Monday, November 17, 2025

Understanding Long Positions in Trading: A Complete Beginner’s Guide

By Century Financial in 'Blog'

What is a Long Position in Trading?

Trade’s barest definition is exchange; it could be an exchange for goods or services for other goods or services, like the barter system, or an exchange of goods or services for currency, and in all of these exchanges, there is a buyer and a seller.

A Long Position refers to the act of purchasing a financial instrument. Opposite to shorting, anybody who takes a long position essentially has a positive or bullish outlook on the market. It can be long-term, where you buy a stock or commodity to enjoy the dividends and capital gains. It could also be short-term, where you buy an asset to capture its upward momentum for quick gains. It is one of the most fundamental terms in trading.

Let’s look at the broader meaning and implications of this act before it's too long.

How Does a Long Position Work?

Here’s how a long position works: you have been hearing about how the tech sector is on its way up due to the increasing popularity of AI. However, geopolitical tensions make you less confident about investing in stocks. So, you analyze and decide precious metals are the way to go; the decision becomes sure after learning the role of silver and copper in the rise of AI, convincing you that silver is going to go up.

After proper due diligence, you realize silver could be a good investment—not physical, but exchange-traded ones. So, you log into your trading platform and find the ETP that aligns with your interests. After confirming the prices, you place an order for as many units as your capital can gather. Voila, you have taken a long position on silver!

Types of Long Positions

A long position can be taken in any instrument. Many trading strategies you should know spell out when and why you should take a long position, depending on the market conditions and desired outlook. For now, let’s look at what a long position in some of the most popular instruments looks like.

Long Position in Stocks

When you buy company shares expecting a rise in their value, you are taking a long position in it. This is the classic “buy low, sell high” approach investors and traders start with.

Long Position in Forex

Currencies are also available to take a long position in. But forex is discussed in pairs. Let’s say you expect the Euro to strengthen against USD, then you’ll go long on EUR/USD.

Long Futures Contracts

Stocks, indices, currencies, commodities can all be traded through future contracts. If the price of the contract goes up by the time the contract matures, your long position becomes profitable.

What is a Long Call or Put Position?

Here, complexities (and confusion) may increase. We discussed that long positions are taken when there is a bullish outlook. But in options, you can go long on a put option as well, which is used when you are bearish about the underlying asset.

In options, long is purely “buying.” So, no matter which direction you expect the market to swing, if you are buying a call or a put option, you are taking a long position.

Long Position vs Short Position

Long and short are the two sides of the same “trade” coin. Where long means buying, short means selling. If you are still wondering,what short trading means, then look at this nifty table:

| Factor | Long Position | Short Position |

|---|---|---|

| Market Outlook | Bullish/expecting market to rise | Bearish/expecting market to fall |

| Action Taken | Buy the asset or derivative | Borrow or sell the asset or derivative |

| Profit Source | Asset appreciates in value | Asset declines in value |

| Time Frame | Often long-term | Typically, short-term |

| Use Case | Wealth building | Hedging or income generation |

When Should Traders Take a Long Position?

The decision to take a long position depends on market sentiments, fundamentals, technical support, capital, and many such factors. Here are some of key scenarios which call for a long position:

Bullish Chart Patterns

Chart patterns like ascending triangles, cup-and-handle, and bullish engulfing patterns indicate potential for upward momentum.

Positive Fundamental Outlook

Fundamental analysis can unveil an asset's potential for long-term gains. A bullish outlook through asset-specific or macroeconomic factors can confirm a long bias.

Market Sentiments Shift

The impact of shifts in the market approach can redirect the short and long-term outlook. A positive shift can be responded to with a long position.

