Wednesday, March 10, 2021

How Much Momentum Remains in Work From Home Stocks?

By Century Financial in 'Brainy Bull'

In this article, US-based investment manager Direxion looks at the performance of work from home stocks relative to the global economy’s recovery.

Life moves pretty fast, so does remote work momentum.

Collectively, investors under appreciate how swiftly humans can adapt to different circumstances. One of the reasons is … life can move pretty fast. Days blend into weeks, and weeks into months. In the midst of a global pandemic, lots of change was accelerated with long-term structural changes occurring under our noses.

One of the most prominent adaptions was the successful adoption of remote work by a wide range of companies, including those that believed productivity was measured by time in a physical location, as opposed to actual output.

Still value to be had

Since the strictest lockdowns lifted, economic recovery has been noticeable, albeit with further bifurcation between the haves and have-nots, whether in the economy or the markets.

The coronavirus pandemic, in many ways, simply lifted the veil on existing inequalities. In the stock market, the haves are growth companies, primarily in the technology sector. The have nots, however, are value companies in sectors such as financials and energy.

Historically, in times of economic recovery when bond yields are increasing and the yield curve is steepening, value as a style does well. Not to say that this time, it is different, but since the COVID-19 crash value has only recovered modestly.

With US president Joe Biden in office, along with Democrat control of Congress, value stocks may have support in addition to the economic recovery, but time will tell.

Value has bounced, but modestly

Source: Bloomberg, as of 31 January 2021

The lack of a robust recovery for value tells us the market is not quite convinced of the path of this recovery, especially the narrative for pent up demand. Even so, one of the more typical responses we hear from investors regarding work from home stocks is that it has simply been a trade, and its best days are behind it. We believe this view is misguided on multiple fronts.

Seven years to herd immunity

Unfortunately, the virus continues to outpace science. On one hand, it is encouraging to see vaccinations outnumber new cases. On the other hand, recent mutations make the need for rapid vaccine deployment even greater.

According to the Bloomberg Vaccine Tracker, the US will not reach the 75% to 85% coverage, suggested by experts to see a return to normal, until the end of 2021. At the current pace, it will take seven years for the entire world to reach that number.

With this being the case, it is hard to see a widespread resurgence of firms forcing employees to work entirely in the office, especially when productivity can be just as high outside of it.

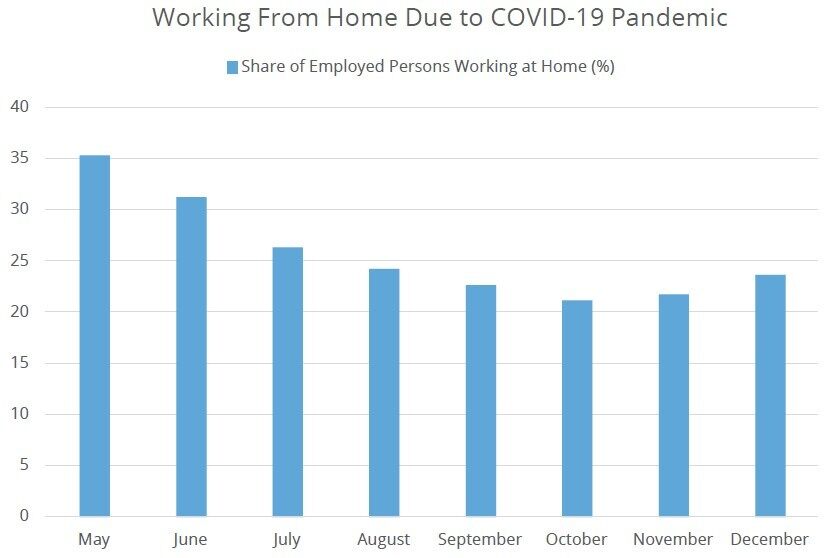

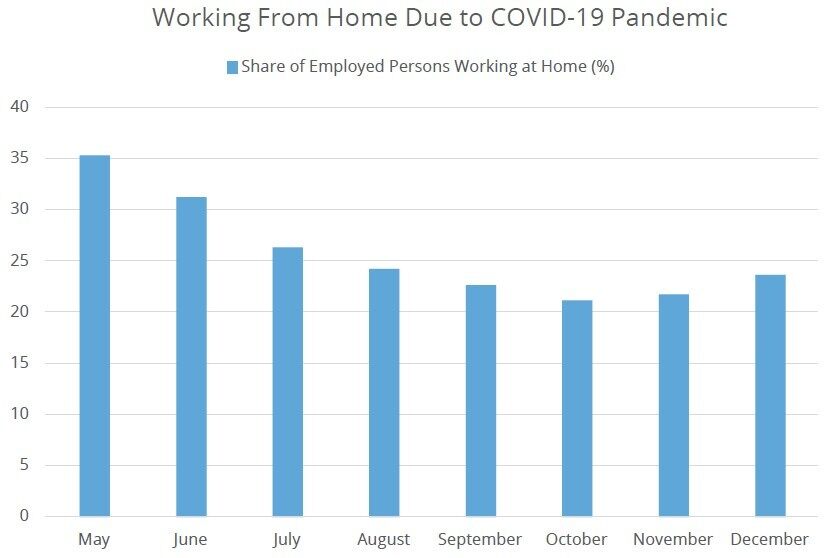

As time goes on, more and more companies continue to embrace remote work or hybrid working models. The most recent data from the US Bureau of Labor Statistics makes this clear, as the percentage of Americans working from home has increased over the last two months, jumping 9% to 23.7%. So, while the number remains lower than May, it is not showing signs of slowing, and is now increasing.

