Wednesday, September 10, 2025

Candlestick Pattern: A Comprehensive Guide for Traders

By Century Financial in 'Blog'

.jpg)

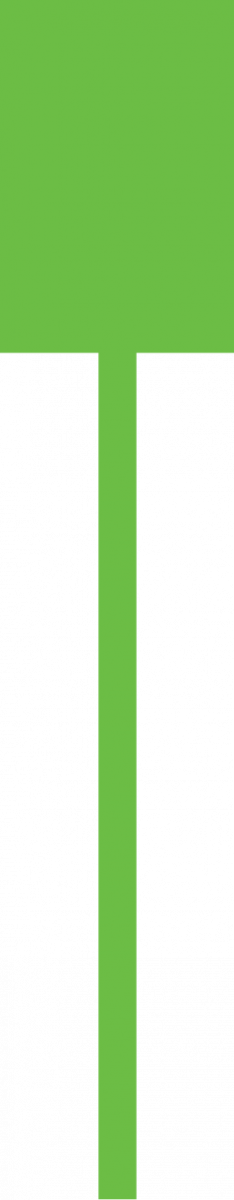

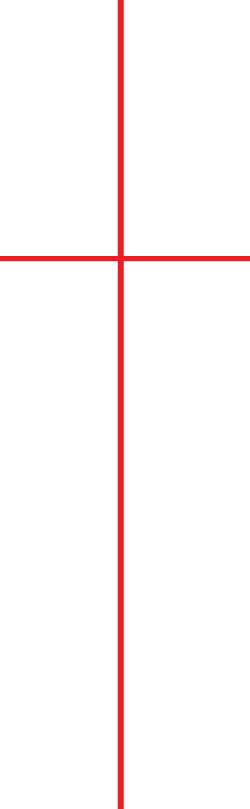

What is a Candlestick Pattern?

A candlestick pattern is a visual representation of price movement for a particular asset over a specific time period. Originating in 18th-century Japan and popularized globally through technical analysis, candlestick patterns help traders predict future price direction based on historical patterns.

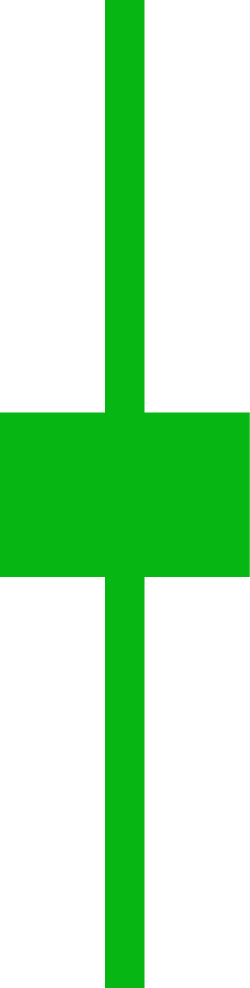

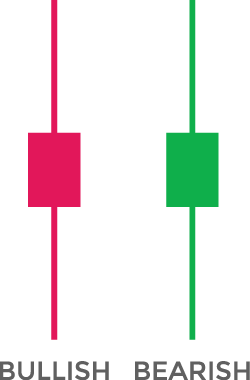

Body:

Represents the range between the opening and closing price of the asset.

Wick (or Shadow)

Thin lines above and below the body indicating harmonic the high and low prices within the timeframe

Color:

Typically green (bullish) or red (bearish), indicating price movement direction.

Candlestick patterns form the foundation of many technical trading strategies and are widely used across markets, including stocks, forex, commodities, and cryptocurrencies. They provide traders with valuable insights into market sentiment, momentum, and potential trend reversals. When used alongside tools like support/resistance levels and volume indicators, candlestick analysis becomes a powerful component of decision-making in both short- and long-term trading.

Why Candlestick Patterns Matter in Trading

Understanding candlestick patterns isn’t just about identifying shapes on a chart — it’s about reading the underlying market psychology and making more informed trading decisions. Here’s why they matter:

Early signals of trend reversals or continuations:

Candlestick formations often appear before a major price move, giving traders an edge in anticipating shifts in momentum.

Clarity on market psychology and sentiment:

Each candlestick reflects the battle between buyers and sellers. Patterns help traders understand who is currently in control — bulls or bears.

