The Union budget released for the fiscal year 2022–23 is Independent India's 75th full budget. Nirmala Sitharaman, the finance minister, presented the fourth Budget of the Modi 2.0 government. The budget is anticipated to establish the groundwork for India's economic expansion and prosperity over the next quarter-century.

Budget Snapshot

The budget for 2022 is critical because India's economy is beginning to recover from the setback caused by the ongoing pandemic. India announced annual spending of half a trillion dollars, a 35 percent increase over the previous year. This may be viewed as a double-edged sword, since heightened government expenditure would certainly stimulate economic growth, but would also add to the already high level of inflation. On the plus side, the government intends to reduce the deficit to 6.4 percent of GDP in FY23, down from 6.9 percent in FY22. By unveiling plans to launch a central bank digital currency, this budget marked a watershed moment in India's digital journey. However, imposing a 30% tax on income from virtual digital assets may pose as a deterrent to investors embracing this new asset class. Bonds in India have taken a beating after the government announced intentions to sell a record amount of bonds in the coming fiscal year to meet the country's borrowing demands. According to estimates, the government intends to issue approximately 15 trillion rupees ($200 billion) in bonds for the fiscal year that begins in April. Aggressive bond sales by the government are negative and could keep G-secs subdued in the future. The rupee has remained stable as India aims for a 9.2 percent GDP growth in the fiscal year 2022-23. Additionally, the implementation of investment initiatives focused on agriculture and transportation is expected to assist the economy recover significantly from the pandemic's aftermath. The government's infrastructure expenditure plans of 200 billion rupees ($2.68 billion) are expected to boost economic development via public investment as Asia's third-largest economy rebounds from a pandemic-induced slowdown.

The Big Deal

One of the major highlights of the Union budget is the announcement to raise government capital expenditure by 35.4 percent to Rs 7.5 trillion. The Capex focus of the government will provide a big boost for the businesses of Indian companies. Additionally, the orders for local defense companies are also going to increase. On defense orders, the government stated that 68 percent of the capital procurement budget would be devoted to the Indian industry in 2022-23, up from 58 percent in 2021-22.

Furthermore, the Government of India is planning to build more than 100 cargo terminals in the subsequent three years, expand highway by 25,000 kilometers, four multi-modal national parks, standardization of metro systems including civil structures, and four pilot projects for setting up coal gasification. The principal beneficiaries of the current budget are companies participating in infrastructure projects such as new roads, highways, and railways. The government's decision to allocate Rs 48,000 crore in Budget under the Pradhan Mantri Awas Yojana (PMAY) and faster approvals for affordable housing in urban areas will benefit real estate developers. The enormous increase in public investment will reinvigorate the corporate investment rate.

Among the policy initiatives, The divestment target for FY23 seems practical. In FY22, there was a vast underperformance regarding the divestment target and what was actually achieved. On the other hand, The FY23 divestment target of Rs 65,000 crore appears achievable, and the government may get to that number by making an offer for sale (OFS) rather than going in for serious stake sales. Also, Climate change has arisen as a significant consideration for policymakers. Finance Minister Nirmala Sitharaman declared that the government would be raising green bonds for mobilising resources for green infrastructure.

Equity Outlook

With a focus on capital spending in order to spur economic growth and employment, the budget for 2022-23 places a clear priority on economic growth. Investing in core sectors with a multiplier effect on GDP, increasing job creation, improving skills, and facilitating digital financial inclusion is what the Union Budget is about.

For the year 2022, Indian equities outperformed their global counterparts in January even as domestic indices fell. This was due to concerns about inflation, stimulus withdrawal, and rate hikes by the U.S. Federal Reserve. While Indian equities have corrected from the peak, they're still outperforming, given a steeper fall in global equities.

After a hiatus of nearly a decade, Indian equities are well-positioned for the next leg of wealth creation. India is likely to be among the leaders in GDP growth for the next decade due to secular earnings growth and structural uptrends, making it a compelling case for creating long-term wealth. Furthermore, the long-term outlook for Indian equities remains positive, thanks to several reform initiatives carried out by the Government and a series of infrastructure-related initiatives lined up in the coming years. Also, unlike the US, India's corporate profit to GDP remains low, and hence in cycle terms, India is far from peak both in corporate profits and valuations.

