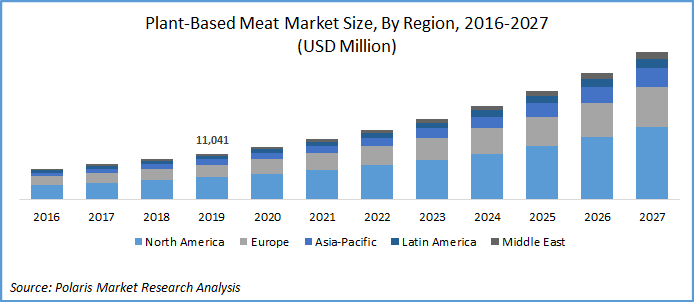

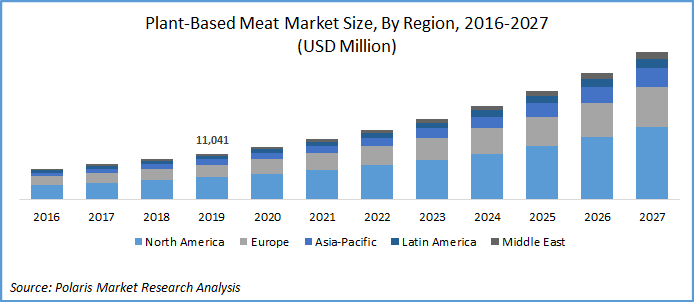

According to a study by Polaris Market Research, the global plant-based meat market size is projected to reach $35.4 billion by 2027, that is a CAGR of over 15%. As a matter of fact, a study by Meticulous Research claims the market could grow to $74 billion by the year 2027 and according to a report from Barclays, the alternative meat industry is expected to become a $140 billion industry over the next decade.

After seeing these crazy numbers, there may be many questions popping up in one's head. What is this industry all about?? What is driving this growth? How can one be a part of this ride? Are there any investment options available for individual investors? Well, this article will dig deeper into this industry and probably answer most of the above questions.

Plant-based meat products mimic the properties of animal meat but are a relatively healthier option and environment-friendly. Picking up steady momentum over the last few years, a global pandemic has shifted this plant-based trend into top gear. Many high-profile experts have warned of the link between factory farming and zoonotic disease outbreaks. For many who weren’t considering a plant-based diet, the pandemic has changed that. And a plant-based diet is no longer a boring, tasteless vegan sacrifice it used to be. It’s now deliciously mainstream. These products are produced to resemble the smell, look, and taste of animal meat. They play a vital role in curbing the problem of obesity prevalent in urban areas. According to the National Institute of Health, roughly 300,000 deaths occur every year due to obesity. Additionally, excess consumption of meat results in an imbalance in the ecosystem as a higher number of animals are killed for human consumption. Data suggests that over 50 billion land animals are slaughtered every year for meeting the meat demand, a figure that excludes male chicks and unproductive hens killed in egg production.

Increasing awareness regarding health issues associated with animal meat consumption & growing inclination towards vegetarianism & environmentally friendly products is expected to propel the growth of this industry. According to a study by Ipsos Retail Performance, number of Americans following plant-based diets has increased from just 290,000 people 15 years ago to more than 9.7 million people in 2019. Besides, the recent havoc created by covid-19 pandemic has further accelerated this trend. Overall, U.S. meat sales are expected to drop by more than $20 billion before the end of 2020. However, a major drawback restricting demand is that meatless products are significantly more expensive than meat products.

Another interesting trend observed within the industry is that plant-based meat companies are targeting their products toward flexitarians, someone who still eats meat, but is opting for meatless alternatives regularly, rather than confine their profits to a small portion of vegan/vegetarian diets. Consequently, U.S. retailers witnessed a 11.4% growth in plant-based meat sales over the last year, while total U.S. retail food sales grew by only 2.2%. The “vegan wave” has now become the flexitarian wave and almost 33% of the U.S. population is flexitarian.

The potential of this market is attracting large well-financianced companies into the business. Below is a list of few companies operating in this sector (most of which trade in the secondary market).

Beyond Meat (BYND)

Beyond Meat, was the first company solely into alternative meat to go public. On its first trading day in May 2019, its shares rocketed 163%, the best IPO performance in nearly two decades. The COVID-19 pandemic has been providing a tailwind to the company's retail business, driven by more consumers eating at home. Shares have gained 548% since the company's May 2019 initial public offering (IPO) and this year the stock is up over 100% as of Oct. 27, compared with the S&P 500's 5% return.

The company is a major disruptor to the $1.4 trillion global meat industry and has rolled out its plant-based products to 112,000 outlets worldwide. The company has struck high-profile deals with several restaurant chains, including Dunkin’ Donuts, Subway and KFC, is making inroads into Asian markets, striking a deal with Starbucks to offer its meatless sausage in China in April 2020. In June 2020, Beyond Meat also announced that it would debut its products in select Pizza Hut, KFC, and Taco Bell stores in China. The faux meat maker has indicated of its plans to open a production facility in Asia before the end of this year, and already sells its products in Singapore, Taiwan and Hong Kong.

