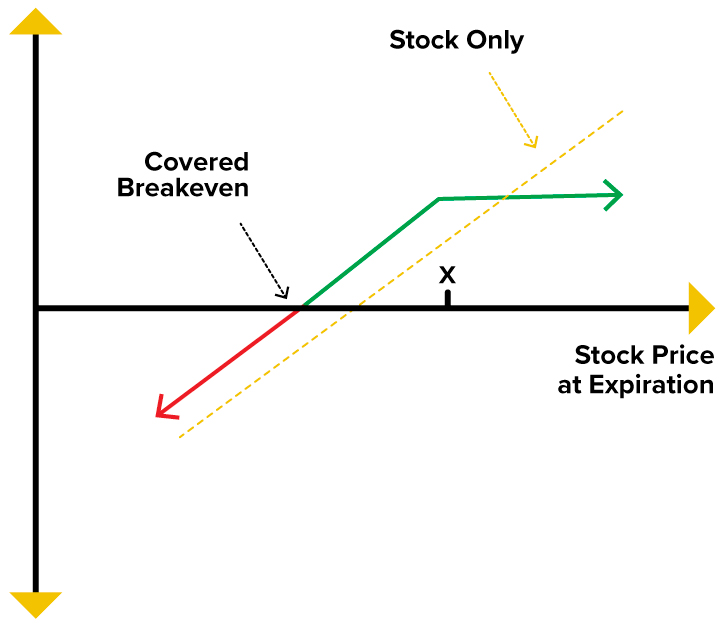

1. Covered Call Strategy

This is one of the best-known option trading strategies. A trader holds the underlying stock and sells call options on it. If the stock remains stable, the premium collected becomes profit.

Option trading example:

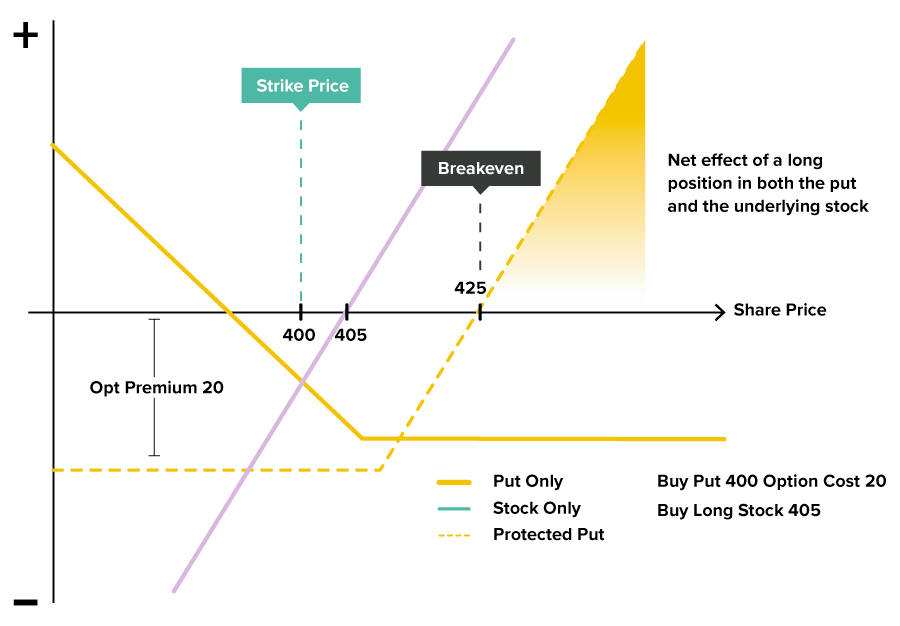

2. Protective Put Strategy

Used as an insurance strategy in stock option trading strategies, it allows traders to safeguard against downside risk.

Example: Buy stock + buy a put option at a lower strike. If the market falls, the put limits your loss.

3. Bull Call Spread

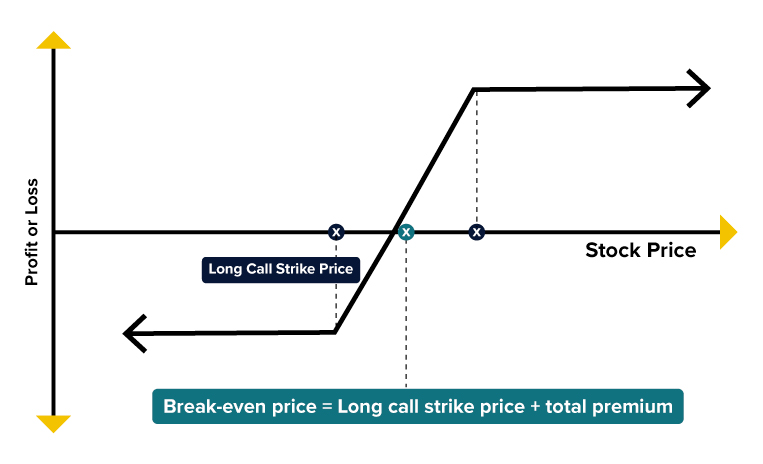

This is a popular option trading method for moderately bullish markets. It involves buying a call option at a lower strike (ITM) and selling another at a higher strike (OTM). While this reduces overall cost, it also impacts the potential upside of the trade.

