Sunday, May 10, 2020

Will Gold reclaim the previous highs of $1900?

By Century Financial in 'Investment Insights'

Gold’s performance this year has been anything but stellar. The yellow metal has been on an incredible bull-run and is up almost 33% from the same time a year ago.

Just 4 months into the year, the metal has already witnessed gains of almost 13% clearly outperforming most other asset classes. It’s no secret that uncertainty – be it political or economic – is a friend to gold and the leap year of 2020 will certainly not be forgotten for many such events- be it spark of geopolitical tensions between the U.S. and Iran, the acquittal of President Donald Trump in an impeachment trial, crash of a Ukrainian flight in Tehran, UK’s departure from the EU or most importantly the spread of the coronavirus.

The metal got a head start of almost 5% in the month of January buoyed by the tensions between the U.S. and Iran when a top ranking Iranian military commander was killed in an airstrike. However, a major trigger for a rally in gold this year was the spread of COVID-19, the deadly virus which has claimed over a quarter million lives and has left millions of people stranded across the world. The pandemic induced crisis has seen the unemployment claims rise to more than 33.5 million since mid-March and the claims now account for 13.9% of the US labor force. And the numbers are expected to rise through May since full reopening is expected only in June.The rally in the metal, however, wasn’t an easy one way up move. Prices were very volatile, and the metal briefly turned lower for the year before climbing to its highest level since late 2012. The precious metal was torn between its potential as a haven investment and a mad scramble to sell the bullion in a bid for cash to cover losses in the equity markets.

Covid-19 was declared as a pandemic on March 11, but gold prices didn’t immediately rally as many expected. Infact, the bullion fell a massive 14% to as low as $1451 before eventually edging higher, as increased volatility and margin calls forced levered investors to sell to provide liquidity. The fall in gold along with risk assets was because the Fed was not easing as fast as inflation expectations were plunging. As a result, real rates rose, and gold prices fell despite the perception of the commodity as a haven. During the 2008 financial crisis, gold faced similar losses with gold prices initially falling in the line with markets. The turning point for the metal in 2008 came when the U.S. Federal Reserve announced quantitative easing, at which point gold began to soar.

Likewise, given the recent unprecedented monetary and fiscal stimulus measures from governments and Central banks across the world, the metal has staged a powerful recovery. The futures edged to as high as $1,788 an ounce on 14 April after trading in the $1,400 range less than a month ago. This was also time when the world witnessed massive surge in the spreads between the spot and futures contract. The spread between London spot gold and New York futures which usually trades within a few Dollars rose to near triple digits in the last week of March.

What caused the Cash/Future spread to Spike?

It was not like the world suddenly ran out of gold, however there was a lack of gold in the desired proportions. Gold markets in London (spot price) deal in the 400 ounces bar whereas 100-ounce bars are delivered against New York futures trading in Comex. In normal times, the conversion of larger London bars into COMEX-acceptable units is a seamless process. The Corona virus pandemic, however, forced the refineries (majorly located in Switzerland & Germany) to temporarily suspend operations and also disrupted flights between many nations. This drove traders into panic as many feared that there will be a shortage of 100-ounce bars for delivery in New York and led to the surge in premiums. With many countries now relaxing their lockdown measures, two of the world’s biggest gold refiners are almost back to pre-COVID-19 operations. Besides, Insurance firms have started covering charter flights to carry gold. Consequently, the spread has also narrowed to nearly $5.

Global recession forecasts combined with the rapid pace of governmental money-printing to boost the activity in gold.

Working in favor of gold are the monetary and fiscal stimulus measures, which do not seem to have an upper limit. World leaders have committed almost $8 trillion to battle the COVID-19 and its economic fallout, driving debt up to dangerously high levels. Rapidly increasing debt-to-GDP levels are driving gold prices higher. It was the financial crisis that launched U.S. debt-to-GDP to post-World War II highs. A similar story developing may support gold even more in the years ahead. The unprecedented monetary stimulus has seen yields on US 10-year treasuries plunge to 0.70% while German 10-year bonds are trading at a negative yield of -0.50%. With high quality treasury paper yielding next to nothing, gold has become an attractive store of value in comparison.

The metal has held on to its gains despite the run up in equities as countries have started relaxing the lockdown measures and reopened their economies. Concerns over a second wave of infections is supporting the safe-haven demand.

