Monday, December 29, 2025

Understanding Margin and Leverage in CFD Trading

By Century Financial in 'Blog'

Two concepts every trader in the world of CFD trading (Contracts for Difference) needs to understand are leverage and margin. These ideas are the cornerstone of current economic and forex trading, giving traders greater market exposure while investing only a small portion of the total trade value. However, while leverage can amplify potential profits, it can also magnify losses, making knowledge and risk management essential.

CFD traders can maximize their capital, trade with confidence in erratic markets, and make better decisions by understanding how margin and leverage operate.

What is Leverage in CFD Trading?

Leverage is one of the most potent tools in CFD trading (Contracts for Difference). Traders can open positions larger than their account balance would usually permit, helping them maximize returns from small price movements.

In simple terms, leverage lets you control a larger trade size using a smaller amount of capital—known as the margin. Traders can amplify both their profits and losses, making leverage a double-edged sword that requires careful risk management.

For example, if you’re trading with a leverage of 1:20, you can control a $20,000 position by depositing just $1,000. This magnifies your market exposure and amplifies your potential gains and losses.

Leverage is widely used in forex, indices, commodities, and equity CFDs, offering flexibility and access to multiple global markets through platforms such as Century Trader and MT5.

How Leverage Works in CFDs

The level of exposure when trading on leverage depends on your margin. “Margin requirement” is the part of your capital used to take the leveraged position. Depending on the leverage ratio, the exposure is magnified, making leverage a key advantage in CFD and forex trading.

CFD traders can control larger positions and earn higher returns from even minor price movements through leverage. However, it’s important to remember both the benefits and drawbacks of leverage trading.

Example of Leveraged Forex Trading

Let’s say you want to trade the EUR/USD currency pair, and your broker offers 1:30 leverage.

Trade size: $30,000

Required margin: $1,000

In this case, you’re controlling a $30,000 position by investing only $1,000 of your own capital.

Your profit increases to $300, or a 30% return on your margin, if EUR/USD moves 1% in your favor. You will lose $300 if the same strategy backfires, though. Leverage increases both gains and losses in this way.

Leverage is an effective tool for optimizing opportunities, as the example demonstrates, but in order to prevent significant losses, it necessitates discipline, market knowledge, and effective risk management.

Professional traders often use stop-loss orders, limit orders, and a clear leverage strategy to balance potential rewards with manageable risks.

Benefits of Leverage Trading

Here are some of the main benefits of trading with leverage in today’s dynamic economic trading environment:

Capital Efficiency

With a smaller deposit, leverage enables you to manage larger market positions. Leverage allows the better use of trading capital while keeping funds available for other opportunities.

Diversification Opportunities

With leverage, traders can spread their investments across multiple markets and asset classes, such as currencies, shares, indices, and commodities . This diversification helps reduce overall portfolio risk while allowing simultaneous participation in different market trends.

Increased Market Exposure

With freed-up capital, you can diversify your portfolio, but leverage increases your short-term position's exposure. This means you can profit from both rising and falling markets, adding flexibility to your trading strategy.

The Risks of Leverage in CFD Trading

The exact mechanism that magnifies profits can equally magnify losses—making leverage a double-edged tool. Managing this risk requires discipline, awareness, and effective trading strategies.

Risk Example

Let’s take an example to illustrate the downside of high leverage:

If you open a 1:50 leveraged position worth $50,000 with just a $1,000 margin, even a 2% unfavorable price movement would result in a $1,000 loss, wiping out your entire margin balance.

This shows how quickly leveraged positions can deplete your capital, especially in volatile markets if not managed carefully.

To mitigate this risk, traders should:

What is Margin in CFD Trading?

Margin is the collateral required to open and maintain leveraged positions in CFD trading. It acts as a security deposit, ensuring you have sufficient funds to cover potential losses if the market moves against your position. In other words, margin is the part of your capital used to take a leveraged position.

There are two main types of margin in CFD and forex trading:

Initial Margin

The initial margin is the amount of money you must deposit to open a new leveraged position. It represents the entry requirement to gain market exposure. For instance, with 1:20 leverage, opening a $20,000 position would require an initial margin of $1,000.

Maintenance Margin

The maintenance margin (or variation margin) is the minimum amount of equity you must maintain in your account to keep your position open. If your account balance falls below this threshold due to market losses, you may receive a margin call—the broker’s request to add more funds to maintain your trade.

Margin Calls and Close-Out Levels

A margin call occurs when your account equity falls below the maintenance margin requirement set by your broker. This situation indicates that your open positions are losing value and your available funds are no longer sufficient to sustain them.

When a margin call is triggered, the broker may take one or more of the following actions:

To avoid margin calls and forced position closures, you should:

Maintaining healthy margin levels ensures that you can trade confidently, manage volatility effectively, and avoid unexpected liquidation events.

How to Calculate Required Margin

The formula to calculate margin is:

Required Margin = Trade Size × Margin Requirement %

For instance, if you trade a 1-lot EUR/USD position ($100,000) with a 3% margin requirement, you must deposit $3,000.

