Thursday, August 06, 2020

GoPro’s Share Price - What to Expect in Q2 Results

By Century Financial in 'Brainy Bull'

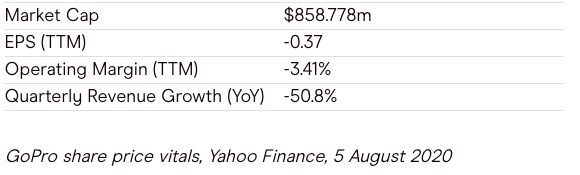

GoPro's [GPRO] share price has had a turbulent 2020 so far. Having started the year at $4.40, the stock slumped to $2 in March as the coronavirus took hold. Since then, GoPro's share price has been moving in the right direction — give or take a few dips along the way — and is now up 23.86% year to date.

Can GoPro's share price continue to gain? The company's upcoming second-quarter results will need to show a marked improvement on its bruising first-quarter performance.

When is GoPro reporting Q2 results?

6 August

What could move GoPro's share price post-earnings?

Change in strategy

Q1 results, and GoPro’s share price following the report’s publication, felt the full impact of the coronavirus. Revenue came in at $119m, down from the $243m seen in the same period last year. Adjusted EBITDA came in at -$41m, compared to -$1m the previous year.

In better news, non-GAAP operating expenses hit their lowest levels since 2014 in Q1, falling 4% year-on-year. This reflects the tech manufacturer’s strategy to increase efficiency which is being pursued by CEO Nicholas Woodman.

"We've taken decisive action to transition into a more efficient and profitable direct-to-consumer business," said Woodman. "This benefits GoPro with a substantially reduced operating expense model, improved gross margin and a significantly lower threshold to profitability."

Shareholders will be closely scrutinising how well Woodman is executing this strategy in Q2 results. GoPro has already made job cuts to reduce costs and has hired a new chief digital officer to lead its direct-to-consumer growth initiatives. Any early signs these changes are working could move GoPro's share price post-earnings.

Move into outdoor wear

Part of GoPro’s shift to a direct-to-consumer approach is the move into outdoor wear. The company will offer branded items including bags and t-shirts to customers directly through its website. Prices will be “attractive” according to Woodman, and GoPro Plus subscribers will receive a 30% discount on the clothing range.

Given that GoPro Plus had over 355,000 subscribers in Q1, up 69% year-on-year, the brand’s market is large and seems to be growing. If the company can leverage this audience together with its 1.3 million social media followers, GoPro's share price could gain in coming quarters. Failure to do so could spell further trouble for the tech firm, however.

What does Wall Street predict for GoPro’s share price?

Wall Street is expecting GoPro to post a $0.17 loss per share in Q2, a decline from earnings of $0.03 a share in the same period last year. Revenue is expected to come in at $114.27m, a 62.2% decline from the $302.29m seen last year.

Will GoPro beat expectations this time? The company has beaten expectations twice in the past four quarters. In Q1 2020 results, losses per share came in at $0.34, narrowly beating the forecasted $0.35.

Over a 12-month timeframe, analysts tracking the stock on Yahoo Finance have pinned a $4.13 target on GoPro's share price. This would see a 24.22% downside on GoPro’s share price through 4 August’s close. Of the 13 analysts offering recommendations, 9 rate GoPro a Hold.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

.png)

.png)

.png)

.png)