Impossible Foods

Impossible Foods, one of the most prominent players in this space, claims that its molecular engineered plant-based burger is nearly indistinguishable from meat. Instead of directly targeting retail consumers, Impossible Foods started by targeting the restaurant market with its meatless burger product. In 2017, Impossible patties could only be found in around 40 US restaurants, which reportedly grew to a whopping 3000 by 2018. In early 2019, Impossible Foods launched its largest restaurant partnership -The Burger King Impossible Whopper. The company has also been aggressively expanding its retail footprint. The Impossible Burger first launched in the retail sector in September 2019 has grown its retail distribution by 100-fold in the last six months to more than 50,000 stores, including Walmart, Kroger, Trader Joe’s, Sprouts Farmers Market, and most recently, Target. Also, Impossible Foods’ burgers will be introduced in nearly 600 Sobeys Inc stores in Canada and it has also started selling its faux beef burgers in Hong Kong and Singapore grocery stores. The company strives to bolster its presence in Asia, before entering the potentially lucrative mainland China market. The company has secured $700 million in funding this year, bringing total funds raised since its founding in 2011 to $1.5 billion.

Tyson Foods, Inc. (TSN)

Tyson revealed its plans to expand its plant-based meat alternatives. The company also unveiled a brand called Raised & Rooted, which would exclusively produce plant-based and blended products.

Conagra Brands, Inc. (CAG)

The company behind Duncan Hines, Marie Callender's, Reddi Wip, and Slim Jim is none other than Conagra brands. However, CAG is also in plant based meat alternative. It markets itself through a vegan meat brand called Gardien, which include plant-based turkey cutlets, chicken wings, chicken strips, sausages, burgers, and meatballs and is currently available at most grocery stores in the US.

Kellogg (K)

The first thing that comes to mind when most people think of Kellogg is probably cereal. However, it has owned a vegetarian food brand called MorningStar Farms since 1999. The company sells more than 90 M pounds of faux meat (chicken, sausage, burgers, etc.) every year. Estimates suggest that MorningStar generates around $450 M in annual revenue, almost double the yearly sales of BYND.

Nestlé (NESN), the world's biggest food company, has also joined the race with the Awesome Burger through its Sweet Earth Brand, which has already begun shipping to grocery stores. Kroger (KR) also stated it will offer a beef alternative under the Simple Truth brand. Besides, Walmart (WMT) also teamed up with Qishan Foods to produce meat alternatives for the Chinese market.

There's no doubt this market has a lot of potential, but the risk associated with anything new and the increased level of competition can make the terrain bumpy for the players. The market is getting crowded, and it remains to be seen whether the companies will be able to sustain in this competitive market. Nonetheless, it will result in lower prices and better quality for the final consumer.

Data Source: Bloomberg

Arun Leslie John

Chief Market Analyst

Disclaimer: Century Financial Consultancy LLC (“CFC”) is Limited Liability Company incorporated under the Laws of UAE and is duly licensed and regulated by the Emirates Securities and Commodities Authority of UAE (SCA).This document is a marketing material and is for informational purposes only and must not be construed to be an advice to invest or otherwise in any investment or financial product. CFC does not guarantee as to adequacy, accuracy, completeness or reliability of any information or data contained herein and under no circumstances whatsoever none of such information or data be construed as an advice or trading strategy or recommendation to deal (Buy/Sell) in any investment or financial product. CFC is not responsible or liable for any result, gain or loss, based on this information, in whole or in part. Please carefully read disclaimer mentioned below/next page/next frame.

PLEASE READ THE FOLLOWING TERMS AND CONDITIONS OF ACCESS FOR THE PUBLICATION BEFORE THE USE THEREOF.

By use of the publication and continuing to access the publication, you accept these terms and conditions and undertake to be bound by the acceptance. CFC reserves the right to amend, remove, or add to the publication and Disclaimer at any time without any prior notice to you. Such modifications may be effective immediately or otherwise. Accordingly, please continue to review this Disclaimer whenever accessing, or using the publication. Your access of, and use of the publication, after modifications to the Disclaimer will constitute your acceptance of the terms and conditions of use of the publication, as modified. If, at any time, you do not wish to accept the content of this Disclaimer, you may not access, or use the publication. Any terms and conditions proposed by you which are in addition to or which conflict with this Disclaimer are expressly rejected by CFC and shall be of no force or effect.

No information as given herein by CFC in this publication should be construed as an offer, recommendation or solicitation to purchase or dispose of any securities/financial instruments/products or to enter in any transaction or adopt any hedging, trading or investment strategy. The data/information contained in the publication is not designed to initiate or conclude any transaction. Neither this publication nor anything contained herein shall form the basis of any contract or commitment whatsoever. Distribution of this publication does not oblige CFC to enter into any transaction. The information in this document is not intended, by itself, to constitute independent, impartial or objective research or a recommendation from CFC and should not be treated as such.

