Tuesday, December 16, 2025

Comprehensive Guide to Asset Allocation & Strategies for Building a Balanced Portfolio

By Century Financial in 'Blog'

.jpg)

Markets rise, fall, stall, and surprise us when we least expect it. Trends burst onto the scene, fade away, and sometimes return looking entirely different. Through all of that noise, one thing consistently holds its ground: a well-balanced portfolio. That is where asset allocation quietly does its job, turning uncertainty into something you can work with instead of something you fear.

You can think of asset allocation as the architecture behind your entire investing approach. It shapes how your capital is distributed across shares, commodities, currencies, indices, and everything in between. When this structure is built thoughtfully, your portfolio can absorb shocks without losing its footing. It stops any single market move from dominating your returns and puts the focus on what matters most: building an investment approach that reflects your goals, your timeline, and the level of risk you are comfortable taking.

What Is Asset Allocation and Why Does It Matter

Asset allocation simply means dividing your money across different types of investments, such as stocks, bonds, cash-like instruments, and other asset classes that align with your outlook. The mix you choose depends on who you are as an investor: your risk tolerance, your time horizon, and the financial goals you're working toward.

Purpose:

At its core, asset allocation is about managing risk while still aiming for growth. When your money is spread across different asset classes, a sharp drop in one area is less likely to derail your entire strategy.

Balance:

It also prevents overexposure. If you’re heavily invested in equities during a downturn, the losses can sting. But a portfolio that also includes bonds, commodities, or cash equivalents can absorb some of that pressure and keep things more stable.

.png)

Flexibility:

A diversified portfolio is built to adapt. By rebalancing occasionally, you can navigate changes in interest rates, geopolitical events, or economic cycles without abandoning your long-term plan.

Asset allocation isn’t something you set once and forget. It evolves as your goals, your risk appetite, and even your life circumstances evolve. Keeping it dynamic helps you stay aligned with your financial targets while building a portfolio that grows steadily and withstands market swings.

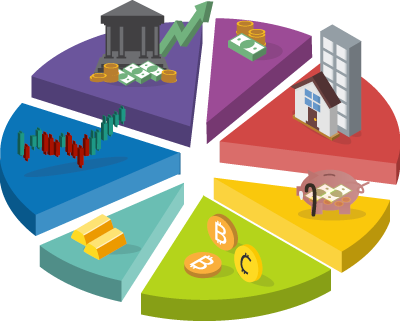

Popular Asset Allocation Strategies

Choosing how to spread your capital across different assets is one of the most important decisions you make in stock market investing. Your asset allocation defines how your investment portfolio behaves when markets rise, fall, or move sideways. The right approach helps you balance growth and stability while shaping your long-term outcomes.

There is no single way to build a portfolio. Some investors prefer disciplined, long-term portfolio allocation strategies, while others want the flexibility to shift quickly when new opportunities appear. The strategies below offer a mix of both, so you can choose an approach that aligns with your risk tolerance, investment horizon, and financial goals.

Strategic Asset Allocation

Strategic asset allocation is a steady, long-term method that sets fixed target percentages for each asset class. Investors decide how much of their capital to allocate to equities, bonds, or commodities, then rebalance occasionally to maintain that mix. This helps rule out emotional decision-making to some extent and lets portfolios weather market volatility. It is ideal for investors who want a calm, disciplined path toward long-term growth.

.png)

Tactical Asset Allocation

Tactical asset allocation takes a more hands-on approach. Investors make short-term adjustments based on market trends, interest rate cycles, or emerging opportunities. Unlike fixed strategic plans, tactical allocation lets you overweight promising sectors or reduce exposure to areas that are weak. It can boost returns when used carefully, but it also requires active monitoring and a deeper understanding of market behavior.

.png)

Dynamic Asset Allocation

Dynamic allocation adapts to shifting market conditions. Instead of following a fixed target, the portfolio adjusts in real time when volatility rises or falls. This style suits active investors who use data, market signals, or advanced tools to guide their decisions. By responding quickly to changing environments, dynamic strategies aim to protect downside risk while still pursuing growth.

