.jpg)

For the Layman

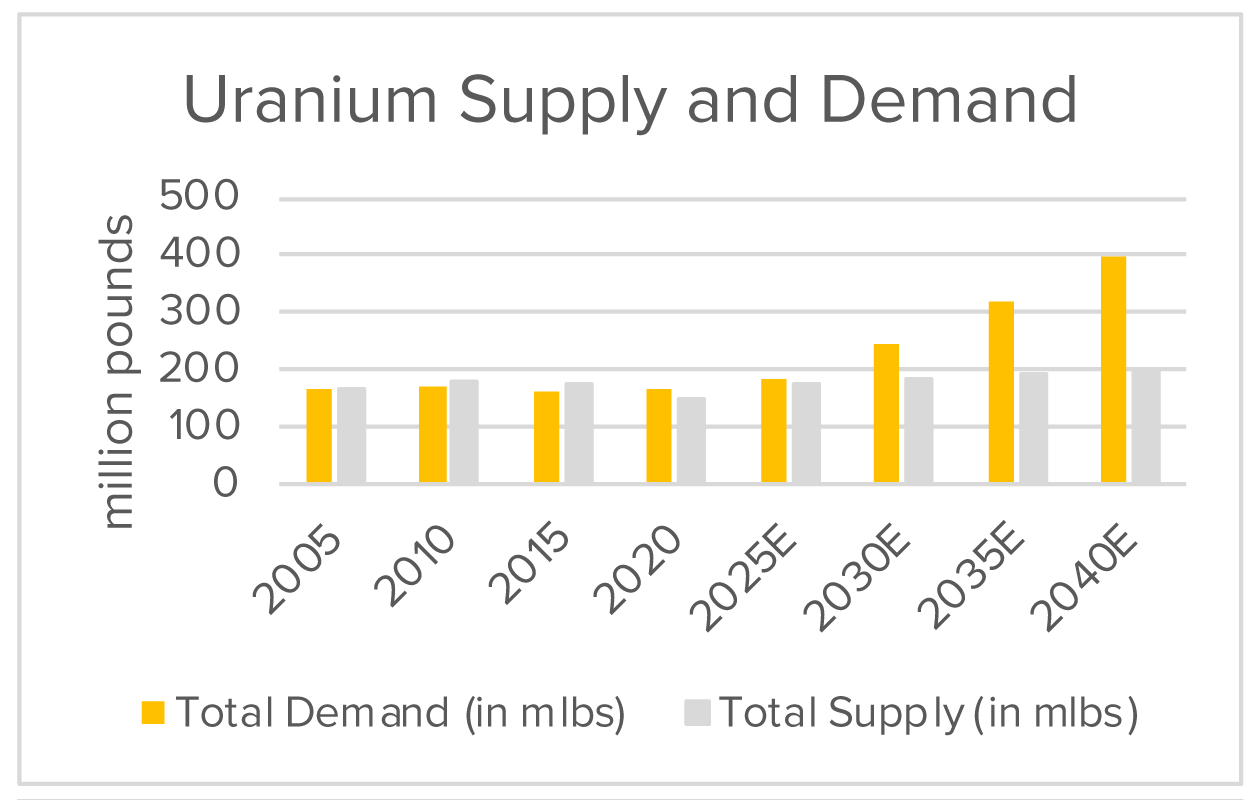

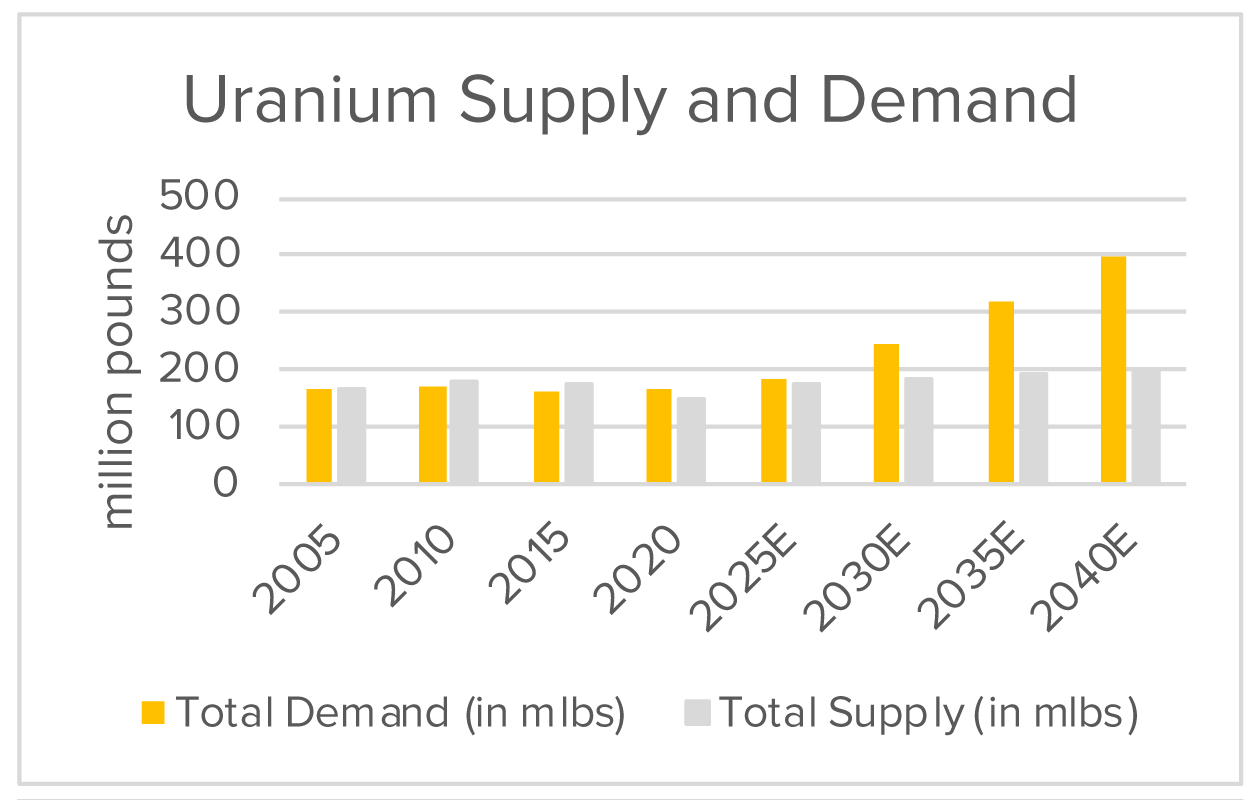

- As of 2025, the uranium market is in 3.3% deficit, and is expected to increase to a 49%+ deficit by 2040, supporting a bullish stance on uranium prices.

- As contracts of uranium miners closely track those of spot uranium, a long position on Cameco Corporation (CCJ), the world's largest-listed vertically integrated uranium producer, would be a direct play. As a diversified option, the Sprott Uranium Miners ETF (URNM) can be an alternative.

- Another method to capitalise on the uranium supercycle is via the Sprott Physical Uranium Trust ETF (U.UN) . This ETF invests and holds substantially all of its assets in uranium in the form of U3O8.

Uranium is a radioactive element that must be refined prior to being manufactured into fuel pellets or rods. Note that the uranium grade 308 is required for energy generation, and all the numbers mentioned in this report are of uranium 308.

The Products

| Ticker | Name | Currency | Prim Exch Nm | Last Px | Mkt Cap | 52W Low | 52W High | Beta |

|---|---|---|---|---|---|---|---|---|

| U-U | SPROTT PHYS | CAD | Toronto | 30.20 | 9572.68 | 18.00 | 30.37 | |

| CCJ | CAMECO CORP | USD | New York | 112.84 | 49131.34 | 35.00 | 114.45 | 1.236 |

| URNM | SPROTT URAN | USD | NYSE Arca | 67.99 | 2205.26 | 27.60 | 68.95 | 1.004 |

.png)

Uranium pellets are stacked together to sealed metal tubes called fuel rods.

Inside the reactor vessel, the fuel rods are immersed in water, where the chemical reaction produces steam that drives the turbine and generates electricity.

Supply and Demand Dynamics