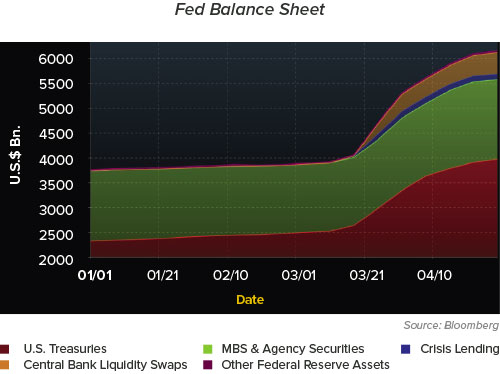

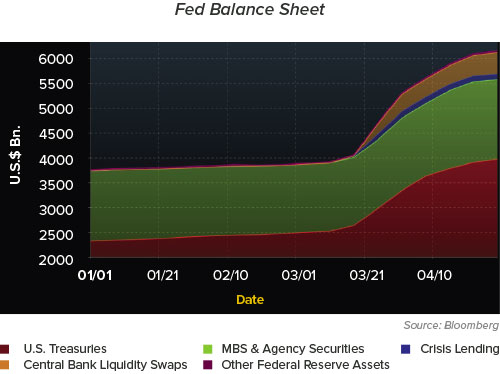

With the ongoing geopolitical, economic and financial market risks, there is little reason to believe the long-term upward trend in gold prices will change anytime soon. According to IMF, the global economy is expected to shrink by 3% during 2020 which will mark the steepest downturn since the Great Depression of the 1930s. With an official recession looming, monetary authorities are poised to buy record amounts of financial assets and double the sizes of their balance sheets. The U.S. Federal Reserve balance sheet has already exceeded the $6.2 trillion mark up from $4.2 trillion in February ($4.5 trillion was the prior peak as a result of the Great Recession).

When policymakers act to accommodate shocks such as the one being experienced now, gold tends to benefit as it is considered as the currency of last resort, acting as a hedge against currency debasement. There are expectations that Fed’s balance sheet could surpass $10 trillion and the fiscal 2020 U.S. budget deficit is expected to quadruple to a record $4 trillion given the steep economic downturn and massive coronavirus rescue spending.

Reflecting these sentiments, Holdings in SPDR Gold Trust, the world’s largest gold-backed ETF, rose to 1,076.39 tons on 5th May, their highest since April 2013. According to World gold council, the global investment demand for gold rose by 80%yoy in the first quarter this year. Gold-backed ETFs saw inflows of more than 298 tons in the first quarter (+300%yoy), which pushed holdings in these products to a record high above 3000 tons.

Nevertheless, the yellow metal's continued gains depend on the Fed's ability to retain control of economic expectations, and keep real rates trending lower. If the economic turmoil prompts a bout of deflation given the massive fall in oil prices which the Fed proves unable to address, the precious metal could come under pressure. However, that seems unlikely. The propensity of governments to indiscriminately flush systems with cash promises adds fuel to the bullion price rally. Besides the prospects of renewed US-China tensions is adding further buoyancy to the metal. In the current environment where interest rates are expected to remain low for a very long time, the yellow metal remains poised to reclaim the 2011 high of $1920 as it is a long-favored hedge against recession, uncertainty and inflation. Gold played a key role during a historically poor first quarter as equities around the globe suffered massive losses amid COVID-19 panic. Going forward, the yellow metal continues to be a must in a well-diversified portfolio as the length and amplitude of the Covid-19 shock on the global economy are simply unknown.

The propensity of governments to indiscriminately flush systems with cash promises to add fuel to the bullion price rally.

Data Source: Bloomberg

Arun Leslie John

Chief Market Analyst

Disclaimer: Century Financial Consultancy LLC (“CFC”) is Limited Liability Company incorporated under the Laws of UAE and is duly licensed and regulated by the Emirates Securities and Commodities Authority of UAE (SCA).This document is a marketing material and is for informational purposes only and must not be construed to be an advice to invest or otherwise in any investment or financial product. CFC does not guarantee as to adequacy, accuracy, completeness or reliability of any information or data contained herein and under no circumstances whatsoever none of such information or data be construed as an advice or trading strategy or recommendation to deal (Buy/Sell) in any investment or financial product. CFC is not responsible or liable for any result, gain or loss, based on this information, in whole or in part. Please carefully read disclaimer mentioned below/next page/next frame.

PLEASE READ THE FOLLOWING TERMS AND CONDITIONS OF ACCESS FOR THE PUBLICATION BEFORE THE USE THEREOF.

By use of the publication and continuing to access the publication, you accept these terms and conditions and undertake to be bound by the acceptance. CFC reserves the right to amend, remove, or add to the publication and Disclaimer at any time without any prior notice to you. Such modifications may be effective immediately or otherwise. Accordingly, please continue to review this Disclaimer whenever accessing, or using the publication. Your access of, and use of the publication, after modifications to the Disclaimer will constitute your acceptance of the terms and conditions of use of the publication, as modified. If, at any time, you do not wish to accept the content of this Disclaimer, you may not access, or use the publication. Any terms and conditions proposed by you which are in addition to or which conflict with this Disclaimer are expressly rejected by CFC and shall be of no force or effect.

No information as given herein by CFC in this publication should be construed as an offer, recommendation or solicitation to purchase or dispose of any securities/financial instruments/products or to enter in any transaction or adopt any hedging, trading or investment strategy. The data/information contained in the publication is not designed to initiate or conclude any transaction. Neither this publication nor anything contained herein shall form the basis of any contract or commitment whatsoever. Distribution of this publication does not oblige CFC to enter into any transaction. The information in this document is not intended, by itself, to constitute independent, impartial or objective research or a recommendation from CFC and should not be treated as such.

