Thursday, January 22, 2026

Pair Trade: Consumer Staples and Consumer Discretionary ETF

By Century Financial in 'Investment Insights'

.jpg)

Pair Trade – Long Consumer Staples (XLP) / Short Consumer Discretionary (XLY)

In Layman’s Terms

- The economic data points to consumer spending slowing to 2% in 2026 from 3.5% in 2025.

- Based on the quarterly estimates, wage growth is also slowing relative to inflation. It's reflected in CPI increasing from 2.7% to 3% and wage growth declining from 3.7% to 3.4% between Q4 2025 and Q2 2026.

- Consumers tend to postpone their non-essential purchases during these times and prioritise essential purchases. Thus, we expect the Consumer Staples ETF (XLY) to outperform the Consumer Discretionary ETF (XLP).

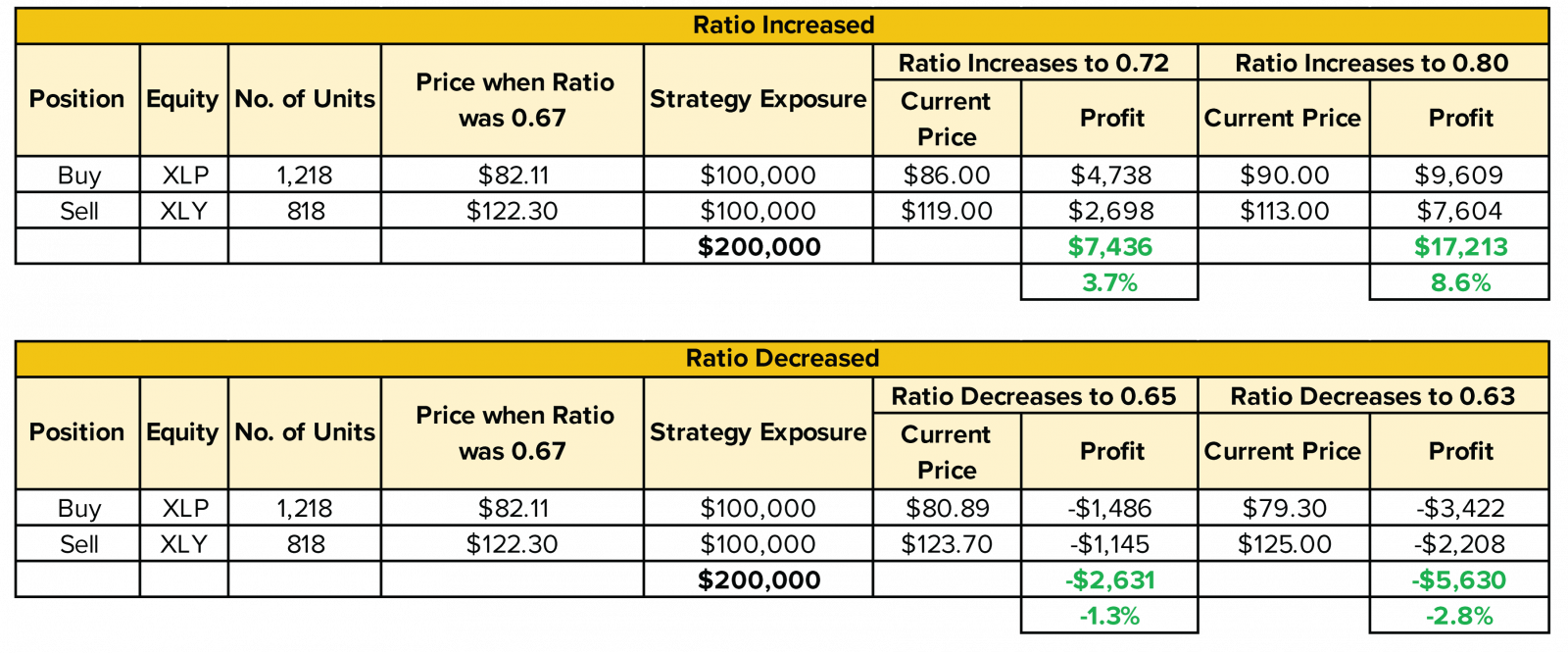

- From the 0.67 level, the near-term targets for the pair remain at 0.72 and 0.80. On the contrary, a support is observed at 0.65 and 0.63, respectively. This implies a maximum gain of 8.6% and a loss of 2.8%.

