Friday, August 01, 2025

Sector-Wise Impact of Trump’s 2025 Tariffs: Commodities, IT, Pharma & More

By Century Financial in 'Blog'

Introduction

It’s Trump’s world, and we’re just living in it, and not in a good way. The world tumbles with every announcement from the White House, about the infamous reciprocal tariffs slammed by the US to all its trading partners. The tremors are instantly felt by markets around the world. Historically, tariffs, when imposed, were supposed to benefit a particular industry. However, this time around, hardly any industry will feel withered, as nearly all trading partners are being tariffed, making foreign goods and products in the commodities significantly expensive for the common American. Let’s deep dive into which sectors and industries might have a turbulent future (for now).

Table of Contents

Automotive and Auto Parts

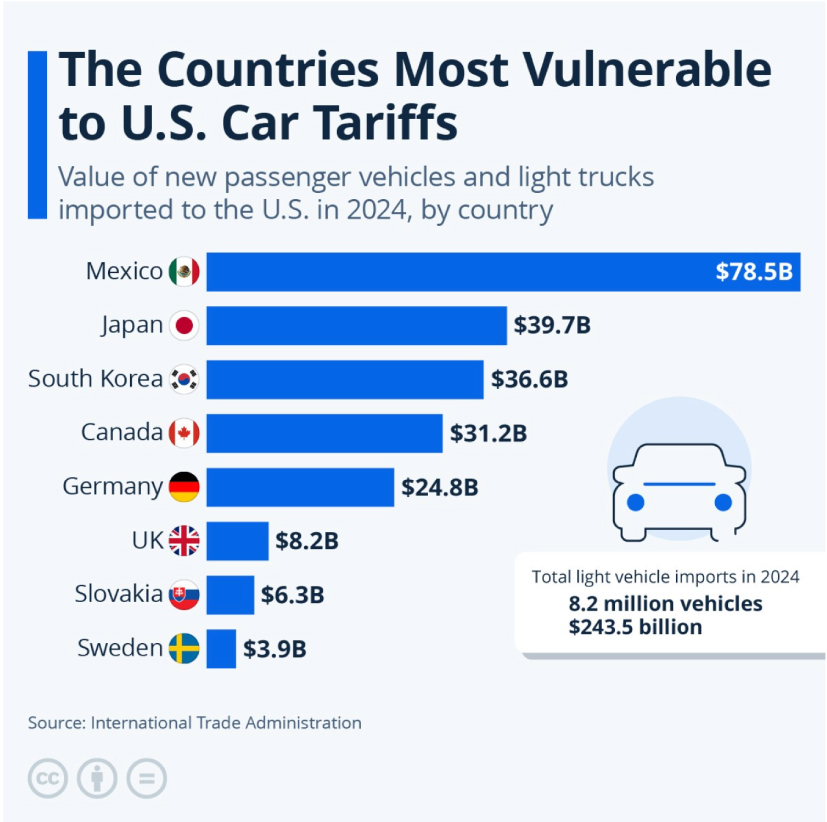

According to a report by Statista, about half the cars on US roads are imported. Even if they’re not, they massively rely on major parts, such as engines from Japan, transmissions from Germany, and chips from Taiwan. Meanwhile, on 7th July 2025, President Trump sent letters to Japan and South Korea will face 25% tariffs against all exports to the US, effective August 1.

US automotive companies are likely to see a rise in production costs as Japan and South Korea contribute high-tech components, transmissions, brakes, steering, ADAS, and EV modules. Japan and Korea include play a key role in US automobile industry contributing 7% and 8% respectively

Japanese automotive giants such as Toyota, even after having a plant in the US, import models like Corolla, Camry from Japan. Mazda Motor of America imports cars from its factories in Japan. South Korean players such as Hyundai and Kia also have a significant presence in the United States. Tariffs are also imposed on Germany which is going to make luxury sedans, BMW and Mercedes, relatively pricier.

Source:Statista

Steel, Copper and Aluminium

July 9th saw Trump impose a 50% tariff on copper imports. The objective behind follows the same objective since the beginning, which is to encourage domestic production of an industry essential for defence, automotive, and electronics.