Looking at the demand and supply dynamics as of 2025, the demand for uranium was 182 million pounds (mlbs), while supply was 176 mlbs, implying a deficit of about 3%. Looking ahead, by 2040, the deficit is expected to increase to as high as 50% as the demand soars to a little under 400 mlbs.

On the supply side, it typically takes about 10-15 years from initial discovery and exploration; however, if feasible, then the mines can run for 20-40 years. Hence, this bottleneck in discovery and exploration limits the supply, even though the globally identified recoverable uranium resources amount to 17.5 Kmlbs.

Demand can be attributed primarily to 2 factors: rising electricity demand and increased pressure for clean energy.

.jpg)

In 2025, the Uranium market is projected (as the actual numbers are yet to be released) to be in a deficit of about 3.3%, as demand and supply stand at 182 mlbs and 176 mlbs, respectively. Looking ahead, the deficit is expected to rise to a staggering 49%+.

Amid the rapid expansion of data centres and hyperscalers, electrification, and industrial growth, electricity demand is expected to increase significantly. This leads to a natural question – Why Nuclear Energy?

The answer is that nuclear energy is denser than fossil fuels. This means a much smaller amount of fuel is required to generate the same amount of electricity, leading to operational cost advantages and less waste by volume. Capacity factor, a measure of efficiency, is the ratio of the power produced by a source over the total power it could have produced if running at full strength over a given period. Nuclear has the highest capacity factor of any power source at 90%, followed by coal and combined-cycle gas (60%), wind (35%), and solar (25%). Furthermore, nuclear energy is often favoured from a sustainable, clean energy standpoint.

