Thursday, September 11, 2025

Small Caps Catch Up? A Long RTY & Short SPX Play

تم إعداد هذا المنشور من قبل سنشري للاستشارات

.jpg)

Aggressive stimulus and fiscal support - At the start of 2025, Beijing announced the issuance of 3 trillion yuan in government bonds to boost business investment and household consumption. This policy support helped China’s economy expand by 5.3% in the first half of 2025, even amid rising external pressures. However, in July and August, the economy slowed down, which raised expectations for Beijing to roll out more stimulus this year to offset the impact of Donald Trump’s trade war.

Signs of fiscal activity are already visible as China’s 10-year bond yields have steadied since January, reflecting heavier bond issuance and sustained government financing efforts.

China 10 year bond yield

PBOC financing support and liquidity boost – Following the release of soft economic data in July, the People’s Bank of China pledged to step up financial support for priority sectors, including technology and consumption. This marks a shift away from its traditional focus on channeling credit to property and infrastructure, signaling a more targeted, innovation-driven approach to sustaining growth and stabilizing demand

Leadership in AI and Advanced Technology - China’s strategic ambitions in AI have accelerated in the wake of DeepSeek’s breakthrough launch, with momentum expected to build over the next 24 months. Despite ongoing semiconductor supply constraints, China is steadily narrowing its gap with the U.S., leveraging its strengths in software development and applied AI to emerge as a leading challenger in the field worldwide. According to the Financial Times, Chinese chipmakers plan to triple AI chip output by 2026, thereby reducing their reliance on Nvidia and strengthening domestic supply chains.

Investor sentiment is aligning with this trend: in the week ending August 31, China-focused AI, tech, and fintech ETFs led global inflows and returns, supported by government stabilization measures and expectations of surging demand for locally produced chips that power the AI and EV industries.

A key enabler of this growth is China’s dominance in electricity. Unlike the U.S., where an aging grid is constraining AI infrastructure, China benefits from a robust and expanding power network. As highlighted by Ember, China has nearly doubled its share of primary energy since 2000 to almost 25%, while the U.S. has remained stagnant—underscoring a structural edge in scaling AI capacity.

Domestic consumption revival – In H1 2025, consumption-related fiscal spending outpaced overall expenditure growth, with targeted subsidies for smartphones and home appliances expected to lift retail sales through the second half of the year. On August 12, authorities introduced a new consumer loan program, effective September 1, that offers subsidized borrowing through August 2026 for automobiles, electronics, and essential services, including elderly care, child care, education, and tourism. This initiative builds on earlier stimulus efforts and is designed to support large-ticket purchases while broadening demand in the service sector. Looking ahead, the PBOC is expected to ease monetary policy further, following weak July activity and credit data, which will provide additional tailwinds for household spending.