Justin Wolfers, Professor of Economics and Public Policy at the University of Michigan“The copper thing is pretty real. There’s going to be a 50% tariff on copper, which has huge implications in the US. If you’re running a factory, where you use copper for whatever you make, all of a sudden the cost of that copper is going to go up 50% for American companies but not for their rivals, pretty good way of shooting American manufacturers in the foot”, said in an interview with ABC News

Interestingly, the U.S. relies on imports for almost half its copper supply, bringing in about 810,000 metric tons in 2024. The biggest impacts are likely to be felt over Chile, Canada, and Mexico.

Electronics and Semiconductors

Nearly all tech giants of the US manufacture their products in China. And China, being the epicentre of the tariff war with the US, didn’t really help the case of US indices as well. One of the major objectives of the entire tariff fiasco was to reduce the dependence on China, and American companies, by hook or by crook, somehow managed to do that.

The tariff policy largely affects tech hardware products, many of which are heavily reliant on manufacturing in China. As a result, price increases are likely on items like laptops, smartphones, tablets, and gaming consoles, along with essential parts such as semiconductors and circuit boards to meet them.

These tech giants have already started making moves owing to the tariff and are trying to save themselves from the crunch. Apple relies heavily on Chinese imports for the production of its flagship products, such as MacBook, iPhone, and other hardware. Apple is moving some final assembly of iPhones, AirPods, iPads, and MacBooks to India and Vietnam, primarily to avoid US tariffs and hedge geopolitical risks.

Nvidia CEO Jensen Huang mentioned that tariffs are unlikely to have a major impact on them, thanks to their domestic investment strategy. Nvidia has announced plans to invest billions of dollars over the next few years, including a chip manufacturing plant in Arizona.

Microsoft, like other counterparts, is adjusting its supply chain, increasingly telling suppliers to stockpile components. The effect of tariffs has already led to a bit of price increase, with Power BI subscription going from $10 to $14 and Teams mobile standard service from $8 to $10.

Pharmaceutical

Fun Fact: The US backs itself as the biggest pharmaceutical industry in the world, by production value, clocking in a $602 billion, far ahead of China and India. Even with such market leader tags, America heavily relies on imports for its active pharmaceutical ingredients (APIs). This cultural shift took place after Big Pharma, such as Pfizer and Johnson & Johnson, started importing their APIs owing to reduced production costs.

Trump has threatened a 200% tariff on all foreign-made medicines in about a year’s time. This could hurt the US in a way that healthcare ends up being unaffordable for Americans, an already expensive and insurance-backed affair, due to extremely high prices on medicines. It would also hurt America’s biggest importer, India, which supplies 40% of America’s ready-for-consumption drugs.

Trump’s tariffs are eventually aimed at booming API production. But what a chain of unawareness is that it would take decades to completely establish manufacturing facilities, as the country’s infrastructure is not ready to handle new API factories.

In an Al Jazeera report, “There are over 400 key ingredients or APIs that need to be produced to be fully integrated, and the US has no personnel resources ever since the Big Pharma left 20 years ago,” said Stanley Chao, managing director of All in Consulting.

Conclusion

Tariffs are usually seen as measures to protect domestic industries and enhance manufacturing, while reducing reliance on foreign goods. But the reality in 2025 is far from what was planned. Industries are expected to see widespread turbulence over the next few months especially in sectors such Electronics, Automobile, Pharmaceutical, Agriculture and many other.

The sweeping tariffs will disrupt global trade and not only leave little money in the hands of American public but also disrupt their lives. The true question is whether this gamble is a way towards American manufacturing movement or just a strain on the global supply chain, time will only tell.

This marketing and educational content has been created by Century Financial Consultancy LLC (“Century”) for general information only. It does not constitute investment, legal, tax, or other professional advice, nor does it constitute a recommendation, offer, or solicitation to buy or sell any financial instrument. The material does not take into account your investment objectives, financial situation, or particular needs.

The opinions expressed by the hosts, speakers, or guests are their own and may change without notice. Information is based on sources we consider to be reliable; however, Century does not guarantee its accuracy, completeness, or timeliness and accepts no liability for any loss arising from reliance on this content.

Trading and investing involve significant risk, and losses may exceed initial deposits. Past performance is not indicative of future results. CFDs and other leveraged products are complex instruments that may not be suitable for all investors. Please ensure you understand how these products work, the associated risks, and seek independent professional advice if necessary.

Century is licensed and regulated by the UAE Capital Market Authority (CMA) under License Nos. 20200000028 and 301044.

Please refer to the full risk disclosure mentioned on our website.

.png)

.png)

.png)

.png)