Strong entry/exit points for technical trading strategies:

When combined with tools like RSI, MACD, or support/resistance zones, candlestick chart patterns provide clear trade setups.

Improves timing and reduces emotional trading:

Recognizing patterns can help traders act based on strategy rather than impulse or fear

Works across all timeframes and asset classes:

Whether you're trading forex, stocks, indices, or commodities on platforms like MT5 or Century Trader, candlestick charts adapt seamlessly.

Foundational to many popular strategies:

Many advanced trading systems are built upon the basics of candle patterns, making it a crucial skill for beginners and pros alike.

Efficient for both scalping and swing trading:

Intraday traders rely on rapid patterns like Doji or Engulfing, while swing traders focus on longer setups like Morning Stars or Marubozu.

Easily visualized on modern platforms:

With advanced charting tools on platforms like CQG and Century Trader, candlestick patterns can be tracked and backtested in real time.

Types of Candlestick Patterns

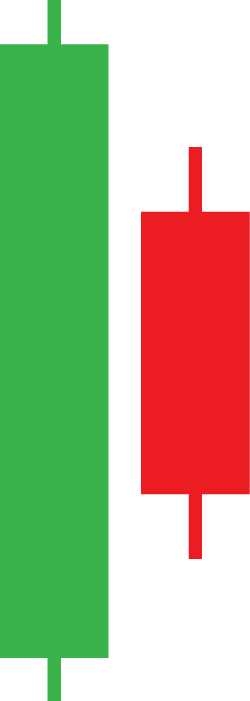

Candlestick patterns can be broadly categorized into bullish, bearish, and neutral (indecision) signals. Each type provides critical insights into market psychology and potential price action.

1. Bullish Candlestick Patterns

Bullish patterns signal that buyers are gaining control and prices may rise. They are often found after a downtrend or at support levels.

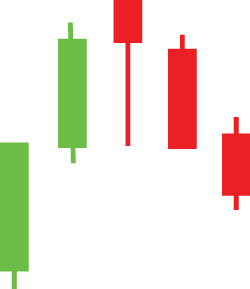

a) Hammer

Appearance

Small body at the top, long lower shadow, little or no upper wick.

Interpretation

Suggests that sellers pushed prices lower, but buyers regained control before the close.

Example: After a sharp drop in gold prices, a hammer on the daily chart may suggest price reversal.

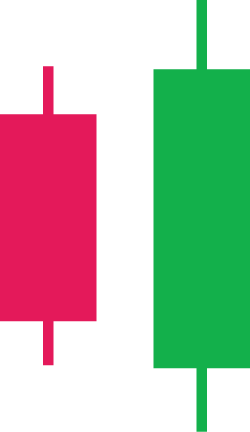

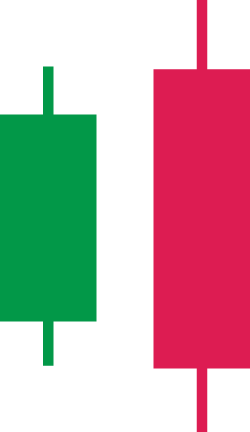

b) Bullish Engulfing

Structure

A small red (bearish) candle followed by a large green (bullish) candle that engulfs the previous body.

Significance

Indicates strong buying momentum.

Application: Commonly seen in trending currency pairs or indices like NASDAQ during a recovery.

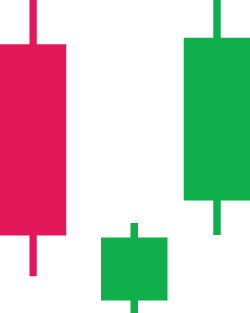

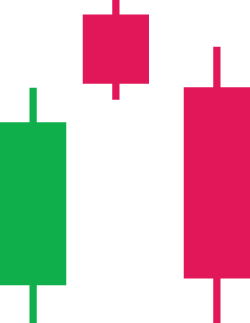

c) Morning Star

Pattern: Three candles

- Large Berish (red) candle

- Small-bodied candle (can be Doji or Spinning Top)

- Strong bullish (green) candle

Implication

Marks the end of selling pressure and beginning of a new uptrend.

Use Case: Frequently seen in daily or weekly charts of major stocks like Tesla or Apple.

d) Piercing Line

Pattern

First candle is bearish; second opens lower but closes above the midpoint of the first candle.

