.jpg)

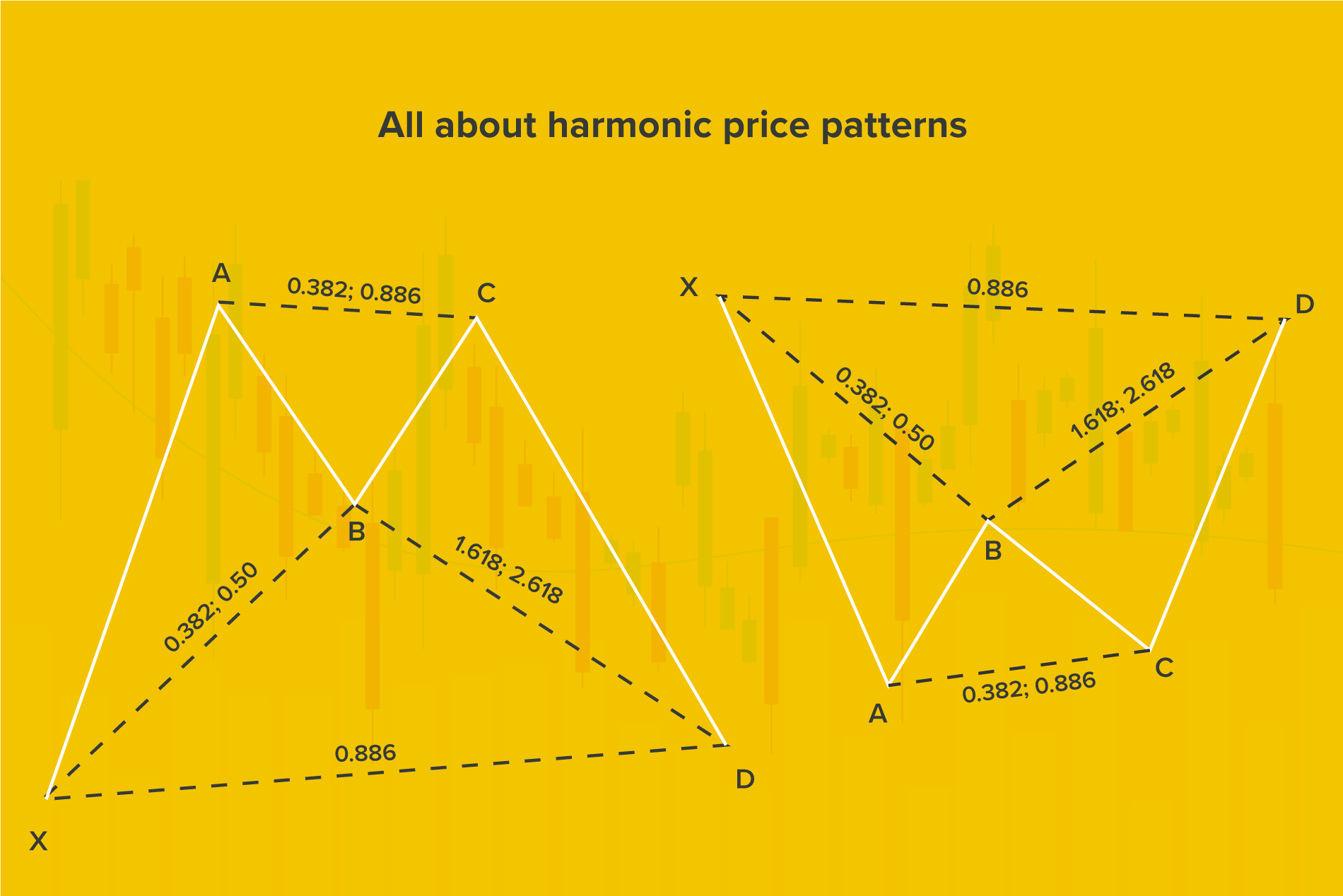

Market prices tend to showcase a trend or pattern which is indicative of whether the price will continue in the same direction or if it will reverse. Harmonic price patterns do just that with the added benefit of being more precise. This is because only specific price movements based on Fibonacci retracements and extensions qualify in the formation of a harmonic pattern. This eliminates a substantial degree of subjectivity.