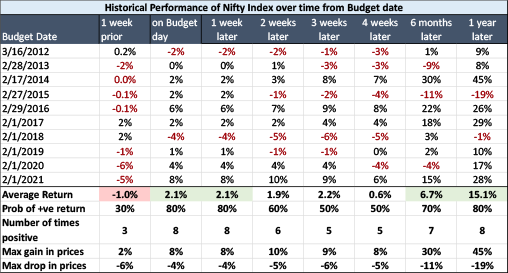

From a quantitative perspective, a study of last ten years indicate that an average return of 6.7% and 15.1% can be expected in Nifty 50 in 6 months and 1 year respectively from the date of the budget.

Rupee Outlook

The Indian rupee depreciated about 2 percent against the US dollar in 2021, its fourth straight year in the red. But it performed better than its peers such as the Japanese yen, the South African rand, and the euro, which depreciated by 11.5 percent, 8.5 percent, and 8 percent respectively. In light of India's abundant foreign exchange reserves and the rupee's strong performance in comparison with its global counterparts, the Indian rupee's depreciation beyond Rs 78 (Dh3.86) per US dollar is unlikely.

While the rupee had depreciated significantly in 2013 when Fed announced monetary tightening, this year-round the scenario will play differently. At present, India holds the fourth largest FOREX reserve in the world (equivalent to about 12 months of import cover). As of December 24, 2021, India's foreign exchange reserves totaled $635 billion (Dh2.3 trillion). Given these circumstances, the Indian rupee is in a better position to handle turbulence induced by the US central bank's tapering. While INR is on relatively sound economic grounds, volatility is still on the cards. India’s trade deficit and how the Fed unveils rate hikes and balance sheet reductions can potentially weigh on the Indian rupee in 2022.

From a quantitative perspective, a study of the last ten years indicates that the rupee generally depreciates by approximately 4.2% over 6 months and 1 year from the budget.

By 2022, markets will probably transition from early-cycle to mid-cycle. India's macro fundamentals remain strong, with economic activity expected to remain well above its long-term trend, suggesting a further boost to consensus GDP growth for FY23. From a long-term perspective, India's growth story is compelling, further upgrading the outlook for the financial markets.

Disclaimer: Century Financial Consultancy LLC (“CFC”) is Limited Liability Company incorporated under the Laws of UAE and is duly licensed and regulated by the Emirates Securities and Commodities Authority of UAE (SCA).This document is a marketing material and is for informational purposes only and must not be construed to be an advice to invest or otherwise in any investment or financial product. CFC does not guarantee as to adequacy, accuracy, completeness or reliability of any information or data contained herein and under no circumstances whatsoever none of such information or data be construed as an advice or trading strategy or recommendation to deal (Buy/Sell) in any investment or financial product. CFC is not responsible or liable for any result, gain or loss, based on this information, in whole or in part. Please carefully read disclaimer mentioned below/next page/next frame.

PLEASE READ THE FOLLOWING TERMS AND CONDITIONS OF ACCESS FOR THE PUBLICATION BEFORE THE USE THEREOF.

By use of the publication and continuing to access the publication, you accept these terms and conditions and undertake to be bound by the acceptance. CFC reserves the right to amend, remove, or add to the publication and Disclaimer at any time without any prior notice to you. Such modifications may be effective immediately or otherwise. Accordingly, please continue to review this Disclaimer whenever accessing, or using the publication. Your access of, and use of the publication, after modifications to the Disclaimer will constitute your acceptance of the terms and conditions of use of the publication, as modified. If, at any time, you do not wish to accept the content of this Disclaimer, you may not access, or use the publication. Any terms and conditions proposed by you which are in addition to or which conflict with this Disclaimer are expressly rejected by CFC and shall be of no force or effect.

No information as given herein by CFC in this publication should be construed as an offer, recommendation or solicitation to purchase or dispose of any securities/financial instruments/products or to enter in any transaction or adopt any hedging, trading or investment strategy. The data/information contained in the publication is not designed to initiate or conclude any transaction. Neither this publication nor anything contained herein shall form the basis of any contract or commitment whatsoever. Distribution of this publication does not oblige CFC to enter into any transaction. The information in this document is not intended, by itself, to constitute independent, impartial or objective research or a recommendation from CFC and should not be treated as such.

The content of this publication should not be considered legal, regulatory, credit, tax or accounting advice. Anyone proposing to rely on or use the information contained in the publication should independently verify and check the accuracy, completeness, reliability and suitability of the information and should obtain independent and specific advice from appropriate professionals or experts regarding information contained in this publication. CFC cannot be held responsible for the impact of any transactional costs or any taxes as may be applicable on transactions.

