.jpg)

You might have to navigate through complex algorithms and calculations in the trading world. But one ratio that every investor can rely on is 1:1. One share, one vote. However, several companies follow a dual stock structure with two or more share classes and a difference in voting rights. While dual stocks have existed since the 1920s, recent IPOs have drawn attention to this alternative voting structure. So, let's find out all that you need to understand about dual stock trading.

What are dual stocks?

Dual stocks, or dual-class shares, divide a company's shares into two classes (or more), which differ in value and voting rights. Usually, the stock division enables a group of investors or founders to retain control over the company with majority voting rights. Dual stock trading occurs during an IPO or company restructuring.

Understanding share classes

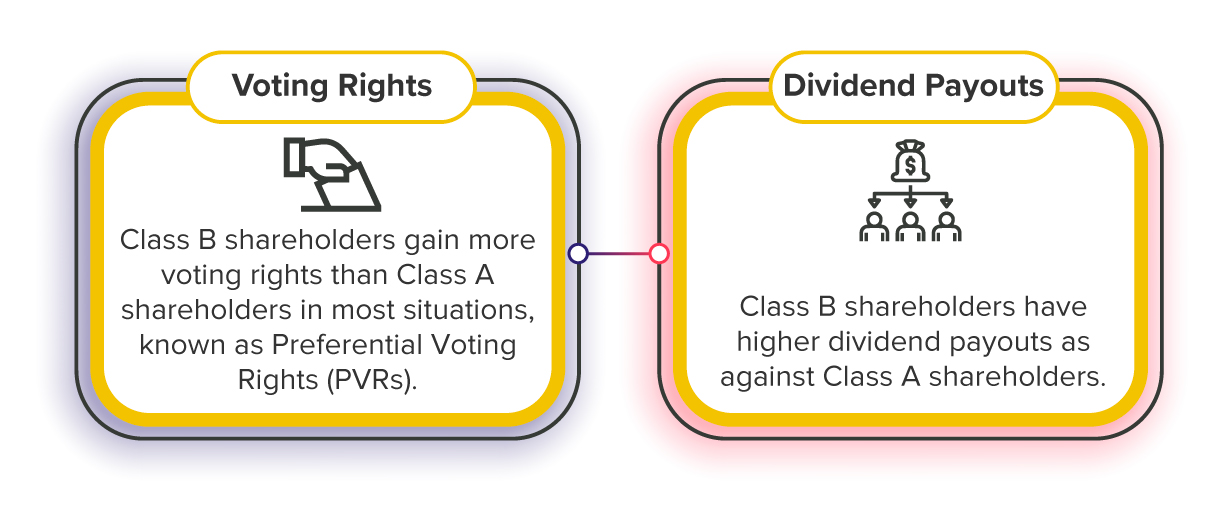

As the shares are divided, it creates two share classes. One part is offered to general investors (Class A), while the other is available to founders and major executives in the company (Class B), making it the founders' class. Look at the two aspects differentiating Class A and Class B shares:

It must be noted that these classes of shares do not define the standard power balance. Hence, the voting power of Class B shares is not always the highest. Class A may have more voting power than Class B due to the organizational structure.

Let's look at a few examples

In 2004, Alphabet (Google's parent company) announced its IPO with three share classes. Class A shares were distributed to general investors, each share carrying one vote. Top firm executives received Class B shares, with ten votes per share. The Class C shares, which had no voting rights, were held exclusively for Google employees.

Google created three share classes to preserve corporate control in the company after it was reorganized as Alphabet Inc. However, having two classes is a more common practice. Such companies include Berkshire Hathaway, Warren Buffet's multinational conglomerate company and Groupon, among others.

.jpg)

Benefits of dual stocks

Dual stocks provide good insulation against the market's short-term mindset, which may affect a founder's long-term visions. They work well for companies because -

Disadvantages of dual stocks

You can only make a sound investment by looking at the whole picture. Dual stock trading can have drawbacks as well -

Balance is the way to go

To prevent a lopsided power struggle between founders and shareholders, companies should strike a balance between dual and single-class stocks using checks and balances. If you are online trading in dual stocks, looking at the full scenario of the voting powers and dividends is ideal before investing in that company.

The content in this blog, including any research, analysis, opinions, forecasts, or other information (collectively, "Information"), is provided by Century Financial Consultancy LLC (CFC) for marketing, educational, and general informational purposes only. It should not be construed as investment advice, a recommendation, or a solicitation to buy or sell any financial instruments.

This Information may also be published across various channels, including CFC’s website, third-party platforms, newsletters, marketing materials, emails, social media, messaging apps, webinars, and other communications. While CFC strives for accuracy, we do not guarantee the completeness, reliability, or timeliness of any content. Any decisions made based on this Information are at your own risk. CFC accepts no liability for any loss or damage arising from its use.

Trading financial products involves significant risk and may not be suitable for all investors. Please ensure you fully understand the risks and seek independent professional advice if necessary.

Please refer to the full risk disclosure mentioned on our website.

__1418016979.jpg)