Remote working momentum is strong

Source: US Bureau of Labor Statistics, as of 31 December 2020

Businesses are adapting just as quickly as we, as people, have [to the pandemic]. From their perspective, this is both about providing the tools and applications for employees to work from anywhere, and about making their own enterprises more digital. And at the same time, work from home related stocks continue to outperform.

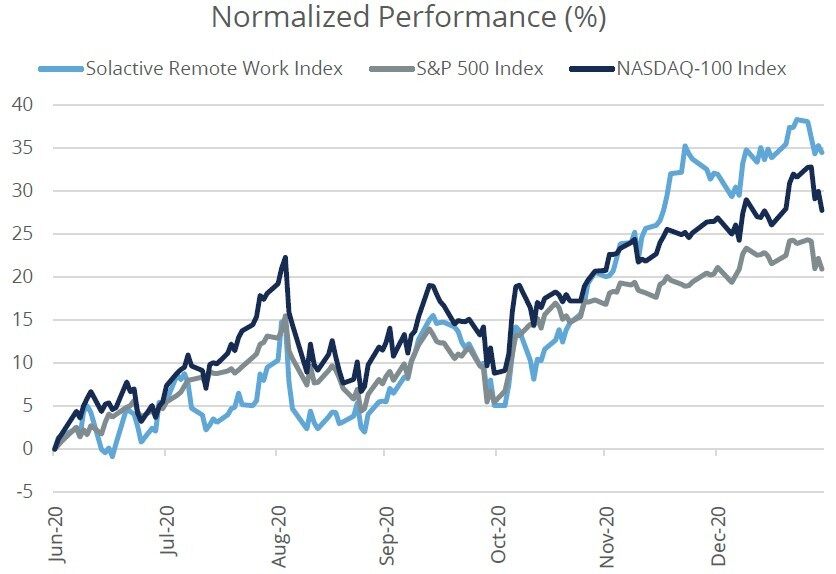

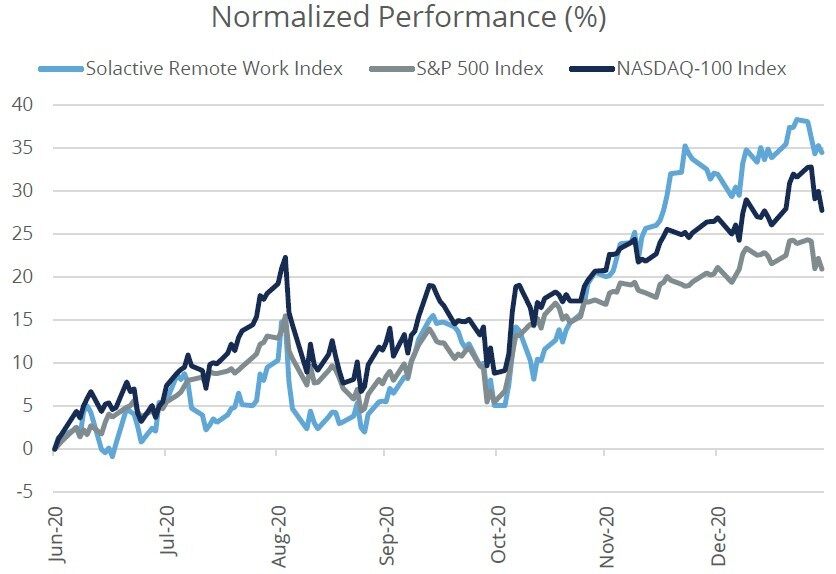

In other words, the market continues to appreciate how quickly change is happening, and the secular nature of the change. The Solactive Remote Work Index has notably outperformed the S&P 500 Index and the Nasdaq 100 Index since the start of July, well after the initial market bounce.

Remote work stocks continue to outperform

Source: Bloomberg, as of 31 January 2021

Investors should not be overly negative on the economic recovery but should not lose sight of the disruption happening before their eyes. In the words of Ferris Bueller: “Life moves pretty fast. If you don't stop and look around once in a while, you could miss it.”

In today’s market environment, it means to take advantage of mega trends such as the increased adoption of remote work, which continues to outperform even as the light at the end of the COVID-tunnel gets brighter.

The Direxion Work From Home ETF [WFH] offers exposure to companies across these four technology pillars, allowing investors to gain exposure to those companies that stand to benefit from an increasingly flexible work environment.

This article was originally published in Direxion’s Spotlight newsletter on 18 February 2021.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.