Information contained herein is based on various sources, including but not limited to public information, annual reports and statistical data that CFC considers reliable. However, CFC makes no representation or warranty as to the accuracy or completeness of any report or statistical data made in or in connection with this publication and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the information contained in this publication. References to any financial instrument or investment product does not imply that an actual trading market exists for such instrument or product. In publishing this document CFC is not acting in the capacity of a fiduciary or financial advisor.

The report does not take into account the investment objectives, financial situations and specific needs of recipients. The recipient of this publication must make its own independent decisions regarding whether this communication and any securities or financial instruments mentioned herein, is appropriate in the light of its investment objectives, investment experience, financial situation, existing portfolio holdings and/or investment needs. Recipients will need to decide on their own as to whether or not the contents of this document are suitable for them.

This document is a marketing material and has been prepared by individual(s), marketing and/or research personnel of CFC. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is purely a marketing communication. In this publication, any opinions, news, research, analysis, prices, or other information constitute is a general market commentary, and do not constitute the opinion or advice of CFC or any form of personal or investment advice. CFC neither endorses nor guarantees offerings of third party, nor is CFC responsible for the content, veracity or opinions of third-party speakers, presenters, participants or providers. CFC will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Charts, graphs and related data or information provided in this publication are intended to serve for illustrative purposes only. The information contained in this publication is prepared as of a particular date and time and will not reflect subsequent changes in the market or changes in any other factors relevant to their determination. All statements as to future matters are not guaranteed to be accurate. CFC expressly disclaims any obligation to update or revise any forward-looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events.

The information in this communication cannot disclose everything about the nature and risks of the abovementioned data / information. This is not an exhaustive list of the risks involved, nor should it be regarded as offering advice on the suitability of these investments for the recipient.

All views expressed in all reports, analysis and documents are subject to change without notice. CFC may have issued other reports, analysis or other documents expressing different views from the contents hereof. Staff members/employees of CFC may provide/present oral or written market commentary or analysis to you that reflect opinions that are contrary to the opinions expressed in this research and may contain insights and reports that are inconsistent with the views expressed in this publication. Neither CFC nor any of its affiliates, group companies, directors, employees, agents or representatives assume any liability nor shall they be made liable for any damages whether direct, indirect, special or consequential including loss of revenue or profits that may arise from or in connection with the use of the information provided in this publication.

Information or data provided by means in this publication may have many inherent limitations, like module errors or lack accuracy in its historical data. Data included in the publication may rely on models that do not reflect or take into account all potentially significant factors such as market risk, liquidity risk, credit risk etc.

CFC and its affiliates reserve the right to act upon or use the contents hereof at any time, including before its publication herein. The use of our information, products and services should be on your own due diligence and you agree that CFC is not liable for any failure to achieve desired return on investment that is in any manner related to availing of services or products of CFC and use of our information, products and services. You acknowledge and agree that past investment performance is not indicative of the future performance results of any investment and that the information contained herein is not to be used as an indication for the future performance of any investment activity. Any prices provided in this document are indicative only and do not represent firm quotes as to either price or size. The value of any investment or income may go down as well as up. All investments involve an element of risk, including capital loss.

This publication is being furnished to you solely for your information and neither it nor any part of it may be used, forwarded, disclosed, distributed or delivered to anyone else. You may not copy, reproduce, display, modify or create derivative works from any data or information contained in this publication. This document may not be published, circulated, reproduced, or distributed in whole or part to any other person (whether within or in a jurisdiction outside UAE) without the prior written consent of CFC.

Declaration of the Financial Analyst

The analyst(s) who prepared this report certifies that the opinions contained herein accurately and exclusively reflect his or her views. The Analyst further undertakes that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein. The analyst(s) who wrote this report does not hold securities in the Company mentioned in the report. The analyst(s) receives a fixed compensation from CFC. No part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this report. The business solicitation or marketing departments of CFC are separate and independent from the reporting line of the analyst(s). The analyst(s) confirms that he or she and his / her associates do not serve as directors or officers of the Company, and the Company or other third parties have not provided or agreed to provide any compensation or other benefits to the analyst(s) in connection with this report. An “associate” is defined as the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child, of the analyst.

Services offered by CFC include products that are traded on margin and can result in losses that exceed deposits. Before deciding to trade on margin products, you should consider your investment objectives, risk tolerance and your level of experience on these products. Trading with leverage carries significant risk of losses and as such margin products are not suitable for every investor and you should ensure that you understand the risks involved and should seek independent advice from professionals or experts if necessary.

__1102779201.jpg)