Tuesday, September 29, 2020

Micron’s share price: What to expect in Q4 earnings

By Century Financial in 'Brainy Bull'

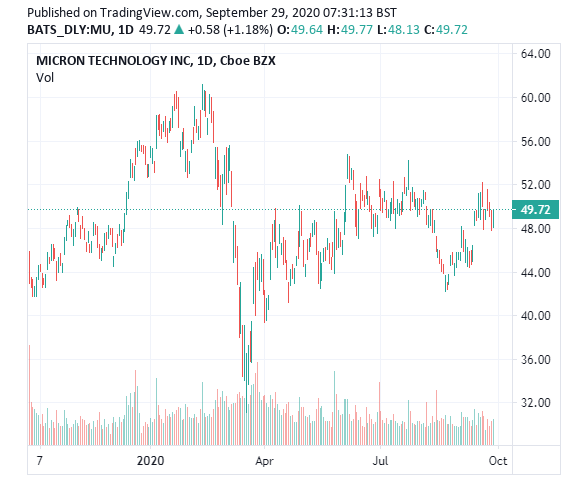

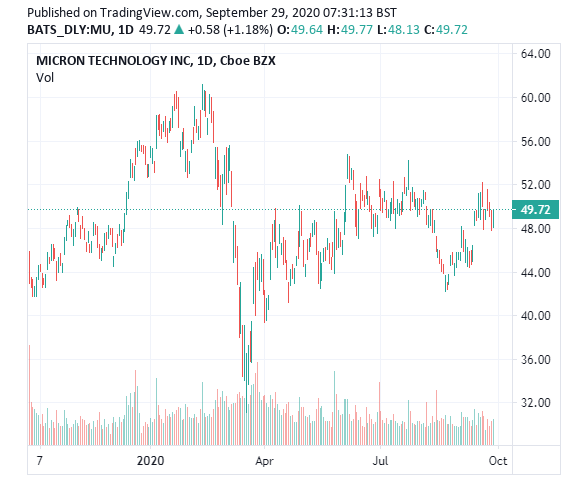

Micron's [MU] share price has jumped almost 8% this month as investors have seemingly changed from bears to bulls on the stock.

Up until the start of September, sentiment on Micron’s share price had definitely been bearish. Price weakness in its computer memory chips had hurt sales, while a government ban on US companies supplying Huawei didn’t do Micron’s earnings any favours. The company itself struck a pessimistic note, warning that customers would reduce cloud spending in the second half of 2020 after a first half boom.

In a stunning example of how quickly things can change, however, Micron’s share price is now soaring, fuelled by a spate of good news. With fourth quarter earnings out this week, is it time to take profits or are there more gains ahead?

When is Micron reporting?

29 September

What should investors expect from Q4?

Shift in sentiment

The pessimistic outlook has, until recently, caused Micron’s share price to lag behind the rest of the semiconductor sector. However, according to TickerSquare on Seeking Alpha, Micron is now entering an ‘upcycle’ as investors ditch momentum stocks for value stocks.

In such a cycle, any positive news around a company can have an outsized influence on its shares. That's certainly true of Micron's share price, which has benefitted from analyst upgrades and Micron’s announcement that it is developing a new graphics card with Nvidia.

"There appears to be an inordinate amount of bullishness surrounding Micron's stock. There is good reason for it. Given the long-term prospects, Micron is an excellent value. But there are risks lurking around the corner. The macro environment is at the top of the list."

Investors should definitely watch out for a continued recovery in revenue from DRAM and NAND sales. Price weakness in these computer memory chips has hurt Micron’s sales recently, yet last quarter saw signs of a recovery as DRAM revenue gained 6% year-on-year, while NAND revenue increased 50%. According to Seeking Alpha, revenue from these two areas accounts for 97% of Micron’s overall revenue.

Signs of a continued recovery could well see Micron’s share price climb even higher. Yet, as TickerSquare warns, any negative sentiment could see an abrupt reversal in fortune.

Impact of losing Huawei

Micron is facing a substantial loss in business after being forced to stop shipping to Huawei due to the US government ban. According to BMO analyst Ambrish Srivastava, business from Huawei had accounted for 10% of Micron's total revenue, leaving it in a "tight spot".

“We believe Micron will be able to recoup some of the business that is lost due to the ban on Huawei, with a net negative impact of about 4% of lost revenues in fiscal 1Q," the analyst said.

Srivastava has a $47 target on Micron's share price, which would see a 4.4% downside if hit. While the loss of business won't be reflected in this quarter's results, shareholders will be expecting an update from Micron on how it plans to plug the Huawei shaped hole in revenue.

What is Wall Street expecting?

Wall Street is expecting revenue to come in at $5.9bn, a 21.2% jump on the $4.87bn seen in the same quarter last year. Earnings are pegged at $0.99 a share, up from the $0.56 a share seen last year.

Micron itself expects revenue to come in between $5.75bn and $6.25bn, on earnings of between $0.95 and $1.05 per share.

Could Micron beat analyst expectations? In the past four quarters, the company has delivered an earnings beat but it is not guaranteed this time around, considering the unpredictable economic and macro environment.

Where next for Micron's share price?

Micron's share price certainly has its fans. September saw Goldman Sachs upgrade the stock from Neutral to Buy, causing the stock to jump 6%. Goldman analyst Toshiya Hari argues that price weakness in NAND and DRAM products won't last, while 5G smartphones could help demand in 2021.

However, the bears are very much still out there. Among them is Citi analyst Christopher Danely, who has a Sell rating on the stock and a $35 price target. This would see a 28.8% downside on Micron’s share price through 25 September’s close.

Looking more widely, it seems general sentiment is positive towards Micron right now. Among the analysts tracking the stock on Yahoo Finance, Micron’s share price has an average target of $63.65, which would see a 29.5% upside if hit.

Of the 31 analysts offering recommendations, 8 rate Micron a Strong Buy and 20 rate it a Buy.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.