Wednesday, August 26, 2020

How will Q2 earnings affect Splunk’s share price?

By Century Financial in 'Brainy Bull'

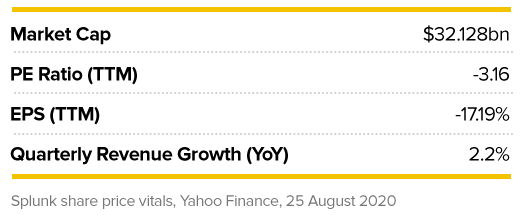

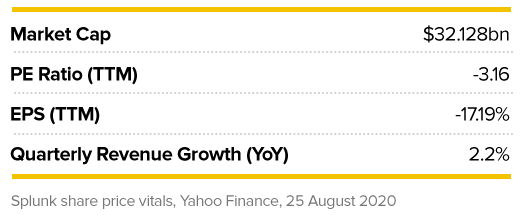

Splunk’s [SPLK] share price took a significant hit earlier this year when it fell to its lowest value since December 2018. The stock dropped almost $20 to $93.92 during intra-day trading on 16 March before closing at $95.71 — marking a 36% fall for the year-to-date.

The slump was in line with the wider coronavirus market downturn. While it took some time, Splunk’s share price has recovered. The stock has rallied 97.99% since a second dip in April.

Since 22 May, Splunk’s share price has continued to trade higher than its February peak, bar one exception when it closed at $173.74 on 11 June.

In fact, Splunk’s share price has recently hit new heights, peaking at $217.36 during intraday trading on 5 August before closing at $217.30. As of 24 August’s close, the stock is up 33% for the year-to-date.

Following its second-quarter earnings report, Splunk’s share price could go either way depending on how the firm’s performance fares against analysts’ expectations.

When is Splunk reporting Q2 earnings?

26 August

Splunk’s earnings history indicates growth

When Splunk released its first-quarter earnings for the fiscal year 2021, it reported a loss of $0.56 per share, which narrowly surpassed the Zacks consensus estimate of a loss of $0.57, marking a 1.75% surprise. Following publication of these results on 21 May, Splunk’s share price enjoyed a jump of almost 13% to close at $184.26 on 22 May.

These results were in stark contrast to the previous quarter, however, when the company reported earnings of $0.96 per share. That said, analysts were expecting the drop and the software company has exceeded consensus earnings estimates three times over the last four consecutive quarters.

For the quarter ended in April 2020, Splunk posted revenue of $434m, which missed the Zacks consensus estimate of $445m by 2.33%. Despite missing estimates, this figure still represents a growth of 2% compared to 2019’s first-quarter revenue of $424m.

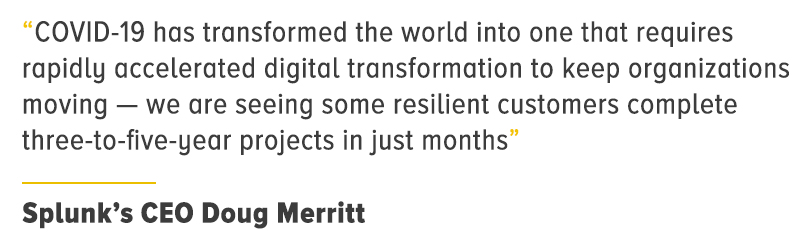

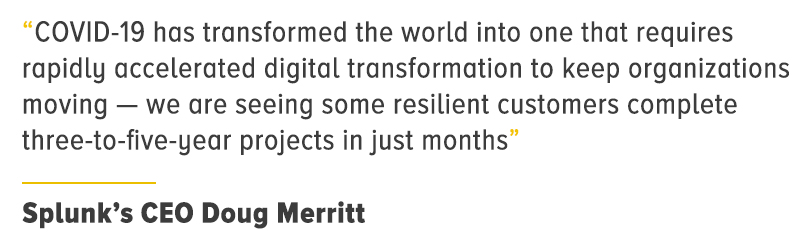

Staying positive, Splunk’s CEO Doug Merritt pegged the company’s recent success on the world’s accelerated digitalisation as a result of COVID-19. In a statement released alongside the results, he said: “COVID-19 has transformed the world into one that requires rapidly accelerated digital transformation to keep organizations moving — we are seeing some resilient customers complete three-to-five-year projects in just months. As customers continue to adapt to this new normal, data matters more than ever, evidenced by our continued strong momentum this quarter.”

Looking ahead to its upcoming earnings release, analysts are expecting a further decline, with the consensus estimate projecting the company to post a loss of $0.32 per share, a decline of 206.7% year-on-year.

However, as Q1 results show, this doesn’t necessarily spell disaster for Splunk’s share price. There’s also a positive projection for revenue as analysts expect Splunk to have made $520.95m for the quarter, a 0.9% growth from the same time last year.

What do the analysts think?

In light of the 33% rally Splunk’s share price has enjoyed this year-to-date, expectations for Splunk’s second-quarter earnings "have ramped", according to Brent Thill, Jefferies analyst.

According to The Fly, Thill thinks management will remain conservative and reiterate the company's fiscal 2022/23 annual recurring revenue growth outlook. Although this could put a short-term "damper on shares," says Thill, he has maintained a Buy rating and raised the firm’s target for Splunk’s share price from $190 to $230.

Splunk has a consensus Hold rating from Zacks Equity Research, which goes against the consensus among 39 analysts polled by CNN Moneyto Buy the stock. This rating is held by a majority of 29 analysts, with only nine suggesting to Hold the stock, one giving it an Outperform rating and another suggesting to Sell.

The median 12-month price target among 35 analysts polled by CNN Money is $191.40, with a high estimate of $254 and a low of $105. The median price represents a 5.36% decrease from Splunk’s share price as of 24 August’s close.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.