Wednesday, May 27, 2020

What to watch for in Costco’s share price ahead of earnings

By Century Financial in 'Brainy Bull'

Although big-box retailers across the board are experiencing coronavirus-induced sales surges, Costco’s [COST] share price is lagging behind its competitors — despite the fact it posted an unexpected earnings beat in March. When it releases first third-quarter earnings on 28 May, can it deliver good enough numbers to buck this trend?

At its Q2 earnings announcement, Costco revealed positive news for its share price investors that, for the month ending March 1, same-store sales were up 12.1% over the previous year. “February sales [also] benefited from an uptick in consumer demand in the fourth week of the reporting period,” the company said. “We attribute this to concerns over the coronavirus.”

As of 20 May, however, the share price was trading 5.9% off its all-time high of $324.08 reached on 20 February — just before the coronavirus-correction first began to take hold of the market. The share price also slid after the earnings release, losing 4.4% over the following days.

This is in contrast to America’s two biggest retailers’ share prices, Walmart [WMT] and Amazon [AMZN], which are up 6.2% and 13.6% since 20 February respectively. Fellow big-box retailers Kroger [KR] and Target [TGT] have also seen their share prices up 7.6% and 0.4% over the past three months.

Costco’s share price has also been far more volatile than Walmart and Amazon, twice dipping below $280, before recovering.

Can Costco stay above $296?

Costco’s upcoming earnings announcement follows a disappointing sales report for April — as stay-at-home orders swept North America and panic buying eased, the firm’s sales fell almost 2%. This is the first time Costco’s sales have fallen in over a decade.

Despite this potential red flag, many analysts are bullish on the stock ahead of earnings. Writing on The Street, Bret Kenwell argues that based on the performance of Target, Home Depot [HD], Walmart and Lowe’s [LOW] following recent earnings, the stock could be a buy ahead of earnings — provided the stock holds above $296.

“Costco stock is above the 20-day, 50-day and 200-day moving averages, as it continues to hold the 20-day as support,” argues Kenwell. “Should shares lose the 20-day moving average as support, look for $300 to buoy Costco. There it will find a key support level throughout 2020, as well as the 50-day moving average.”

If Costco is able to trade within 1.5% of its all-time high within 24 hours of announcing its earnings results, Kenwell adds, “it will put shares at or above $320.40 by May 28th, the day it reports earnings.”

If he is correct, this would represent a 6.1% increase on 21 May’s closing price of $301.97.

The consensus on Costco

When Costco reports this week, it’s expected to announce earnings of $1.93 per share, up 2.12% year-on-year, on revenue of $37.52bn for the quarter. This compares to $2.10 per share for the last quarter, which beat analysts’ expectations of $2.06 per share.

Zack’s analysts meanwhile believe that Costco “looks well on track despite [a] recent sales blip”, noting that online sales were up an impressive 85.7% in April.

The firm added: “The company’s growth strategies, better price management, strong membership trends and increasing penetration of e-commerce business have been also supporting the performance. Notably, shares of this company have gained approximately 3.7% so far in the year against the industry’s decline of 7.9%.”

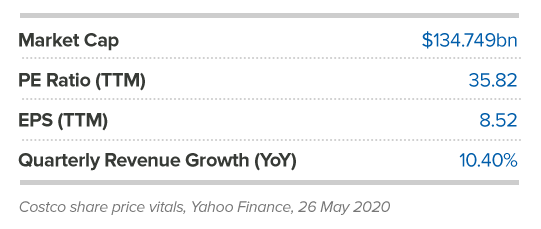

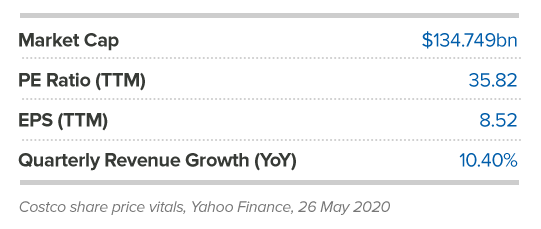

Despite currently holding a relatively high P/E ratio of 35.5, the consensus rating for the share price by analysts polled by CNN Money is “buy”. Of 31 analysts, 17 rate the stock a buy or outperform, while 11 rate the share price a hold and just one rates the stock a sell.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

.png)

.png)

.png)

.png)