.jpg)

What is a Doji Candlestick?

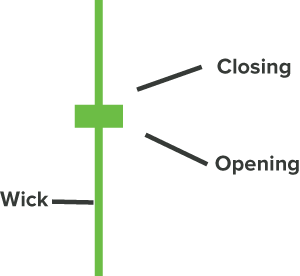

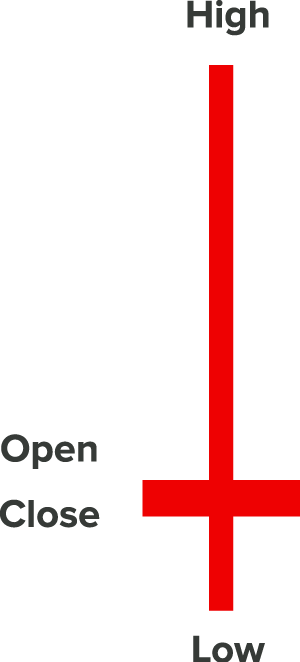

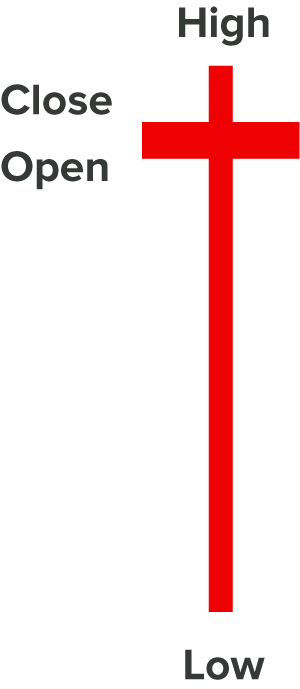

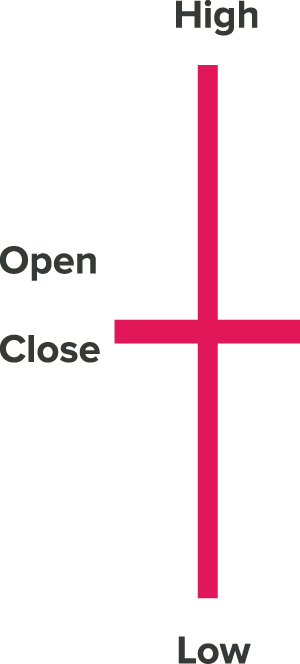

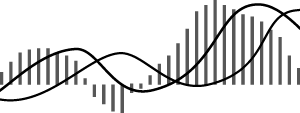

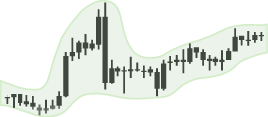

A Doji candlestick is a technical analysis pattern that forms when an asset's opening and closing prices are nearly identical, resulting in a candle with a very thin or nonexistent body. It signifies market indecision, where neither buyers nor sellers have gained control — creating a potential inflection point in price movement.

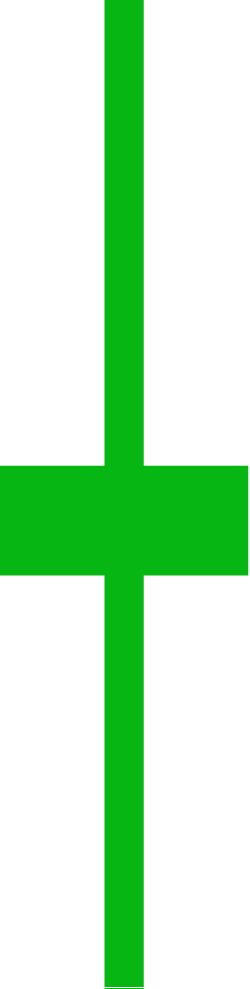

In charts, the doji candle resembles a cross, plus sign, or inverted T, depending on the position of its upper and lower shadows (wicks). Though small in appearance, its presence can carry strong implications, especially at the end of a trend.

Understanding the Psychology Behind a Doji

This stalemate hints that momentum may be weakening — a crucial insight for traders watching for reversals, pauses, or continuations.

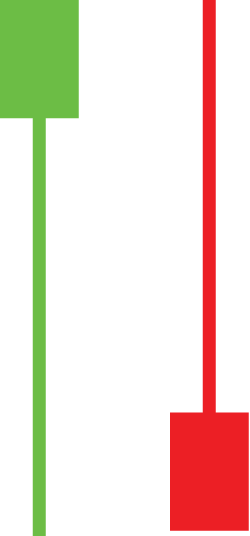

Doji Candle vs Other Candlestick Patters

While the doji candlestick is characterized by a near-zero body, it is distinct from other small-bodied candles like:

Spinning tops:

Small body with longer shadows, but the close and open are not equal.

Marubozu candles:

Full-bodied candles with no wicks, indicating decisive movement.

Hammer or shooting star:

Small body with a single dominant wick, indicating potential reversal.

The doji stands apart because it reflects pure indecision, which can be powerful when combined with trend analysis.