Costs of Leveraged Trading

While CFDs offer flexible trading opportunities across various markets, leveraged trading also involves certain costs that traders must consider. For precise profit calculation and efficient risk management, it is imperative to assess these expenses.

Below are the key costs associated with trading leveraged CFDs:

Overnight Financing (Swap Fees)

When you hold a leveraged CFD position overnight, brokers typically charge or credit overnight financing fees, also known as swap rates. The amount depends on factors such as leverage used, position size, and the underlying asset.

Spread Costs

The spread is the difference between the bid (sell) and ask (buy) prices of a CFD instrument. It represents the broker’s fee for executing a trade. Tight spreads are preferable because they reduce the cost of entering and exiting trades, especially in high-volume forex or index CFDs.

Commission Fees

Some brokers charge a commission on specific CFD instruments. This fee is usually a fixed rate per trade or a percentage of the total transaction value.

Risk Management in CFD and Leverage Trading

Effective risk management is essential for success in CFD trading and leveraged forex trading. While leverage can amplify profits, it can also magnify losses, making disciplined strategies critical for protecting capital and maintaining long-term profitability.

- Use Margin Sensibly

- Set Stop-Loss Orders

- Hedge Your Position

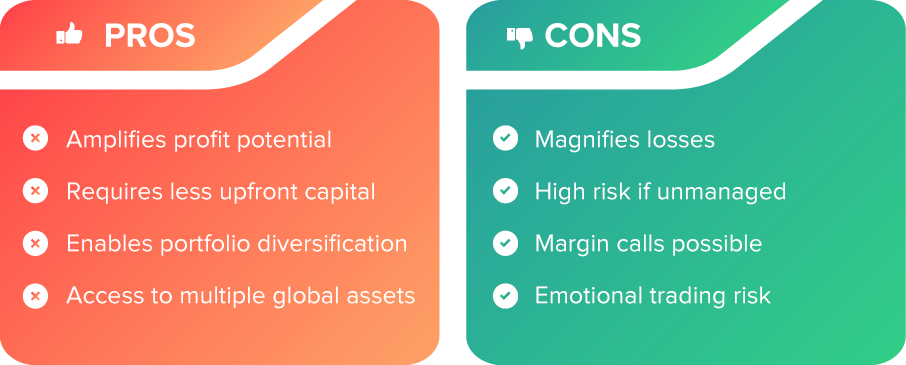

Pros and Cons of Leverage Trading

Understanding the pros and cons can help you make informed decisions and develop effective strategies. Here are some upsides and downsides to consider:

Conclusion

Understanding margin and leverage is fundamental to becoming a disciplined CFD trader. Leverage allows you to control larger market positions with smaller capital, making trading more accessible and capital-efficient. However, it also increases potential risks, as losses can exceed the initial margin if markets move against you.

By learning how margin requirements are calculated, setting appropriate leverage levels, and applying solid risk management techniques like stop-loss orders and position sizing, traders can strike a balance between opportunity and caution. Whether you trade forex, commodities, indices, or shares through CFDs, success lies in understanding how leverage truly works and using it wisely to strengthen your overall trading strategy.

FAQs

Q1. What is the difference between margin and leverage?

A: Margin is the deposit needed to open a position, while leverage determines how much market exposure you can control relative to your deposit.

Q2: What leverage ratio is best for beginners?

A: Beginners should start with demo accounts and low leverage ratios to learn and manage risk effectively.

Q3: Can I lose more than my margin in CFD trading?

A: In volatile markets, losses can exceed your margin. It’s crucial to use risk management tools and trade with a reputable broker like Century Financial.

Q4. Do all instruments have the same leverage levels?

A: No. Leverage varies by instrument type. For example, forex pairs typically offer higher leverage than shares or commodities.

Q5. Is leverage trading suitable for long-term investors?

A: Leverage trading is generally better suited to short- to medium-term traders, but long-term investors can use leverage instruments as hedging tools.

Related Reads

This marketing and educational content has been created by Century Financial Consultancy LLC (“Century”) for general information only. It does not constitute investment, legal, tax, or other professional advice, nor does it constitute a recommendation, offer, or solicitation to buy or sell any financial instrument. The material does not take into account your investment objectives, financial situation, or particular needs.

The opinions expressed by the hosts, speakers, or guests are their own and may change without notice. Information is based on sources we consider to be reliable; however, Century does not guarantee its accuracy, completeness, or timeliness and accepts no liability for any loss arising from reliance on this content.

Trading and investing involve significant risk, and losses may exceed initial deposits. Past performance is not indicative of future results. CFDs and other leveraged products are complex instruments that may not be suitable for all investors. Please ensure you understand how these products work, the associated risks, and seek independent professional advice if necessary.

Century is licensed and regulated by the UAE Capital Market Authority (CMA) under License Nos. 20200000028 and 301044.

Please refer to the full risk disclosure mentioned on our website.

.png)

.png)

.png)

.png)