Tuesday, June 02, 2020

Moderna’s share price volatility: what will happen to the vaccine maker?

By Century Financial in 'Brainy Bull'

.png)

These past few months, biotech company Moderna [MRNA] has been among the winners of the stock market. Its share price is up 214.4% for the year to 29 May, as investors have rallied behind the biotech businesses searching for a coronavirus cure.

Indeed, Moderna’s promise of a potential experimental vaccine attracted many to the share price, defying the wider stock market rout. But some are now questioning if this rally has been part of a share price short squeeze.

The company unveiled positive results for Phase 1 of its COVID-19 vaccine trial on 18 May, prompting the share price to rally as much as 30% to $87 per share throughout that day. By close, the share price was up 277% compared with the same time last year.

The next day, the company announced a $1.3bn stock offering to fund the manufacture of the potential vaccine, selling 7.6 million shares priced at $76 apiece. It said that any money not used for coronavirus vaccine development would fund drug discovery in other areas.

The company has state backing, too. In April, the US government agreed to provide $483m in federal funding, in order to support its vaccine research. Commenting on data from the initial phases of the vaccine-making process, Moderna CEO Stephane Bancel told Bloomberg: “This is a very good sign that we make an antibody that can stop the virus from replicating.” The data “couldn’t have been better.”

Moderna going through a short squeeze?

Despite the apparently good news, however, many short sellers have Moderna firmly in the crosshairs. According to Ihor Dusaniwsky, an S3 Partners analyst, Moderna’s share price has the fifth-largest outstanding short position in the biotech sector, valued at around $1.63bn as of 19 May.

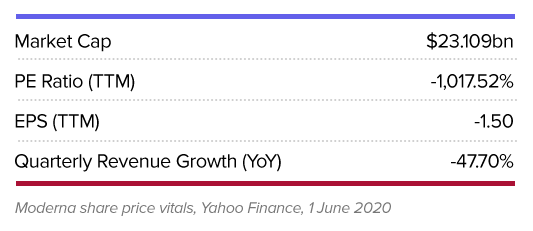

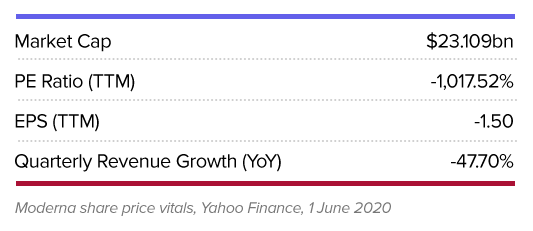

According to GuruFocus, Moderna’s 19 May market cap of $30bn is “pretty high” for a company that’s yet to turn a profit. Vaccines, meanwhile, are a notoriously tricky business to be in. Phase 2 trials, which are yet to start, are far from guaranteed to bring breakthrough results. Any bad news could trigger a downturn in the company’s share price.

Indeed, the company’s share price has already started to see its value drop, as investors grow concerned about its experimental vaccine. Between 18 and 28 May, Moderna’s stock has dropped 30.5% to $55.54 — the following day it recovered somewhat to $61.50. However, speaking to Reuters, Oppenheimer analyst Hartaj Singh said: “The stock was due for a pullback on some concerns around timing of COVID-19 vaccine development.”

What do the analysts say now?

Among 10 analysts offering 12-month share price targets for Moderna, polled by the Financial Times, there is a median target of $92 per share, representing a 66% increase from 28 May’s closing price. The majority of analysts polled rate Moderna as outperform, giving a broadly positive outlook, all uncertainty considered.

Analysts polled by MarketWatch, however, give the general consensus of buy, with a slightly lower average price target of $86.55.

The 11 analysts polled by CNN Business, meanwhile, predict a median share price target of $90.00, with a high estimate of $112.00 and a low estimate of $52.00.

Following the promising results of Phase 1 trials, Goldman Sachs analyst Salveen Richter raised the program's probability of success to 75% from 70%. The bank is "optimistic on the forward outlook for the vaccine”

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

.png)

.png)

.png)

.png)