Tuesday, September 01, 2020

Will IAG’s share price continue losing altitude following strike action?

By Century Financial in 'Brainy Bull'

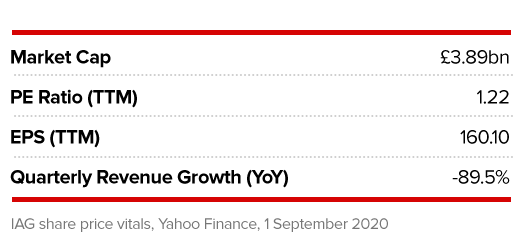

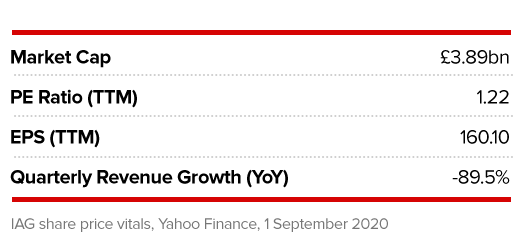

Given the notable nosedive IAG's [IAG] share price has taken this year, it's tempting to argue the current price is something of a bargain. Down 70% this year to date, the owner of British Airways, Aer Lingus and other carriers has certainly experienced its fair share of turbulence in the markets.

Yet with IAG’s share price taking off over 23% throughout August, now could be time for investors to climb onboard. Headwinds, however, include the very real prospect of strike action in the Autumn and a rights issue that could dilute the stock further.

So, is IAG's share price a bargain right now, or is it set to lose more altitude?

What is moving IAG's share price?

Strike action on the horizon

IAG-owned British Airways is one of the main culprits putting pressure on IAG’s share price. Travel restrictions and lack of demand are seeing the airline burn through £20m a day. To reduce costs, it is axing up to 12,000 jobs, with the remaining staff moving on to new contracts.

According to union Unite, these new contracts would reduce pay by as much as 43% and see job security decrease. Unite has announced that it is going ahead with strike action later this year in light of these changes. While the strike still has to pass a vote with union members, any industrial action would severely affect BA's ability to operate.

‘Enough is enough,’ Unite said in a statement. ‘We will now instruct our legal specialists to proceed to industrial and legal action, which will hit BA in the autumn.’

Quarantine measures continue to hit travel sector

The threat of strike action meant IAG missed out on gains enjoyed by the wider travel sector towards the end of August, after the UK government took Portugal off its 'red list'. With Spain still on the list, the option to travel to Portugal again was a very important boost for the British travel industry.

That said, there's still a lot of gloom surrounding the sector and news of increased infection rates in parts of Europe continues to cause problems. Not helping IAG’s cause is the UK government’s decision to add Austria and Switzerland to its list of at-risk countries. With new entries being added with little notice, IAG's share price is likely to be turbulent for a while yet.

Plans to raise €2.75bn in rights issue

To help keep IAG in the sky the company is planning to raise €2.75bn by selling new shares in a rights issue. While this would raise capital, Davy analysts Stephen Furlong and Ross Harvey note it could also dilute shareholder stock by as much as 50%. In response, the analysts cut their rating on IAG from Outperform to Neutral, pinning a 200p target on IAG’s share price. Hitting this would see a 7.5% downside on the current price through 28 August’s close.

The rest of 2020 is likely to pose more challenges for IAG's share price. A second wave of the coronavirus across the globe could see more travel restrictions imposed. IAG's own assessments predict it will only resume 34% of its normal schedule by the end of 2020.

So, is IAG a buy?

For investors looking beyond 2020, there are some blue skies on the horizon. While losses are likely this year, Furlong and Harvey suggest IAG will see a €2bn profit in 2021. However, for investors thinking of picking up shares everything depends on timing. With an upcoming rights issue, it might be worth holding off to see if IAG's share price loses even more altitude before buying.

Analysts tracking IAG's share price on the Financial Times have a 291.95p average price target, which would see a 35% upside on the current share price. Of the 16 offering recommendations, 10 rate the stock as Outperform.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.