Tuesday, May 19, 2020

Will Target’s share price hinge on a lockdown sales lift in Q1 earnings?

By Century Financial in 'Brainy Bull'

.png)

Big-box retailer Target’s [TGT] share price has emerged as one of 2020’s most resilient stocks. The company’s share price has held its ground during the coronavirus pandemic — it has surged, from around $92 in mid-March to hit $120.94 as of 15 May. Overall, its share price has risen 69% from this time last year, where it was just $70.81. Target’s share price is down just 4% year-to-date, relative to the S&P 500’s 12% decline.

In a recent business update, Target said it had seen sales bouncing both in the run-up to and during the coronavirus lockdown. During February, comparable sales were up 3.8% as consumers began to stock up on essential items. In March, it saw a massive 40% growth in its Essentials and Food & Beverage categories, as shopping habits began to reflect the fact customers were now spending the majority of their time at home. In April, sales were up by more than 5% overall. If Q1 earnings results convey similar optimism, is a post-earnings share price bounce in store?

Target recorded record-setting digital growth as shoppers avoided busy retail locations, with sales up by over 275% in April. It has also reported particularly strong demand for cleaning products, food, beverages, games and crafts. So, investor optimism that Target’s first-quarter earnings due Wednesday (20 May) will help elevate the company’s share price further, will be high.

Does Target see trouble ahead?

There have been weaknesses, however, in Target’s recent performance, primarily in demand for clothes which fell 40% in April. It has also seen a mid-teen decline in-store sales from its 1,900 sites which it says will affect profitability.

Target has withdrawn guidance for Q1, outlining a number of factors that are set to reduce profitability, including an increase in coronavirus-related staff pay and benefits which has already cost the company over $300m. It has also noted a consumers shift “towards lower-margin categories” and clothing write-downs because of falling demand. Together, these factors are expected to reduce first-quarter margins by 5%.

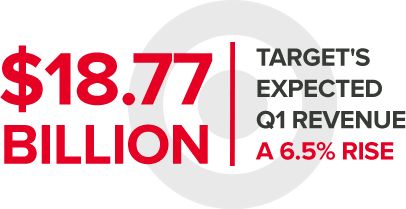

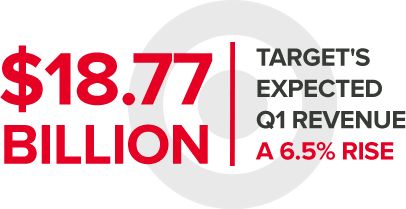

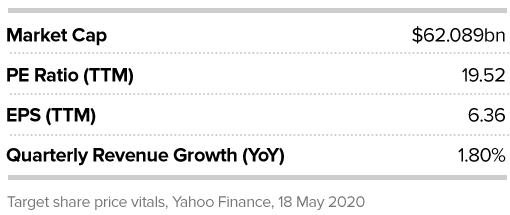

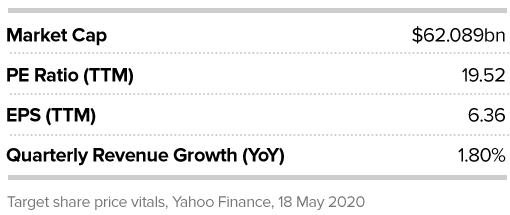

According to Zacks, Target is expected to report EPS of $0.77, down 49.7% from the same quarter last year. It expects revenues of $18.77bn, up 6.5% from the same time last year. For the full year, Zacks is forecasting earnings at Target of $5.23 per share.

Looking to the long term

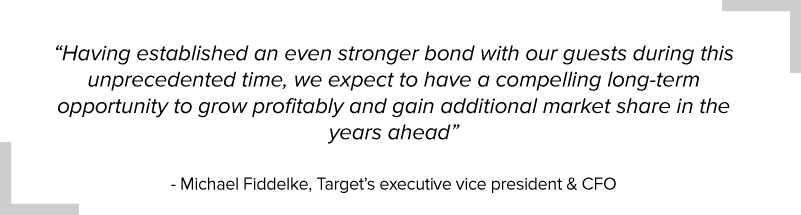

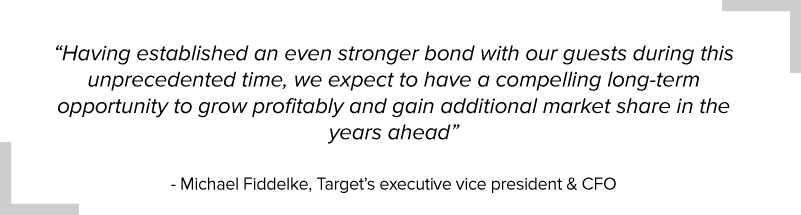

Target has also suspended share buybacks and will reduce the number of stores it remodels and opens this year, but Michael Fiddelke, Target’s executive vice president and chief financial officer, remains confident about the long-term picture.

"While we expect our short-term profitability to be affected by COVID-19, we expect to have the financial capacity to emerge from this crisis in a position of strength. Having established an even stronger bond with our guests during this unprecedented time, we expect to have a compelling long-term opportunity to grow profitably and gain additional market share in the years ahead," he said.

This is largely due to the company’s recent investment in digital offerings, including same day services, buy online and pick up in-store and its acquisition of grocery delivery service Shipt. It is also confident that post-pandemic these shifts in customer behaviour will remain and become the norm.

Analysts are certainly convinced that Target’s aim is true. According to MarketScreener, the share price currently holds a consensus “outperform” recommendation and a share price target of $123.40.

Nomura Instinet retail analyst Michael Baker thinks the short-term problems Target faces are a “blip”. “Nothing we are seeing here is permanent, except maybe Target picking up new customers,” he told CNBC. In a note to clients, Edward Yruma of KeyBanc added: “We think that Target is uniquely positioned to benefit from a contracting department store space and investments in digital.”

Target’s low-cost offering is also likely see a surge in interest – alongside rivals Walmart [WMT] and Costco [COST] — as the economic downturn begins to bite.

“Consumers are reacting very quickly to the change in economic conditions, even when it comes to purchasing consumables,” Scott Mushkin of R5 Capital wrote. “The swiftness of this is somewhat surprising to us and may reflect that more economic hardship is already taking place than is widely understood.”

However, analysts at Stifel are less convinced. They have retained a hold rating citing concerns over “near-term cost pressures related to the coronavirus and the “ongoing and increasingly rapid shift of consumer spending away from traditional retail, relevant as Target has greater exposure to channels with high online penetration, including apparel, hardlines, and household essentials,” its analysts wrote.

Moody’s has also cut its outlook for the US retail sector as a whole, saying that it is faced with an “unprecedented mix of woes”.

But Target, through its affordability, could continue to offer customers a convenient and cost-effective way to get all their household and grocery items in one location. Coupled with its digital developments, it is well-placed to prove its status as a leading retailer in the months ahead.

Source: This content has been produced by Opto trading intelligence for Century Financial and was originally published on cmcmarkets.com/en-gb/opto

Disclaimer: Past performance is not a reliable indicator of future results.

The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by Century Financial or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Century Financial does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and Century Financial shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.