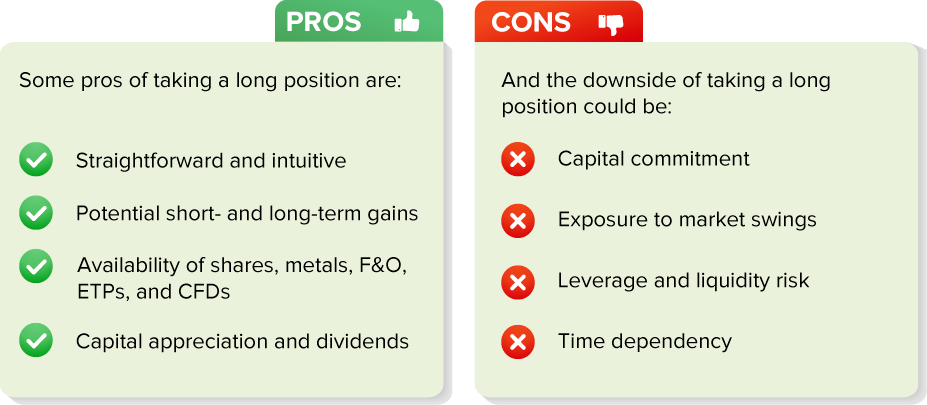

Pros and Cons of a Long Position

How to Open a Long Position with Century Financial

The trading platform you choose can be the difference between a timely, smooth entry and an erroneous order. With the Century Trader App, MT5 , and IBKR platforms, you can go long on shares, take long positions in futures and options, or take a long CFD Trading position with ease.

To initiate a long position with us, first do your due diligence by studying and analyzing the markets. Select from the 40,000 shares, 100+ indices, 130 commodities, and 330 currencies.

Estimate the amount of capital you are willing to take the position for. And keep in mind that with leverage, your exposure is amplified.

Enter the quantity or capital amount, decide if you want to buy at market price, or place a limit order. It is advised to place a stop-loss, especially if the trade is short-term, and click buy.

That’s how you open a long position with us.

Best Practices for Taking Long Positions

Trading is about timing, discipline, and understanding the market. Here are some practices that even seasoned traders swear by:

Seize opportunities with ease—choose Century today!

FAQs

Q1. What is the difference between a long position and a long call position?

A: A long position is a broader concept where you buy an asset with the assumption that it will appreciate. Long call position, on the other hand, relates to options trading where you buy a call option.

Q2: Can I take long positions in forex trading?

A: A long position simply means buying, so yes, you can take long positions in forex trading in popular pairs like USD/EUR and in regional pairs as well. Not just forex, you can take long positions in commodities, treasuries, indices, CFDs, etc.

Q3: How is a long position different from a short position?

A: They are two different legs of the same trade. While a long position means purchasing an asset, a short position is another term for selling an asset. Another difference is profits. In the long position, profits are dependent on prices rising, and prices should fall for a short position to be profitable.

Q4. Can UAE traders take long positions in global stocks and commodities?

A: Definitely. Choose trusted brokers and an efficient platform like Century. Do your homework on the asset and its trends, and place a buy order to take a long position. Commodity and share trading online can be done easily through our platform.

Q5. What platforms can I use at Century Financial to take a long trade?

A: You can use the Century Trader App with a fast and intuitive UI to take leveraged long positions. We also offer the MT5 trading platform for advanced traders with world-class charting tools and smooth trade execution.

This marketing and educational content has been created by Century Financial Consultancy LLC (“Century”) for general information only. It does not constitute investment, legal, tax, or other professional advice, nor does it constitute a recommendation, offer, or solicitation to buy or sell any financial instrument. The material does not take into account your investment objectives, financial situation, or particular needs.

The opinions expressed by the hosts, speakers, or guests are their own and may change without notice. Information is based on sources we consider to be reliable; however, Century does not guarantee its accuracy, completeness, or timeliness and accepts no liability for any loss arising from reliance on this content.

Trading and investing involve significant risk, and losses may exceed initial deposits. Past performance is not indicative of future results. CFDs and other leveraged products are complex instruments that may not be suitable for all investors. Please ensure you understand how these products work, the associated risks, and seek independent professional advice if necessary.

Century is licensed and regulated by the UAE Capital Market Authority (CMA) under License Nos. 20200000028 and 301044.

Please refer to the full risk disclosure mentioned on our website.

.png)

.png)

.png)

.png)