Monday, September 29, 2025

Understanding Intrinsic Value vs Extrinsic Value in Trading

By Century Financial in 'Blog'

Introduction to Intrinsic Value vs Extrinsic Value

In financial markets, it's important to understand the difference between intrinsic and extrinsic value. Whether you are evaluating the intrinsic value of a stock for long-term investing or analyzing options extrinsic value for derivatives trading, both concepts play a central role in determining price, profitability, and strategy. They help investors and traders strategize and make more informed decisions.

What is Intrinsic Value?

Intrinsic means something inherent. Following that logic, Intrinsic Value refers to the true, fundamental worth of an asset based on underlying financial data, not just its market price.

For stocks, the intrinsic value of a stock is determined using methods like:

Example: If a company's intrinsic value is calculated at $50 but the stock is trading at $40, the stock is undervalued and may present a buying opportunity.

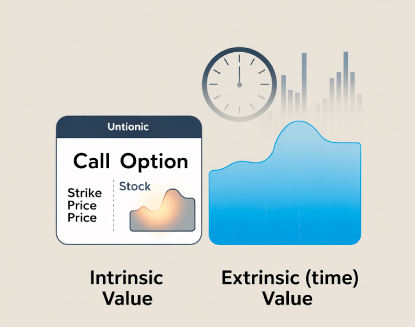

Intrinsic value in option trading refers to the difference between the option's strike price and the current market price of the underlying asset.

What is Extrinsic Value?

Extrinsic value (also known as time value or premium) refers to the value of an option above its intrinsic value. It is influenced by factors such as:

Let's say an option is trading at $8 and its intrinsic value is $5. In this case, the option's extrinsic value is $3.

Unlike intrinsic value, extrinsic value decreases as the option approaches expiration, a phenomenon known as time decay.

Intrinsic Value vs Extrinsic Value: Key Differences

Here's a quick comparison of intrinsic vs extrinsic value in both stock and options trading:

| Factor | Intrinsic Value | Extrinsic Value |

|---|---|---|

| Definition | True/fair value of an asset | Additional value above intrinsic (time/volatility premium) |

| Stock Market | Based on company fundamentals | Not directly applicable |

| Options Market | Difference between strike and market price | Value derived from time & volatility |

| Dependence | Objective (financials, cash flow) | Subjective (market sentiment, time decay) |

| Trading Insight | Identifies undervalued/overvalued assets | Helps price options & time strategies |

Why Traders Must Understand Intrinsic vs Extrinsic Value

Both values are essential in making trading decisions:

Stock Investors use intrinsic value to identify undervalued stocks for long-term investment.

Options Traders analyze both intrinsic and extrinsic values to determine fair pricing, hedge risks, and maximize profits.

By mastering these concepts, traders can reduce confusion and adopt strategies backed by data-driven analysis.

Intrinsic Value in Options Trading

When trading options, intrinsic value in option trading represents the immediate exercise value. For example:

A call option with a strike price of $100 and stock price of $110 has an intrinsic value of $10.

A put option with a strike price of $100 and stock price of $90 also has an intrinsic value of $10.

Understanding this helps traders know whether an option is in the money (ITM), at the money (ATM), or out of the money (OTM).

Options Extrinsic Value Explained

Options extrinsic value is the premium paid for the chance that the option could increase in profitability before expiry. It depends heavily on volatility and time decay. The further the expiry, the more the value of the option and possibilities for fluctuations. Traders use this measure to decide when to enter or exit positions.

Short-term traders may sell options to capture extrinsic value before it decays, while buyers may leverage extrinsic value for potential high gains in volatile markets.

How Century Financial Helps You Apply These Concepts

At Century Financial, we empower you with professional tools and platforms to evaluate and trade assets based on intrinsic and extrinsic values. Whether you're trading stocks, CFDs, commodities, or options, our platforms provide advanced charting, analysis, and risk management features.

.png)

Century Trader App - Trade anytime, anywhere with intuitive tools.

Start trading smarter by evaluating opportunities through intrinsic and extrinsic value analysis with Century Financial.

FAQs

Q1. What is the difference between intrinsic and extrinsic value in options?

A: Intrinsic value is the real, exercise-based value of an option, while extrinsic value is the premium paid for time and volatility beyond intrinsic worth.

Q2: How do you calculate the intrinsic value of a stock?

A: You can calculate the intrinsic value of a stock using discounted cash flows, earnings multiples, or dividend models to determine its fair worth compared to the market price.

Q3: Why is extrinsic value important in options trading?

A: Extrinsic value reflects market sentiment and potential future price movement. It helps traders decide on strategies like buying calls, selling puts, or hedging.

Q4. Can a stock have extrinsic value?

A: No. Extrinsic value is specific to options contracts. Stocks only have intrinsic value based on fundamentals.

Q5. How does time decay affect extrinsic value?

A: As an option nears expiration, extrinsic value decreases due to time decay. This benefits option sellers and negatively impacts buyers.

Conclusion

Understanding intrinsic value vs extrinsic value is essential for investors and traders aiming to maximize profits while managing risks. For stock traders, intrinsic value highlights undervalued opportunities, while for options traders, analyzing extrinsic value is key to timing strategies effectively.

At Century Financial, we provide you with advanced trading platforms like the Century Trader App, MT5, CQG, and TWS, helping you make informed decisions across asset classes, including currencies, shares, commodities, indices, treasuries, ETFs, and CFDs.

This marketing and educational content has been created by Century Financial Consultancy LLC (“Century”) for general information only. It does not constitute investment, legal, tax, or other professional advice, nor does it constitute a recommendation, offer, or solicitation to buy or sell any financial instrument. The material does not take into account your investment objectives, financial situation, or particular needs.

The opinions expressed by the hosts, speakers, or guests are their own and may change without notice. Information is based on sources we consider to be reliable; however, Century does not guarantee its accuracy, completeness, or timeliness and accepts no liability for any loss arising from reliance on this content.

Trading and investing involve significant risk, and losses may exceed initial deposits. Past performance is not indicative of future results. CFDs and other leveraged products are complex instruments that may not be suitable for all investors. Please ensure you understand how these products work, the associated risks, and seek independent professional advice if necessary.

Century is licensed and regulated by the UAE Capital Market Authority (CMA) under License Nos. 20200000028 and 301044.

Please refer to the full risk disclosure mentioned on our website.

__1439480927.jpg)

.png)

.png)

.png)

.png)