Market Behavior

Suggests a shift in momentum from sellers to buyers.

Best Seen In: Forex pairs like EUR/USD or JPY/CHF during retracement phases.

e) Inverted Hammer (Bonus)

Appearance

Small body with a long upper wick

Location

Appears after a downtrend.

Implication: Suggests a potential bullish reversal, especially if followed by a bullish candle.

2. Bearish Candlestick Patterns

Bearish patterns indicate that sellers are taking control and the price may fall. These often appear after an uptrend or near resistance zones.

a) Shooting Star

Structure

Small real body at the bottom with a long upper wick.

Implication

Bulls tried to push higher but failed, and sellers stepped in.

Example: Seen in commodities like crude oil after sharp rallies.

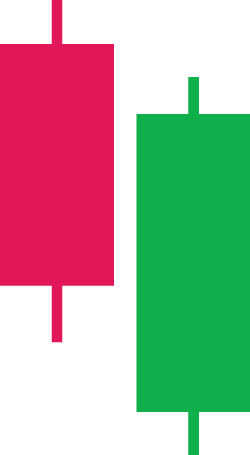

b) Bearish Engulfing

Structure

Small real body at the bottom with a long upper wick.

Interpretation

Indicates a potential bearish reversal.

Example: Useful when spotted in tech stocks after earnings spikes.

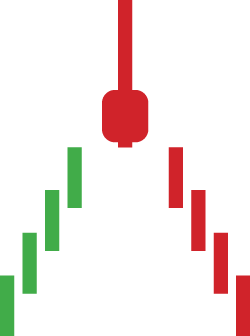

c) Evening Star

Formation: Opposite of Morning Star

- Strong bullish (green) candle

- Small-bodied candle (indecision)

- Large bearish (red) candle

Signal

Trend reversal to the downside.

Context: Powerful when appearing on weekly charts or near overbought RSI levels.

d) Dark Cloud Cover

Pattern

Bullish candle followed by a bearish candle that opens higher but closes below the midpoint of the previous.

Market Implication

Strong bearish sentiment entering the market.

Example: Seen in financial indices like the FTSE 100 before downswings.

e) Hanging Man (Bonus)

Looks like

A Hammer but appears after an uptrend.

Implication

Suggests that selling pressure is creeping in, and the trend may reverse.

3. Neutral or Indecision Patterns

These patterns reflect market uncertainty. While not directional themselves, they often precede breakouts or trend continuations/reversals, depending on the context.

a) Doji

Structure

Open and close are nearly the same, forming a “+” or cross shape.

Types

Regular Doji, Dragonfly Doji (bullish bias), Gravestone Doji (bearish bias).

Implication: Signals indecision — direction often depends on preceding trend.

b) Spinning Top

Appearance

Small real body with long upper and lower shadows.

Market Message

Tug-of-war between bulls and bears with no clear winner.

Usage: Useful for spotting market pauses during strong trends.

c) Inside Bar (Bonus)

Structure

Entire candle is within the range of the previous candle.

Interpretation

Consolidation — can break either way.

Tip: Combine with breakout strategy or volume surge for entry.

d) High Wave Candle

Looks like

Long wicks on both ends with a small body.

Signal: Extreme indecision

Commonly seen before major economic data releases or earnings.

Usage: Useful for spotting market pauses during strong trends.