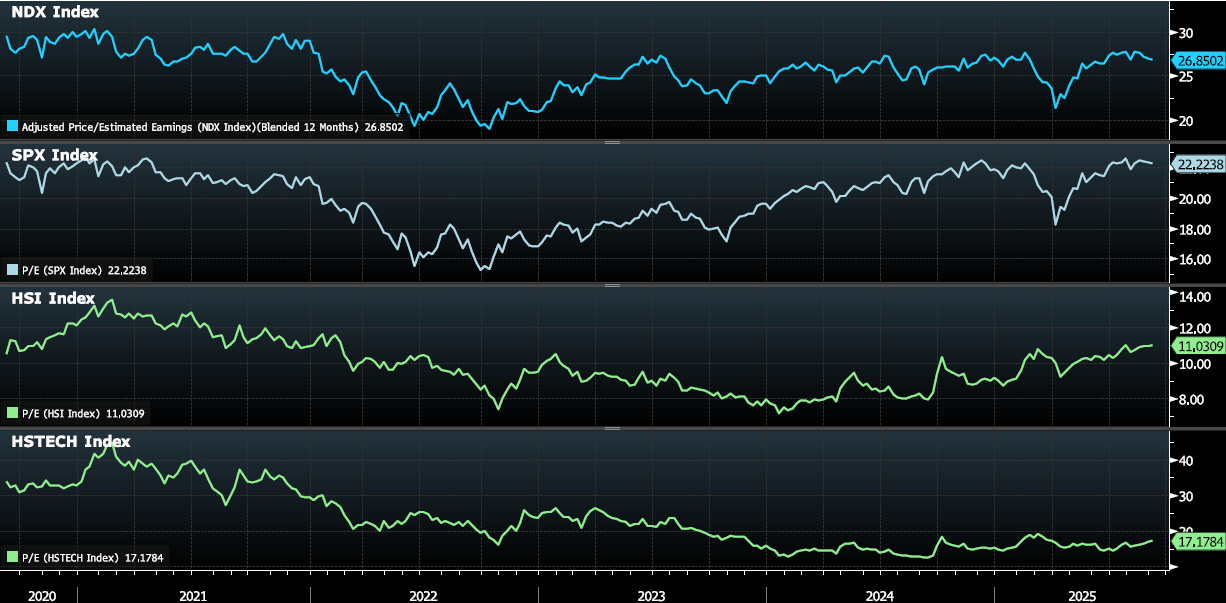

Attractive Valuations – With concerns over stretched valuations in U.S. tech, investors are increasingly rotating into Chinese tech stocks. Alibaba’s recent earnings beat highlighted this trend, with stronger cloud sales and a revival in e-commerce drawing renewed attention from global funds. A softer U.S. dollar is further reducing the appeal of dollar-denominated assets, encouraging diversification into Asia. Valuation gaps remain compelling: while the S&P 500 and Nasdaq trade at forward P/Es above 20, the Hang Seng and Hang Seng Tech Index continue to sit well below that threshold, offering investors both growth exposure and relative value.

Technicals

Hang Seng Index (HK50)

(1).png)

Source: Trading View

Timeframe: Weekly

Date: 2nd September 2025

- The Hang Seng Index trades at HKD 25,343 and has already broken out of the 2022 resistance at HKD 24,210.

- It is currently trading in an ascending parallel channel on the weekly timeframe.

- The index trades below the HKD 30,000 touched in 2021, and faces a near-term resistance and support at HKD 27,000 and HKD 24,210, respectively.

The following two ETFs listed in US give specific exposure to China Technology and AI-related stocks.

KraneShares CSI China Internet ETF (KWEB)

.png)

Source: Trading View

Timeframe: Weekly

Date: 2nd September 2025

- The ETF is testing the 2022 resistance and has formed a three-year base.

- A breakout from this level can push it towards the next resistance at $54

- The pattern gets invalidated below $30, which coincides with the ascending trendline support.

Invesco China Technology ETF (CQQQ)

.png)

Source: Trading View

Timeframe: Weekly

Date: 2nd September 2025

- The ETF has broken out of the 2022 resistance at $51.44 and is restesting the same level. It can potentially test the next resistance at $74.29.

- The high volumes in the recent months reflect the optimism around stimulus and smart money building positions.

- On the contrary, the chart gets invalidated below $36.

Risks and Assumptions related to Back-tested trading strategies

Disclaimer:Century Financial Consultancy LLC (CFC) is duly licensed and regulated by the Securities and Commodities Authority of UAE (SCA) under license numbers 20200000028 and 301044 to practice the activities of Trading broker in the international markets, Trading broker of the OTC derivatives and currencies in the spot market, Introduction, Financial Consultation and Financial Analysis, and Promotion. CFC is a Limited Liability Company incorporated under the laws of UAE and registered with the Department of Economic Development of Dubai (registration number 768189). CFC has its registered office at 601, Level 6, Building no. 4, Emaar Square, Downtown, Dubai, UAE, PO Box 65777.

PLEASE READ THE FOLLOWING TERMS AND CONDITIONS OF ACCESS FOR THE PUBLICATION BEFORE THE USE THEREOF.

Please carefully read the terms and conditions before using the Publication (which means and includes this document/flyer, charts, diagrams, illustrations, images, and all of its contents) ("Publication"). By accessing and continuing to use the Publication, you acknowledge and accept the terms and conditions outlined in this Disclaimer ("Disclaimer"). CFC holds the right to modify or update the Publication and the Disclaimer at any time without any prior notice. Your access and usage of the Publication post the modifications or updates to the Disclaimer will constitute your agreement to abide by the revised terms and conditions. If you do not agree with the contents of this Disclaimer please refrain from using the Publication. Any terms and conditions you propose that may contradict this Disclaimer are liable to be rejected by CFC and shall be considered null and void.

This Publication is a marketing material. It has not been prepared in accordance with legal requirements intended to promote the independence of investment research and, therefore, is a straightforward marketing communication. This Publication's opinions, news, research, analysis, prices, and other information comprise a general market commentary and do not represent the opinion or advice of CFC or any form of personalized or investment advice. Accordingly, CFC is not liable for any loss or damage, including but not limited to any loss of profit, that may arise directly or indirectly from using or relying on this Publication.

The information in this Publication cannot disclose everything about the nature and risks of the abovementioned data/information. Therefore, this is not an exhaustive list of the risks involved. Please refer to our website for the complete Risk Disclosure Statement.

Charts, graphs, tables, calculations of profit and loss, leverage, scenario analysis, other numbers and calculations and related data or information provided in this Publication are intended for illustrative purposes only. The information contained in this Publication is prepared as of a particular date and time and will not reflect subsequent changes in the market or any other factors relevant to their determination. All statements as to future matters are not guaranteed to be accurate. CFC disclaims any obligation to amend or revise any forward-looking statements to reflect new information, events, or circumstances after the date of this Publication or to reflect the occurrence of unanticipated events. The Publication may contain forward-looking statements and projections based on current market conditions and an assessment of future trends. Actual results may differ materially from those projected. CFC does not guarantee the accuracy or reliability of any such statements.

