Monday, April 06, 2020

Oil Wars - Making Sense of Current Chaos & The Way Ahead

By Century Financial in 'Investment Insights'

Oil prices at one point of time had tumbled by more than 70%. The situation has become so dire that some US & Canadian benchmarks are trading dangerously close to $ 0/barrel. Canadian Western Select, benchmark for Canadian oil sand industry dipped to $ 4 levels while Midland Texas crude is about to break below $ 10 levels. Oklahama Sour is trading near $ 5 levels whereas Wyoming Sweet prices are down to $ 3 levels. This has caused some products being sold at negative prices. Energy trading giant Mercuria recently bid -19 cents/barrel for Wyoming Asphalt Sour in effect asking producers to pay for getting rid of their output. Economic prospects for major global oil refiners & producers around the world have become so bad that some of them are considering or have already closed their refinery output.

In India, top refiners Indian Oil Corp and Mangalore Refinery and Petrochemicals have declared force majeure, with MRPL in the process of shutting down its entire plant. Italy's API said it would close operations temporarily at its Ancona refinery. Spain's Repsol would cut runs by about 10 % at its complex refineries. Several US refineries have also decided to cut their output with plants in Texas announcing the same. This comes even as US total oil production currently stands near 13 mbpd, near previous record high.

Oil Market Chaos – Making Sense

Oil prices are currently suffering from double whammy of increased oil supply as well as lower oil demand. On the demand side, ongoing spread of COVID -19 pandemic is expected to reduce 2020 oil demand by at least 25 % to 30 %. On the supply side, ongoing oil wars between Saudi’s & Russian’s has caused major supply glut across the entire global oil market supply chain. Small producers too have jumped into the fray to increase their market share.

Post the outcome of March 6 OPEC meeting, EIA’s forecast now assumes that OPEC will target market share instead of a balanced global oil market. EIA forecasts OPEC crude oil production will average 29.2 million barrels per day (b/d) from April through December 2020, up from an average of 28.7 million b/d in the first quarter of 2020. For Brent price forecast, EIA now forecasts crude benchmark prices will average $43/b in 2020, down from $64/b in 2019. A ray of hope lies in EIA’s 2021 forecast where it sees Brent prices touching $55/barrel on back of declining global oil inventories.

For Saudi’s, this time it is a battle of egos with kingdom clearly wanting to show to the world their dominance. Saudi Arabia’s aggressive stance is on back of Russia’s reluctance to agree to OPEC’s decision to reduce oil output in light of falling oil demand. Since past many years, Saudi’s even went further by cutting additional oil production to cover up surplus from other OPEC+ members. Russia on other hand is focused on playing its own geopolitical game to see US Shale oil producers getting out of business with lower oil prices. Drilling costs associated with shale oil extraction is considered to be relatively expensive as compared to normal onshore/offshore drilling. This is due to expensive hydraulic fracturing or fracking technology. As per market estimates, average production cost for shale drilling is range of $ 40 - $ 90/barrel. Compare this with onshore/offshore drilling cost of $ 44 - $46/barrel for Russia & the math is clear. For Saudi Arabia, the production cost happens to be lowest in the world within range of $ 10 - $ 15.