Top 16 Candlestick Patterns Every Trader Should Know

| Pattern | Type | Implication |

|---|---|---|

| Hammer |  Bullish Bullish |

Reversal after downtrend |

| Inverted Hammer |  Bullish Bullish |

Reversal signal |

| Bullish Engulfing |  Bullish Bullish |

Strong buying pressure |

| Morning Star |  Bullish Bullish |

Trend reversal |

| Piercing Line |  Bullish Bullish |

Downtrend weakening |

| Three White Soldiers |  Bullish Bullish |

Strong bullish trend |

| Hanging Man |  Bearish Bearish |

Weakening uptrend |

| Shooting Star |  Bearish Bearish |

Reversal after uptrend |

| Bearish Engulfing |  Bearish Bearish |

Start of downtrend |

| Evening Star |  Bearish Bearish |

Trend reversal |

| Dark Cloud Cover |  Bearish Bearish |

Bearish shift |

| Three Black Crows |  Bearish Bearish |

Strong downtrend |

| Doji |  Neutral Neutral |

Indecision |

| Spinning Top |  Neutral Neutral |

Uncertainty |

| Marubozu |  Directional Directional |

Strong trend, no wicks |

| Long-Legged Doji |  Neutral Neutral |

High volatility, indecision |

How to Read and Interpret Candlestick Charts

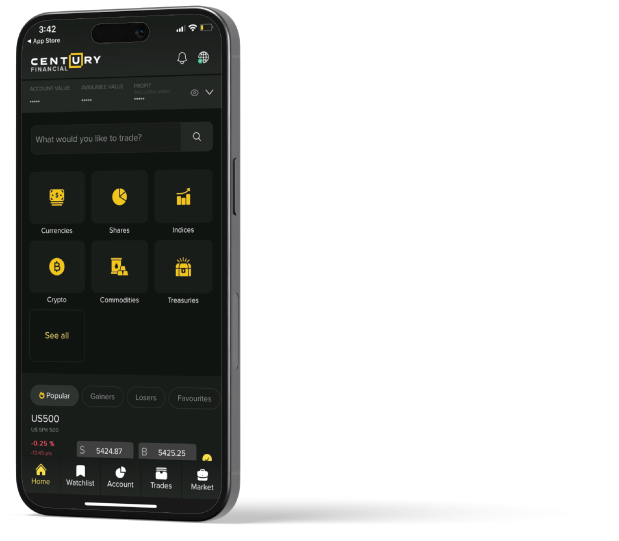

Real-World Example Using Century Trader

Using Century Trader, suppose you're analyzing the EUR/USD currency pair. After a long downtrend, a hammer appears on the 4-hour chart, followed by a bullish engulfing. This dual confirmation could signal a strategic long entry, especially when supported by RSI divergence.

Try it yourself on Century Trader — access multiple timeframes and chart tools for real-time candlestick pattern analysis.

Pros and Cons of Candlestick Patterns

Advantages

Limitations

Best Practices for Trading with Candle Patterns

FAQs About Candlestick Patterns

Q1. What is the most reliable candlestick pattern?

A: The engulfing pattern (bullish or bearish) is widely regarded for its reliability, especially when supported by trendlines or indicators.

Q2: How many candlestick patterns are there?

A: There are over 40 recognized patterns, but most traders focus on the top 10–16 core patterns for practical use.

Q3: Can I use candlestick patterns for intraday trading?

A: Yes, candlestick patterns are highly effective for intraday strategies, especially on 5-minute, 15-minute, or 1-hour charts.

Q4. Are candlestick patterns accurate?

A: While they can be powerful tools, accuracy improves significantly when used with volume analysis, indicators, and trend confirmation.

Q5. What platforms support candlestick charts?

A: Platforms like Century Trader, MetaTrader 5 (MT5), and CQG offer detailed candlestick charting with customizable tools and indicators.

Conclusion: Mastering Candle Patterns for Smarter Trades

Understanding and applying candlestick patterns empowers traders to read the market’s pulse effectively. By integrating these patterns with broader trading strategies, tools, and platforms like Century Trader, you gain an edge in market timing and trade execution.

This marketing and educational content has been created by Century Financial Consultancy LLC (“Century”) for general information only. It does not constitute investment, legal, tax, or other professional advice, nor does it constitute a recommendation, offer, or solicitation to buy or sell any financial instrument. The material does not take into account your investment objectives, financial situation, or particular needs.

The opinions expressed by the hosts, speakers, or guests are their own and may change without notice. Information is based on sources we consider to be reliable; however, Century does not guarantee its accuracy, completeness, or timeliness and accepts no liability for any loss arising from reliance on this content.

Trading and investing involve significant risk, and losses may exceed initial deposits. Past performance is not indicative of future results. CFDs and other leveraged products are complex instruments that may not be suitable for all investors. Please ensure you understand how these products work, the associated risks, and seek independent professional advice if necessary.

Century is licensed and regulated by the UAE Capital Market Authority (CMA) under License Nos. 20200000028 and 301044.

Please refer to the full risk disclosure mentioned on our website.

.png)

.png)

.png)

.png)