The content of this publication should not be considered legal, regulatory, credit, tax or accounting advice. Anyone proposing to rely on or use the information contained in the publication should independently verify and check the accuracy, completeness, reliability and suitability of the information and should obtain independent and specific advice from appropriate professionals or experts regarding information contained in this publication. CFC cannot be held responsible for the impact of any transactional costs or any taxes as may be applicable on transactions.

Information contained herein is based on various sources, including but not limited to public information, annual reports and statistical data that CFC considers reliable. However, CFC makes no representation or warranty as to the accuracy or completeness of any report or statistical data made in or in connection with this publication and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the information contained in this publication. References to any financial instrument or investment product does not imply that an actual trading market exists for such instrument or product. In publishing this document CFC is not acting in the capacity of a fiduciary or financial advisor.

The report does not take into account the investment objectives, financial situations and specific needs of recipients. The recipient of this publication must make its own independent decisions regarding whether this communication and any securities or financial instruments mentioned herein, is appropriate in the light of its investment objectives, investment experience, financial situation, existing portfolio holdings and/or investment needs. Recipients will need to decide on their own as to whether or not the contents of this document are suitable for them.

This document is a marketing material and has been prepared by individual(s), marketing and/or research personnel of CFC. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is purely a marketing communication. In this publication, any opinions, news, research, analysis, prices, or other information constitute is a general market commentary, and do not constitute the opinion or advice of CFC or any form of personal or investment advice. CFC neither endorses nor guarantees offerings of third party, nor is CFC responsible for the content, veracity or opinions of third-party speakers, presenters, participants or providers. CFC will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Charts, graphs and related data or information provided in this publication are intended to serve for illustrative purposes only. The information contained in this publication is prepared as of a particular date and time and will not reflect subsequent changes in the market or changes in any other factors relevant to their determination. All statements as to future matters are not guaranteed to be accurate. CFC expressly disclaims any obligation to update or revise any forward-looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events.

The information in this communication cannot disclose everything about the nature and risks of the abovementioned data / information. This is not an exhaustive list of the risks involved, nor should it be regarded as offering advice on the suitability of these investments for the recipient.

All views expressed in all reports, analysis and documents are subject to change without notice. CFC may have issued other reports, analysis or other documents expressing different views from the contents hereof. Staff members/employees of CFC may provide/present oral or written market commentary or analysis to you that reflect opinions that are contrary to the opinions expressed in this research and may contain insights and reports that are inconsistent with the views expressed in this publication. Neither CFC nor any of its affiliates, group companies, directors, employees, agents or representatives assume any liability nor shall they be made liable for any damages whether direct, indirect, special or consequential including loss of revenue or profits that may arise from or in connection with the use of the information provided in this publication.

Information or data provided by means in this publication may have many inherent limitations, like module errors or lack accuracy in its historical data. Data included in the publication may rely on models that do not reflect or take into account all potentially significant factors such as market risk, liquidity risk, credit risk etc.

CFC and its affiliates reserve the right to act upon or use the contents hereof at any time, including before its publication herein. The use of our information, products and services should be on your own due diligence and you agree that CFC is not liable for any failure to achieve desired return on investment that is in any manner related to availing of services or products of CFC and use of our information, products and services. You acknowledge and agree that past investment performance is not indicative of the future performance results of any investment and that the information contained herein is not to be used as an indication for the future performance of any investment activity. Any prices provided in this document are indicative only and do not represent firm quotes as to either price or size. The value of any investment or income may go down as well as up. All investments involve an element of risk, including capital loss.

This publication is being furnished to you solely for your information and neither it nor any part of it may be used, forwarded, disclosed, distributed or delivered to anyone else. You may not copy, reproduce, display, modify or create derivative works from any data or information contained in this publication. This document may not be published, circulated, reproduced, or distributed in whole or part to any other person (whether within or in a jurisdiction outside UAE) without the prior written consent of CFC.

Declaration of the Financial Analyst

The analyst(s) who prepared this report certifies that the opinions contained herein accurately and exclusively reflect his or her views. The Analyst further undertakes that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein. The analyst(s) who wrote this report does not hold securities in the Company mentioned in the report. The analyst(s) receives a fixed compensation from CFC. No part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this report. The business solicitation or marketing departments of CFC are separate and independent from the reporting line of the analyst(s). The analyst(s) confirms that he or she and his / her associates do not serve as directors or officers of the Company, and the Company or other third parties have not provided or agreed to provide any compensation or other benefits to the analyst(s) in connection with this report. An “associate” is defined as the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child, of the analyst.

Services offered by CFC include products that are traded on margin and can result in losses that exceed deposits. Before deciding to trade on margin products, you should consider your investment objectives, risk tolerance and your level of experience on these products. Trading with leverage carries significant risk of losses and as such margin products are not suitable for every investor and you should ensure that you understand the risks involved and should seek independent advice from professionals or experts if necessary.

__1102779201.jpg)

.png)

.png)

.png)

.png)