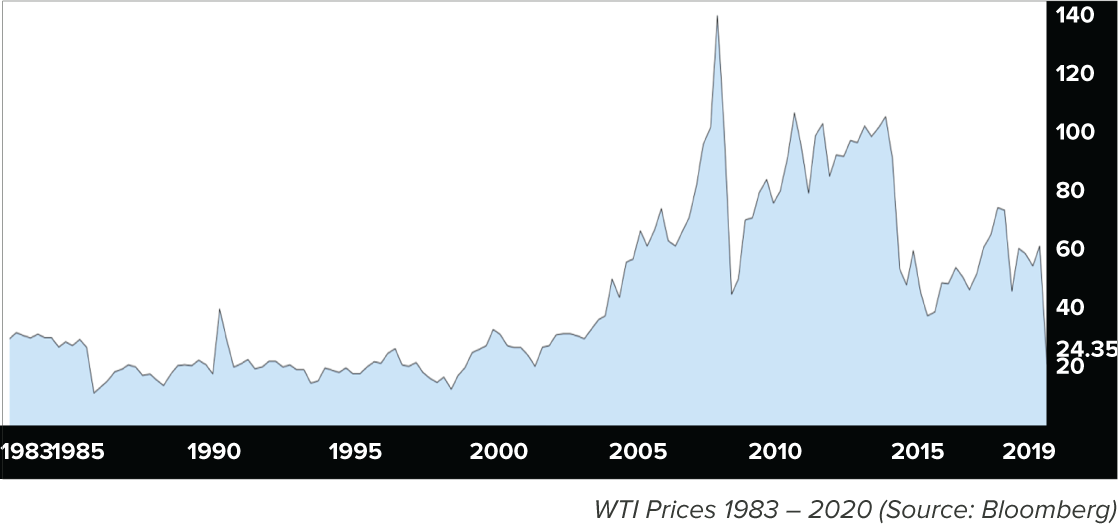

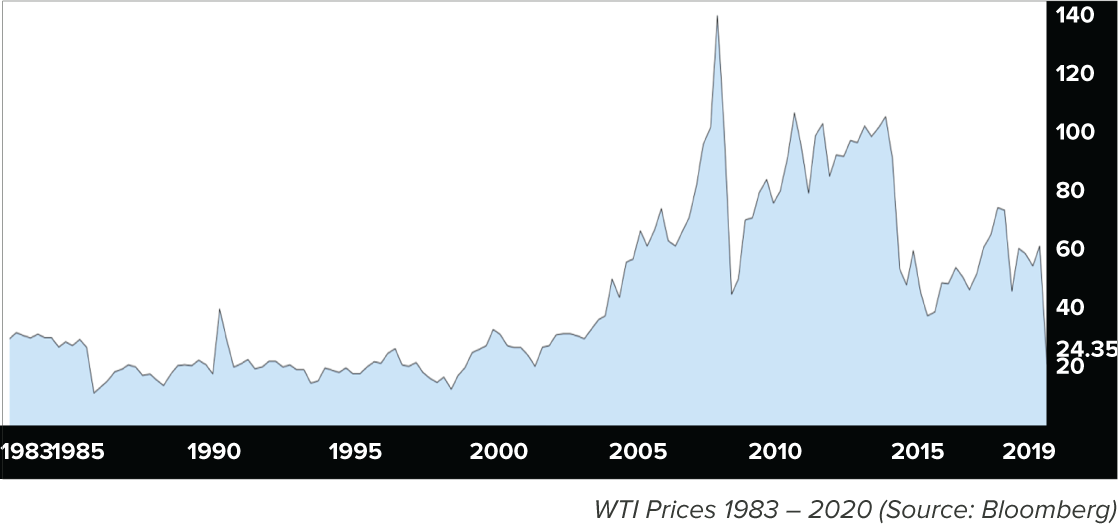

Looking at the below chart, WTI prices have touched a 19 year low whereas Brent prices have touched 18 year low. Such lower prices have created a super contango structure where in the long dated Brent futures contract beyond 6 month expiry are trading at a premium of $ 10 + as compared to current spot prices. For Brent, the contango premiums are near 10 year high indicative of massive supply glut prevalent in the market. Major oil traders are making use of this and have booked massive amounts of onshore as well offshore storage capacities. Freight industry & big shipping players are having a roll with prices of oil tankers more than doubling since start of this year. Saudi Arabia’s oil tanker spree has reportedly seen around 700 % rise in ship earners income. This comes as the kingdom has hired dozens of large oil carries in order to store their oil surplus.

Path to Recovery – Way Ahead

President Trump is reportedly putting immense pressure on both Saudis & Russians to come back to negotiating table & work around on some sort of compromise. Whether or not both sides agree, path to recovery for oil prices is going to be a complex one. The world is staring at massive supply glut with leading industry consultant IHS Markit putting surplus in the range of 800 million to 1.3 billion barrels for H1 2020. On a monthly basis, the excess could range from 4 - 10 mbpd from February to May, with demand in March and April down by as much as 10 mbpd. US oil industry is likely to bear the brunt with their output expected to drop in range of 2 – 4 mbpd over course of next 18 months.

