Wednesday, July 01, 2020

Why Zoom's share price continues to hit new highs

By Century Financial in 'Brainy Bull'

Zoom Video Communications [ZM] share price at the beginning of the year ($68.72) wasn’t much higher than after the stock’s first day of trading in April 2019. The tech stock had closed at $62 on its first day of trading — a then impressive 72% premium on the IPO price of $36.

Six months ago, most people hadn’t heard of video-communications platform Zoom. In spite of that, during the coronavirus pandemic, Zoom has become a household name; its share price hit an all-time of $259.51 on 25 June, representing growth of 281% YTD.

This outperformance is good news for investors and traders, but what continues to bolster Zoom’s share price? And should those invested expected medium-to-long-term returns?

Zooming ahead

Although Zoom’s share price was reasonably strong during its first six months (peaking at an intraday high of $104.49 on 26 July), it slumped in October 2019. It didn’t reach the same heights until February this year.

As COVID-19 put many countries in lockdown, investors rallied behind stay-at-home stocks — a trend fortified over fears of a second wave of the coronavirus.

Zoom and other such stocks are listed on the Nasdaq, helping the index’s strong performance compared to the S&P 500 and the Dow. While the latter two were down 6.9% and 12.3% respectively, the Nasdaq was up 8.7% for the year to date through 26 June.

“The COVID-19 crisis has driven higher demand for distributed, face-to-face interactions and collaboration using Zoom,” Eric Yuan CEO (pictured) said when announcing Zoom’s Q1 results. “Use cases have grown rapidly as people integrated Zoom into their work, learning, and personal lives.”

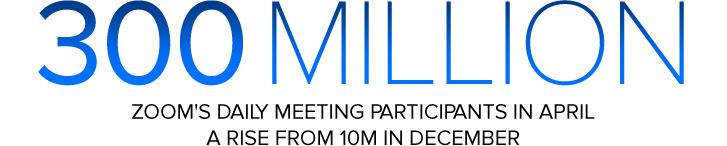

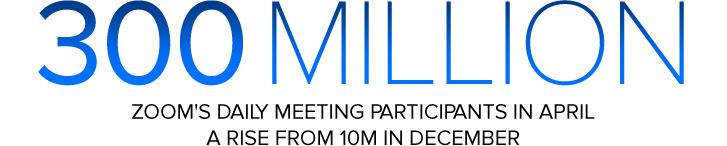

This corresponds with Zoom reporting that daily meeting participants grew to 300 million in April, compared to just 10 million back in December.

In its fiscal Q1 2021 earnings report, published at the beginning of June, Zoom reported revenue soared 169% year-over-year to $328.2m, dwarfing the $202.5m Wall Street consensus estimate.

Looking ahead, the company has significantly altered its guidance and now expects full-year revenue to be between $1.7bn to $1.8bn — growth of about 187% year over year. It also expects adjusted earnings per share of $1.21 to $1.29, a 256% increase.

During a Zoom meeting with analysts following the Q1 results, Yuan also said, “video is going to change everything about communication”, highlighting that the total addressable market (TAM) was larger than previously expected. In its fiscal Q1 2020 earnings, the company estimated its market size to be $43bn or more by 2022.

Zoom hasn’t provided an updated TAM figure because it’s “hard” to estimate. For context, Zoom's fiscal 2021 revenue guidance of $1.7bn to $1.8bn is just over 4% of the former TAM of $43bn.

A stay-at-home pure play

Rishi Jaluria, analyst at DA Davidson, believes Zoom will beat its own revenue expectations. "It sounds odd to say, but I actually think that's conservative,” Jaluria told Business Insider.

Seyrafi’s rating is in line with the Zacks Consensus Estimate, which rates Zoom’s share price as a strong buy.

However, 31 analysts polled by CNN Business share a consensus hold rating, with a majority of 12 analysts. It’s a close call though as 11 gave a buy rating and three gave the stock an outperform rating, the remaining five analysts rate the stock a sell.

Among 23 analysts, also polled by CNN Business, the consensus 12-month median price target of $217 represents a 14.86% drop from Zoom’s share price peak on 25 June. The highest estimate for the stock is for $299 and the lowest is $156, representing an increase of 17.33% and drop of 39.58% respectively, compared to the June peak.

“Zoom is perhaps the purest stay-at-home stock right now, and the world has changed somewhat permanently since COVID-19,” Seyrafi said in a note seen by MarketWatch. “There are several large trillion-dollar industries, such as business travel and commercial real estate, from which we see Zoom capturing much value going forward.”

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.