No information given in this Publication should be construed as an endorsement of any particular security, company, or industry, offer, recommendation, or solicitation to purchase or dispose of any securities/financial instruments/products or to enter into any transaction or adopt any hedging, trading or investment strategy. The data/information contained in the Publication is not designed to initiate or conclude any transaction. Neither this Publication nor anything contained herein shall form the basis of any contract or commitment whatsoever. Distribution of this Publication does not oblige CFC to enter into any transaction.

The Publication should not be considered legal, regulatory, credit, tax, or accounting advice. Anyone proposing to rely on or use the information contained in the Publication should independently verify and check its accuracy, completeness, reliability, and suitability and obtain independent professional advice. The Publication does not take into account the investment objectives, financial situations, and specific needs of recipients. The recipient of this Publication must make independent decisions regarding whether this communication and any securities or financial instruments mentioned herein are appropriate in the light of their investment objectives, investment experience, financial situation, existing portfolio holdings and/or investment needs. Recipients will need to decide on their own as to whether or not the contents of this Publication are suitable for them.

Information contained in this Publication is based on various sources, including but not limited to public information, annual reports, and statistical data that CFC believes to be reliable. However, CFC makes no representation or warranty as to the accuracy or completeness of any report or statistical data made in or in connection with this Publication and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the information contained in this Publication. In addition, the names used to describe various financial products or instruments in this Publication may vary from the ones used on different trading platforms.

All views expressed in all reports, analysis and documents are subject to change without notice. CFC may have issued other reports, analysis, or other documents expressing different views from this Publication. In addition, staff members/employees of CFC may provide/present oral or written market commentary or analysis to you that reflect opinions contrary to the opinions expressed in this research and may contain insights and reports inconsistent with the views expressed in this Publication. Neither CFC nor any of its affiliates, group companies, directors, employees, agents, or representatives assume any liability, nor shall they be made liable for any damages, whether direct, indirect, special, or consequential, including loss of revenue or profits that may arise from or in connection with the use of the information provided in this Publication.

Information or data provided by means in this Publication may have many inherent limitations, like module errors or lack of accuracy in its historical data. In addition, data included in the Publication may rely on models that do not reflect or consider all potentially significant factors such as market risk, liquidity risk, interest risk, credit risk etc.

CFC and its affiliates reserve the right to act upon or use the contents hereof at any time. The use of our information, products and services should be on your own due diligence and you agree that CFC is not liable for any failure to achieve the desired return on investment that is in any manner related to availing of services or products of CFC and use of our information, products and services. You acknowledge and agree that past investment performance is not indicative of the future performance results of any investment and that the information contained in this Publication is not to be used as an indication for the future performance of any investment activity. Any prices provided in this Publication are indicative only and do not represent firm quotes as to either price or size.

This Publication is being furnished to you solely for your information and neither it nor any part of it may be used, forwarded, disclosed, distributed or delivered to anyone else. You may not copy, reproduce, display, modify or create derivative works from any data or information contained in this Publication. This document may not be published, circulated, reproduced, or distributed in whole or part to any other person (whether within or in a jurisdiction outside UAE) without the prior written consent of CFC.

Declaration of the Financial Analyst: The Analyst(s) who prepared this report certifies that the opinions contained herein exclusively reflect his or her views. The Analyst further undertakes that he or she has taken reasonable care to maintain independence and objectivity in respect of the opinions herein. The Analyst(s) who wrote this report does not hold securities in the Company mentioned in the report (“Company”). The Analyst(s) confirms that he or she and his / her Associates do not serve as directors or officers of the Company, and the Company or other third parties have not provided or agreed to provide any compensation or other benefits to the Analyst(s) in connection with this report. An “Associate” is defined as the spouse, parent or step-parent, or any minor child (natural or adopted) or minor step-child of the Analyst. The Analyst(s) receives a fixed compensation from CFC. No part of his or her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this report. The business solicitation or marketing departments of CFC are separate and independent from the reporting line of the Analyst(s).

Trading in financial products carries risk. Trading in leveraged Over-The-Counter (OTC) Derivative products including Contracts for Difference (CFDs) and spot foreign exchange contracts involves a significant risk of loss which can exceed deposits and may not be suitable for all investors. OTC Derivative products / CFDs are complex financial instruments that do not confer any claim or right to the underlying financial instrument. Transactions in these instruments are very risky, and you should trade only with the capital you can afford to lose. Before deciding to trade on these products, you should consider your investment objectives, risk tolerance, and your level of experience. Accordingly, you should ensure that you understand the risks involved and seek independent advice from professionals, if necessary.