Looking at the past recoveries for WTI & Brent, the benchmarks have taken at least 6 months to 1 year for gaining back 80 % to 100 % of their original price levels. During last GFC of 2008 when Brent prices fell to low of 36, prices recovered to their high of $ 128 only during start of 2012. Similarly for WTI, prices recovered from low of $ 35 to high of $ 114 only during mid of 2011. As such the journey for oil price recovery would most probably be a long one with traders increasingly using the ongoing recessionary theme to sell on any rallies. Oil prices are likely to consolidate further at these lower levels with any short term bounce likely to be sold. Global economy is poised to enter into an extended period of slowdown & even recession should the current lockdown measures extend beyond April end. Long term investors are best suited to make use of these lower oil prices to start accumulating & even average out their buying prices on any dips. In case of further upswings, this may provide them with good value & further new opportunities.

Data Source: Bloomberg

Arun Leslie John

Chief Market Analyst

Disclaimer: Century Financial Consultancy LLC (“CFC”) is Limited Liability Company incorporated under the Laws of UAE and is duly licensed and regulated by the Emirates Securities and Commodities Authority of UAE (SCA).This document is a marketing material and is for informational purposes only and must not be construed to be an advice to invest or otherwise in any investment or financial product. CFC does not guarantee as to adequacy, accuracy, completeness or reliability of any information or data contained herein and under no circumstances whatsoever none of such information or data be construed as an advice or trading strategy or recommendation to deal (Buy/Sell) in any investment or financial product. CFC is not responsible or liable for any result, gain or loss, based on this information, in whole or in part. Please carefully read disclaimer mentioned below/next page/next frame.

PLEASE READ THE FOLLOWING TERMS AND CONDITIONS OF ACCESS FOR THE PUBLICATION BEFORE THE USE THEREOF.

By use of the publication and continuing to access the publication, you accept these terms and conditions and undertake to be bound by the acceptance. CFC reserves the right to amend, remove, or add to the publication and Disclaimer at any time without any prior notice to you. Such modifications may be effective immediately or otherwise. Accordingly, please continue to review this Disclaimer whenever accessing, or using the publication. Your access of, and use of the publication, after modifications to the Disclaimer will constitute your acceptance of the terms and conditions of use of the publication, as modified. If, at any time, you do not wish to accept the content of this Disclaimer, you may not access, or use the publication. Any terms and conditions proposed by you which are in addition to or which conflict with this Disclaimer are expressly rejected by CFC and shall be of no force or effect.

No information as given herein by CFC in this publication should be construed as an offer, recommendation or solicitation to purchase or dispose of any securities/financial instruments/products or to enter in any transaction or adopt any hedging, trading or investment strategy. The data/information contained in the publication is not designed to initiate or conclude any transaction. Neither this publication nor anything contained herein shall form the basis of any contract or commitment whatsoever. Distribution of this publication does not oblige CFC to enter into any transaction. The information in this document is not intended, by itself, to constitute independent, impartial or objective research or a recommendation from CFC and should not be treated as such.

The content of this publication should not be considered legal, regulatory, credit, tax or accounting advice. Anyone proposing to rely on or use the information contained in the publication should independently verify and check the accuracy, completeness, reliability and suitability of the information and should obtain independent and specific advice from appropriate professionals or experts regarding information contained in this publication. CFC cannot be held responsible for the impact of any transactional costs or any taxes as may be applicable on transactions.

Information contained herein is based on various sources, including but not limited to public information, annual reports and statistical data that CFC considers reliable. However, CFC makes no representation or warranty as to the accuracy or completeness of any report or statistical data made in or in connection with this publication and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the information contained in this publication. References to any financial instrument or investment product does not imply that an actual trading market exists for such instrument or product. In publishing this document CFC is not acting in the capacity of a fiduciary or financial advisor.