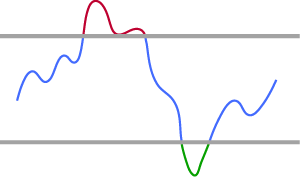

Types of Doji Candlesticks

Doji patterns vary based on the length and placement of their shadows. Each type sends a slightly different message:

1. Standard Doji:

2. Gravestone Doji:

3. Dragonfly Doji

4. Long-Legged Doji

5. Four-Price Doji:

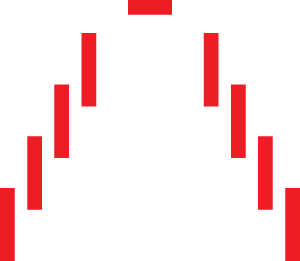

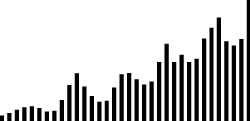

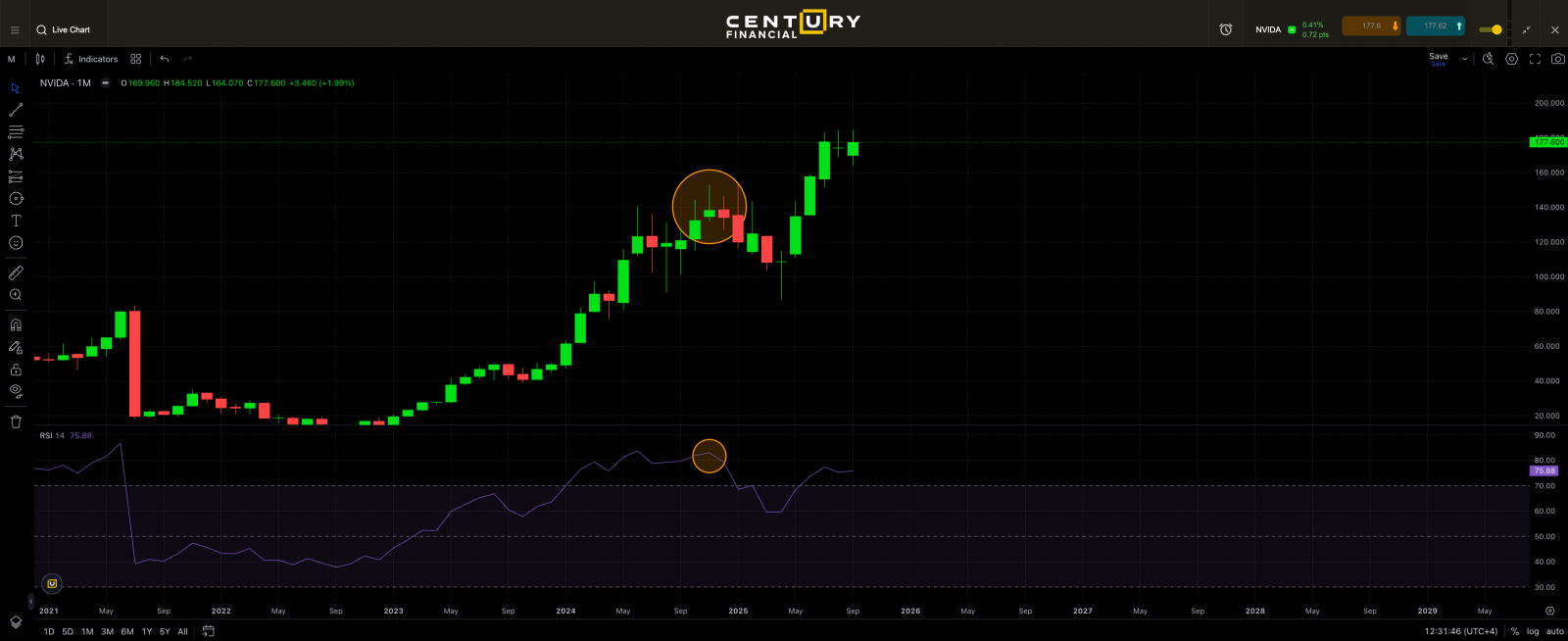

Interpreting Doji Candles in Different Market Contexts

A doji's significance changes based on where it appears in the trend:

After an Uptrend

This marketing and educational content has been created by Century Financial Consultancy LLC (“Century”) for general information only. It does not constitute investment, legal, tax, or other professional advice, nor does it constitute a recommendation, offer, or solicitation to buy or sell any financial instrument. The material does not take into account your investment objectives, financial situation, or particular needs.

The opinions expressed by the hosts, speakers, or guests are their own and may change without notice. Information is based on sources we consider to be reliable; however, Century does not guarantee its accuracy, completeness, or timeliness and accepts no liability for any loss arising from reliance on this content.

Trading and investing involve significant risk, and losses may exceed initial deposits. Past performance is not indicative of future results. CFDs and other leveraged products are complex instruments that may not be suitable for all investors. Please ensure you understand how these products work, the associated risks, and seek independent professional advice if necessary.

Century is licensed and regulated by the UAE Capital Market Authority (CMA) under License Nos. 20200000028 and 301044.

Please refer to the full risk disclosure mentioned on our website.

.png)

.png)

.png)

.png)