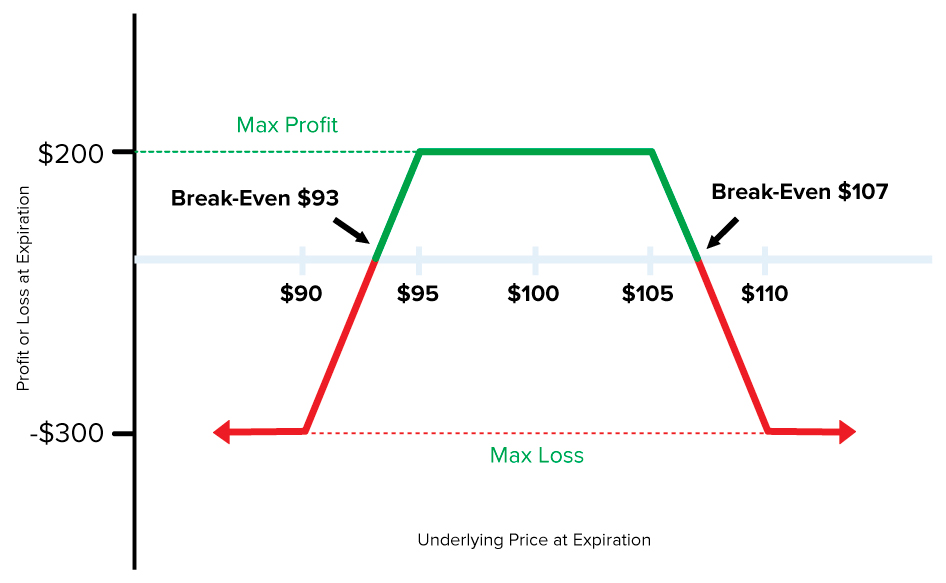

4. Iron Condor

A classic option-selling strategy for range-bound markets. Traders sell an out-of-the-money call and put, while simultaneously buying further out-of-the-money options for protection. Profit is made if the market stays within a specific range.

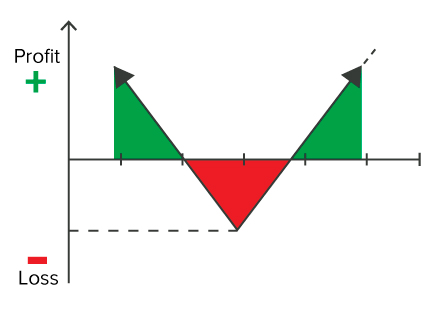

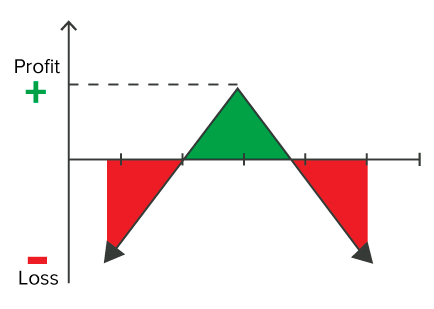

5. Straddle

This strategy is ideal when high volatility is expected, but direction is uncertain. A trader buys both a call and a put at the same strike price. The market could swing in either direction, but with the right timing and presence, this strategy could prove beneficial.

Long Straddle

Short Straddle

Practical Option Trading Tips for Beginners

Option Trading at Century

At Century Financial, we provide seamless access to global derivatives and stock markets with advanced platforms. You can trade options across currencies, shares, commodities , indices , treasuries , ETFs, CFDs , and more.

Why Choose Century for Option Trading?

Access to global markets with diverse instruments.

Secure and regulated environment for safe trading.

Competitive pricing and transparent fee structure.

Advanced research tools and 24/7 support.

Solutions designed for both beginners and professionals.

FAQs on Option Trading Strategies

Q1. What is the best option trading strategy for beginners?

A: Covered calls and protective puts are beginner-friendly strategies as they limit risk.

Q2. How can I minimize risk in option trading?

A: Hedging strategies like protective puts, iron condors, and spreads can be used to cap losses while maintaining upside potential.

Q3. What are the top option selling strategies?

A: Covered calls and iron condors are popular selling strategies designed for stable market conditions.

Q4. Which platforms are best for option trading?

A: Century provides IBKR (Interactive Brokers) which is ideal for both new and professional traders.

Q5. Can I trade futures and options together?

A: Yes, future option trading is common. Traders use options on futures to hedge risks or enhance returns.

Conclusion

Mastering option trading strategies is essential for anyone looking to balance risk and reward in today’s volatile markets. From beginner-friendly approaches like covered calls and protective puts to advanced setups such as iron condors and straddles, each strategy serves a unique purpose depending on market conditions. The key lies in aligning your strategy with your financial goals, risk appetite, and the right option trading platforms.

This marketing and educational content has been created by Century Financial Consultancy LLC (“Century”) for general information only. It does not constitute investment, legal, tax, or other professional advice, nor does it constitute a recommendation, offer, or solicitation to buy or sell any financial instrument. The material does not take into account your investment objectives, financial situation, or particular needs.

The opinions expressed by the hosts, speakers, or guests are their own and may change without notice. Information is based on sources we consider to be reliable; however, Century does not guarantee its accuracy, completeness, or timeliness and accepts no liability for any loss arising from reliance on this content.

Trading and investing involve significant risk, and losses may exceed initial deposits. Past performance is not indicative of future results. CFDs and other leveraged products are complex instruments that may not be suitable for all investors. Please ensure you understand how these products work, the associated risks, and seek independent professional advice if necessary.

Century is licensed and regulated by the UAE Capital Market Authority (CMA) under License Nos. 20200000028 and 301044.

Please refer to the full risk disclosure mentioned on our website.

.png)

.png)

.png)

.png)