The report does not take into account the investment objectives, financial situations and specific needs of recipients. The recipient of this publication must make its own independent decisions regarding whether this communication and any securities or financial instruments mentioned herein, is appropriate in the light of its investment objectives, investment experience, financial situation, existing portfolio holdings and/or investment needs. Recipients will need to decide on their own as to whether or not the contents of this document are suitable for them.

This document is a marketing material and has been prepared by individual(s), marketing and/or research personnel of CFC. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is purely a marketing communication. In this publication, any opinions, news, research, analysis, prices, or other information constitute is a general market commentary, and do not constitute the opinion or advice of CFC or any form of personal or investment advice. CFC neither endorses nor guarantees offerings of third party, nor is CFC responsible for the content, veracity or opinions of third-party speakers, presenters, participants or providers. CFC will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Charts, graphs and related data or information provided in this publication are intended to serve for illustrative purposes only. The information contained in this publication is prepared as of a particular date and time and will not reflect subsequent changes in the market or changes in any other factors relevant to their determination. All statements as to future matters are not guaranteed to be accurate. CFC expressly disclaims any obligation to update or revise any forward-looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events.

The information in this communication cannot disclose everything about the nature and risks of the abovementioned data / information. This is not an exhaustive list of the risks involved, nor should it be regarded as offering advice on the suitability of these investments for the recipient.

All views expressed in all reports, analysis and documents are subject to change without notice. CFC may have issued other reports, analysis or other documents expressing different views from the contents hereof. Staff members/employees of CFC may provide/present oral or written market commentary or analysis to you that reflect opinions that are contrary to the opinions expressed in this research and may contain insights and reports that are inconsistent with the views expressed in this publication. Neither CFC nor any of its affiliates, group companies, directors, employees, agents or representatives assume any liability nor shall they be made liable for any damages whether direct, indirect, special or consequential including loss of revenue or profits that may arise from or in connection with the use of the information provided in this publication.

Information or data provided by means in this publication may have many inherent limitations, like module errors or lack accuracy in its historical data. Data included in the publication may rely on models that do not reflect or take into account all potentially significant factors such as market risk, liquidity risk, credit risk etc.

CFC and its affiliates reserve the right to act upon or use the contents hereof at any time, including before its publication herein. The use of our information, products and services should be on your own due diligence and you agree that CFC is not liable for any failure to achieve desired return on investment that is in any manner related to availing of services or products of CFC and use of our information, products and services. You acknowledge and agree that past investment performance is not indicative of the future performance results of any investment and that the information contained herein is not to be used as an indication for the future performance of any investment activity. Any prices provided in this document are indicative only and do not represent firm quotes as to either price or size. The value of any investment or income may go down as well as up. All investments involve an element of risk, including capital loss.

This publication is being furnished to you solely for your information and neither it nor any part of it may be used, forwarded, disclosed, distributed or delivered to anyone else. You may not copy, reproduce, display, modify or create derivative works from any data or information contained in this publication. This document may not be published, circulated, reproduced, or distributed in whole or part to any other person (whether within or in a jurisdiction outside UAE) without the prior written consent of CFC.

Declaration of the Financial Analyst

The analyst(s) who prepared this report certifies that the opinions contained herein accurately and exclusively reflect his or her views. The Analyst further undertakes that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein. The analyst(s) who wrote this report does not hold securities in the Company mentioned in the report. The analyst(s) receives a fixed compensation from CFC. No part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this report. The business solicitation or marketing departments of CFC are separate and independent from the reporting line of the analyst(s). The analyst(s) confirms that he or she and his / her associates do not serve as directors or officers of the Company, and the Company or other third parties have not provided or agreed to provide any compensation or other benefits to the analyst(s) in connection with this report. An “associate” is defined as the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child, of the analyst.

Services offered by CFC include products that are traded on margin and can result in losses that exceed deposits. Before deciding to trade on margin products, you should consider your investment objectives, risk tolerance and your level of experience on these products. Trading with leverage carries significant risk of losses and as such margin products are not suitable for every investor and you should ensure that you understand the risks involved and should seek independent advice from professionals or experts if necessary.