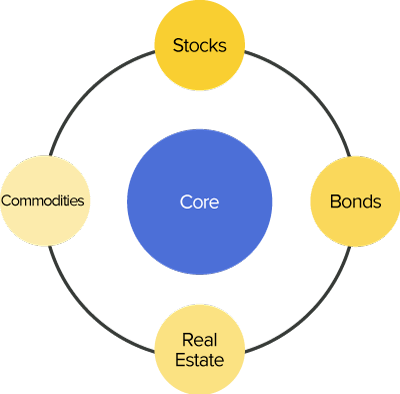

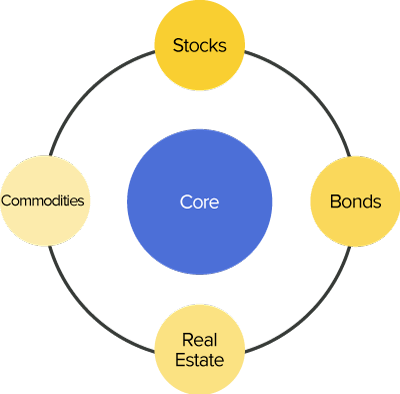

Core-Satellite Strategy

The core-satellite framework brings structure and creativity together. The “core” of the portfolio is built with stable assets such as index funds, high-quality bonds, or large-cap stocks. Around this, investors add “satellites” that target higher potential returns in sectors like technology, real estate, emerging markets, or commodities. The core keeps the portfolio grounded while the satellites pursue opportunities that may outperform broader markets.

Age-Based or Target-Date Allocation

Age-based or target-date allocation adjusts your portfolio according to your age, risk tolerance, and specific financial goals.

The idea is simple: younger investors have a longer time horizon and can typically take on more risk, favoring growth-oriented assets such as equities, CFDs, or emerging-market investments. As investors get older, the strategy gradually shifts toward more stable assets.

Factors to Consider Before Allocating Assets

Every investor’s strategy will differ. Before setting your asset allocation plan, it’s crucial to evaluate key factors that can impact both risk and return.

Risk Tolerance

Some investors are comfortable with high volatility for potentially higher returns, while others prefer stability and predictability. Understanding your risk tolerance is essential before deciding how to allocate your portfolio across asset classes. Assess your emotional response to market swings and potential losses, as overreacting to short-term fluctuations can harm long-term performance. Tools like scenario analysis and historical performance reviews can help gauge your comfort level with different investment options.

Investment Horizon

Your investment horizon directly impacts your allocation strategy. Short-term traders may focus on tactical moves to capitalize on market trends. At the same time, long-term investors may benefit from stable allocations to growth-oriented assets such as equities or diversified funds. Matching your investment horizon with appropriate asset classes helps manage risk and ensures liquidity when funds are needed.

Market Conditions

Market conditions significantly affect asset performance. For example, rising interest rates may make bonds less attractive, while inflationary periods favor commodities or inflation-protected securities. Staying informed about macroeconomic trends enables investors to adjust their allocations proactively.

Trading Platform Capabilities

Your trading platform plays a critical role in managing your portfolio efficiently. Advanced charting, real-time analytics, and multi-market execution tools offered by platforms like Century Trader allow investors to monitor positions, assess risk, and respond quickly to market changes.

Practical Steps to Build Your Asset Allocation Plan

Step 1: Define Your Goals

Defining your investment goals is the foundation of a successful asset allocation plan. Knowing if your goal is long-term growth or wealth preservation will guide all subsequent decisions and ensure your portfolio aligns with your personal objectives.

Set Time Horizons

Consider your short-term, medium-term, and long-term financial goals. A defined timeline helps choose investments that align with liquidity needs and growth expectations.

Step 2: Assess Risk

By understanding your emotional and financial capacity for risk, you can avoid impulsive decisions that could negatively impact long-term returns.

Understand Your Comfort Level

Decide whether you prefer a conservative, moderate, or aggressive portfolio, i.e., if you need stability and low volatility or higher returns through growth-oriented assets.

Use Risk Assessment Tools

Leverage questionnaires, scenario analysis, and historical market data to quantify your risk tolerance and guide allocation decisions.

Step 3: Select Asset Classes

Combining different asset classes can reduce risk while maximizing potential returns across market cycles.

