Thursday, June 04, 2020

Slack’s share price set to surge on remote working trend

By Century Financial in 'Brainy Bull'

The climb in Slack Technologies’ [WORK] share price has become something of an unstoppable force this year.

Boosted by global pandemic lockdowns, the collaborative communication software business has become one of the most popular work-from-home pure plays in the market.

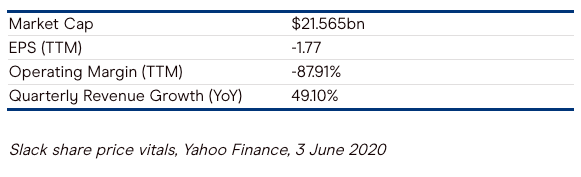

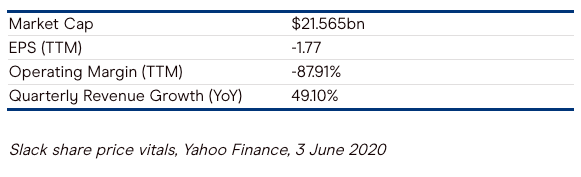

Its share price is up 70.7% YTD to 2 June and at $38.38 it is trading at 29.2% above its 50-day moving average of $29.70 and just off its all-time high of $38.62.

Furthermore, on Tuesday a vote of confidence from a top industry analyst prompted a spike in Slack’s share price, sending it up 3.2% at close.

With Slack on track to unveil strong quarterly figures in its upcoming quarterly results announcement tomorrow (4 June), what should investors and traders look out for to judge its long-term growth potential?

The future of work

While the cloud-based messaging platform was already popular among businesses before the pandemic, the sudden and widespread move to employees working from home has dramatically expanded its market.

How many new users the company has gained since the COVID-19 outbreak will, therefore, be key to determining its position in the market.

That changing dynamic in the workplace will be a driving force for Slack’s business in the years to come as well. Like many unicorns, the company has been operating at a loss since its debut earnings release. In the first quarter of the fiscal year 2020 Slack reported a loss of $38.4m that grew to $363.7m by the second.

Over the last two quarters, however, it has managed to decease that figure month-to-month, and it now stands at $91.2m, or $0.16 per share, for the fourth quarter of fiscal year 2020.

For the first quarter of fiscal year 2021, Slack expects a net loss of between $42m and $38m, or $0.07 and $0.06, while the consensus estimate among analysts at FactSet is a loss of $0.17 per share, according to The Street.

Growing competition from Microsoft Teams

The sudden rise in remote working has created major demand for technologies like group video conferencing and collaboration software, which is accelerating a battle over the future of business.

Microsoft [MSFT] was quick on the uptake. The tech giant has been expanding the capabilities of its conferencing and collaboration software, Teams. Chief executive Satya Nadella hails it critical to the company’s future, but the aggressive push has not gone unnoticed by rivals like Slack. “They want to kill us, as opposed to have a great product and make customers happy,” Slack CEO Stewart Butterfield (pictured) told the Wall Street Journal.

The threat of increasing competition is a potential headwind to Slack. However, as the global collaboration software market forecasted to grow from $8.9bn in 2019 to $23bn in 2020, according to market researcher Wise Guy Reports, there should be plenty of space for Slack to expand.

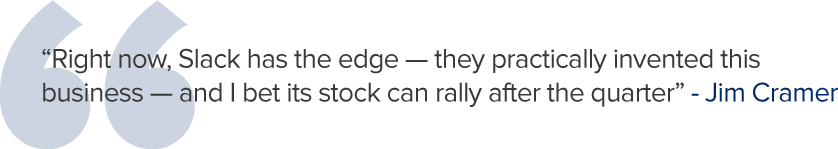

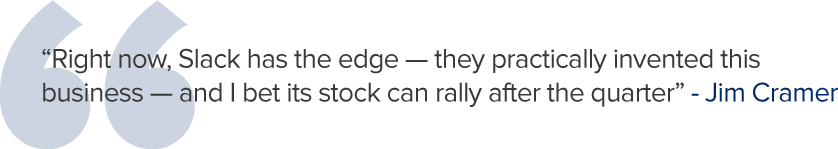

However, Jim Cramer doesn’t believe market competition will be a significant concern, despite the stock having a number of sceptics. “Right now, Slack has the edge — they practically invented this business — and I bet its stock can rally after the quarter,” he said on his show Mad Money.

This week, Derrick Wood, an analyst at Cowen, gave the stock an outperform rating with a price target of $45 ahead of its first-quarter earnings release. In a note, he cited the shift to remote work as a “major boost shot” for the company, Barron’s reports.

“The market doesn’t seem to fully appreciate this as many are caught up on the Microsoft threat overhang. But digital collaboration has just got a lot more strategic, which favours best-of-breed, and we see a re-rate coming on the heels of a strong print on Thursday,” Wood said.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

.png)

.png)

.png)

.png)