The content of this publication should not be considered legal, regulatory, credit, tax or accounting advice. Anyone proposing to rely on or use the information contained in the publication should independently verify and check the accuracy, completeness, reliability and suitability of the information and should obtain independent and specific advice from appropriate professionals or experts regarding information contained in this publication. CFC cannot be held responsible for the impact of any transactional costs or any taxes as may be applicable on transactions.

Information contained herein is based on various sources, including but not limited to public information, annual reports and statistical data that CFC considers reliable. However, CFC makes no representation or warranty as to the accuracy or completeness of any report or statistical data made in or in connection with this publication and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the information contained in this publication. References to any financial instrument or investment product does not imply that an actual trading market exists for such instrument or product. In publishing this document CFC is not acting in the capacity of a fiduciary or financial advisor.

The report does not take into account the investment objectives, financial situations and specific needs of recipients. The recipient of this publication must make its own independent decisions regarding whether this communication and any securities or financial instruments mentioned herein, is appropriate in the light of its investment objectives, investment experience, financial situation, existing portfolio holdings and/or investment needs. Recipients will need to decide on their own as to whether or not the contents of this document are suitable for them.

This document is a marketing material and has been prepared by individual(s), marketing and/or research personnel of CFC. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is purely a marketing communication. In this publication, any opinions, news, research, analysis, prices, or other information constitute is a general market commentary, and do not constitute the opinion or advice of CFC or any form of personal or investment advice. CFC neither endorses nor guarantees offerings of third party, nor is CFC responsible for the content, veracity or opinions of third-party speakers, presenters, participants or providers. CFC will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Charts, graphs and related data or information provided in this publication are intended to serve for illustrative purposes only. The information contained in this publication is prepared as of a particular date and time and will not reflect subsequent changes in the market or changes in any other factors relevant to their determination. All statements as to future matters are not guaranteed to be accurate. CFC expressly disclaims any obligation to update or revise any forward-looking statements to reflect new information, events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events.

The information in this communication cannot disclose everything about the nature and risks of the abovementioned data / information. This is not an exhaustive list of the risks involved, nor should it be regarded as offering advice on the suitability of these investments for the recipient.

All views expressed in all reports, analysis and documents are subject to change without notice. CFC may have issued other reports, analysis or other documents expressing different views from the contents hereof. Staff members/employees of CFC may provide/present oral or written market commentary or analysis to you that reflect opinions that are contrary to the opinions expressed in this research and may contain insights and reports that are inconsistent with the views expressed in this publication. Neither CFC nor any of its affiliates, group companies, directors, employees, agents or representatives assume any liability nor shall they be made liable for any damages whether direct, indirect, special or consequential including loss of revenue or profits that may arise from or in connection with the use of the information provided in this publication.

Information or data provided by means in this publication may have many inherent limitations, like module errors or lack accuracy in its historical data. Data included in the publication may rely on models that do not reflect or take into account all potentially significant factors such as market risk, liquidity risk, credit risk etc.

CFC and its affiliates reserve the right to act upon or use the contents hereof at any time, including before its publication herein. The use of our information, products and services should be on your own due diligence and you agree that CFC is not liable for any failure to achieve desired return on investment that is in any manner related to availing of services or products of CFC and use of our information, products and services. You acknowledge and agree that past investment performance is not indicative of the future performance results of any investment and that the information contained herein is not to be used as an indication for the future performance of any investment activity. Any prices provided in this document are indicative only and do not represent firm quotes as to either price or size. The value of any investment or income may go down as well as up. All investments involve an element of risk, including capital loss.

This publication is being furnished to you solely for your information and neither it nor any part of it may be used, forwarded, disclosed, distributed or delivered to anyone else. You may not copy, reproduce, display, modify or create derivative works from any data or information contained in this publication. This document may not be published, circulated, reproduced, or distributed in whole or part to any other person (whether within or in a jurisdiction outside UAE) without the prior written consent of CFC.

Declaration of the Financial Analyst

The analyst(s) who prepared this report certifies that the opinions contained herein accurately and exclusively reflect his or her views. The Analyst further undertakes that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein. The analyst(s) who wrote this report does not hold securities in the Company mentioned in the report. The analyst(s) receives a fixed compensation from CFC. No part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this report. The business solicitation or marketing departments of CFC are separate and independent from the reporting line of the analyst(s). The analyst(s) confirms that he or she and his / her associates do not serve as directors or officers of the Company, and the Company or other third parties have not provided or agreed to provide any compensation or other benefits to the analyst(s) in connection with this report. An “associate” is defined as the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child, of the analyst.

Services offered by CFC include products that are traded on margin and can result in losses that exceed deposits. Before deciding to trade on margin products, you should consider your investment objectives, risk tolerance and your level of experience on these products. Trading with leverage carries significant risk of losses and as such margin products are not suitable for every investor and you should ensure that you understand the risks involved and should seek independent advice from professionals or experts if necessary.