Fundamentals

- Based on economic forecasts, consumer spending in the US is expected to decline to 2% in 2026, down from 3.5% growth in 2025. The quarterly CPI forecasts indicate an increase from 2.7% in Q4 2025 to 3% in Q2 2026. In contrast, the average hourly earnings are expected to decelerate from 3.7% in Q4 2025 to 3.4% in Q2 2026. Moreover, the unemployment rate is expected to inch up to 4.5% in 2026 from 4.3% in 2025. According to the University of Michigan consumer sentiment survey, the index remains at 54, nearly 25% below last January's reading. In such an environment, consumers typically shift their spending towards essentials and delay their discretionary (non-essential) purchases. Hence, the consumer staples (XLY) may outperform the consumer discretionary (XLP), reinforcing defensive spending behaviour.

- The analyst outlook for some of the XLP ETF's top-weighted holdings also remains positive as follows:

Walmart – In its Q4 results, the company forecasts net sales to grow 3.75-4.75% and operating income to rise 8-11%. This indicates that Walmart is likely to see its operating income increase faster than sales for the whole year, highlighting the strength of its business. Additionally, the company is strategically positioned to boost its market share through its value and convenience options, appealing to consumers, including those from higher-income households. Regarding AI, it has also collaborated with Gemini recently to make agent-led shopping smoother and increase sales.

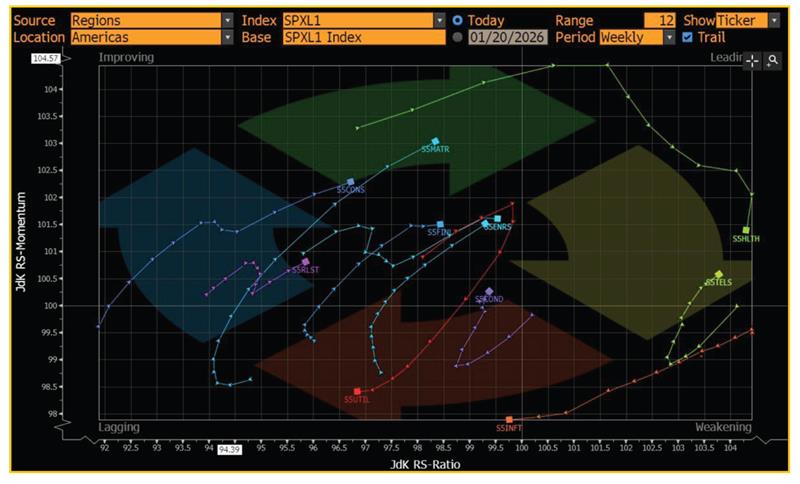

Costco – The company's sales grew by 8.5% in December, driven by higher traffic and higher average ticket. Their digitally enabled sales also grew by 18% in December, compared with 16.3% in November. The company has demonstrated retail resilience, with same-store sales robust enough to support sustained long-term growth. - The sector rotation graph also shows increased money flow into Consumer Staples, which outperformed XLY in momentum over the past week. Additionally, the top holdings of the XLY ETF, Amazon and Tesla, have fallen below their 50-day SMA levels, further supporting the ongoing trend.

Source: Bloomberg

Date: 19th January 2026

Macro ETF Flows

- Market sentiment has weakened amid renewed trade tensions, driven by President Trump’s unpredictable stance on Greenland and escalating tariff threats toward Europe.

- Consequently, the past week has exhibited twice the average 30-day trading volume of 15.8 million in the Consumer Staples sector. Such levels of trading volume were last observed following President Trump's announcement of tariffs in the week commencing April 7, 2025. This explicitly indicates institutional positioning towards more defensive sectors.

.png)

Source: Bloomberg

Date: 19th January 2026

The weekly trading volume in XLP was 138 million, nearing the 156 million recorded in April 2025. Additionally, the trading volume in the week before was also notably high at nearly 104 million.

