Thursday, October 05, 2023

Tech Triumphs: The 2023 IPO Tales of Arm and Instacart

By Century Financial in 'Blog'

.jpg)

Synopsis:

In 2023, global IPOs declined, but tech firms like Arm and Instacart stood out. Arm's IPO reached a notable $65 billion valuation, while Instacart navigated valuation challenges to secure $10 billion. Their stories underscore the importance of adaptability in a shifting financial landscape.

An initial public offering (IPO) refers to offering shares of a private corporation to the public in a new stock issuance for the first time. An IPO allows a company to raise equity capital from public investors.

The IPO Landscape:

The first half of 2023 recorded 615 IPOs with US $60.9b capital raised, a 5% and 36% decrease year-over-year (YOY), respectively. However, some emerging markets are booming with IPO activities, as they benefited from the global demand for rich mineral resources, their vast population, growing unicorns or entrepreneurial SMEs.

The technology sector has continued to be the leading sector in IPO activities to date in 2023.

Valuation of IPO

The valuation of the IPO is done by its investment bankers or underwriters. These entities go through the company’s financials, like the assets, liabilities, performance, and the ability to generate revenue. The data is carefully analysed over a period and is sent for an audit.

They carefully consider few factors to find a fair valuation for the IPO

Why do firms go for an IPO?

The main reason for a company to launch its share in the public is to raise capital for business.

But the story is more than that.

If the existing investors wish to liquidate their interest partially or entirely, listing on a stock exchange can provide a solution.

A successful IPO provides a company with value, reputation, status, and additional finances for funding any merger and acquisition deals.

Mentioned are the recently popular IPOs released.

The Much-awaited Tech IPO

The entrance of the chip designer and an initial public offering (IPO) that caught the eye of the biggest tech companies, Apple, Samsung, and Intel, all signalled their interest.

It was the ARM IPO

The Rise of Instacart

Founded in 2012, Instacart delivers groceries from chains including Kroger, Costco and Wegmans and had to drop its stock price dramatically to make it appealing to public market investors.

The bulk of Instacart’s competition comes from Amazon and big brick-and-mortar retailers like Target and Walmart.

Some key statistics***

InstaCart IPO

Grocery delivery app Instacart bumped its per-share proposed IPO price range from $26 to $28 to $28 to $30, raising its total valuation to $10 billion and the boost in Instacart's IPO price range comes after Arm's IPO, which led to 25% gains on its first day of trading.

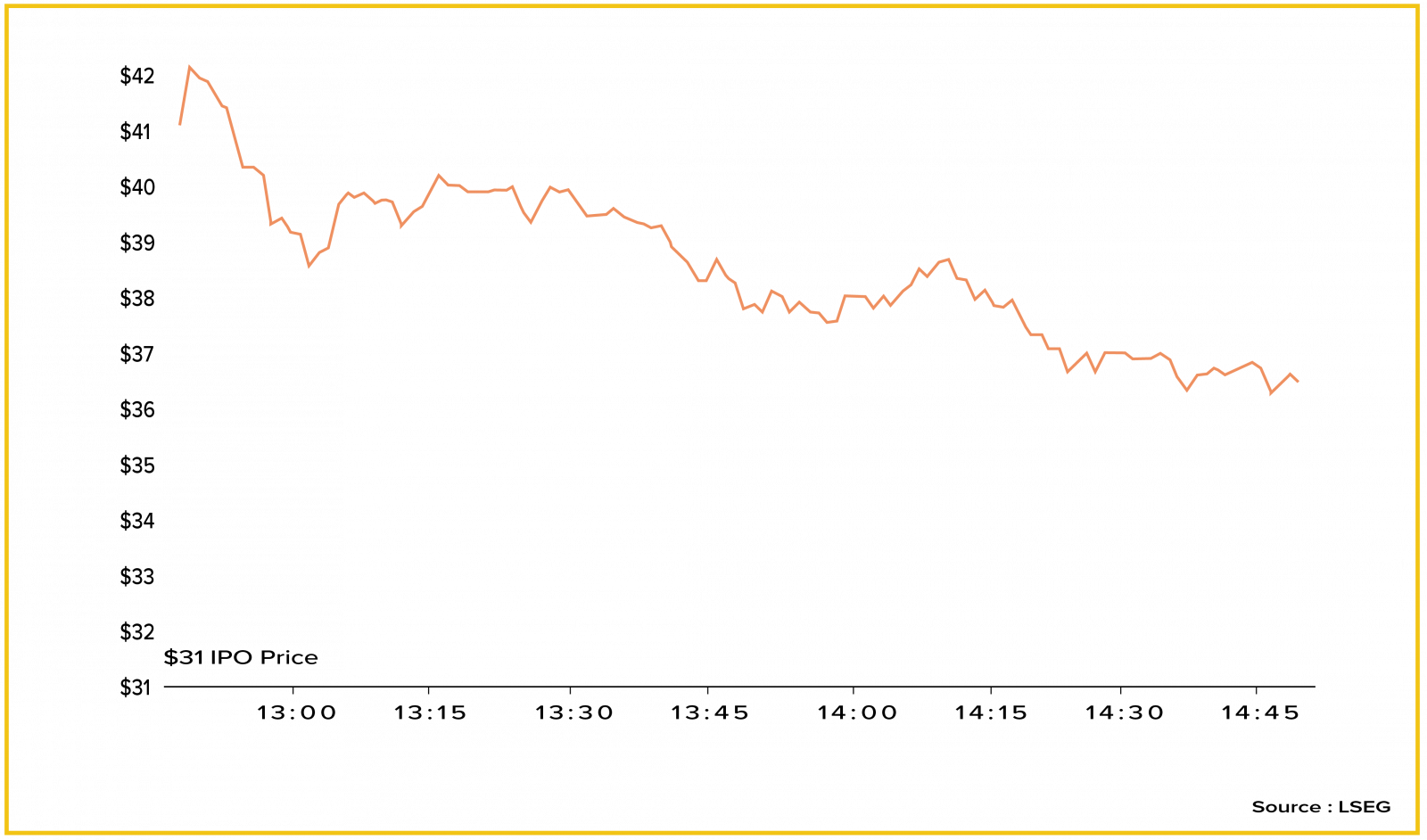

Instacart in its first day on Wall Street

The stock closed at $33.70 after hitting a high of $42.95.

.png)

Recap

In 2023, while many new companies found it harder to start on the stock market, tech companies like Arm did well. Instacart's ups and downs show the challenges new businesses face today. Both remind us that being flexible and creative is key in changing times.

This marketing and educational content has been created by Century Financial Consultancy LLC (“Century”) for general information only. It does not constitute investment, legal, tax, or other professional advice, nor does it constitute a recommendation, offer, or solicitation to buy or sell any financial instrument. The material does not take into account your investment objectives, financial situation, or particular needs.

The opinions expressed by the hosts, speakers, or guests are their own and may change without notice. Information is based on sources we consider to be reliable; however, Century does not guarantee its accuracy, completeness, or timeliness and accepts no liability for any loss arising from reliance on this content.

Trading and investing involve significant risk, and losses may exceed initial deposits. Past performance is not indicative of future results. CFDs and other leveraged products are complex instruments that may not be suitable for all investors. Please ensure you understand how these products work, the associated risks, and seek independent professional advice if necessary.

Century is licensed and regulated by the UAE Capital Market Authority (CMA) under License Nos. 20200000028 and 301044.

Please refer to the full risk disclosure mentioned on our website.

__1439480927.jpg)

.png)

.png)

.png)

.png)