Tuesday, September 08, 2020

Slack share price: is there room left to run ahead of Q4 earnings?

By Century Financial in 'Brainy Bull'

This year has been a turbulent one for Slack’s [WORK] share price. It has gone from an all-time low to an all-time high in the space of three months. On 16 March, Slack’s share price fell to an intra-day low of $15.10 before closing at $17.04, down 24.2% year-to-date and its lowest ever value.

It was quick to recover, though, closing at $24.75 a week later on 23 March, and topping its pre-slump peak later that week, closing at $28.58 on 27 March, up 27.1% year-to-date.

Since then, Slack’s share price has reached an all-time high of $39.90, up 77.5% year-to-date. Although Slack’s share price has fallen since, it was still up 29.3% year-to-date as of its 4 September’s close.

This is, however, 24.5% lower than the value at which it debuted on 20 June last year. On its first-ever day of trading, Slack’s share price surged 48% higher than the $26 reference point set by the company when it opened.

As the tech company reports its second-quarter earnings on 8 September, how will Slack’s share price react?

How has Slack been performing?

When Slack announced its first-quarter earnings on 4 June, it reported a loss of $0.02 per share, beating analysts’ expectations of a loss of $0.07 per share — a healthy earnings surprise of 71.4%. This was an improvement on the same period a year prior, when Slack announced losses of $0.26 per share, and marked the fourth consecutive quarter where Slack surpassed earnings estimates.

For the quarter ended April 2020, Slack also exceeded revenue estimates of $186.5m when it posted actual revenues of $201.65m, a surprise of 7.6%. Similarly to its earnings surprise, Slack has beaten consensus revenue estimates for the past four consecutive quarters. Slack’s share price enjoyed a boost in June, following such positive results.

“Q1 was a phenomenal quarter for Slack, with the addition of 12,000 net new paid customers and 50% revenue growth year-over-year,” Stewart Butterfield, CEO and founder of Slack said. “We believe the long-term impact the three months and counting of working from home will have on the way we work is of generational magnitude. This will continue to catalyse adoption for the new category of channel-based messaging platforms.”

Looking ahead to its second-quarter results, Slack is expected to report a loss of $0.03 per share according to Zacks, which would represent a growth of 78.6% from the same period a year ago.

Meanwhile, the consensus estimate for revenue expects Slack to post net sales of $208.33m, an increase of 43.7% from the same period a year ago.

For the full year, the Zacks consensus estimate is projecting losses of $0.16 per share, which would result in a 42.9% increase from 2019. As for revenue, analysts expect Slack to make $866.86m for the full year, a growth of 37.5% from the fiscal year 2020.

Is Slack one to watch?

Slack is “basically replacing email at the workplace”, John Ballard wrote in The Motley Fool, emphasising the capacity for company growth.

“[Slack] ended 2019 with more than 660,000 organisations using its platform and 110,000 of those on a paid subscription plan,” he continued. “But through the first half of the year, its customer base has already spiked to over 750,000 organisations.”

“Revenue has grown exponentially over the last few years, but Slack is still a relatively small company with a lot of potential to gain the business of more customers across different industries,” Ballard pointed out. “There is also an opportunity to sell additional services to existing users, as noted by its consistently high net dollar retention rate of over 130%.”

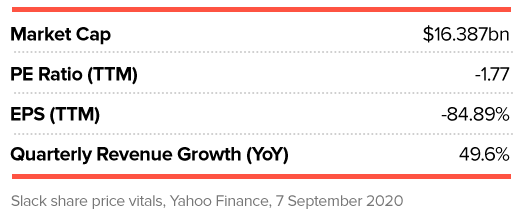

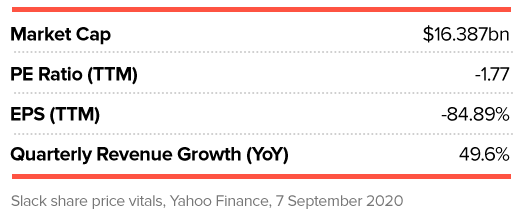

Zacks has given Slack’s share price a Hold rating. The consensus among 23 analysts polled by MarketBeatis to Buy the stock. This comes from a majority of 14, with seven analysts giving the share price a Hold rating, while two suggest Selling.

Among 23 analysts offering 12-month forecasts for Slack’s share price, MarketBeat reports an average target of $34.14, with a high estimate of $45 and a low of $20. The median estimate represents a 17.4% increase on Slack’s share price as of 4 September’s close.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.