How can the Uranium Supercycle be Played?

Uranium Miners

Currently, like other commodities, uranium does not trade in the open market, and buyers and sellers negotiate contracts privately. However, over the long term, the perceived spot price and the price set by miners tend to be similar; in fact, the price set by miners is often at a premium, as shown.

This means that the miners would be direct beneficiaries when the price of uranium increases. A stock to watch out for in this space is Cameco Corporation (CCJ).

CCJ is the world's largest-listed vertically integrated uranium producer and is well positioned to take advantage of a favourable outlook for the nuclear energy industry.

Uranium ETF

Another method to capitalise on the uranium supercycle is via the Sprott Physical Uranium Trust ETF (U.UN). This ETF invests and holds substantially all of its assets in uranium in the form of U3O8.

From a technical standpoint, it has broken out above the trendline resistance on the monthly timeframe, supporting a bullish stance.

Others

Though CCJ and U.UN would be direct beneficiaries of a rally in the uranium prices, it must be noted that there would be other companies that would gain from the momentum in the uranium space. Other beneficiaries include: Oklo Inc. (OKLO), NuScale Power Corporation (SMR), and Constellation Energy Corporation (CEG).

Disclaimer:Century Financial Consultancy LLC (CFC) is licensed and regulated by the Capital Market Authority (CMA) of the UAE under license numbers 20200000028 and 301044 to carry out the activities of Financial Products dealer, Trading Broker in international markets, Trading Broker of OTC derivatives and currencies in the spot market, Introduction, Financial Consultations, and Promotion. CFC is incorporated under UAE law, registered with the Dubai Economic Department (No. 768189), with its office at 601, Level 6, Building No. 4, Emaar Square, Downtown Dubai, UAE, PO Box 65777.

Terms and Conditions of Access

By accessing and continuing to use the Publication (which includes this document, flyer, charts, diagrams,

illustrations, images, calculations, scenario analysis, and related data or content), you confirm that you

have read, understood, and agreed to the terms of this Disclaimer.

CFC reserves the right to amend or update the Publication and this Disclaimer at any time without prior

notice. Continued use following any such update constitutes your acceptance of the revised terms. If you do

not agree with these terms, please discontinue use of the Publication.

Purpose and Intended Use

This Publication is classified as marketing material and should not be regarded as independent investment

research. It is provided for informational, educational, and illustrative purposes only and does not

constitute investment advice, a recommendation, an offer, or a solicitation to buy or sell any financial

instruments or services. All views expressed are general market commentary and may not reflect the opinions of

CFC as a whole.

Risk Disclosures and Limitations

The information presented does not cover all the risks associated with the products or scenarios discussed.

Please refer to the full Risk

Disclosure Statement available on our website.

This Publication reflects information available at the time of preparation and does not account for subsequent

developments. Any forward-looking statements involve assumptions and uncertainties; actual outcomes may differ

materially. CFC does not guarantee the accuracy, completeness, or reliability of the information and disclaims

liability for any action taken based on it.

No Offer or Contractual Commitment

No part of this Publication constitutes an offer, agreement, or commitment to enter into any transaction.

Distribution of this Publication does not oblige CFC to engage in any trade or provide any services. Product

names or terms may differ across platforms or providers. This material should not be interpreted as legal,

regulatory, tax, accounting, or credit advice. Recipients should seek independent professional advice and

assess their own financial situation, objectives, and risk profile before making investment decisions.

Data Sources and Interpretation

This Publication may rely on publicly available data, third-party information, or model-based assumptions. CFC

makes no representation or warranty as to their accuracy or completeness. Data limitations, errors, or

outdated inputs may impact the reliability of projections or scenarios. Names of financial products may differ

from those used on trading platforms.

Use, Reproduction, and Analyst Disclosure

This Publication is intended solely for the recipient’s informational use. It may not be copied, transmitted,

or distributed in any form, wholly or partially, without prior written permission from CFC.

Analyst Declaration: The Analyst(s) certifies that all opinions expressed in this Publication represent their own independent views and that reasonable care was taken to ensure objectivity. They do not hold securities in the companies mentioned, and their compensation is not linked to the views expressed. CFC’s research and marketing divisions operate independently.

Trading Risk Warning:

Trading in financial products involves significant risk. Leveraged OTC derivatives, such as Contracts for

Difference (CFDs) and spot forex contracts, carry a high risk of loss that can potentially exceed initial

deposits and may not be suitable for all investors. These instruments do not confer ownership of underlying

assets. Investors must carefully evaluate their investment objectives and risk tolerance, and consult

independent advisors where appropriate.

.png)

.png)

.png)

.png)