Like all good patterns, harmonic patterns are best traded once they are formed completely.

Trading harmonic patterns require patience, but when applied correctly, they provide wonderful insights into potential future price movements. So let’s learn some of the patterns traders can use to make a successful trade.

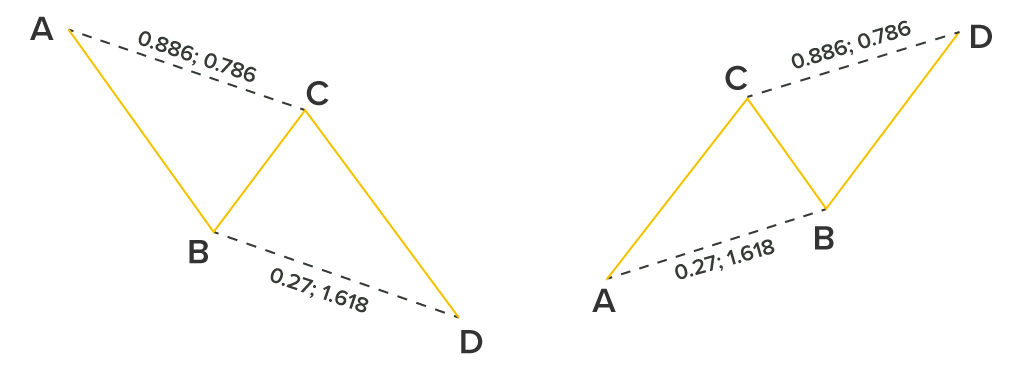

The ABCD Pattern

Deemed by many as the simplest pattern of them all, the ABCD pattern comprises of four points and three movements. The movements include

The pattern’s name derives from the concept that AB = CD. , When the Fibonacci retracement tool is used on the AB leg, the BC leg should touch 0.618 for it to be the same length as AB. The time taken for C to reach D should be equal to the time taken for A to reach B. This allows traders to either choose their point of entry close to C, which is known as Potential Reversal Zone (PRZ) or wait till the pattern completes itself before deciding on a position.