Diversify Across Multiple Assets

Mix equities, commodities, indices, treasury securities, and currencies to reduce portfolio risk. Diversification ensures that gains in one area can offset losses in another.

Balance Growth and Stability

Include a combination of stable, income-generating assets and high-growth investments to maintain both security and upside potential.

Step 4: Choose Trading Platforms

A reliable trading platform is essential for efficiently executing your allocation strategy. The right platform offers the tools, insights, and access needed to manage multiple asset classes effectively.

Evaluate Platform Features

Select platforms like MT5 that offer access to multiple asset classes, advanced charting, and real-time analytics.

Ensure Efficient Execution

Good platforms allow seamless order execution and monitoring, making it easier to implement both strategic and tactical allocation decisions.

Step 5: Rebalance Regularly

Regular rebalancing helps maintain your portfolio’s intended risk-return profile. By periodically adjusting your holdings, you can ensure your strategy remains aligned with your goals despite market fluctuations.

Monitor Portfolio Performance

Review your portfolio at least quarterly to track performance and ensure your allocation aligns with your targets.

Adjust to Maintain Target Ratios

Rebalancing involves buying or selling assets to restore your intended allocation, helping manage risk and capture potential gains.

Rebalancing: The Secret to Long-Term Success

Rebalancing involves periodically realigning your portfolio back to its original target allocation. For example, if equities outperform and exceed your target percentage, you sell a portion and reinvest in underperforming assets to restore balance.

Regular rebalancing prevents overexposure to high-risk sectors, helping manage volatility and protect your portfolio from unexpected market swings. It also locks in profits from well-performing assets.

Conclusion

A balanced portfolio isn’t about perfection—it’s about preparation. Asset allocation ensures your money works for you across all market conditions, cushioning shocks while capturing growth. The more intentional your mix, the more resilient your financial future becomes.

A well-planned asset allocation strategy is one of the most effective ways to balance risk and reward in any market. By understanding your financial goals, assessing your risk tolerance, and diversifying across different asset classes such as equities, commodities, currencies, and fixed-income instruments, you can build a portfolio that remains resilient in changing market conditions.

Elevate your trading

experience

with

Century Trader App

Elevate your trading experience

with

Century Trader App

FAQs

Q1. What is the primary goal of asset allocation?

A: The primary goal of asset allocation is to balance risk and return by diversifying investments across multiple asset classes, such as equities, bonds, commodities, and currencies.

Q2: How often should I rebalance my portfolio?

A: Most investors rebalance their portfolios quarterly or annually to maintain their target allocation. Active traders, however, may adjust monthly or even weekly depending on market conditions and short-term trends.

Q3: Can I use asset allocation in forex trading?

A: Yes, asset allocation can be applied to forex trading by diversifying across different currency pairs, regions, and economic sectors. Additionally, you can combine forex positions with other asset classes.

Q4. Which Century platform is best for beginners?

A: The Century Trader is ideal for beginners due to its intuitive interface, simplified charting tools, and educational resources. For more advanced traders, MT5 offers sophisticated analytics, automated trading, and multi-asset access.

Q5. Is asset allocation suitable for CFD trading?

A: Absolutely. CFDs allow investors to gain exposure to shares, commodities, indices, and currencies without owning the underlying assets, making it easy to implement an allocation strategy.

Related Reads

This marketing and educational content has been created by Century Financial Consultancy LLC (“Century”) for general information only. It does not constitute investment, legal, tax, or other professional advice, nor does it constitute a recommendation, offer, or solicitation to buy or sell any financial instrument. The material does not take into account your investment objectives, financial situation, or particular needs.

The opinions expressed by the hosts, speakers, or guests are their own and may change without notice. Information is based on sources we consider to be reliable; however, Century does not guarantee its accuracy, completeness, or timeliness and accepts no liability for any loss arising from reliance on this content.

Trading and investing involve significant risk, and losses may exceed initial deposits. Past performance is not indicative of future results. CFDs and other leveraged products are complex instruments that may not be suitable for all investors. Please ensure you understand how these products work, the associated risks, and seek independent professional advice if necessary.

Century is licensed and regulated by the UAE Capital Market Authority (CMA) under License Nos. 20200000028 and 301044.

Please refer to the full risk disclosure mentioned on our website.

.png)

.png)

.png)

.png)