.png)

Source: Bloomberg

- The above screenshot indicates that the ETF received a weekly inflow of $1 billion for the week ending January 16, almost twice the average of $520 million over the past month.

Technicals

Pair Trade - Long Consumer Staples (XLP) / Short Consumer Discretionary (XLY)

.png)

Source: Bloomberg

Date: 19th January 2026

- The pair demonstrates an average of 0.72 on a yearly basis, and it currently trades at 0.67. This implies a gain of almost 7.7% before reaching the average.

- The ratio has exceeded both the 50-day (red line) and 100-day (white line) moving averages. Additionally, a bullish crossover is imminent, signalling potential upward momentum for the pair.

- A near-term target for the pair remains at 0.72, followed by 0.80. If it crosses 0.8, it can test the high of 0.90, created on April 21.

Scenario Analysis

Disclaimer:Century Financial Consultancy LLC (CFC) is licensed and regulated by the Capital Market Authority (CMA) of the UAE under license numbers 20200000028 and 301044 to carry out the activities of Financial Products dealer, Trading Broker in international markets, Trading Broker of OTC derivatives and currencies in the spot market, Introduction, Financial Consultations, and Promotion. CFC is incorporated under UAE law, registered with the Dubai Economic Department (No. 768189), with its office at 601, Level 6, Building No. 4, Emaar Square, Downtown Dubai, UAE, PO Box 65777.

Terms and Conditions of Access

By accessing and continuing to use the Publication (which includes this document, flyer, charts, diagrams, illustrations, images, calculations, scenario analysis, and related data or content), you confirm that you have read, understood, and agreed to the terms of this Disclaimer.

CFC reserves the right to amend or update the Publication and this Disclaimer at any time without prior notice. Continued use following any such update constitutes your acceptance of the revised terms. If you do not agree with these terms, please discontinue use of the Publication.

Purpose and Intended Use

This Publication is classified as marketing material and should not be regarded as independent investment research. It is provided for informational, educational, and illustrative purposes only and does not constitute investment advice, a recommendation, an offer, or a solicitation to buy or sell any financial instruments or services. All views expressed are general market commentary and may not reflect the opinions of CFC as a whole.

Risk Disclosures and Limitations

The information presented does not cover all the risks associated with the products or scenarios discussed. Please refer to the full Risk Disclosure Statement available on our website.

This Publication reflects information available at the time of preparation and does not account for subsequent developments. Any forward-looking statements involve assumptions and uncertainties; actual outcomes may differ materially. CFC does not guarantee the accuracy, completeness, or reliability of the information and disclaims liability for any action taken based on it.

No Offer or Contractual Commitment

No part of this Publication constitutes an offer, agreement, or commitment to enter into any transaction. Distribution of this Publication does not oblige CFC to engage in any trade or provide any services. Product names or terms may differ across platforms or providers. This material should not be interpreted as legal, regulatory, tax, accounting, or credit advice. Recipients should seek independent professional advice and assess their own financial situation, objectives, and risk profile before making investment decisions.

Data Sources and Interpretation

This Publication may rely on publicly available data, third-party information, or model-based assumptions. CFC makes no representation or warranty as to their accuracy or completeness. Data limitations, errors, or outdated inputs may impact the reliability of projections or scenarios. Names of financial products may differ from those used on trading platforms.

Use, Reproduction, and Analyst Disclosure

This Publication is intended solely for the recipient’s informational use. It may not be copied, transmitted, or distributed in any form, wholly or partially, without prior written permission from CFC.

Analyst Declaration: The Analyst(s) certifies that all opinions expressed in this Publication represent their own independent views and that reasonable care was taken to ensure objectivity. They do not hold securities in the companies mentioned, and their compensation is not linked to the views expressed. CFC’s research and marketing divisions operate independently.

Trading Risk Warning:

Trading in financial products involves significant risk. Leveraged OTC derivatives, such as Contracts for Difference (CFDs) and spot forex contracts, carry a high risk of loss that can potentially exceed initial deposits and may not be suitable for all investors. These instruments do not confer ownership of underlying assets. Investors must carefully evaluate their investment objectives and risk tolerance, and consult independent advisors where appropriate.

.png)

.png)

.png)

.png)