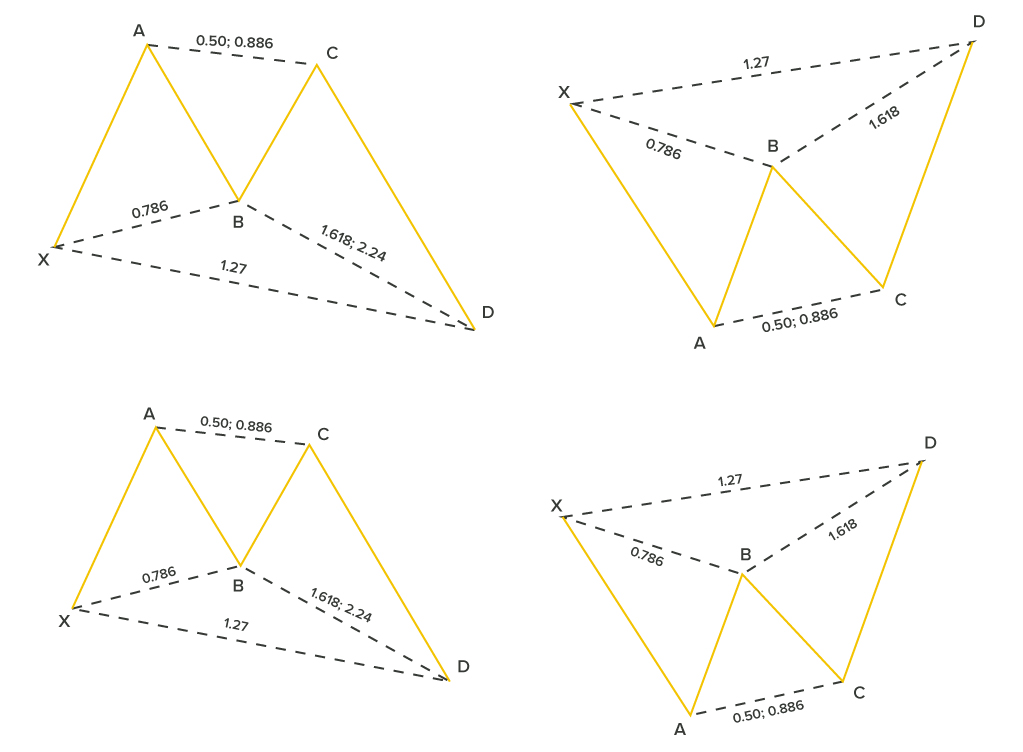

The BAT pattern

First recognized by Scott Carney, this pattern occurs when the trend reverses temporarily, making it a useful tool for scalpers. . Unlike the ABCD pattern, it has an additional leg and point called ‘X’. This pattern appears similar to the Gartley pattern but the ratios are not identical.

The BAT pattern formation is a 5-point retracement structure with a specific Fibonacci measurement for each point. Generally, D entails a zone where the price tends to reverse. When the first leg, XA,moves to a BC retracement, and the retracement stops at 50% of the movement from point B to XA, we see the emergence of the BAT pattern. The CD extension, at the very least, must be 1.618 of the BC leg and should reach 2.618. The figure will be deemed invalid if it is less than the BC. The endpoint (D) will create the PRZ, allowing traders to choose their positions.

The Gartley pattern

Created by Harold McKinley Gartley, the Gartley pattern has similarities to the BAT pattern. It is a simple harmonic pattern that occurs after a substantial low or high, or usually when a correction of the trend is about to happen.

The qualifying factors for a Gartley pattern are:

Remember, when you develop a trading strategy, the stop-loss point is placed at X, and the take-profit is set at C.

The butterfly pattern

Identified by Bryce Gilmore, the butterfly pattern is used to recognize potential retracements through a combination of Fibonacci ratios. As a reversal pattern which often occurs towards the end of a trend, it is comprised of four legs, which are marked as XA, BC, AB, and CD.

For traders that use this pattern, the ratio they need to identify the most is 0.786 retracement of the XA leg. It will help to plot point B, thus assisting traders in recognizing the PRZ.

The crab pattern

The crab pattern is meant for traders that seek a trading strategy to enter during extreme highs or lows. It follows a C-D, B-C, A-B and X-A pattern, with its most relevant feature being the 1.618 extensions of the XA movement to identify the PRZ.

In its bullish version, when there is a sharp rise from X to A, the first leg is formed. The AB leg, which retraces between 38.2% and 61.8%, is subsequently followed by an extreme projection of BC to identify the pattern’s completion and the potential reversal of the trend. In the bearish version, it will keep an eye out for a dip from X to A, which is followed by a slight price rise, then a slight decline, and a sharp rise to point D.

Every trader seeks to be successful, and harmonic patterns can help you get there. Moreover, if plotted correctly, these patterns can be a reliable trading tool.

Century Financial Consultancy LLC (CFC) is duly licensed and regulated by the Securities and Commodities Authority of UAE (SCA) under license numbers 2020000028, 2020000081, and 301044 to practice the activities of Trading broker in the international markets, Trading broker of the Over-The-Counter (OTC) derivatives and currencies in the spot market, Introduction, Financial Consultation and Financial Analysis, and Promotion. CFC is a Limited Liability Company incorporated under the laws of the UAE and registered with the Department of Economic Development of Dubai (registration number 768189).

CFC may provide research reports, analysis, opinions, forecasts, or information (collectively referred to as Information) through CFC’s Websites, or third-party websites, or in any of its newsletters, marketing materials, social media, individual and company e-mails, print and digital media, WhatsApp, SMS or other messaging services, letters, and presentations, individual conversations, lectures (including seminars/webinars) or in any other form of verbal or written communication (collectively referred to as Publications).

Any Information provided in this publication is provided only for marketing, educational and/or informational purposes. Under no circumstances is any Information meant to be construed as an offer, recommendation, advice, or solicitation to buy or sell trading positions, securities, or other financial products. CFC makes no representation or warranty as to the accuracy or completeness of any report or statistical data made in or in connection with this Publication and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the use of the Information.

Please refer to the full risk disclosure mentioned on our website.