Tuesday, August 11, 2020

Will a Strong Earnings Report Push Tencent’s Share Price to Further All-Time Highs

By Century Financial in 'Brainy Bull'

Tencent’s [TCEHY] share price has experienced an incredible year so far — hitting all-time high after all-time high — as its gaming and social media revenues surged during the coronavirus pandemic.

On 9 July, the firm’s first notable peak, Tencent’s share price reached an all-time high of $72.90 before closing at $71.28.

Less than two weeks later, on 21 July, Tencent’s share price beat the previous best close, hitting $71.49. The stock’s most recent all-time high was reached when it closed at $72.57 on 6 August — up 51.15% year-to-date.

The following day, Tencent’s share price dipped 7.4% to close at $67.22. However, the majority of analysts remain bullish on the stock.

Tencent’s share price on the Hong Kong stock exchange [0700] has followed a similar pattern, with both jumping up in tandem on the same dates.

It closed most recently at HK$527.50 on 7 August – not quite an all-time high, but just 5.97% off the HK$561 that it had hit two days earlier, and 6.47% off its most recent closing high of HK$564 on 21 July.

With Tencent’s share price trying hard to break new ground in both territories, will the company’s Q2 earnings report, due 12 August, help the stock continue to soar?

Lesson’s from Tencent’s Q1 performance

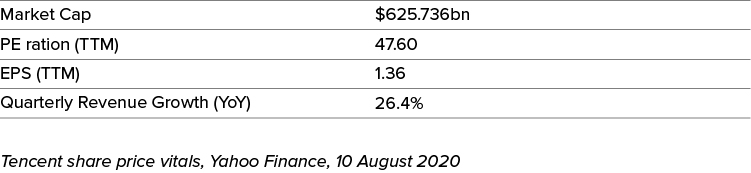

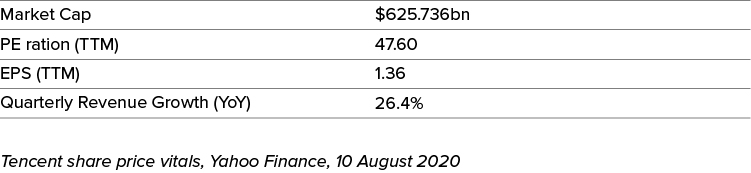

The multinational conglomerate, which has major holdings in tech, film, music, and gaming, released its Q1 earnings on 13 May. It reported earnings of $0.40 per share, beating the Zacks consensus estimate of $0.35, a surprise of 14.3%. Compared to the same period in 2019, this marked a growth of 25%.

In local currency, non-GAAP earnings were RMB2.817 per share, up 28.8% from Q1 2019.

For the quarter ended March 2020, Tencent posted revenue of $15.25bn, which beat Zacks’ consensus estimate by 7.5% and was 20.5% higher than 2019’s Q1 revenue of $12.66bn.

There is little doubt that the coronavirus pandemic has helped fuel this growth. One notable indicator is that Tencent’s revenue from online games grew 30.8% to RMB37.3bn from the same period last year.

Moreover, the total growth for smartphone games grew a huge 64% year-on-year to RMB34.75m, driven by consumers spending a lot more time playing Tencent’s franchise games.

Looking ahead to Q2, Zacks analysts expect Tencent to announce earnings of $0.42 per share alongside revenues of $16.01bn, which would represent year-on-year growth of 16.67% and 22.94% respectively.

For the full year, the research publication expects earnings of $1.76 per share on revenues of $68.9bn. If correct, the results would show respective year-over-year growth of 26.6% and 26.3%.

Moreover, Bloomberg reported that Tencent is in talks to merge two of China’s biggest game-streaming platforms, Huya Inc. [HUYA] and DouYu [DOYU]. Tencent has stakes in both businesses, and such a merger would result in a gaming giant with more than 300 million users and a combined market value of $10bn.

The news has already helped to push the share price of all three companies upwards, but if the deal does go through, these stocks could climb even higher.

Is Tencent a buy?

“As the major shareholder of both platforms, Tencent would benefit because a merger would remove unnecessary competition between them. The enlarged scale can also help to drive cost synergies and fend off emerging competitors,” Bloomberg Intelligence analyst Vey-Sern Ling said.

Tencent has a consensus Buy rating from Zacks, in line with the consensus among 49 analysts polled by CNN Money.

A huge majority of 42 analysts hold this view, while two rate Tencent’s share price as Outperform and the remaining four suggest to Hold the stock.

The median 12-month target for Tencent’s share price among 46 analysts polled by CNN is $71.28, with a high estimate of $84.51 and a low of $55.48. The median price target would represent a 6% increase on Tencent’s share price as of 7 August’s close.

This median target is lower than the all-time high Tencent’s share price has enjoyed, but not by much. Any swing towards the high end of these estimates would present an opportunity for the stock to register new records.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.